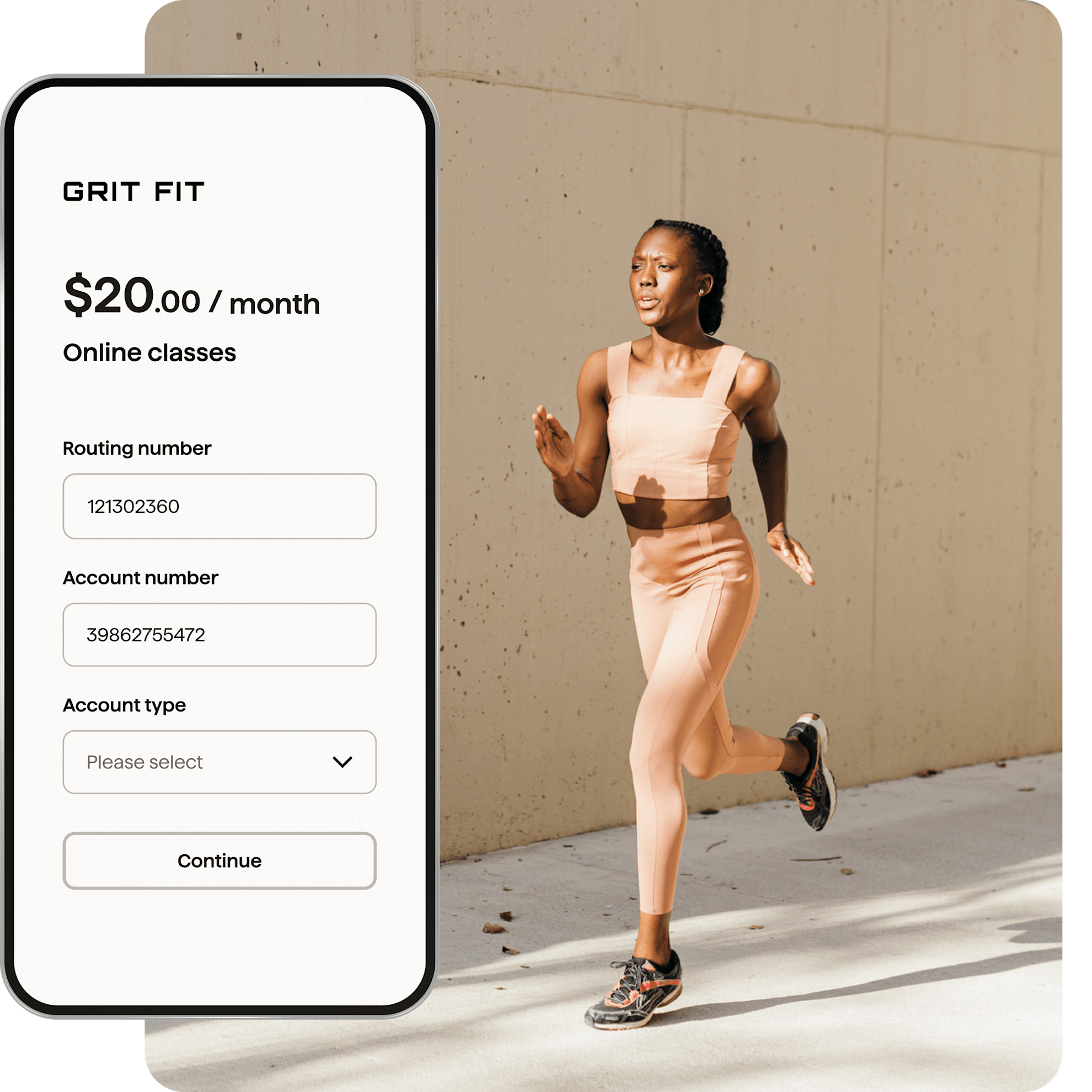

Simple and secure ACH Pull payments

Perfect for subscriptions and memberships

Cut your costs, keep customers, and even go global. For monthly payments, weekly payments, or anything else.

