Recurring payments made easy

Get set up in minutes and collect payments around the world in the local bank debit scheme, such as via ACH debit in the US. It’s perfect for regular or ad hoc payments, and for fixed or variable amounts.

For invoice payments

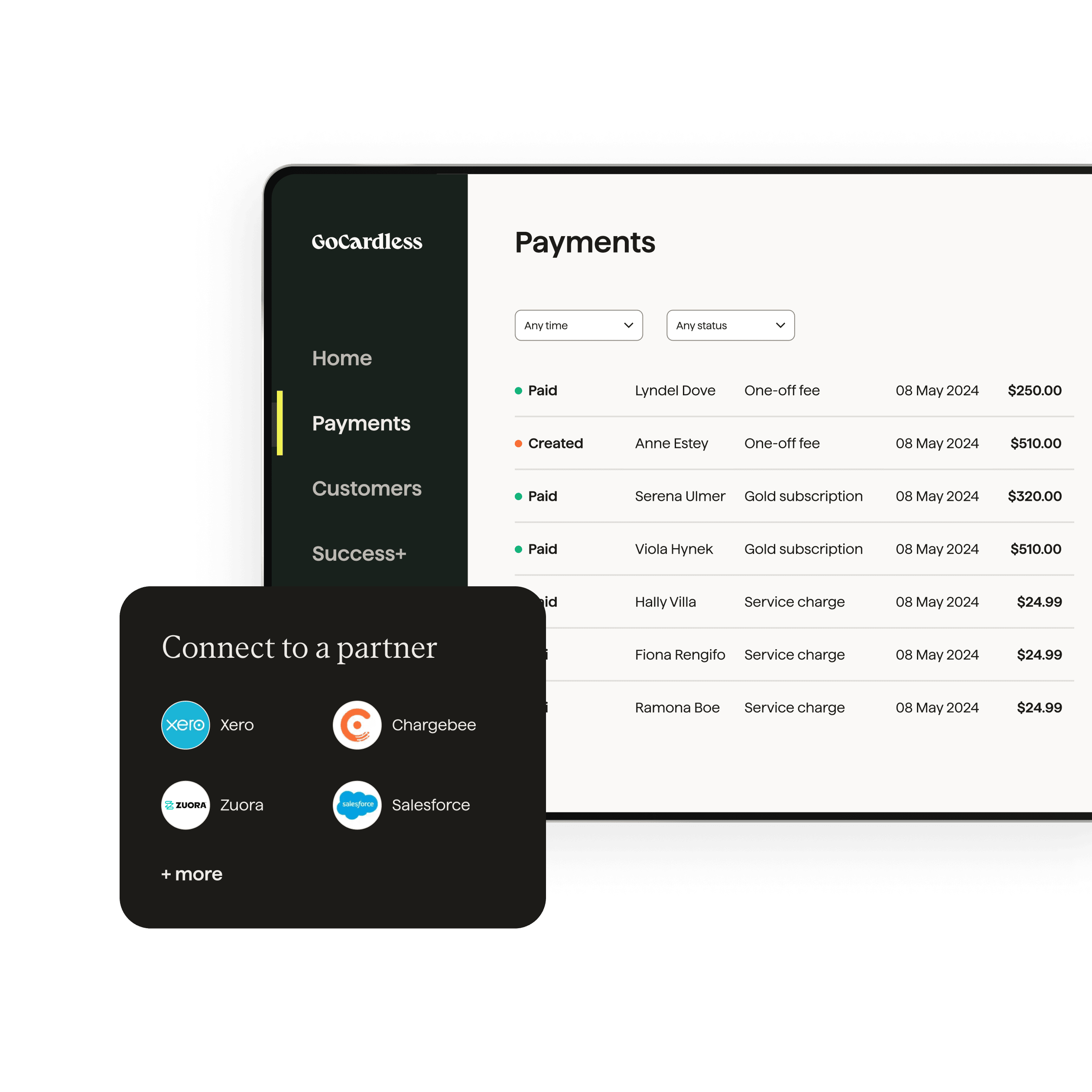

