Simple and secure direct bank payments

Forget about failed payments, with GoCardless

Collecting payments should just work, without you having to worry about frequent failures.

10–15% of card payments fail

Card payments have lots of complexity, which means lots of things can go wrong. And for every payment that fails, you’re stuck with annoying admin that costs you.

GoCardless stops those awkward conversations with clients, it saves time and it obviously helps cash flow – that’s a huge thing!”

Saija Mahon, Founder & MD, Mahon Digital

Let’s do you one better

GoCardless is built on bank payments, instead of relying on card networks. Which means fewer things go wrong, reducing your failed payments.

Instead of 10-15% of payments failing like with cards, we see numbers more like 0.5-2.9%. Happy days.

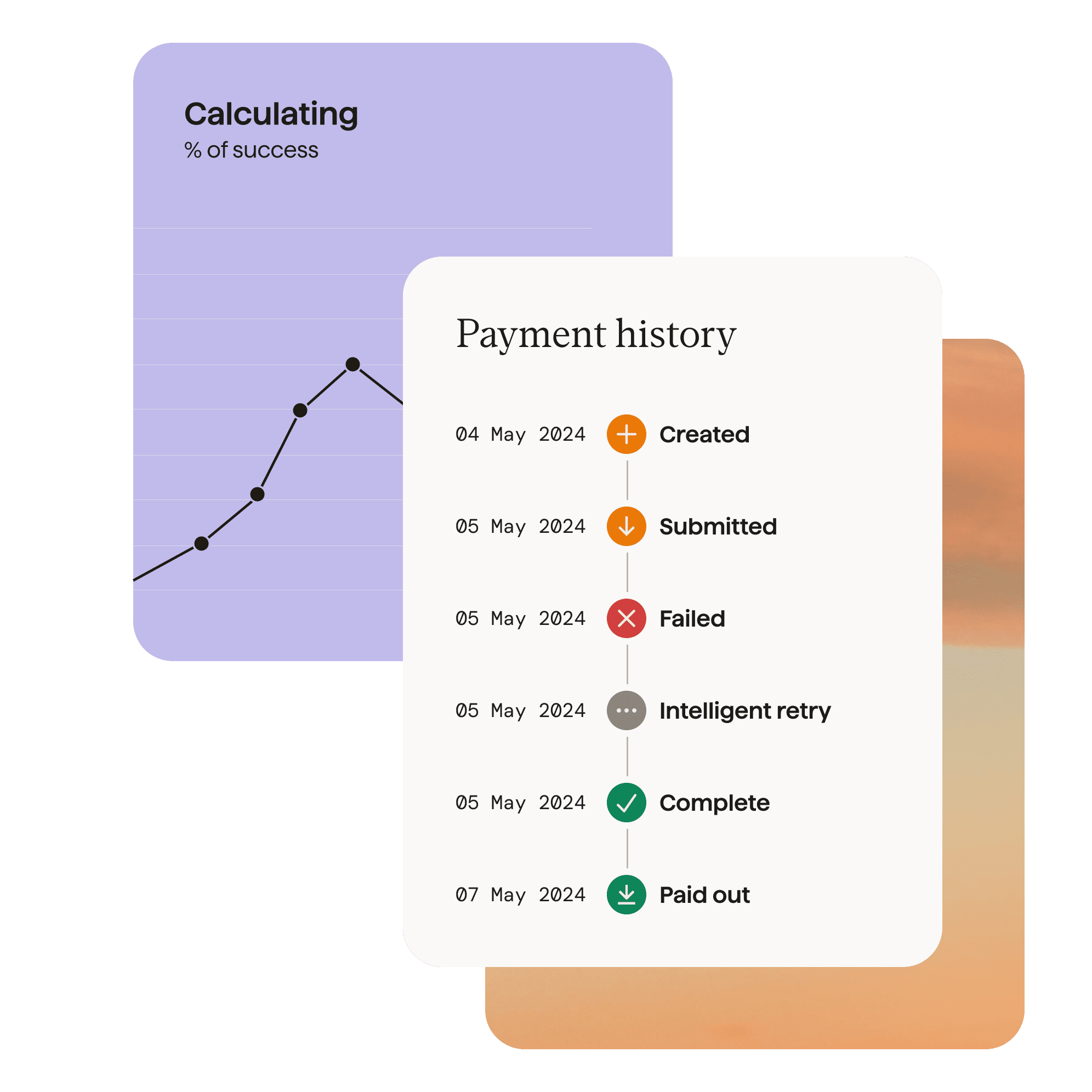

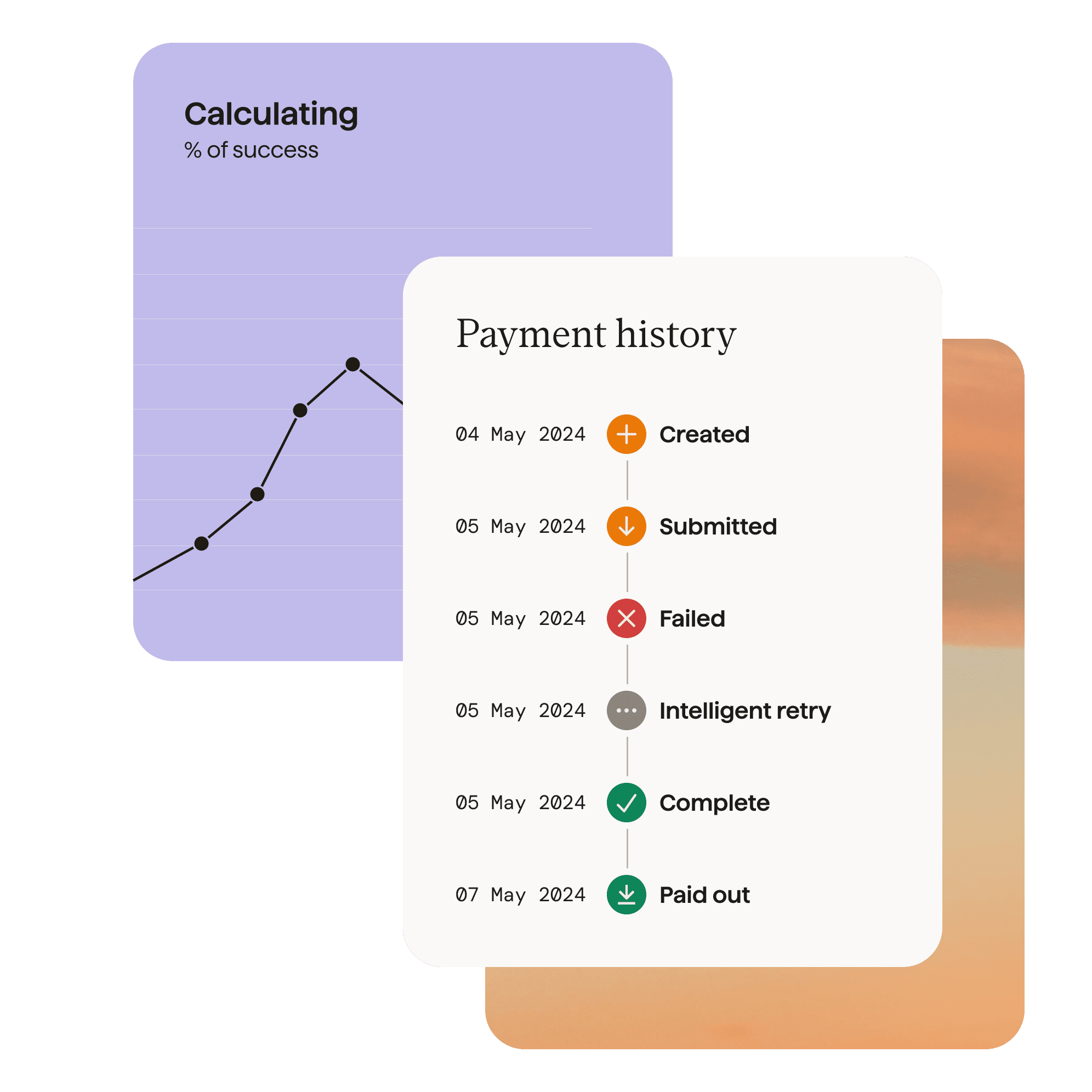

Even less fuss, with Success+

Move over, manual retries. Our payments intelligence product, Success+, automatically retries failed payments on the best day for each customer.

Recovering 70% of failed payments, on average. So you maximise your payment success rate.

How it works

Trusted by 75,000+ businesses. Of all sizes. Worldwide.

![]()

Seamless integrations

"Xero has chosen GoCardless as its best-in-class solution for Direct Debit and it shows."

Ready for payment collection with fewer failures?

Give GoCardless a go – no obligations – with low, pay-as-you-go pricing. And get started in minutes.