GoCardless for enterprise businesses

Made for recurring payments at scale

GoCardless is the most effective way to collect subscriptions and invoice payments, both domestically with ACH debit, and around the world through relevant local bank debit schemes

Manually processing checks and wire transfers creates unwelcome admin for you and your customers. With ACH Pull, after initial set up, payments are automatically collected on the due date set with you or your customer lifting a finger.

Manually processing checks and wire transfers creates unwelcome admin for you and your customers. With ACH Pull, after initial set up, payments are automatically collected on the due date set with you or your customer lifting a finger.

Manually processing checks and wire transfers creates unwelcome admin for you and your customers. With ACH Pull, after initial set up, payments are automatically collected on the due date set with you or your customer lifting a finger.

Manually processing checks and wire transfers creates unwelcome admin for you and your customers. With ACH Pull, after initial set up, payments are automatically collected on the due date set with you or your customer lifting a finger.

Manually processing checks and wire transfers creates unwelcome admin for you and your customers. With ACH Pull, after initial set up, payments are automatically collected on the due date set with you or your customer lifting a finger.

Local payments, global reach

Collect recurring payments with GoCardless, wherever your customers are. Offer the local bank debit payment option in over 30 countries, including the UK (Bacs Direct Debit), Eurozone countries (SEPA), the USA (ACH debit), Canada (PAD), Australia (BECS AU) and New Zealand (BECS NZ).

Flexible integration options

API integration

A best-in-class, customizable checkout flow, easily embeddable on your website. Localized for over 30 countries. Optimized for improved conversion