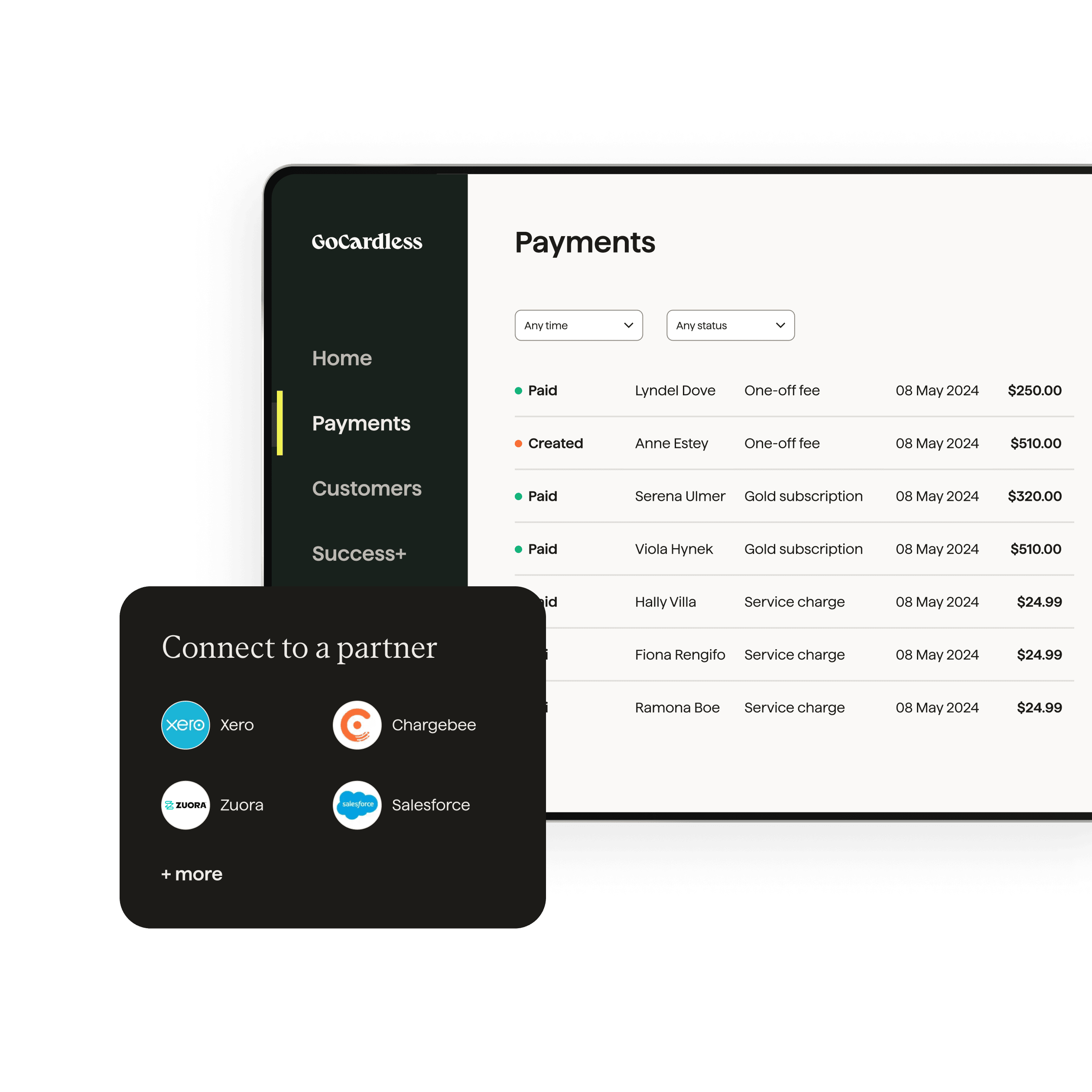

Say goodbye to late invoice payments. Once a customer is set up, you can collect and reconcile payments automatically via bank debit (such as ACH debit in the US), whenever they are due. Manage payments using your existing invoicing software or our intuitive dashboard.

