Last editedMay 20221 min read

This practical guide will help you to design and send compliant SEPA Direct Debit pre-notifications.

This practical guide will help you to send compliant SEPA Direct Debit pre-notifications.

A pre-notification informs your customer when they can expect a single payment or regular subscription to leave their account. It is a mandatory requirement of SEPA Direct Debit, and can be sent by email, phone, via SMS, with an invoice or in a letter.

To create fully compliant pre-notifications, you will need to:

Inform the customer with the appropriate notice period

Include the amount, due date, mandate reference and creditor ID

Include your contact details

Throughout this guide the examples are take from the GoCardless pre-notification emails.

1. Email the customer with the appropriate notice period

Why? Gives the customer the chance to ensure they have sufficient funds

How? Send the pre-notification X calendar days, as agreed when the customer set up their mandate, before the payment leaves their account

The pre-notification period agreed with your customer must be no longer than 14 days before the date that the payment is charged. Best practice is to agree to send pre-notifications three working days in advance.

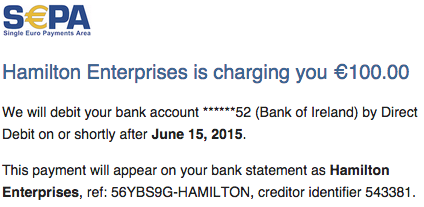

2. Include the amount, due date, mandate reference and creditor ID

Why? Helps ensure the customer recognises the charge on their statement

How? Either send an email before each payment, or give details up front for a fixed subscription

For recurring direct debits of the same amount, such as subscription plans, you only need to inform the payer before the first Direct Debit collection if you include details of all future charge dates (e.g., "first working day of each month"). A new pre-notification is then only necessary if the amount or frequency changes.

Example of a pre-notification for a one-off or recurring variable amount:

Example of a pre-notification for a recurring amount with multiple collection dates:

3. Include your contact details

Why? Makes it easy for the customer to contact you with any queries

How? Include a snippet in each email with your address

SEPA Direct Debit and GoCardless

GoCardless is an end-to-end SEPA Direct Debit provider and can completely handle SEPA compliance on your behalf, or guide you through your own custom integration.

GoCardless can send compliant emails for SEPA Direct Debit on your behalf. We cover all major European languages and automatically send emails in the language of the payer. We automatically send emails three calendar days before a SEPA Direct Debit collection.

Read more about the business benefits of collecting SEPA payments via GoCardless.

If you wish to send your own emails, you can do this with GoCardless Pro. Your Account Executive will support you during your implementation of compliance guidelines.

Looking for an easy & affordable way to collect SEPA payments?

GoCardless saves merchants time, money & stress collecting SEPA payments.