GoCardless for enterprise businesses

Get paid sooner, with GoCardless

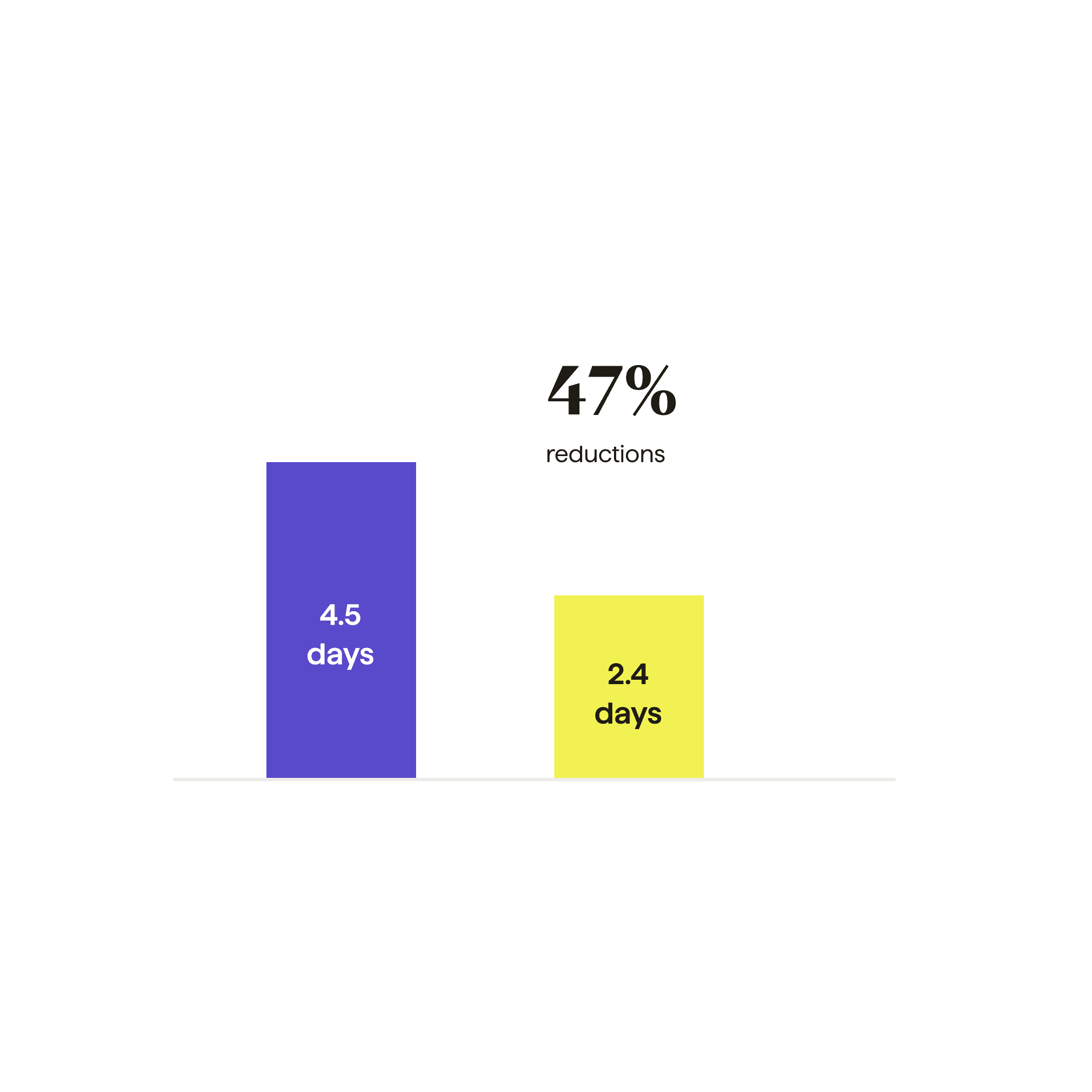

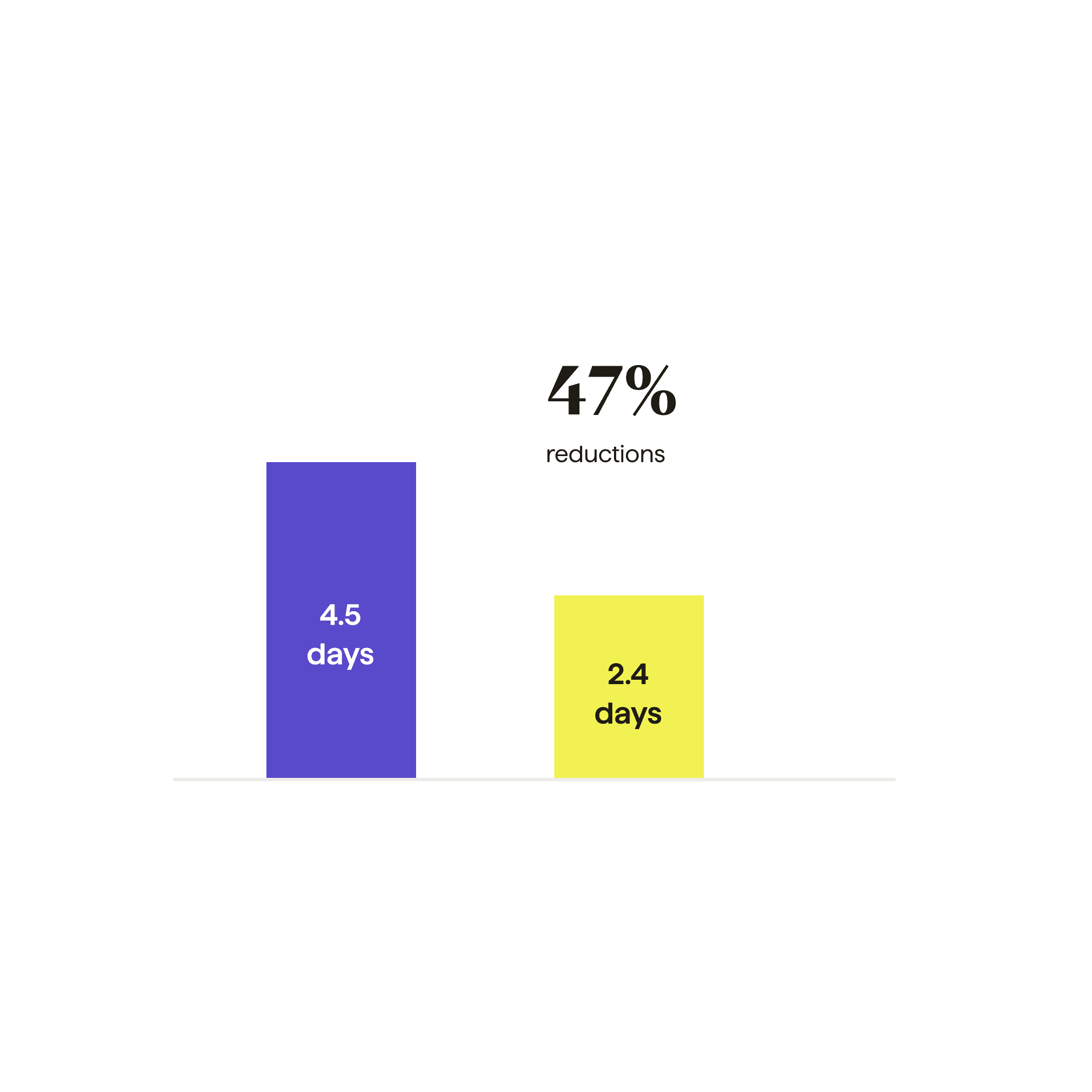

Take control of when you collect payments. And minimise your debtor days, reducing the time to receive payments by 47%.

Why do ‘due’ dates feel anything but?

Your company did the work. Your customer agreed to the date payment was due. So why must late payments feel so inevitable?

A high DSO and a growing list of outstanding receivables limits your ability to invest in your future.

Overall, having a rock-solid platform like GoCardless for automated monthly payment collection is a huge advantage from a cash flow point of view. We can be more confident of our ongoing income, and we can see an income stream that is forecastable for the near future.

Clare Caras-Altas, Finance Director, Taurus Insurance Services

Take back control of your cash

Let your customers make instant, one-off payments to you seamlessly. Or set up automated, recurring payments so neither of you has to lift a finger.

47% reduction in payout timings

An IDC White Paper sponsored by GoCardless found that businesses experience, on average, a 47% reduction in payout timings with GoCardless.

