Simple and secure direct bank payments

The easiest way to collect payments online

We make payment processing easier for small businesses. Getting them paid on time and saving time, money, and stress. Let’s help you too.

All kinds of payments. Just one platform.

Doesn’t matter whether it’s bills, invoice payments, subscriptions, memberships, or instalments.

One-off, ad hoc, or recurring payments. Instant or automatic. Domestic or international.

GoCardless offers flexible payment processing for all.

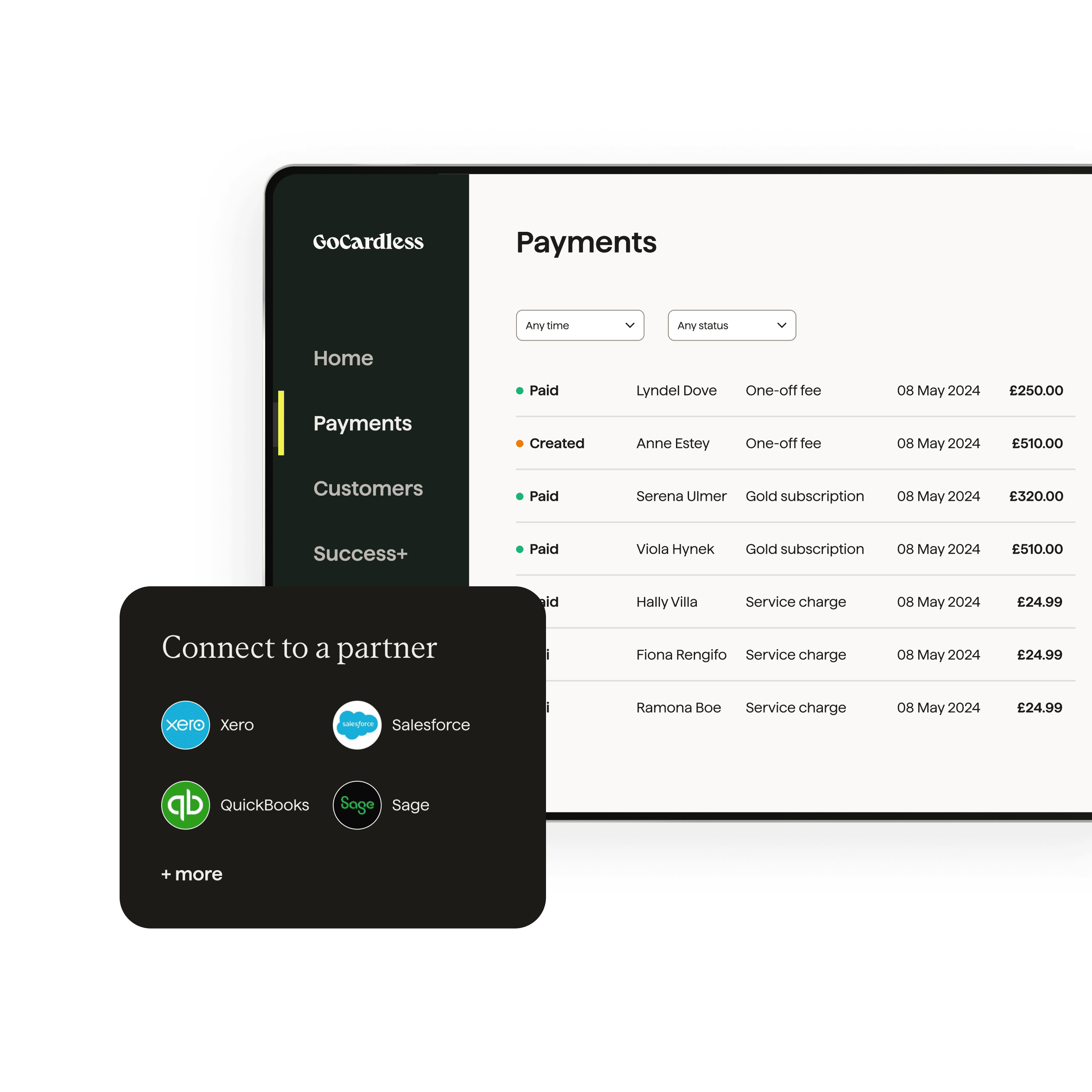

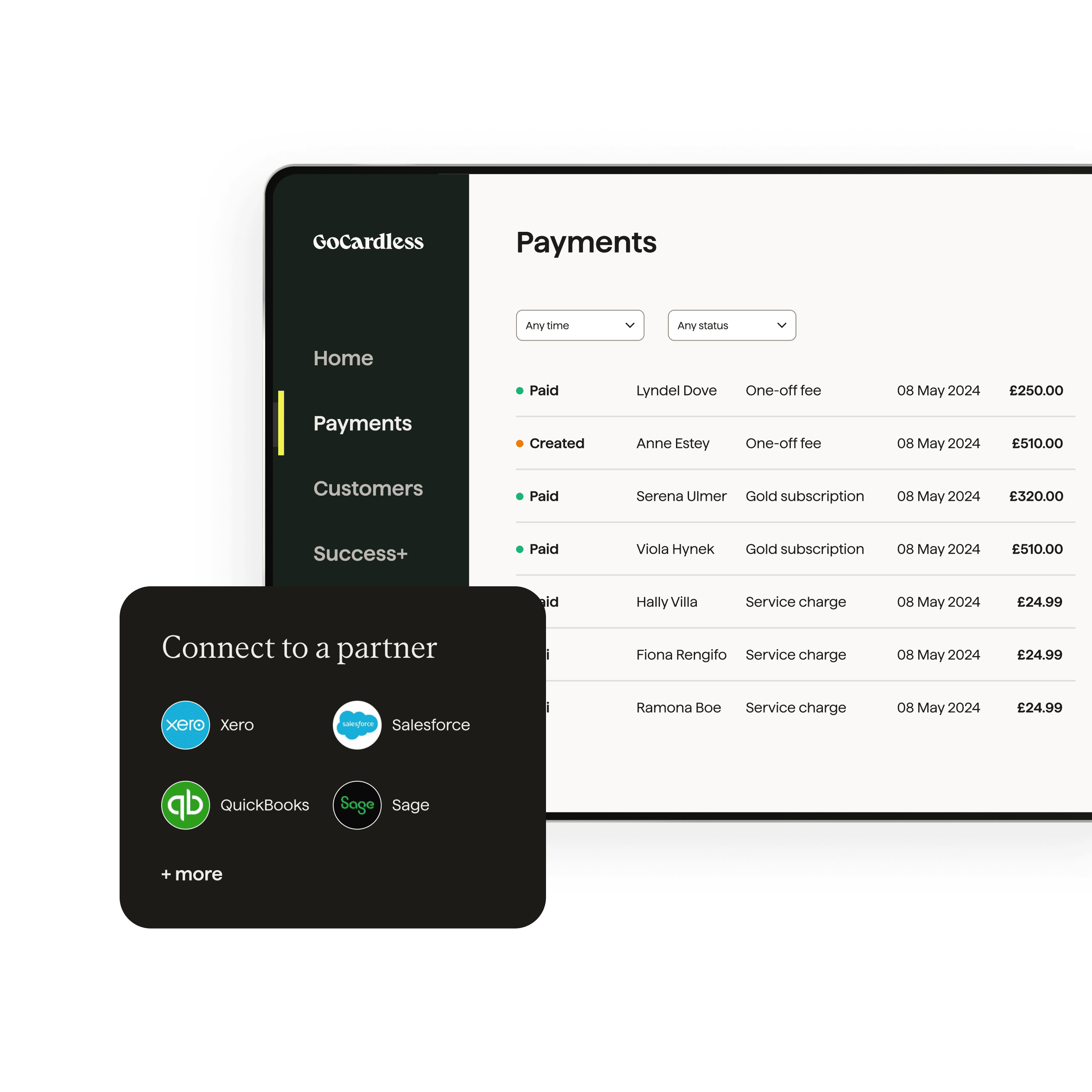

We play nice with others

You can use GoCardless on its own to collect payments. Or you can connect it to software you already use, like Xero, QuickBooks, Sage, or 350+ more.

Just charge your customers like you normally do, and GoCardless handles the rest.