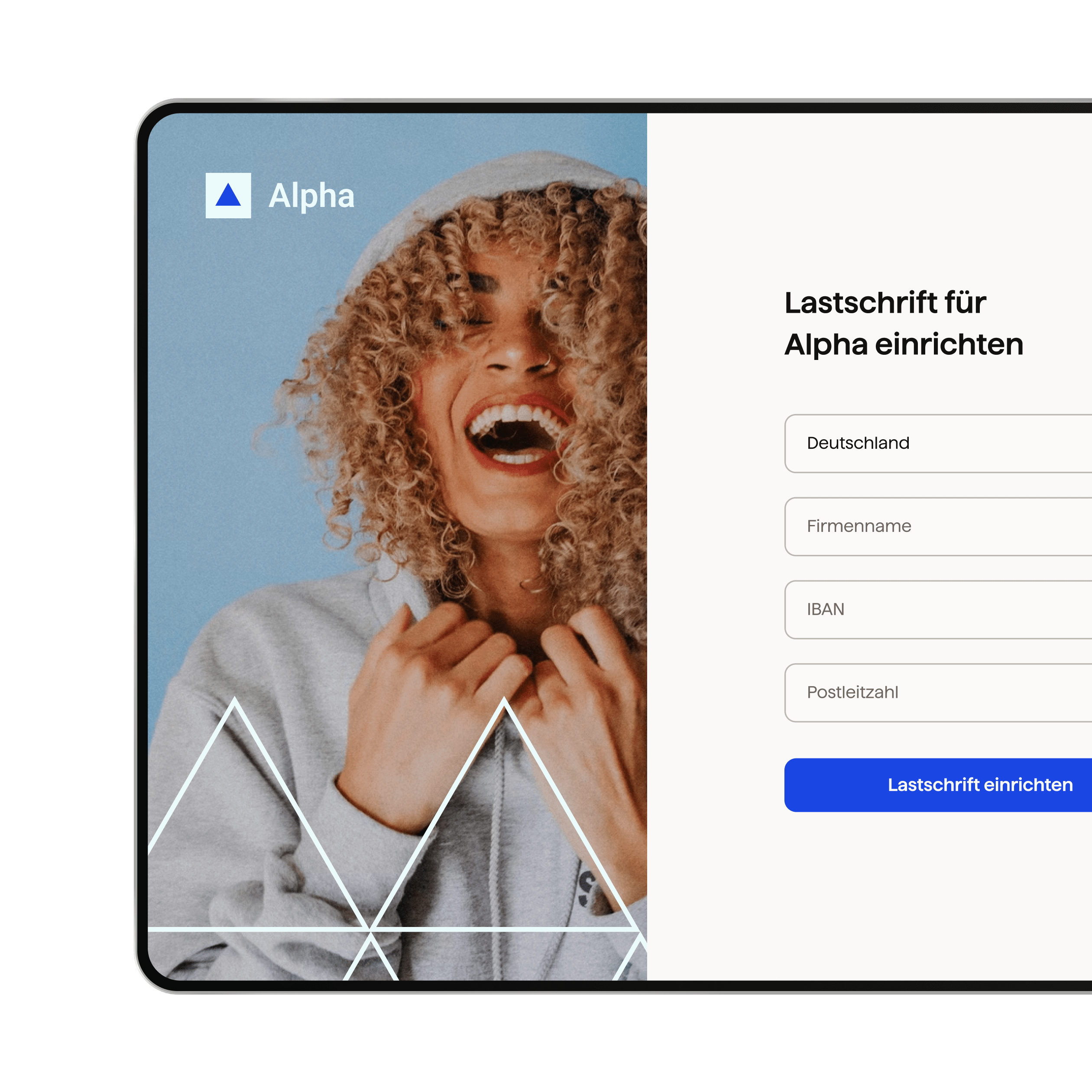

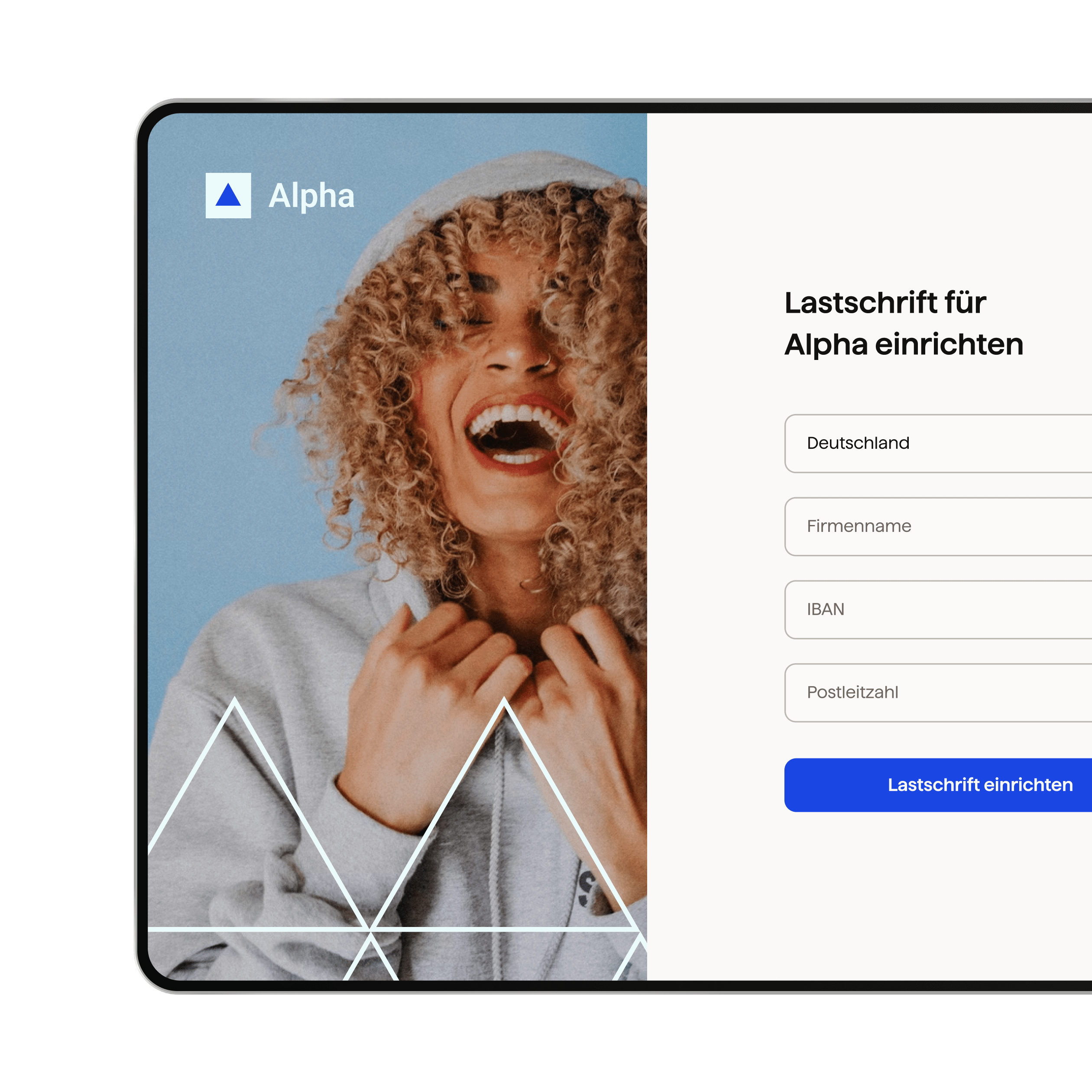

Pre-built payment page

A best-in-class, customizable checkout flow, easily embeddable on your website. Localized for over 30 countries. Optimized for improved conversion.

Secure payment link

Start using GoCardless right now, with pre-built payment flows and automated notifications localized for over 30 countries.

