GoCardless for enterprise businesses

Reduce churn

30% of your churn is involuntary, stemming from failed payments. With GoCardless, maximise payment success and retain your customers for longer.

30% of your churn is involuntary

Churn is a concern for every subscription business – and around 30% of it is involuntary, typically caused by failed credit and debit payments due to lost, stolen or expired cards. Losing customers through churn means missing out on recurring revenue. Plus, acquiring new customers is up to 25x more expensive than retaining your existing ones.

We’ve had less than a dozen payment failures since we started using GoCardless eight months ago, which is really impressive.

Patrick Hughes, Former Assistant Corporate Controller, Autotask

Reduce failed payments to as low as 0.5%

The average GoCardless payment failure rate at the first attempt is just 2.5%. And with Success+ to retry those that do fail, you can optimise your payments even further.

Pull-based payment collection

GoCardless is built on bank debit, a pull-based, bank-to-bank payment method that allows businesses to collect payments directly from their customers’ bank accounts.

Low payment failure rates

With GoCardless, around 97.3% of payments will be collected successfully first time around. With real-time reporting, you’ll know instantly when a payment does fail so you can act fast.

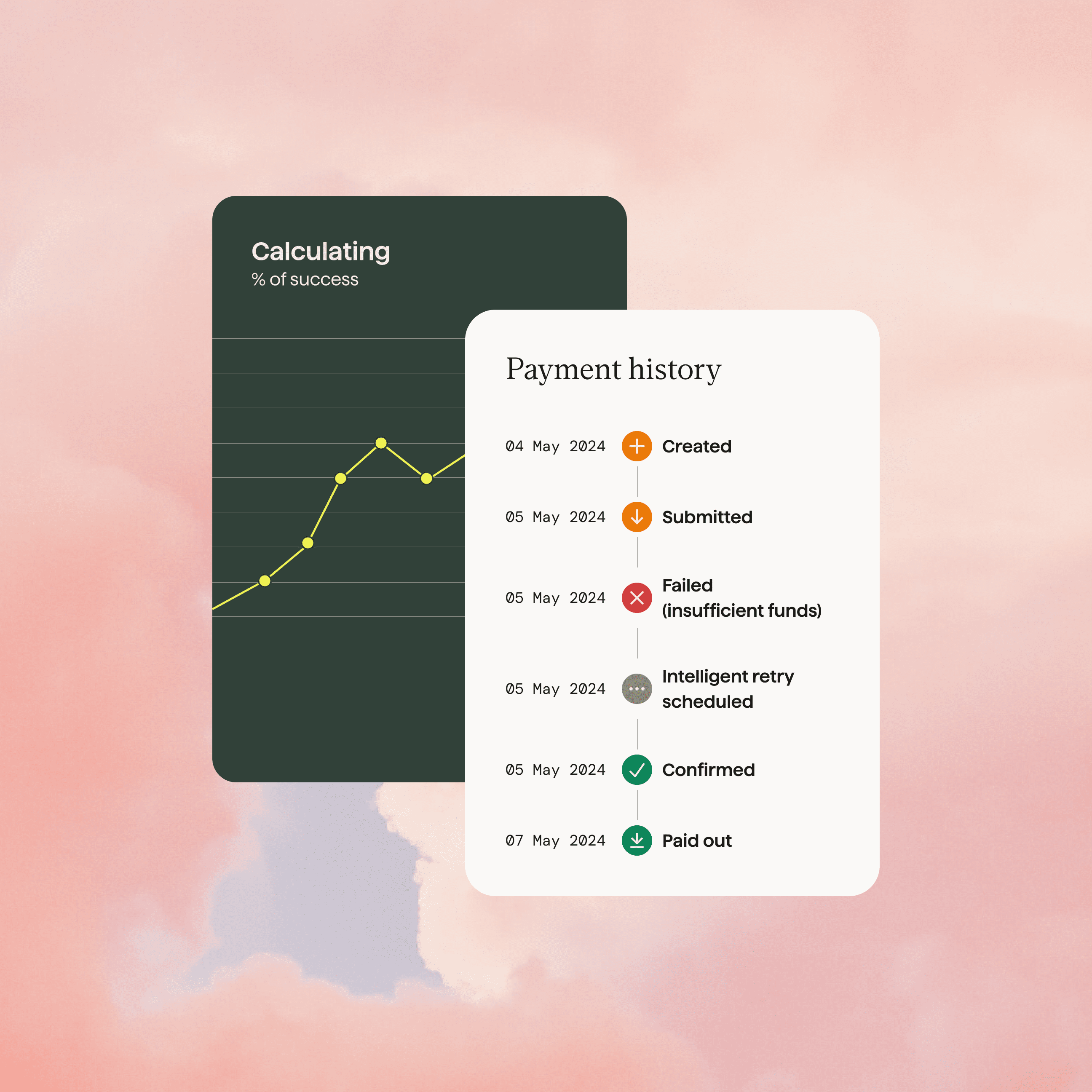

Intelligent retries

Recover up to 76% of any failed payments Success+, which retries payments on the optimal day to collect from each customer.