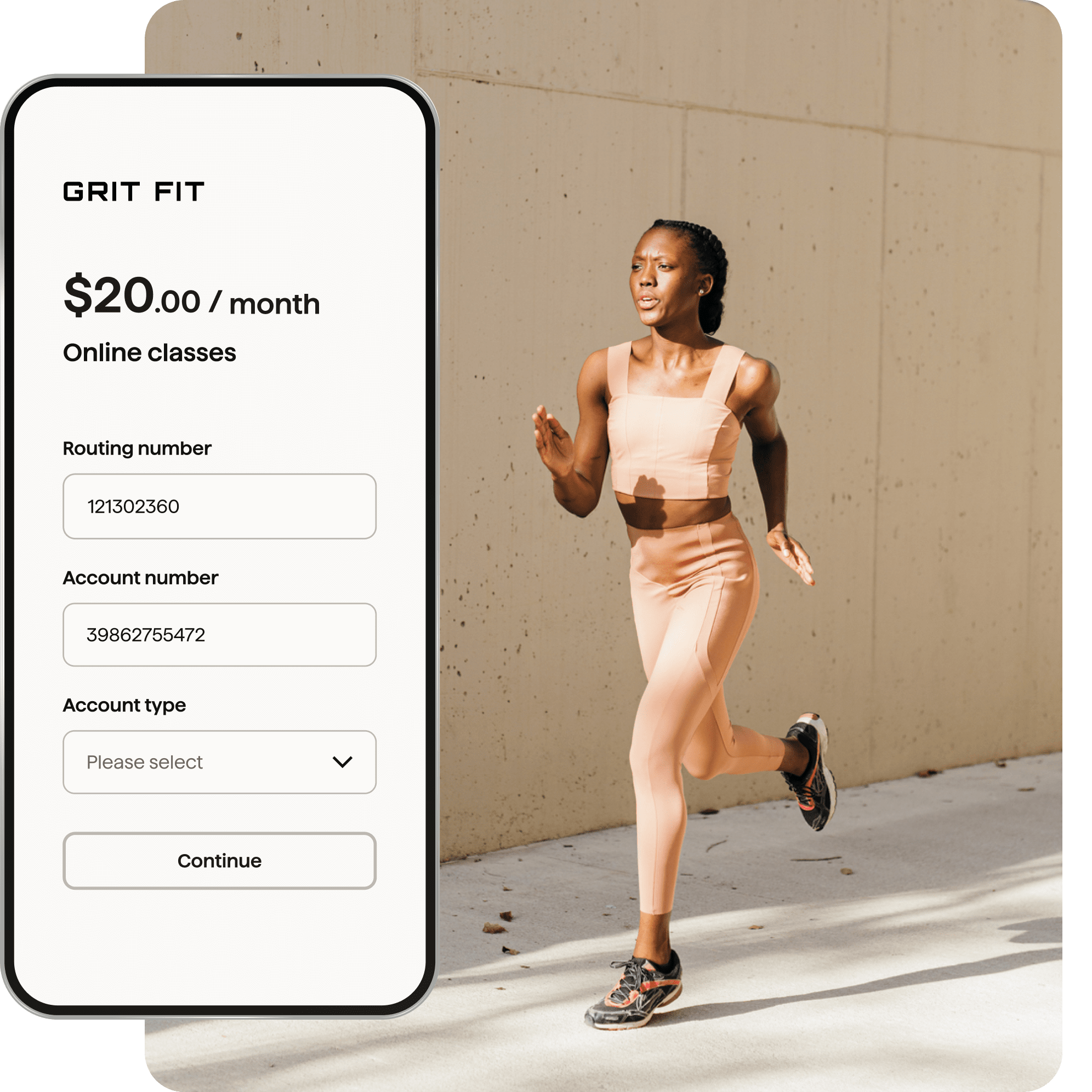

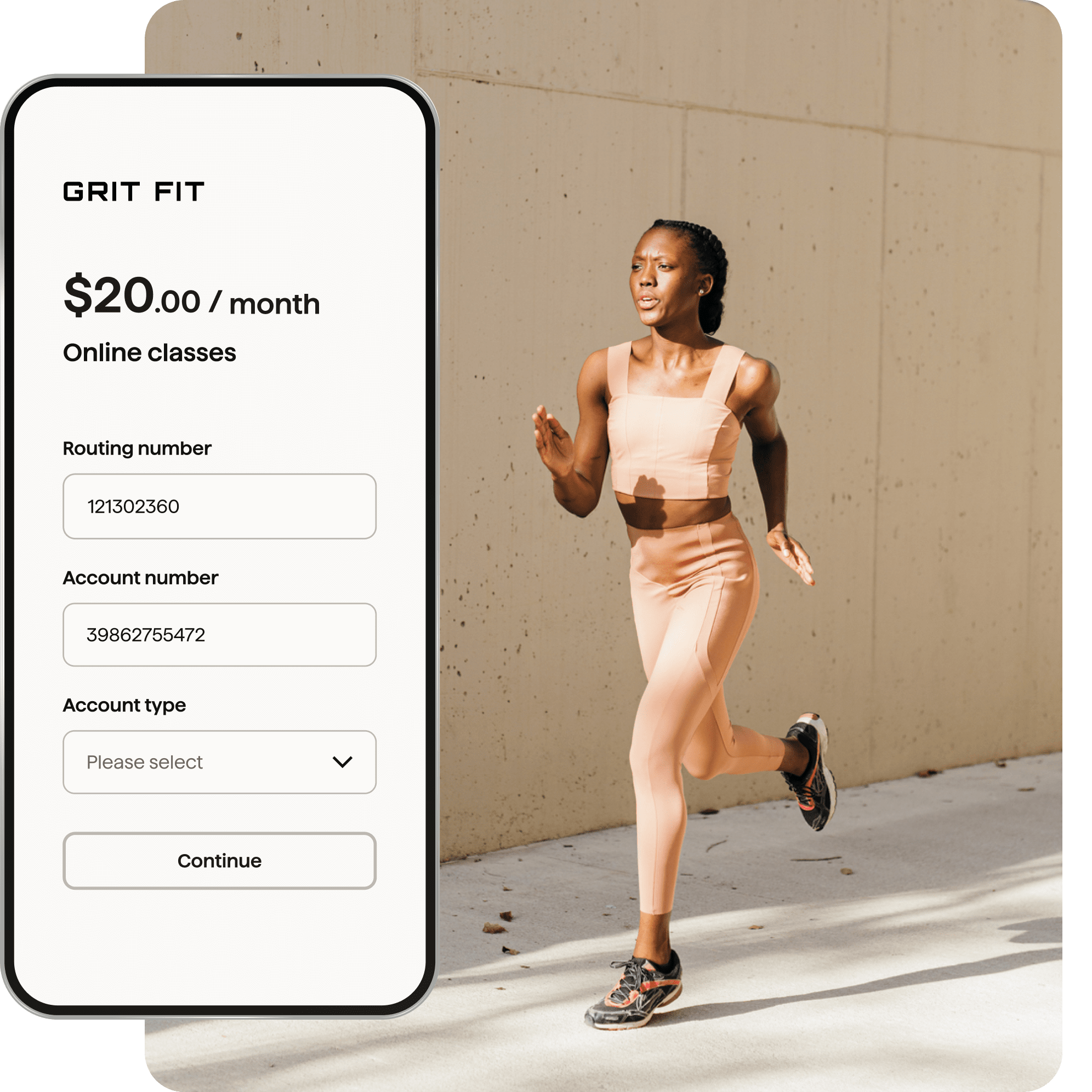

For subscription and membership payments

Create flexible recurring payment plans to suit your business. Take bank debit payments (such as ACH debit in the US) directly on your website or by sending your customers a secure payment link.

Ideal for your customers

Simple

Setting up payments only takes two minutes for customers to complete online.

Transparent

Customers will always be notified by email when a subscription is starting or one-time payment is being taken.

Efficient

Eliminate the need for customers writing and mailing out checks, logging into online banking or forgetting to pay.

Safe and protected

Your customers’ payments are fully protected if a payment is ever taken in error.