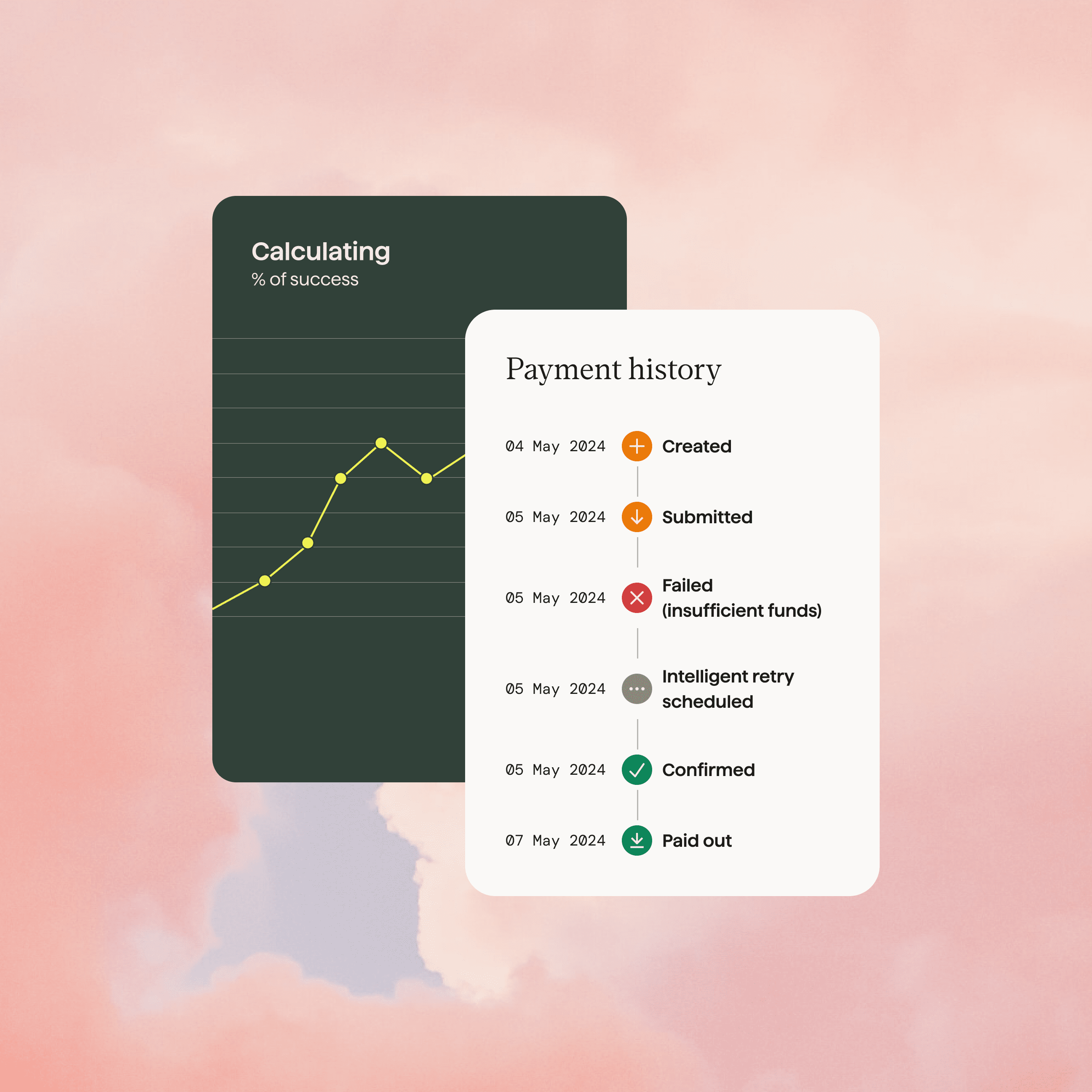

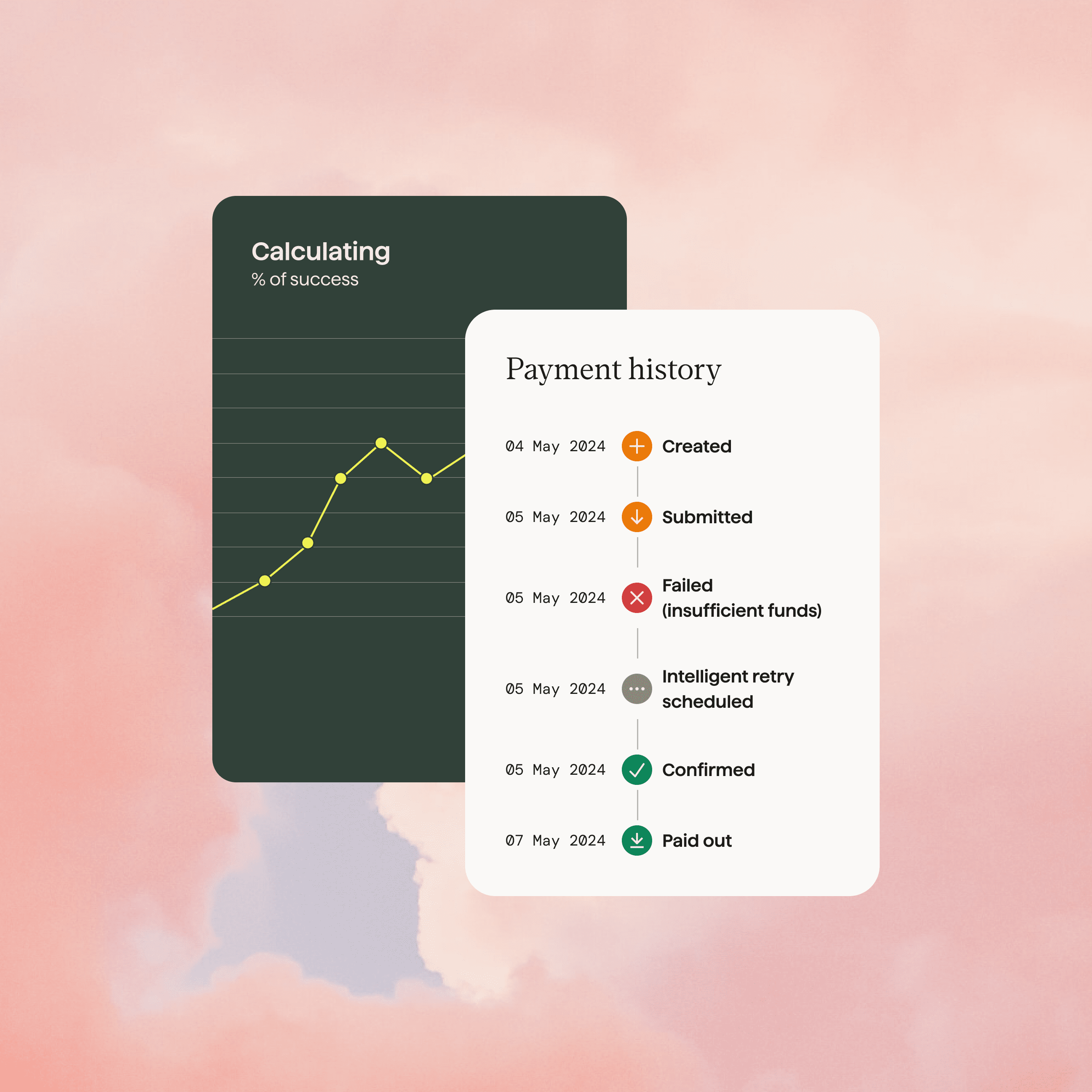

Fewer failures means more money

With GoCardless, 97.3 - 99% of payments are successfully collected the first time. Success+ boosts that to 99.5%, with failed payments automatically retried on the best day for each customer.

Automate or not. It’s up to you.

Get paid sooner by setting up automated, recurring payments. But you can also use GoCardless to easily collect instant, one-off payments.

Save time with Success+

Success+ is our payments intelligence product that does the heavy lifting for you. Automatically retrying failed payments on the best day for each of your customers.

89% of businesses said Success+ saves them time.

Everything just works… It’s now a one- or two-touch billing process, once a month. We don’t need to think or worry about it anymore."

John Heggs, Finance Manager, intY

Trusted by 75,000+ businesses. Of all sizes. Worldwide.

Ready to get paid sooner, with GoCardless?

Speak to one of our payment experts about your challenges with payment collection. We’ll show you how GoCardless can help.