GoCardless for enterprise businesses

Reduce churn

30% of your churn is involuntary, stemming from failed payments. With GoCardless, maximize payment success and retain your customers for longer.

30% of your churn is involuntary

Churn is a concern for every subscription business. Every subscriber that churns is a source of recurring revenue lost, and acquiring a new customer is up to 25x more expensive than retaining an existing one. 30% of that churn is involuntary, typically caused by failed credit and debit card payments. It occurs when a card is lost or stolen, it expires, or the customer’s bank rejects the payment.

We’ve had fewer than a dozen payment failures since we started using GoCardless eight months ago, which is really impressive.

Patrick Hughes, (Former) Assistant Corporate Controller, Autotask

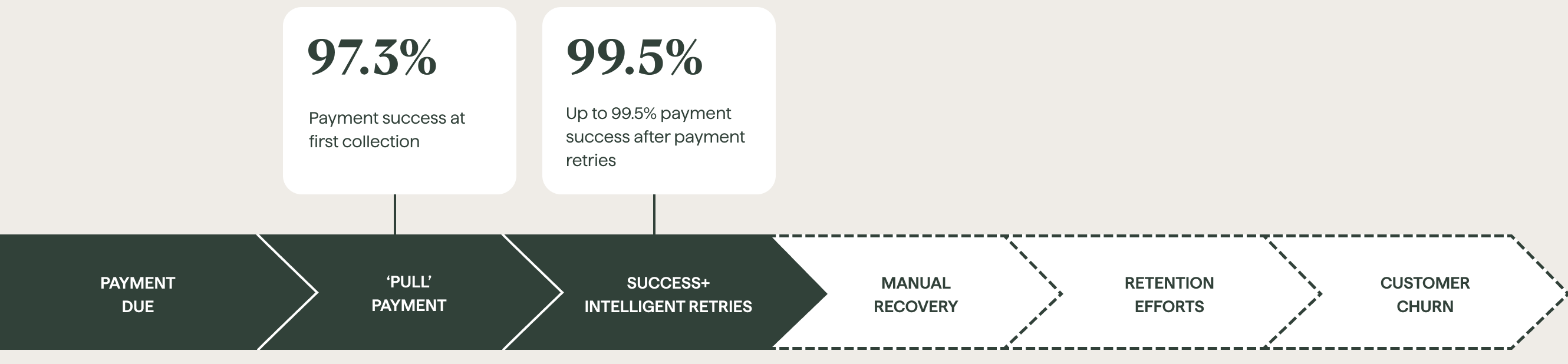

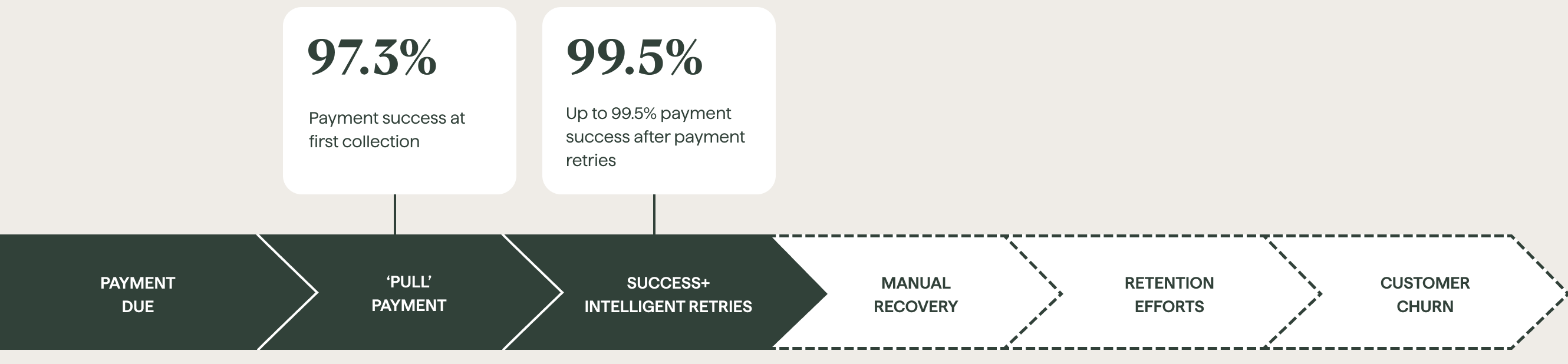

Reduce failed payments to as low as 0.5%

The average GoCardless payment failure rate at the first attempt is just 2.5%. Optimise your payments even further, using Success+ to retry those that do fail.