// Code example for creating a subscription

$client = new \GoCardlessPro\Client(array(

'access_token' => 'your_access_token_here',

'environment' => \GoCardlessPro\Environment::SANDBOX

));

$client->subscriptions()->create([

"params" => ["amount" => 40,

"currency" => "AUD",

"name" => "Premium Subscription",

"interval_unit" => "monthly",

"day_of_month" => 1,

"metadata" => ["order_no" => "ABCD1234"],

"links" => ["mandate" => "MA123"]]

]);# Code example for creating a subscription

import gocardless_pro

client = gocardless_pro.Client(access_token="your_access_token_here", environment='sandbox')

client.subscriptions.create(params={

"amount": "40",

"currency": "AUD",

"name": "Premium Subscription",

"interval_unit": "monthly",

"day_of_month": "1",

"metadata": {

"order_no": "ABCD1234"

},

"links": {

"mandate": "MA123"

}

})

]);# Code example for creating a subscription

@client = GoCardlessPro::Client.new(

access_token: "your_access_token",

environment: :sandbox

)

@client.subscriptions.create(

params: {

amount: 40,

currency: "USD",

name: "Premium Subscription",

interval_unit: "monthly",

day_of_month: 1,

links: {

mandate: "MD123"

}

}

)import static com.gocardless.GoCardlessClient.Environment.SANDBOX;

String accessToken = "your_access_token_here";

GoCardlessClient client = GoCardlessClient

.newBuilder(accessToken)

.withEnvironment(SANDBOX)

.build();

import com.gocardless.services.SubscriptionService.SubscriptionCreateRequest.IntervalUnit;

Subscription subscription = client.subscriptions().create()

.withAmount(40)

.withCurrency("USD")

.withName("Premium Subscription")

.withIntervalUnit(IntervalUnit.MONTHLY)

.withDayOfMonth(1)

.withMetadata("order_no", "ABCD1234")

.withLinksMandate("MD123")

.execute();var subscriptionRequest = new GoCardless.Services.SubscriptionCreateRequest()

{

Amount = 40,

Currency = "USD",

Name = "Premium Subscription",

Interval = 1,

IntervalUnit = GoCardless.Services.SubscriptionCreateRequest.SubscriptionIntervalUnit.Monthly,

Links = new GoCardless.Services.SubscriptionCreateRequest.SubscriptionLinks()

{

Mandate = "MD0123"

}

};// Code example for creating a subscription

const constants = require('gocardless-nodejs/constants');

const gocardless = require('gocardless-nodejs');

const client = gocardless('your_access_token_here', constants.Environments.Sandbox);

const subscription = await client.subscriptions.create({

amount: "40",

currency: "USD",

name: "Premium Subscription",

interval_unit: "monthly",

day_of_month: "1",

metadata": {

order_no: "ABCD1234"

},

links: {

mandate: "MA123"

}

});![[en-US] nwe-code_summary_block-secondary-dark](https://images.ctfassets.net/40w0m41bmydz/5kIKu7t2kTxWsbNH7lEGwl/37df5a894ae3389153f4234deac2ed9a/code-example-en-us.png?w=670&h=670&q=50&fm=png)

![[en-US] nwe-code_summary_block-secondary-dark](https://images.ctfassets.net/40w0m41bmydz/5kIKu7t2kTxWsbNH7lEGwl/37df5a894ae3389153f4234deac2ed9a/code-example-en-us.png?w=670&h=670&q=50&fm=png)

Connect to your software

Connect GoCardless directly to your business using pre-built integrations with over 200 leading billing and CRM systems.

The solution offered all the automation features we needed and was already pre-integrated with our OSS/BSS system. We were sold pretty quickly.

Antoine Lord, Product Manager, oxio

Made for payment success

Collect 97.3% of payments successfully at the first time of asking, with bank debit (such as ACH debit in the US). When a payment does fail, sit back and let Success+ schedule payment retries on the best day for each customer.

Built for security and scale

ISO27001 certified

Security protocols across our business, services and products have been fully audited and certified with this globally recognised international standard.

GDPR compliant

The GoCardless global data risk management programme is built to strict GDPR standards and applies privacy best practices to help protect and respect personal data.

Trusted by global businesses

GoCardless processes $35bn+ annually, and has been funded by prestigious investors including Google Ventures and Salesforce Ventures.

Compliance built-in

We handle the complexities of bank debit across 30+ countries in a single integration.

Moving to GoCardless was the natural step in our payments evolution to allow us to scale, without payments being the limiting factor.

Chris Latchford, Global Head of Payments Strategy, Funding Circle

A team dedicated to your success

Onboarding

Expert onboarding specialists will provide dedicated support to get GoCardless set up for your business.

Integration

Our solution architects will work closely with your team to help you build a best-in-class integration designed for your needs.

Ongoing support

You’ll have a dedicated customer success team by your side, every step of the way.

Always evolving

With a world-class product development team, we’re constantly improving your ability to easily and predictably collect recurring payments at scale.

Trusted by 85,000+ businesses. Of all sizes. Worldwide

Want to learn more?

Speak to one of our experts today about your payment challenges, and see how we can help.