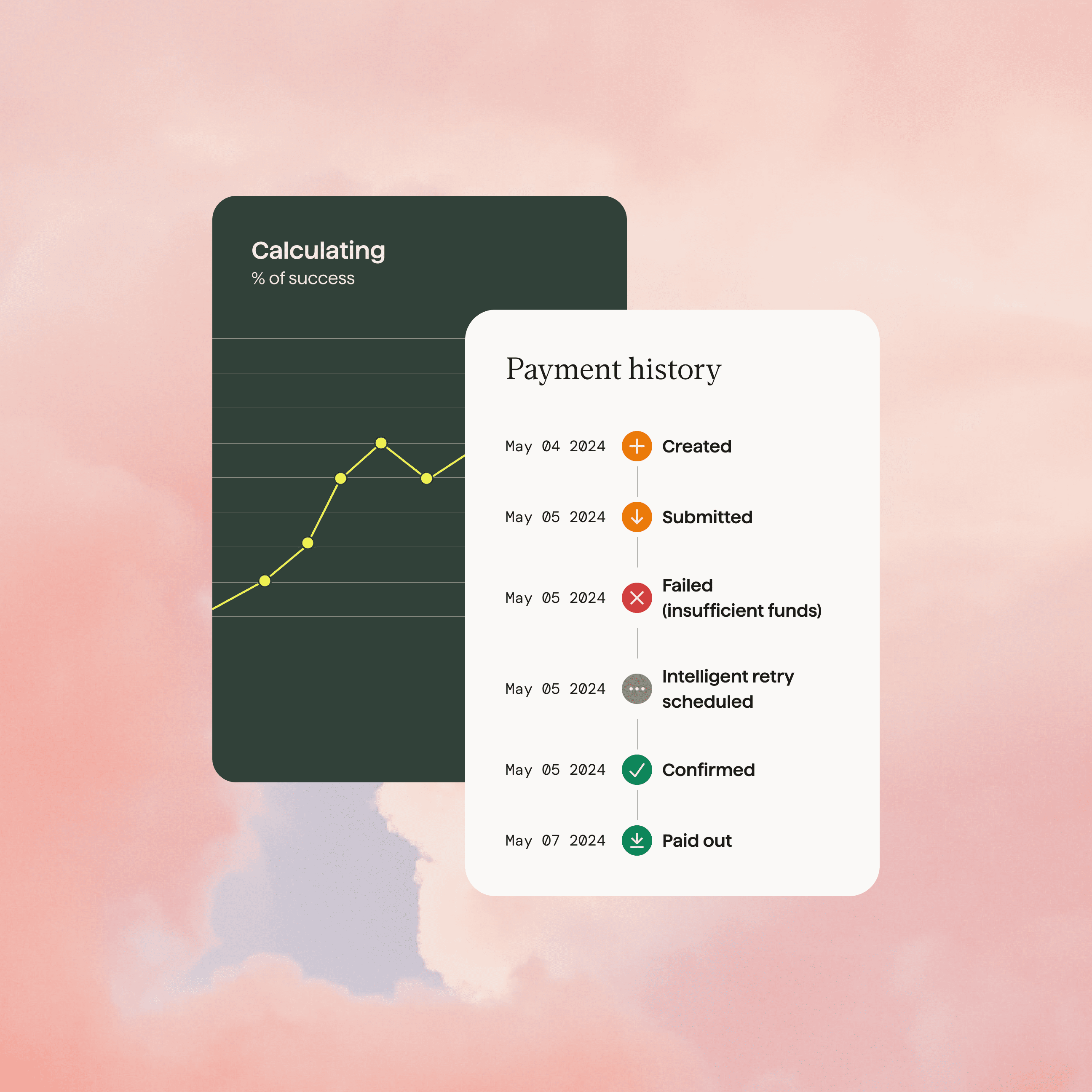

30% of your churn is involuntary. Involuntary churn happens when payments fail and otherwise happy customers lose access to your product or service.

Minimize the involuntary churn that holds back growth. Collect 97.3% of payments successfully at the first time of asking, with ACH Pull.

30% of your churn is involuntary. Involuntary churn happens when payments fail and otherwise happy customers lose access to your product or service.

Minimize the involuntary churn that holds back growth. Collect 97.3% of payments successfully at the first time of asking, with ACH Pull.

30% of your churn is involuntary. Involuntary churn happens when payments fail and otherwise happy customers lose access to your product or service.

