Manual process, failed payments and high card fees can all add up. The true cost of collecting payments goes far beyond transaction fees and can heavily impact your revenue. Automate your payments with ACH Pull from GoCardless and reduce the overall cost of collecting payments.

Manual process, failed payments and high card fees can all add up. The true cost of collecting payments goes far beyond transaction fees and can heavily impact your revenue. Automate your payments with ACH Pull from GoCardless and reduce the overall cost of collecting payments.

Manual process, failed payments and high card fees can all add up. The true cost of collecting payments goes far beyond transaction fees and can heavily impact your revenue. Automate your payments with ACH Pull from GoCardless and reduce the overall cost of collecting payments.

How GoCardless works

Flexible integration options

API integration

A best-in-class, customizable checkout flow, easily embeddable on your website. Localized for over 30 countries. Optimized for improved conversion

Pre-built payment page

A best-in-class, customizable checkout flow, easily embeddable on your website. Localized for over 30 countries. Optimized for improved conversion.

Secure payment link

Start using GoCardless right now, with pre-built payment flows and automated notifications localized for over 30 countries.

// Code example for creating a subscription

$client = new \GoCardlessPro\Client(array(

'access_token' => 'your_access_token_here',

'environment' => \GoCardlessPro\Environment::SANDBOX

));

$client->subscriptions()->create([

"params" => ["amount" => 40,

"currency" => "AUD",

"name" => "Premium Subscription",

"interval_unit" => "monthly",

"day_of_month" => 1,

"metadata" => ["order_no" => "ABCD1234"],

"links" => ["mandate" => "MA123"]]

]);# Code example for creating a subscription

import gocardless_pro

client = gocardless_pro.Client(access_token="your_access_token_here", environment='sandbox')

client.subscriptions.create(params={

"amount": "40",

"currency": "AUD",

"name": "Premium Subscription",

"interval_unit": "monthly",

"day_of_month": "1",

"metadata": {

"order_no": "ABCD1234"

},

"links": {

"mandate": "MA123"

}

})

]);# Code example for creating a subscription

@client = GoCardlessPro::Client.new(

access_token: "your_access_token",

environment: :sandbox

)

@client.subscriptions.create(

params: {

amount: 40,

currency: "USD",

name: "Premium Subscription",

interval_unit: "monthly",

day_of_month: 1,

links: {

mandate: "MD123"

}

}

)import static com.gocardless.GoCardlessClient.Environment.SANDBOX;

String accessToken = "your_access_token_here";

GoCardlessClient client = GoCardlessClient

.newBuilder(accessToken)

.withEnvironment(SANDBOX)

.build();

import com.gocardless.services.SubscriptionService.SubscriptionCreateRequest.IntervalUnit;

Subscription subscription = client.subscriptions().create()

.withAmount(40)

.withCurrency("USD")

.withName("Premium Subscription")

.withIntervalUnit(IntervalUnit.MONTHLY)

.withDayOfMonth(1)

.withMetadata("order_no", "ABCD1234")

.withLinksMandate("MD123")

.execute();var subscriptionRequest = new GoCardless.Services.SubscriptionCreateRequest()

{

Amount = 40,

Currency = "USD",

Name = "Premium Subscription",

Interval = 1,

IntervalUnit = GoCardless.Services.SubscriptionCreateRequest.SubscriptionIntervalUnit.Monthly,

Links = new GoCardless.Services.SubscriptionCreateRequest.SubscriptionLinks()

{

Mandate = "MD0123"

}

};// Code example for creating a subscription

const constants = require('gocardless-nodejs/constants');

const gocardless = require('gocardless-nodejs');

const client = gocardless('your_access_token_here', constants.Environments.Sandbox);

const subscription = await client.subscriptions.create({

amount: "40",

currency: "USD",

name: "Premium Subscription",

interval_unit: "monthly",

day_of_month: "1",

metadata": {

order_no: "ABCD1234"

},

links: {

mandate: "MA123"

}

});![[en-US] nwe-code_summary_block-primary-dark](https://images.ctfassets.net/40w0m41bmydz/5kIKu7t2kTxWsbNH7lEGwl/37df5a894ae3389153f4234deac2ed9a/code-example-en-us.png?w=670&h=670&q=50&fm=png)

![[en-US] nwe-code_summary_block-primary-dark](https://images.ctfassets.net/40w0m41bmydz/5kIKu7t2kTxWsbNH7lEGwl/37df5a894ae3389153f4234deac2ed9a/code-example-en-us.png?w=670&h=670&q=50&fm=png)

Connect to your software

Connect GoCardless to your business software to automate payment collection and reconciliation.