How it works

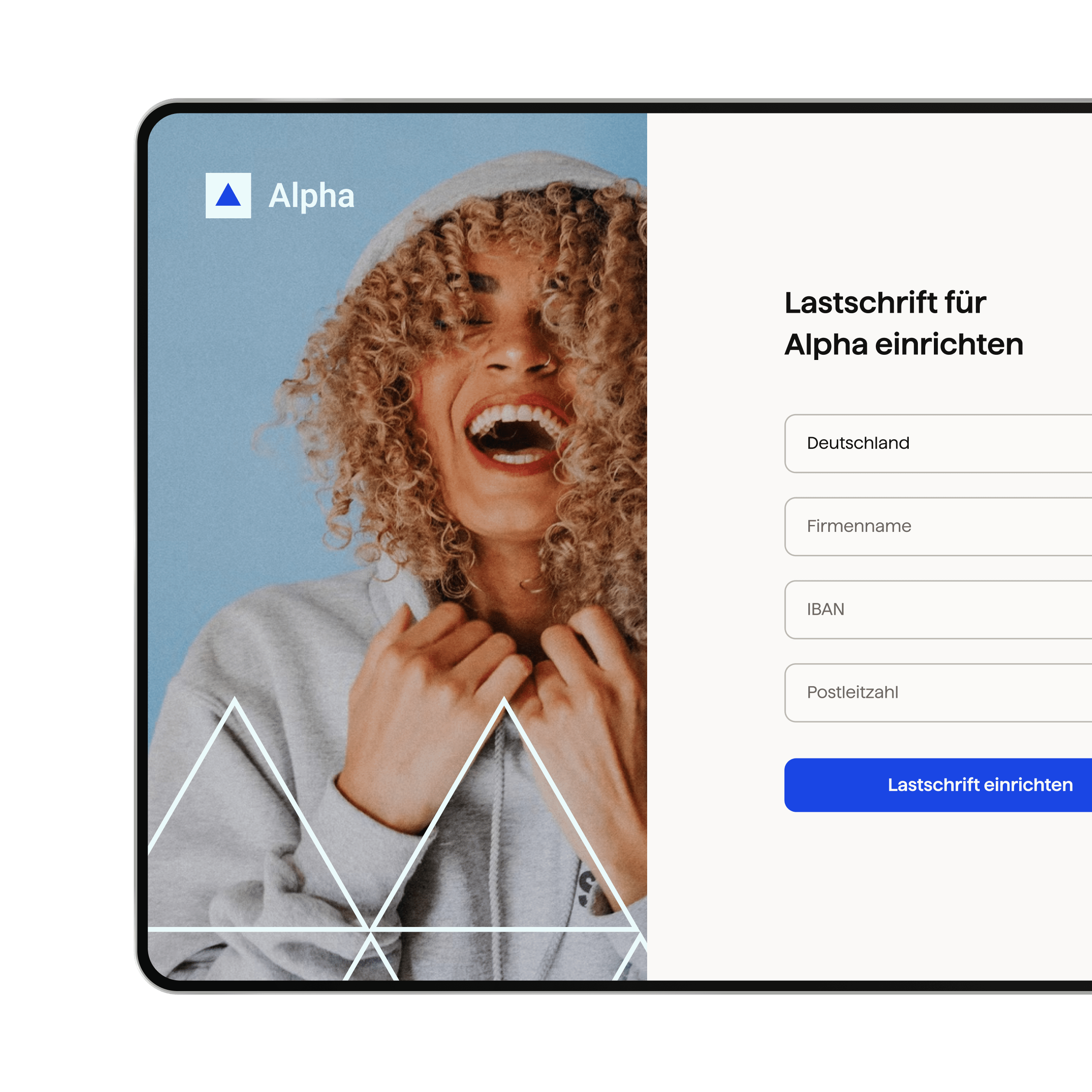

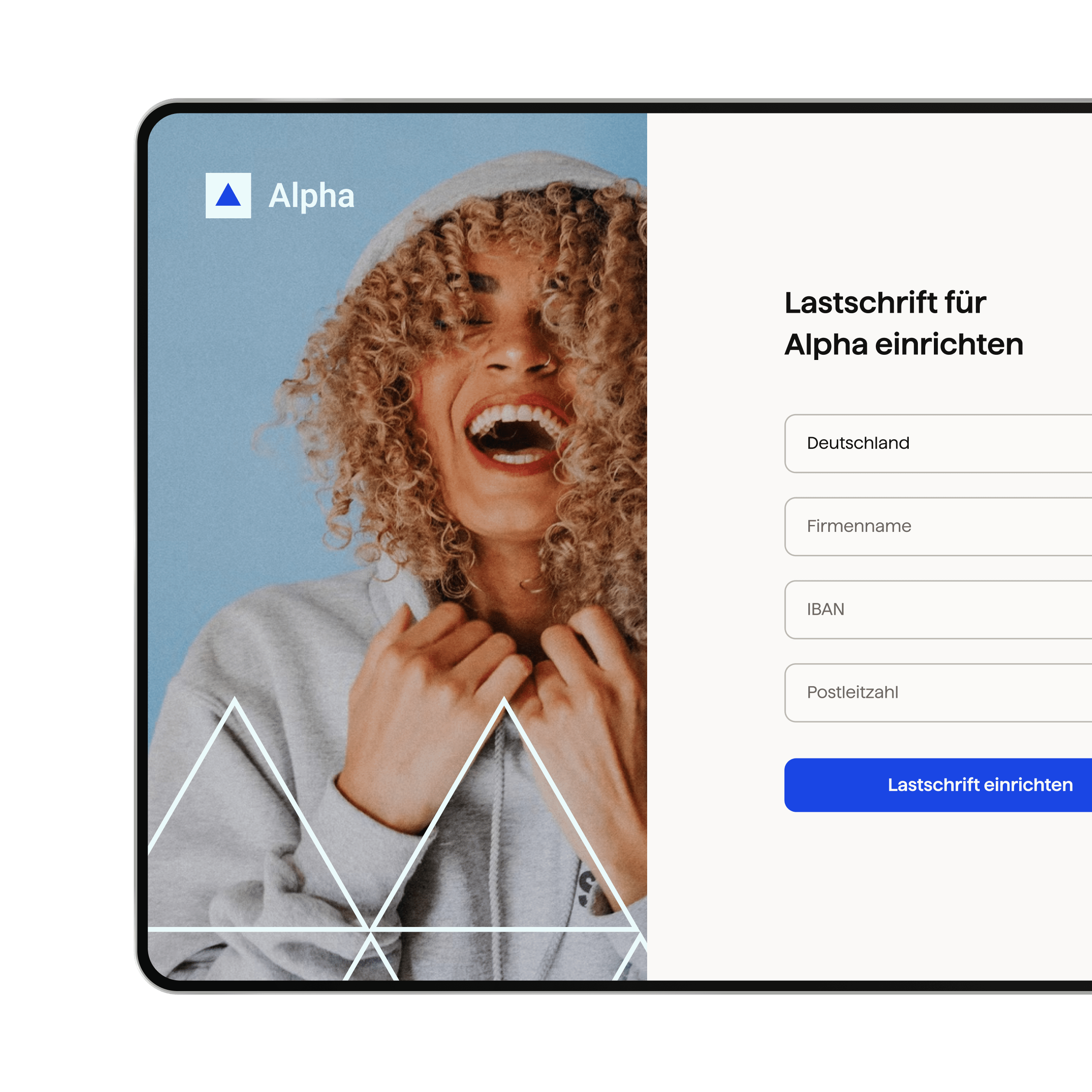

Local payments, global reach

Collect bank debit payments from over 30 countries including the US (via ACH debit), UK (Bacs Direct Debit), Eurozone (SEPA Direct Debit), Canada (PAD), Australia and New Zealand (BECS), all in your home currency. Customize our out-of-the-box, fully localized payment pages, or build a bespoke integration using our API.

We are now processing over $8 million per month. That seems a lot, but it has actually been no burden on Capital on Tap because it's all just being handled by GoCardless in the background, and it's really streamlined and automated for our customers.

