GoCardless for enterprise businesses

Reduce payment time

Reduce the time to receive payments by 47%, and minimise your debtor days by taking full control of when payments are made.

Your high DSO is slowing you down

A high DSO and a growing list of outstanding receivables limits your brand’s ability to invest for the future.

Overall, having a rock-solid platform like GoCardless for automated monthly payment collection is a huge advantage from a cash flow point of view. We can be more confident of our ongoing income, and we can see an income stream that is forecastable for the near future.

Clare Caras-Altas, Finance Director, Taurus Insurance Services

Take back control of your cash

GoCardless is built on bank debit, a pull-based payment method. This puts you in control of when payments are collected, giving you full oversight of your accounts receivable.

Pull-based payment collection

GoCardless is built on bank debit, a pull-based, bank-to-bank payment method that allows businesses to pull payments directly from their customers’ bank accounts.

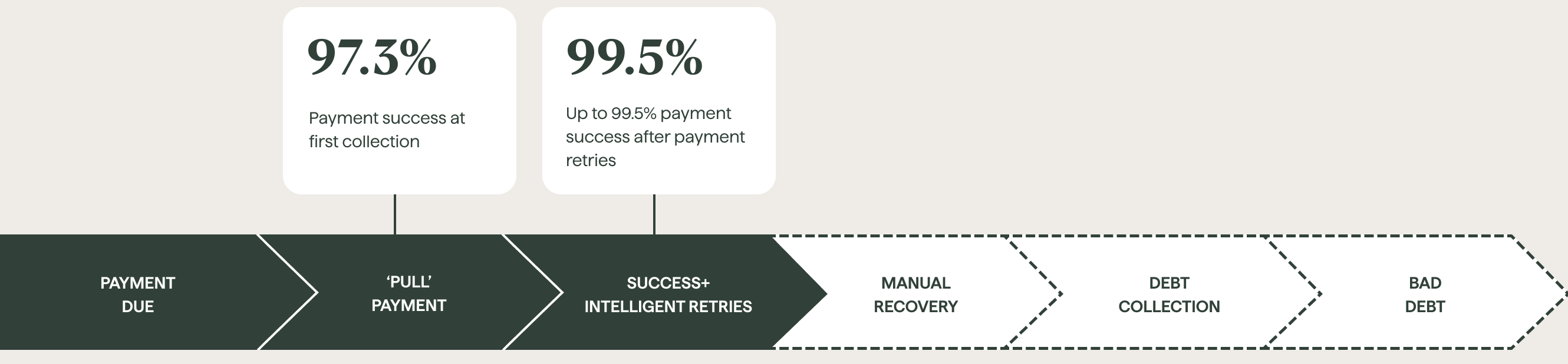

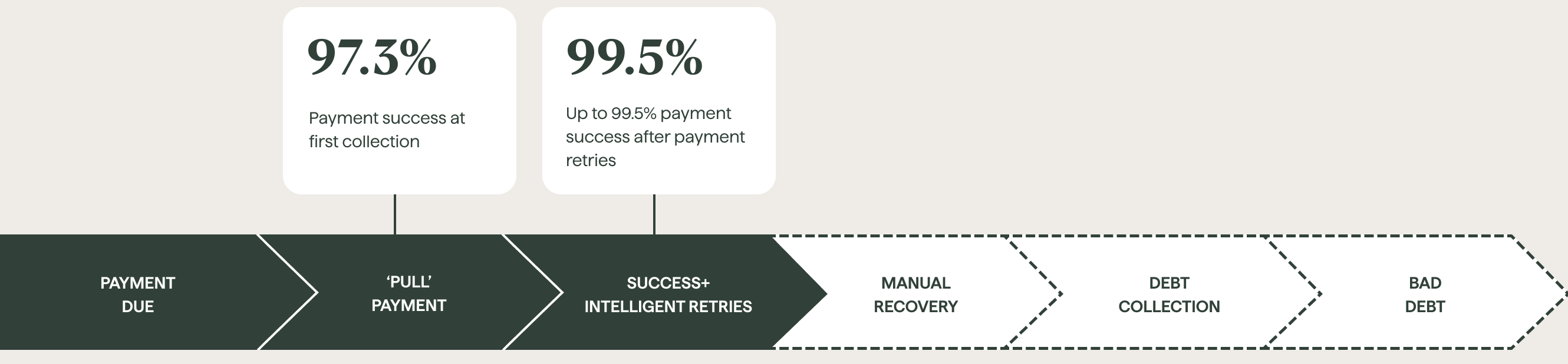

Low payment failure rates

With GoCardless, around 97.3% of payments will be collected successfully at the first time of asking. With real-time reporting, know instantly when a payment does fail so you can take action.