Minimize the involuntary churn that holds back growth. Collect 97.3% of payments successfully at the first time of asking, with ACH Pull.

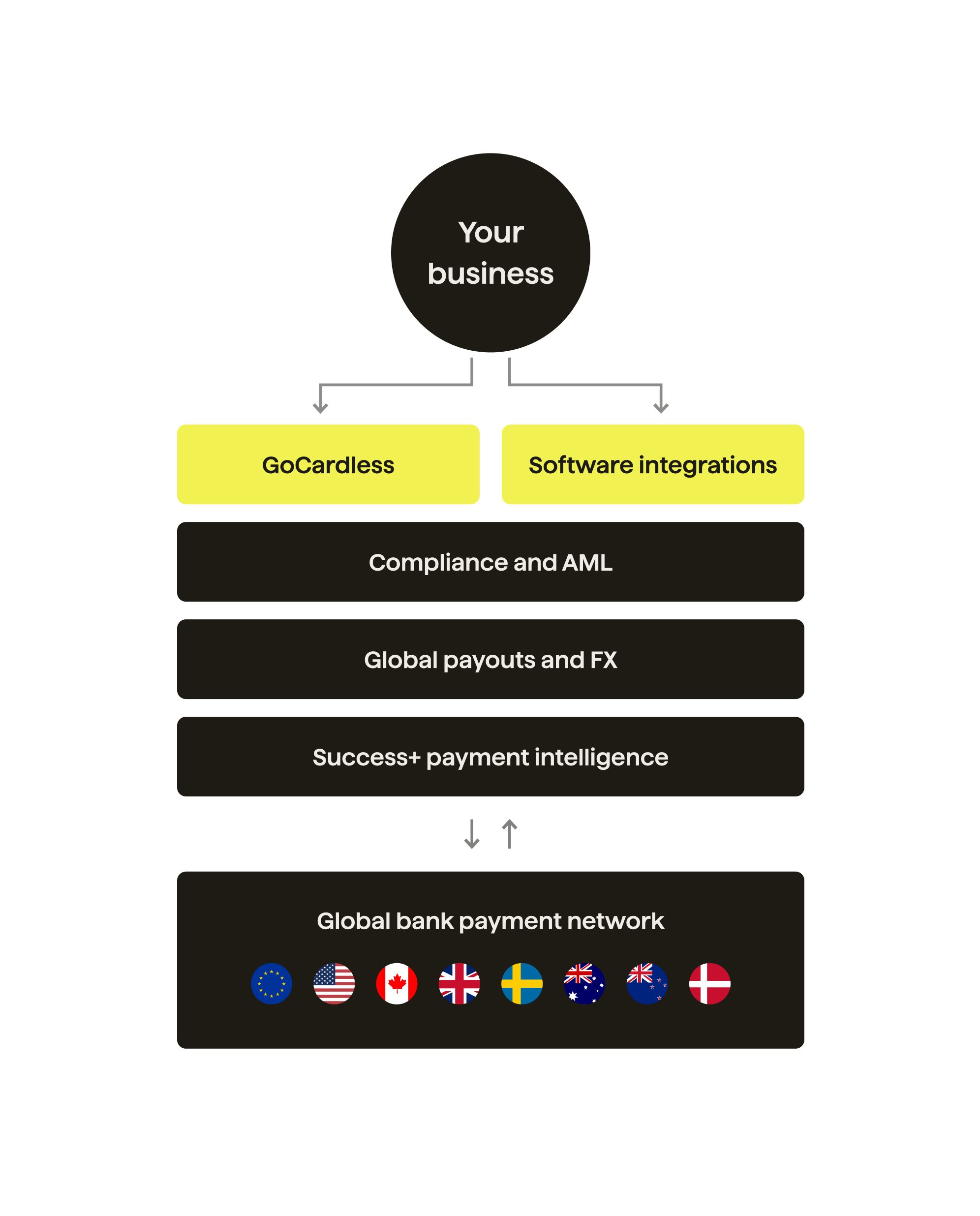

How it works

Local payments, global reach

Collect recurring bills with GoCardless, wherever your customers are. Offer the local Version of ACH Pull in over 30 countries, including the UK, Eurozone, Canada, Australia and New Zealand.