Pull-based payment collection

GoCardless is built on bank debit, a pull-based, bank-to-bank payment method that allows businesses to pull payments directly from their customers’ bank accounts.

Low payment failure rates

With GoCardless, around 97.3% of payments will be collected successfully at the first time of asking. With real-time reporting, know instantly when a payment does fail so you can take action.

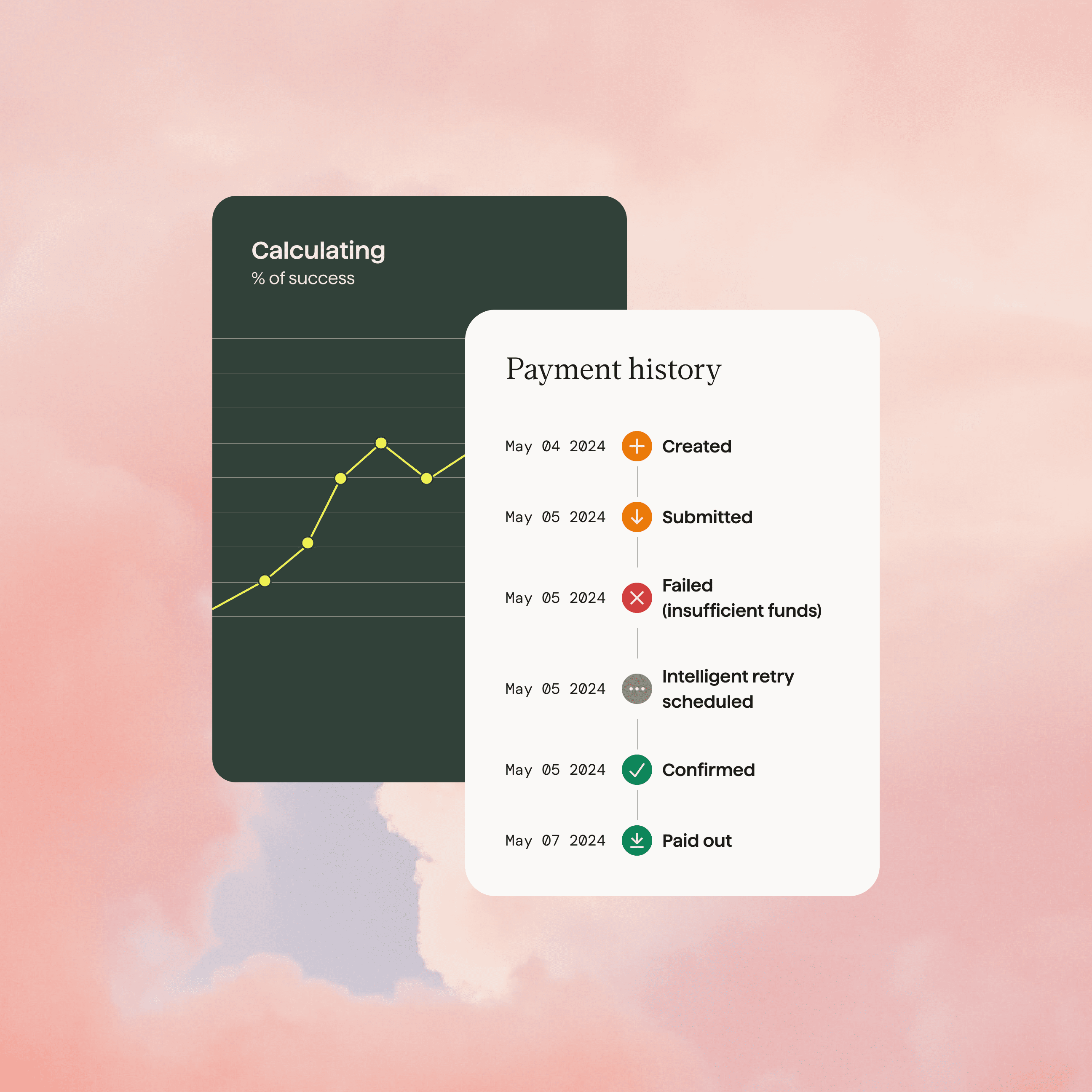

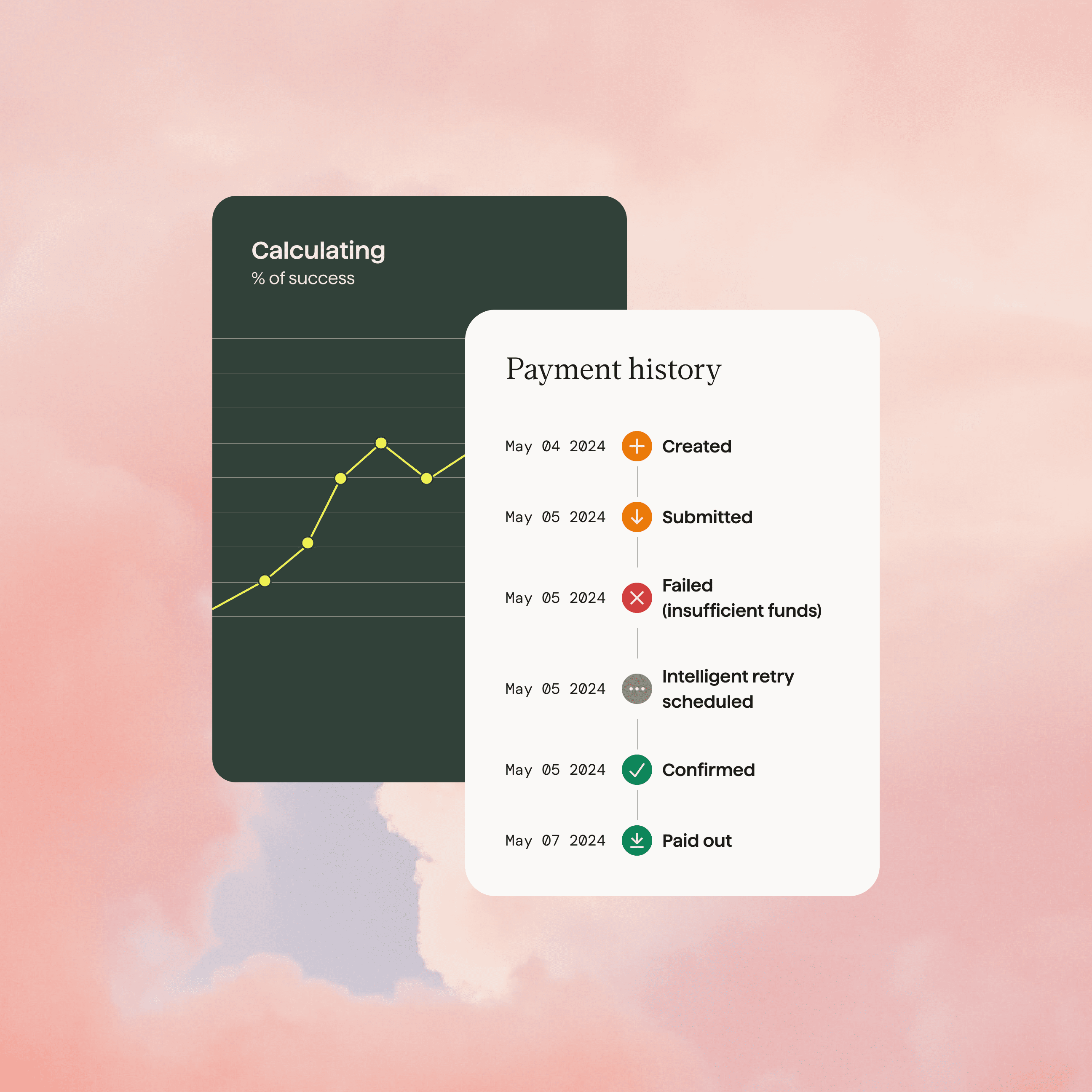

Intelligent retries

Sit back and let Success+ retry payments on the optimal day to collect from each customer. Recover up to 76% of any payments that do fail with Success+.

Optimize your payments with Success+

Success+ does all the heavy lifting, calculating the best time to retry a payment and tracking which payments have been successfully collected. 89% of businesses said Success+ saves them time.

Fully-customizable payment pages

Provide your customers with a seamless, on-brand, and high-converting payment experience as soon as they start doing business with you.

We have a payment failure rate of only 0.4%, and many of those are rectified instantly upon retrying the payment.

Damian Clements, Finance Director, Yorkshire Energy

"Getting everything live was totally painless"

The British Journal of Photography is a renowned photography magazine with subscribers from all over the world. Using GoCardless, BJOP has increased its renewal rate from 60 to 90%, and transformed its online offering into an end-to-end subscription model.

Trusted by 85,000+ businesses. Of all sizes. Worldwide

Want to learn more?

Speak to our payment experts today about your payment challenges to see how we can help.