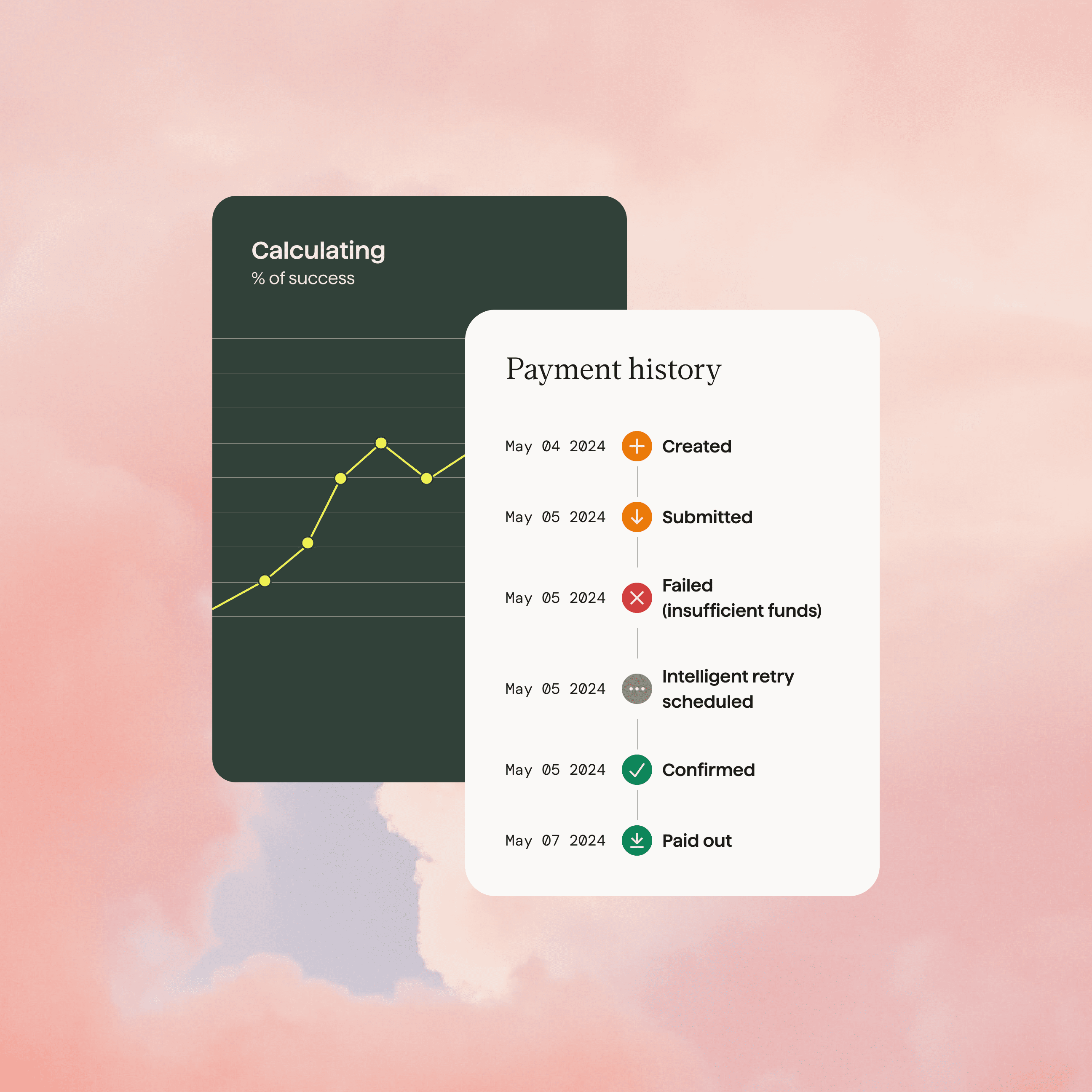

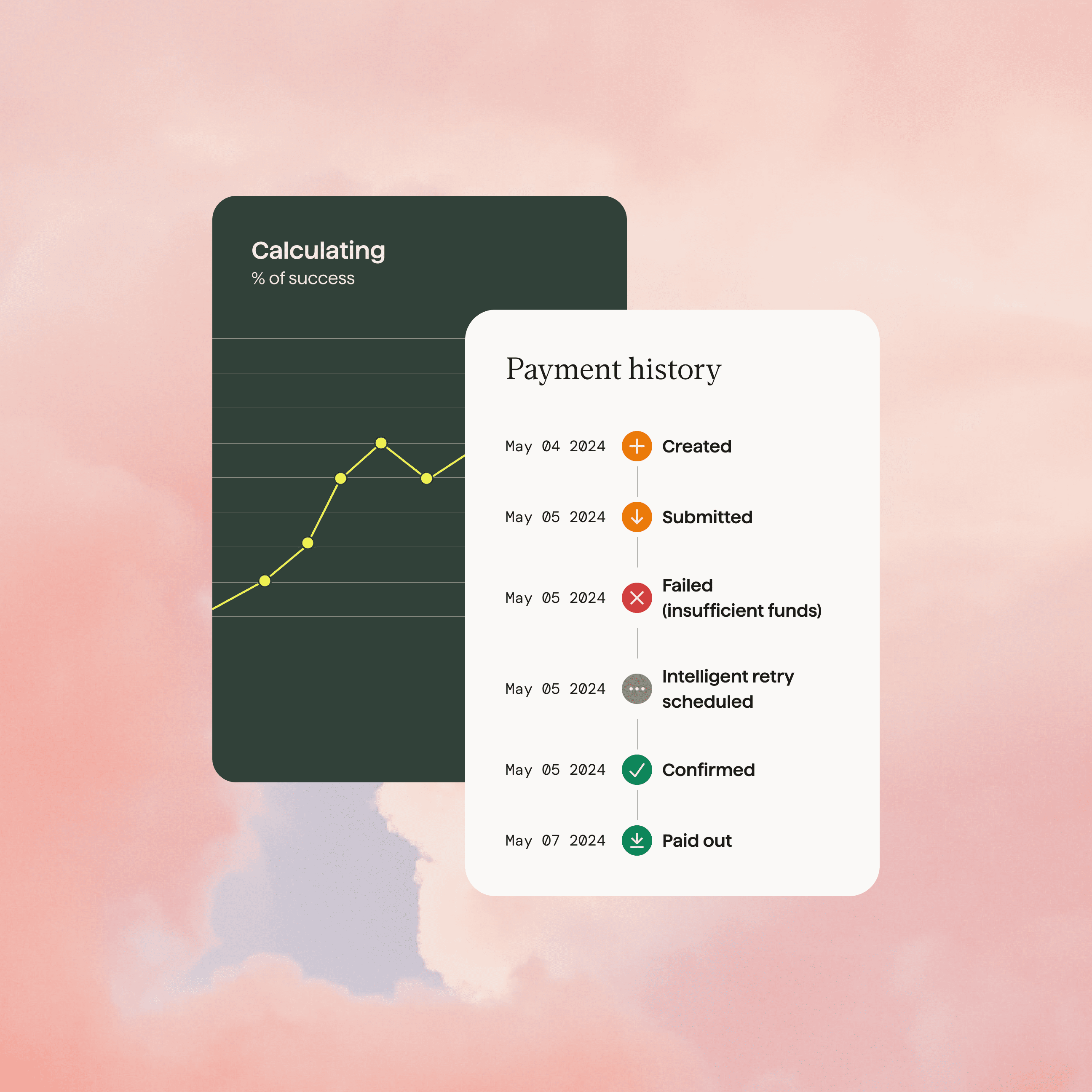

Intelligent retries

Sit back and let Success+ retry payments on the optimal day to collect from each customer. Recover up to 76% of any payments that do fail with Success+.

Optimize your payments with Success+

Success+ does all the heavy lifting, calculating the best time to retry a payment and tracking which payments have been successfully collected. 89% of businesses said Success+ saves them time.

Everything just works… It’s now a one- or two-touch billing process, once a month. We don’t need to think or worry about it anymore."

John Heggs, Finance Manager, intY

Trusted by 85,000+ businesses. Of all sizes. Worldwide

How can we help?

Speak to one of our payment experts about the challenges of reducing payout timings, and we’ll work with you to transform the way you collect recurring payments.