Optimise your payments with Success+

Success+ does all the heavy lifting, calculating the best time to retry a payment and tracking which payments have been successfully collected. 89% of businesses said Success+ saves them time.

Customise your own payment pages

Create a payment system that’s seamless, on-brand, and high-conversion – giving customers a great experience from the very start.

We have a payment failure rate of only 0.4%, and many of those are rectified instantly upon retrying the payment.

Damian Clements, Finance Director, Yorkshire Energy

"Getting everything live was totally painless"

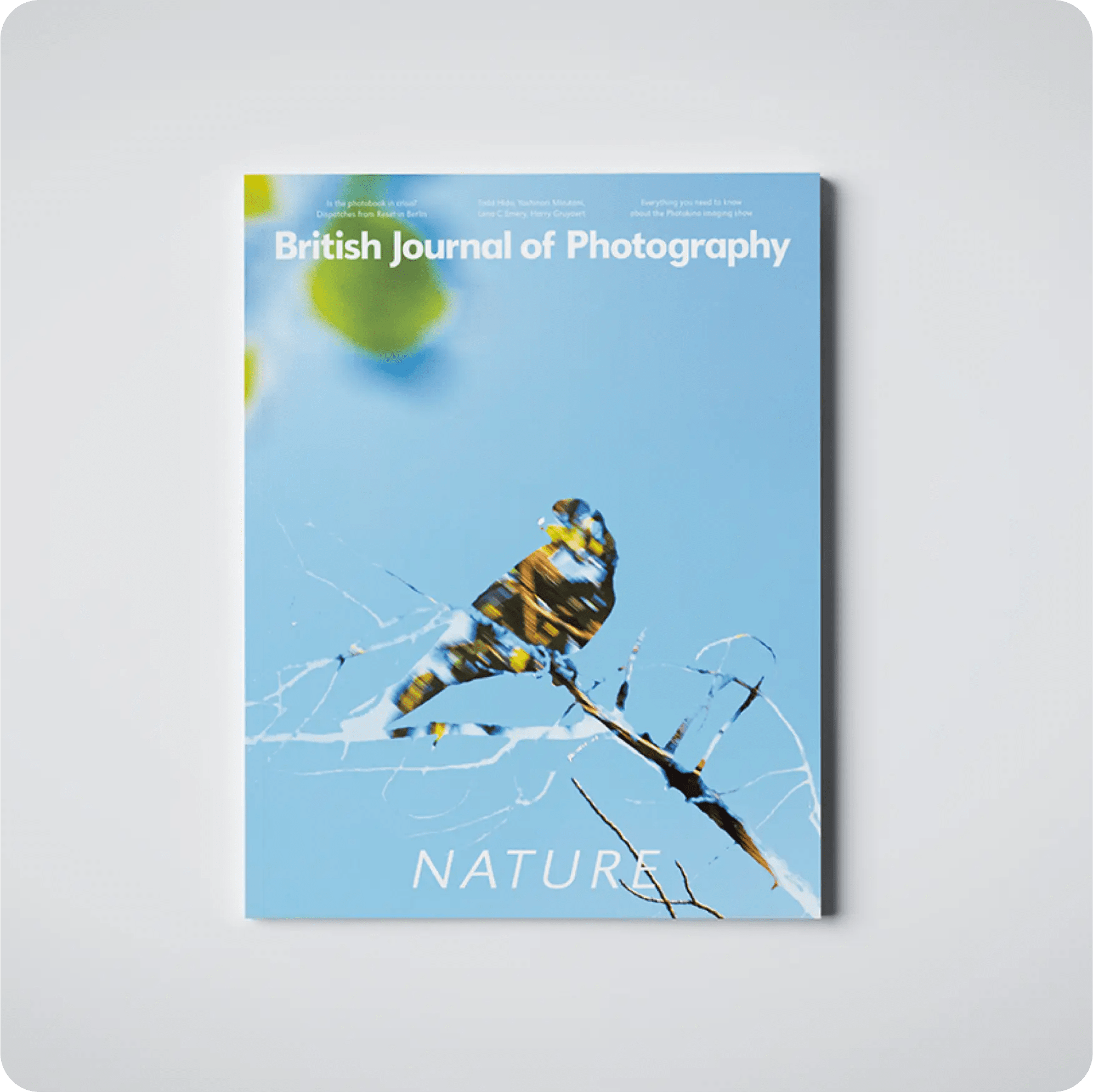

The British Journal of Photography is a renowned photography magazine with subscribers based all over the world. Using GoCardless, BJOP has been able to increase renewal rate from 60 to 90%, and transform its online offering into an end-to-end subscription model.

Trusted by 85,000+ businesses. Of all sizes. Worldwide.

Want to learn more?

Speak to one of our experts today about your payment challenges, and see how we can help.