Reduce failed payments

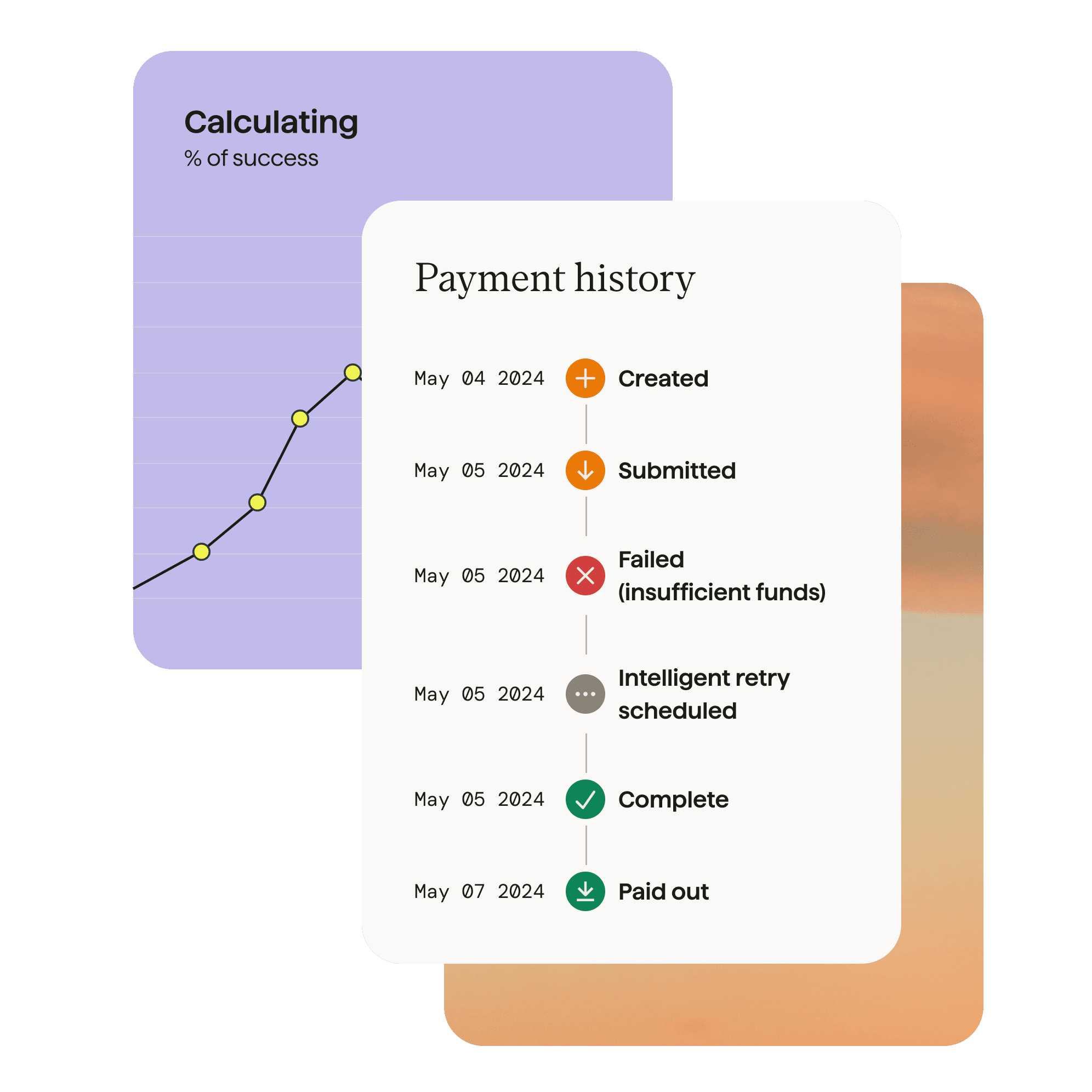

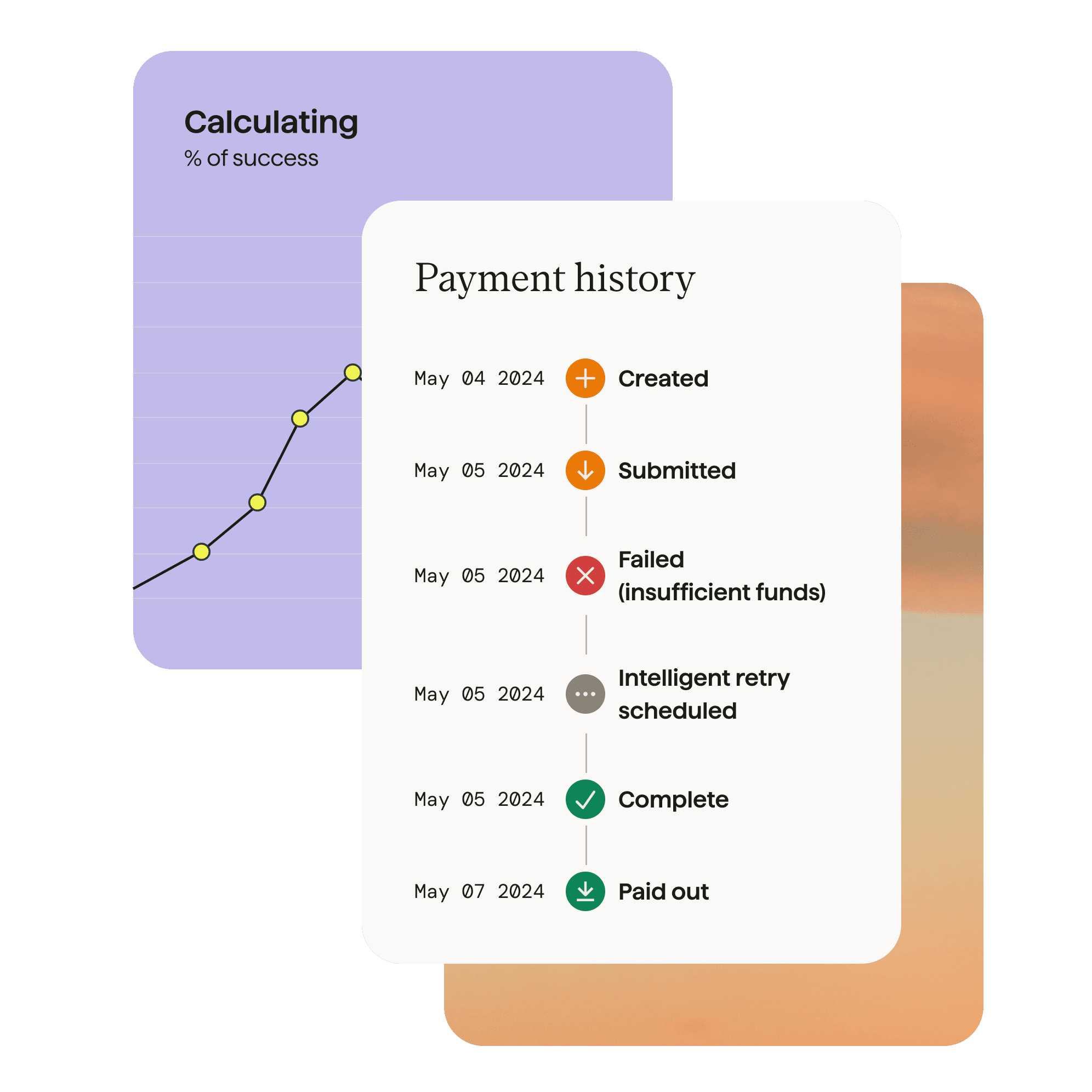

GoCardless collects approximately 97.3% of payments successfully the first time. Success+ schedules payment retries on the best day for each customer.

10–15% of card payments fail

10–15% of all credit and debit card payments fail because cards are lost, expire, or are rejected by issuing banks. Each failed payment needs to be retried and rectified. That adds to the busy work of collecting payments.

GoCardless stops those awkward conversations with clients, it saves time and it obviously helps cash flow – that��’s a huge thing!”

Saija Mahon, Founder & MD, Mahon Digital

Improve your payment success rate with GoCardless

GoCardless is built on bank-to-bank payments like ACH debit in the US, and has a low failure rate of around 2.5% at the first collection attempt. With bank debit, bank accounts don’t expire, so customer details rarely need updating.

Optimize your payments with Success+

Sit back and let Success+ retry payments on the optimal day to collect from each customer. Recover up to 76% of any payments that do fail with Success+.

How it works

Trusted by 85,000+ businesses. Of all sizes. Worldwide

Ready, Set, Go?

Pay as you go pricing, with low transaction fees and no monthly contract. Get started in minutes.