Flexible integration options

API integration

A best-in-class, customizable checkout flow, easily embeddable on your website. Localized for over 30 countries. Optimized for improved conversion

Pre-built payment page

A best-in-class, customizable checkout flow, easily embeddable on your website. Localized for over 30 countries. Optimized for improved conversion.

Secure payment link

Start using GoCardless right now, with pre-built payment flows and automated notifications localized for over 30 countries.

// Code example for creating a subscription

$client = new \GoCardlessPro\Client(array(

'access_token' => 'your_access_token_here',

'environment' => \GoCardlessPro\Environment::SANDBOX

));

$client->subscriptions()->create([

"params" => ["amount" => 40,

"currency" => "AUD",

"name" => "Premium Subscription",

"interval_unit" => "monthly",

"day_of_month" => 1,

"metadata" => ["order_no" => "ABCD1234"],

"links" => ["mandate" => "MA123"]]

]);# Code example for creating a subscription

import gocardless_pro

client = gocardless_pro.Client(access_token="your_access_token_here", environment='sandbox')

client.subscriptions.create(params={

"amount": "40",

"currency": "AUD",

"name": "Premium Subscription",

"interval_unit": "monthly",

"day_of_month": "1",

"metadata": {

"order_no": "ABCD1234"

},

"links": {

"mandate": "MA123"

}

})

]);# Code example for creating a subscription

@client = GoCardlessPro::Client.new(

access_token: "your_access_token",

environment: :sandbox

)

@client.subscriptions.create(

params: {

amount: 40,

currency: "USD",

name: "Premium Subscription",

interval_unit: "monthly",

day_of_month: 1,

links: {

mandate: "MD123"

}

}

)import static com.gocardless.GoCardlessClient.Environment.SANDBOX;

String accessToken = "your_access_token_here";

GoCardlessClient client = GoCardlessClient

.newBuilder(accessToken)

.withEnvironment(SANDBOX)

.build();

import com.gocardless.services.SubscriptionService.SubscriptionCreateRequest.IntervalUnit;

Subscription subscription = client.subscriptions().create()

.withAmount(40)

.withCurrency("USD")

.withName("Premium Subscription")

.withIntervalUnit(IntervalUnit.MONTHLY)

.withDayOfMonth(1)

.withMetadata("order_no", "ABCD1234")

.withLinksMandate("MD123")

.execute();var subscriptionRequest = new GoCardless.Services.SubscriptionCreateRequest()

{

Amount = 40,

Currency = "USD",

Name = "Premium Subscription",

Interval = 1,

IntervalUnit = GoCardless.Services.SubscriptionCreateRequest.SubscriptionIntervalUnit.Monthly,

Links = new GoCardless.Services.SubscriptionCreateRequest.SubscriptionLinks()

{

Mandate = "MD0123"

}

};// Code example for creating a subscription

const constants = require('gocardless-nodejs/constants');

const gocardless = require('gocardless-nodejs');

const client = gocardless('your_access_token_here', constants.Environments.Sandbox);

const subscription = await client.subscriptions.create({

amount: "40",

currency: "USD",

name: "Premium Subscription",

interval_unit: "monthly",

day_of_month: "1",

metadata": {

order_no: "ABCD1234"

},

links: {

mandate: "MA123"

}

});![[en-US] nwe-code_summary_block-primary-dark](https://images.ctfassets.net/40w0m41bmydz/5kIKu7t2kTxWsbNH7lEGwl/37df5a894ae3389153f4234deac2ed9a/code-example-en-us.png?w=670&h=670&q=50&fm=png)

![[en-US] nwe-code_summary_block-primary-dark](https://images.ctfassets.net/40w0m41bmydz/5kIKu7t2kTxWsbNH7lEGwl/37df5a894ae3389153f4234deac2ed9a/code-example-en-us.png?w=670&h=670&q=50&fm=png)

The solution offered all the automation features we needed and was already pre-integrated with our OSS/BSS system. We were sold pretty quickly.