Zoe Newman, US Managing Director, Capital on Tap

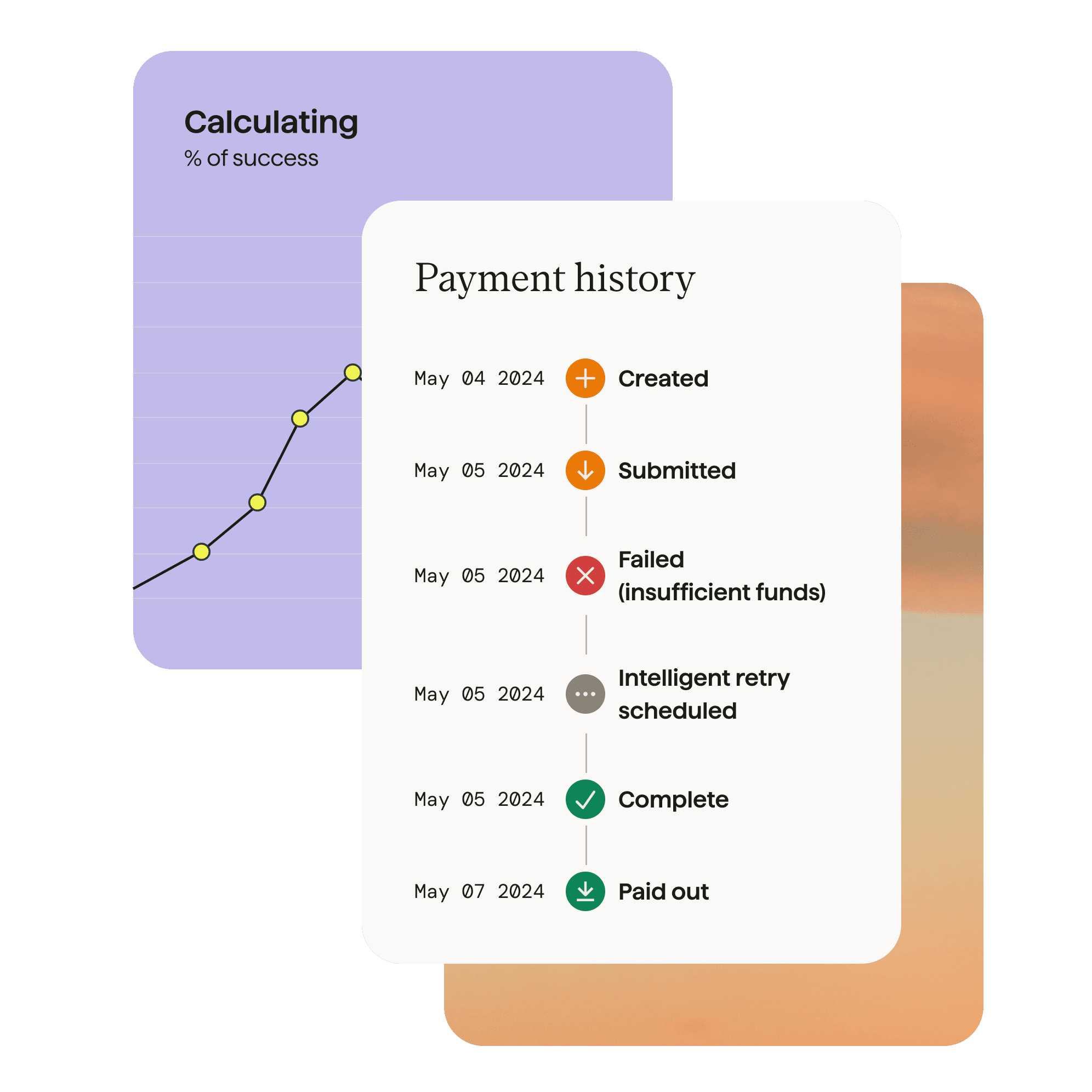

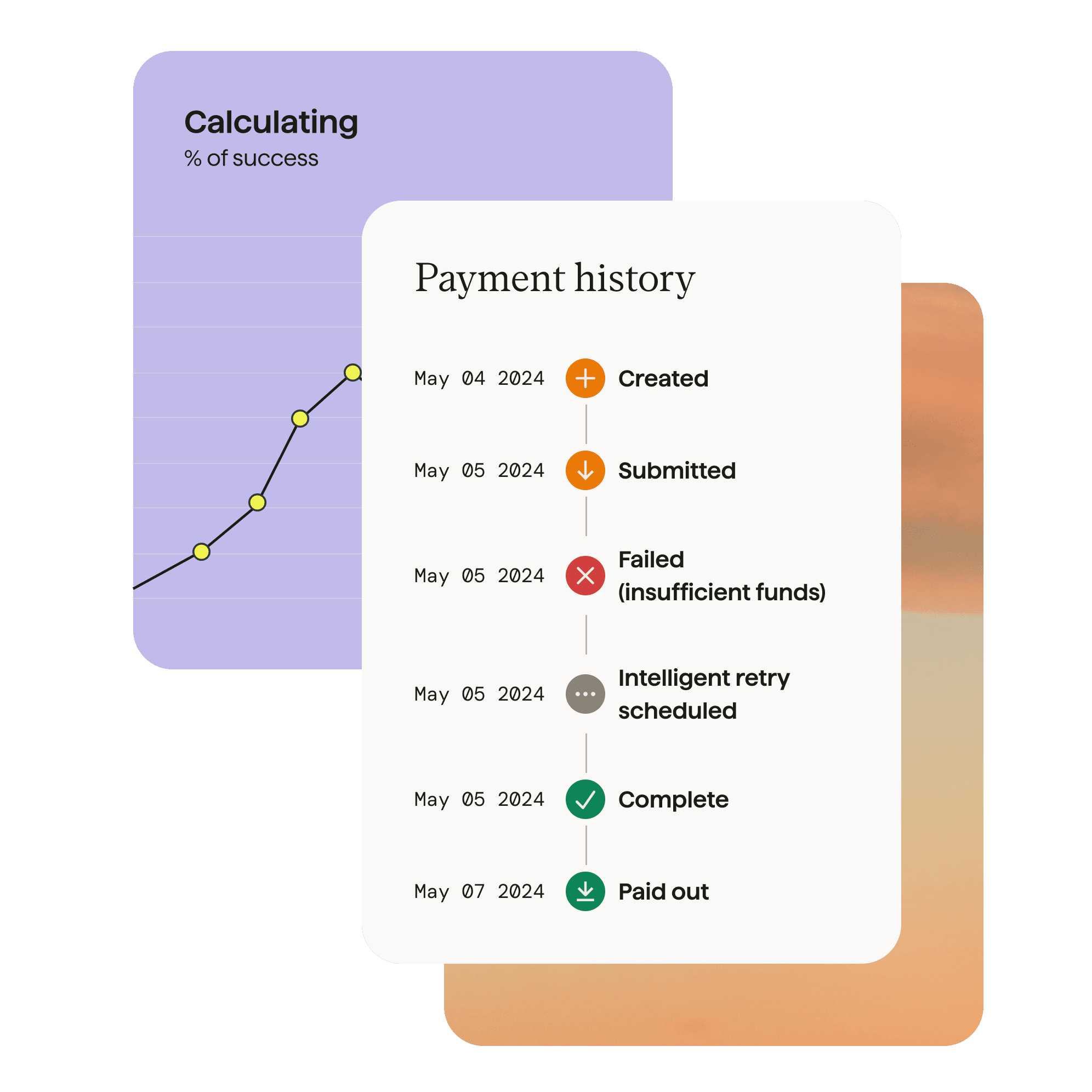

Made for payment success

Collect 97.3% of payments successfully at the first time of asking, with bank debit - like ACH debit in the US. When a payment does fail, sit back and let Success+ try again on the best day for each customer.

Made to grow with your business

International payments

Collect payments from customers around the world, including the UK, Eurozone countries, the USA, Canada and Australia.

Completely customizable

Customize our out-of-the-box payment pages, or build your own bespoke integration using our API.

Real-time alerts

Get an email for any failed payment or customer cancellation. Sit back and let Success+ automatically retry any payments that do fail.

Fully safe and secure

GoCardless is authorised by the Financial Conduct Authority, and ISO27001 certified for security standards.

Trusted by 85,000+ businesses. Of all sizes. Worldwide

Ready to get started?

Pay as you go pricing, with low transaction fees and no monthly contract. Get started in minutes.