We are now processing over $8 million per month. That seems a lot, but it has actually been no burden on Capital on Tap because it's all just being handled by GoCardless in the background, and it's really streamlined and automated for our customers.

Zoe Newman, US Managing Director, Capital on Tap

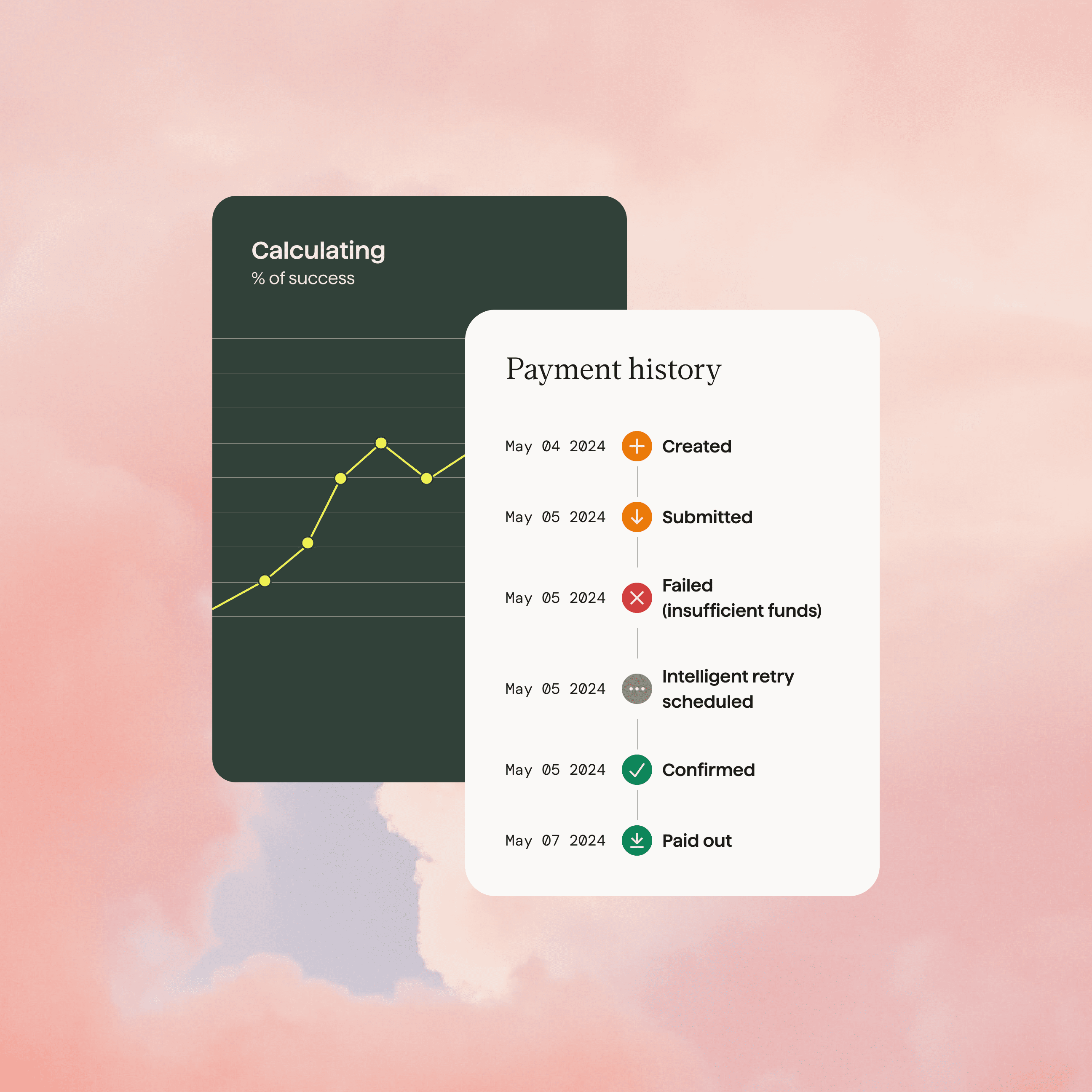

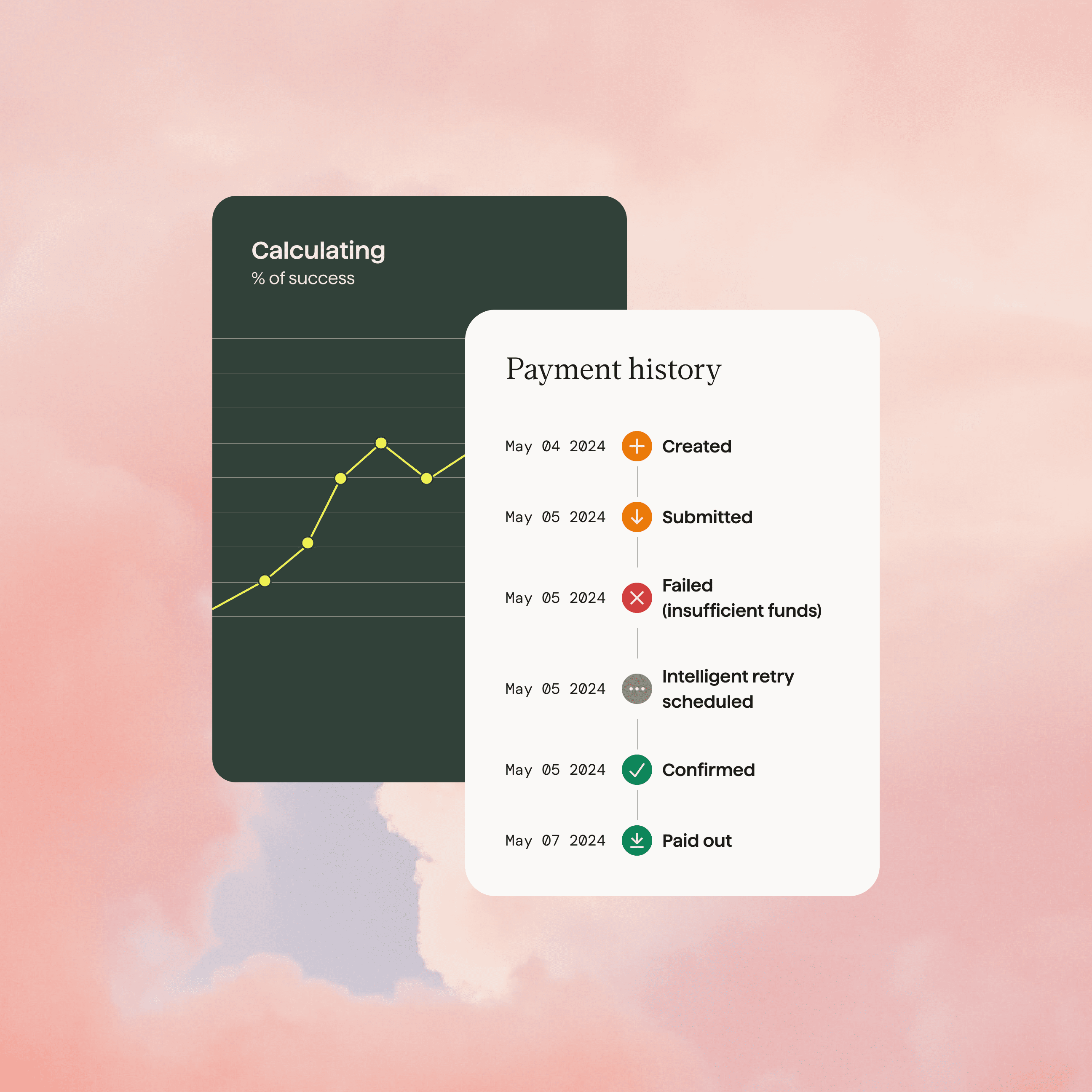

Made for payment success

Collect 97.3% of payments successfully the first time around with GoCardless. When a payment does fail, sit back and let Success+ schedule payment retries on the best day for each customer.

Built for security and scale

ISO27001 certified

Security protocols across our business, services and products have been fully audited and certified with this globally recognised international standard.

Trusted by global businesses

GoCardless processes $35bn+ annually, and has been funded by prestigious investors including Google Ventures and Salesforce Ventures.

Compliance built-in

We handle the complexities of bank debit across 30+ countries in a single integration.

Trusted by 85,000+ businesses. Of all sizes. Worldwide

Want to learn more?

Speak to one of our experts today about your payment challenges, and see how we can help.