Antoine Lord, Product Manager, oxio

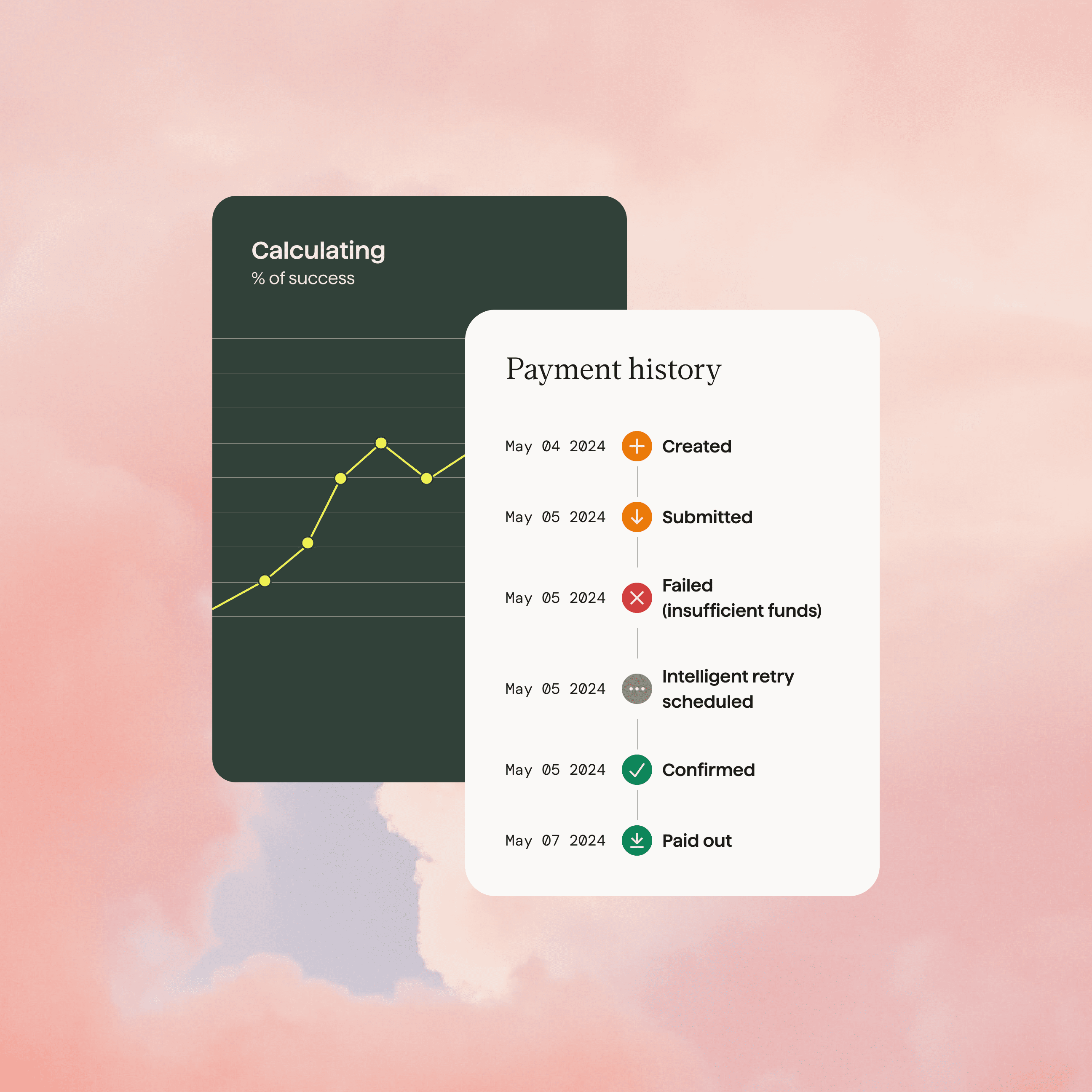

Made for payment success

Collect 97.3% of payments successfully at the first time of asking, with bank debit - like ACH debit in the US. If a payment does fail, sit back and let Success+ try again on the best day for each customer.

Built for security and scale

ISO27001 certified

Security protocols across our business, services and products have been fully audited and certified with this globally recognised international standard.

Trusted by global businesses

GoCardless processes $35bn+ annually, and has been funded by prestigious investors including Google Ventures and Salesforce Ventures.

Compliance built-in

We handle the complexities of bank debit across 30+ countries in a single integration.

Trusted by 85,000+ businesses. Of all sizes. Worldwide

Want to learn more?

Speak to one of our experts today about your payment challenges, and see how we can help.