GoCardless for enterprise businesses

Reduce your operational costs

Reduce the total cost of collecting and managing recurring payments by up to 56% with GoCardless.

Collecting recurring bills is expensive

From setup costs and card processing fees to lost revenue from customer churn, the true cost of collecting payments goes well beyond transaction costs. And every added operational cost stifles growth.

These setbacks are compounded by FX costs and hidden fees if you collect payments internationally.

Since moving to GoCardless, we have reduced the cost of processing payments by 90%.

Damian Brychy, COO and Co-Founder, Capital on Tap

Cost-effective payment collection

Automate your payment collection with GoCardless and reduce the cost of collecting payments.

Recurring payments, automated

Reduce operational costs by automating otherwise manual processes. Manage payment collection and reconciliation through an extensive choice of over 200 leading partner integrations or our best-in-class API.

Real-time notifications

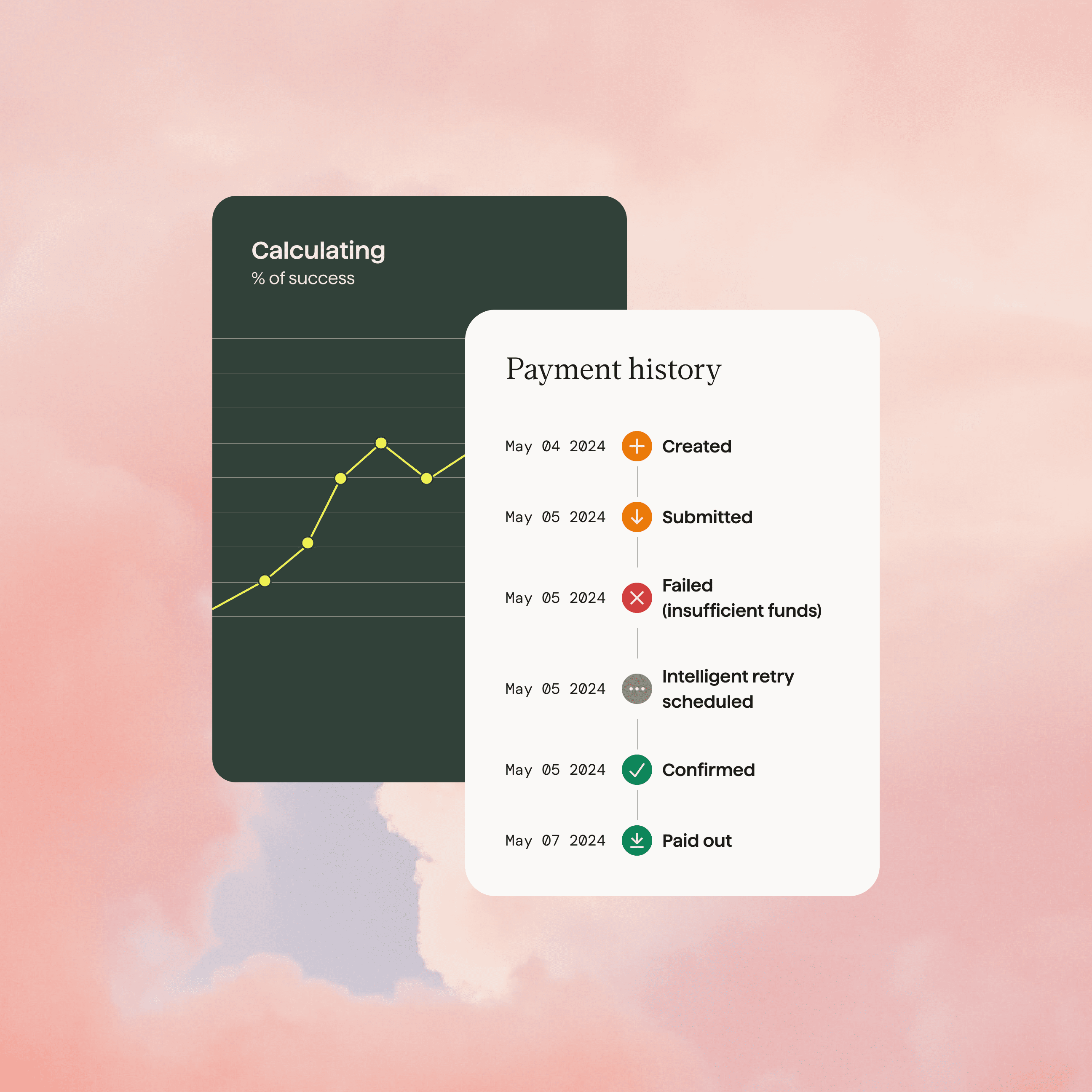

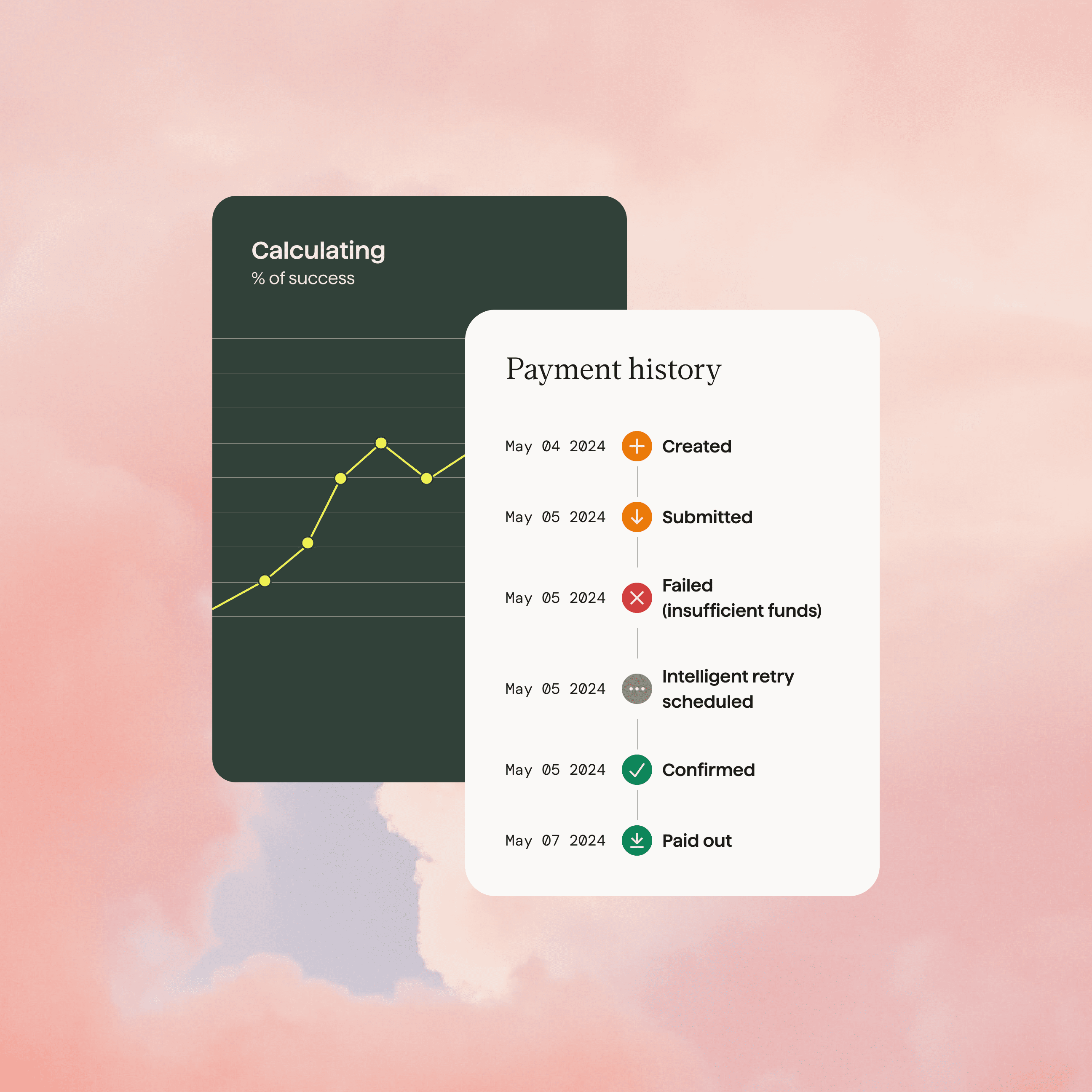

With GoCardless, up to 97.3% of payments will be collected successfully at the first time of asking. With real-time reporting, you’ll know instantly when a payment fails and can take action with Success+.

Total visibility over payments

Get user-friendly insights and reporting delivered in real-time, allowing you to keep track of the entire payment process. React quickly when a payment does fail, and reduce the burden on your customer support team.

Increase efficiency

Using GoCardless, 59% fewer team resources are required to implement and manage payments.*

Made for payment success

Collect 97.3% of payments successfully the first time with ACH bank debit. If a payment does fail, sit back and let Success+ try again on the best day for each customer.

Made for recurring billing

GoCardless is the only payment provider built specifically for recurring billing. Whether you’re collecting invoices, subscription payments or membership fees, we’ll take care of the payment collection process so you can focus on what you do best.

Everything just works… It’s now a one- or two-touch billing process, once a month. We don’t need to think or worry about it anymore."

John Heggs, Finance Manager, intY

6x faster payment collection with GoCardless

US-based SaaS business Autotask sells subscriptions in more than 50 countries, including the UK, the Netherlands and Germany. Before discovering GoCardless, half of its customers paid monthly fees through bank transfer or check; and half by credit card.

Since switching to Gocardless, Autotask has been able to reduce debtor days to just 3.5 days and minimize payment failure rates to less than 1%.

Trusted by 85,000+ businesses. Of all sizes. Worldwide

How can we help?

Speak to one of our payment experts about the challenges of reducing your payment processing costs, and we’ll work with you to transform the way you collect recurring payments.