See all 350+ systems GoCardless connects with

Your customers will love us too

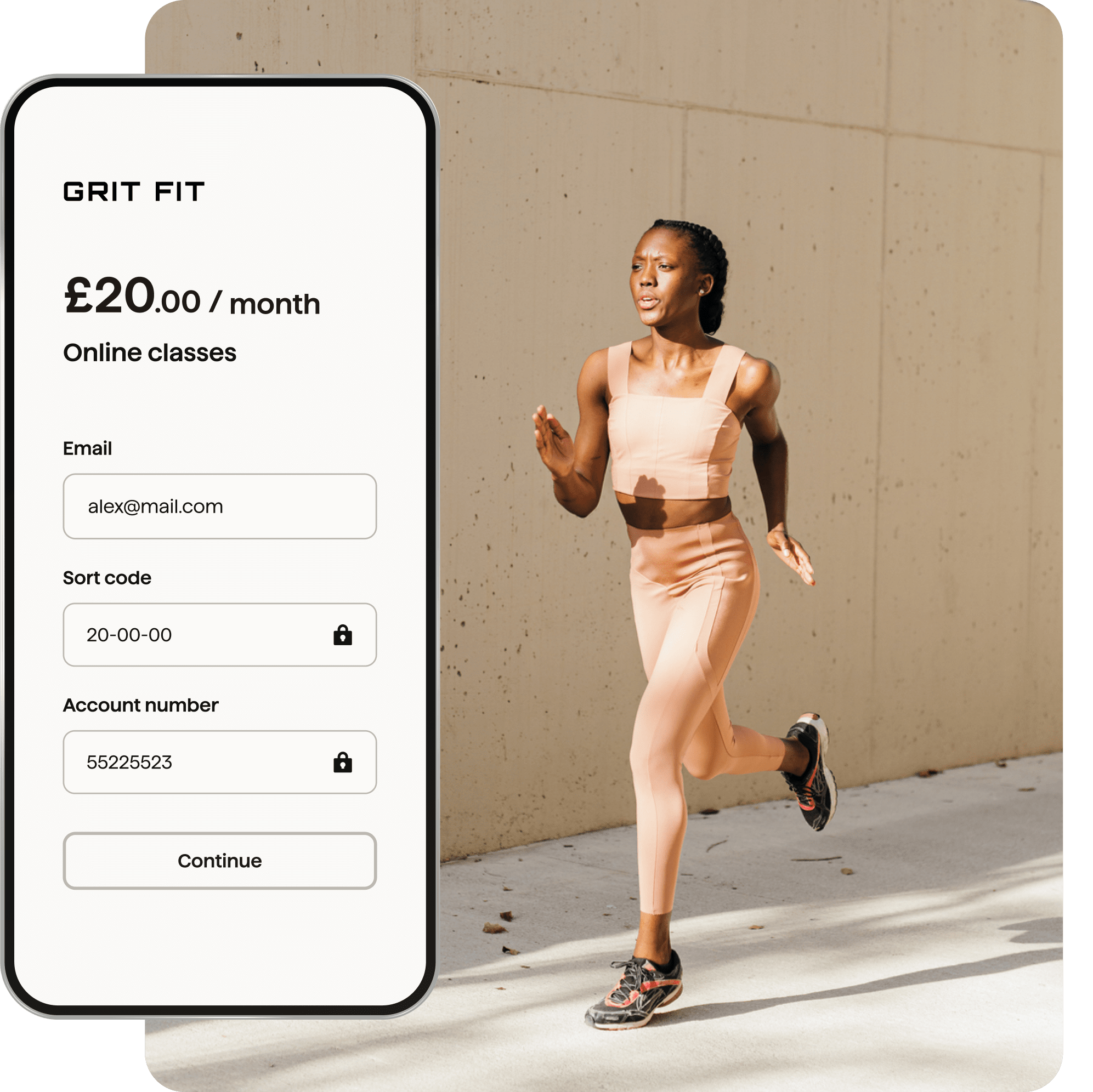

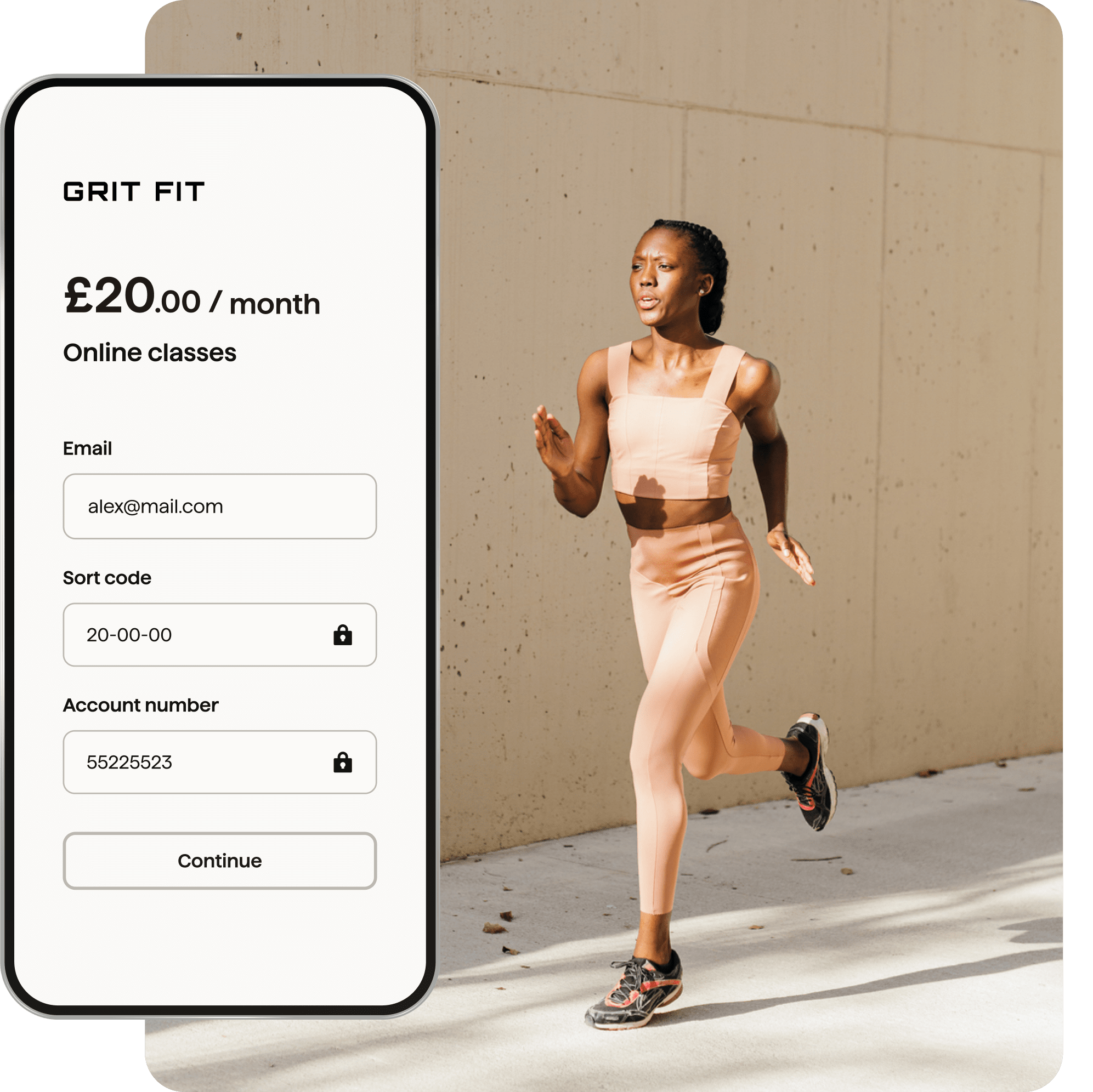

Quick and easy

They can pay in a few taps or clicks, on any device. Or set up convenient, automated payments.

Transparent

Email notifications give your customers a heads up before payments are taken. No nasty surprises.

Secure

We’re authorised by the FCA, GDPR compliant, and any payments collected via our Direct Debit feature are protected by the Direct Debit Guarantee.

How it works

Local payments, global reach

Collect international payments from customers in 30+ countries. Even if you only have a UK bank account.

We’ve teamed up with Wise to offer in-built FX at the real market rate. (Markups and hidden fees aren’t our style.)

Moving clients to GoCardless is pain-free — and once everything is set up, cash collection takes care of itself.

Ben Nacca, Founder, Cone Accounting

Failed payments are optional, not inevitable

GoCardless successfully collects 99% of instant, one-off payments – and 97.3% of automated, recurring payments – on the first try.

If one fails, use Success+ to automatically retry on the best day for each customer.

Made to grow with your business

International payments

Collect international payments whenever you’re ready. No complex contract negotiations needed.

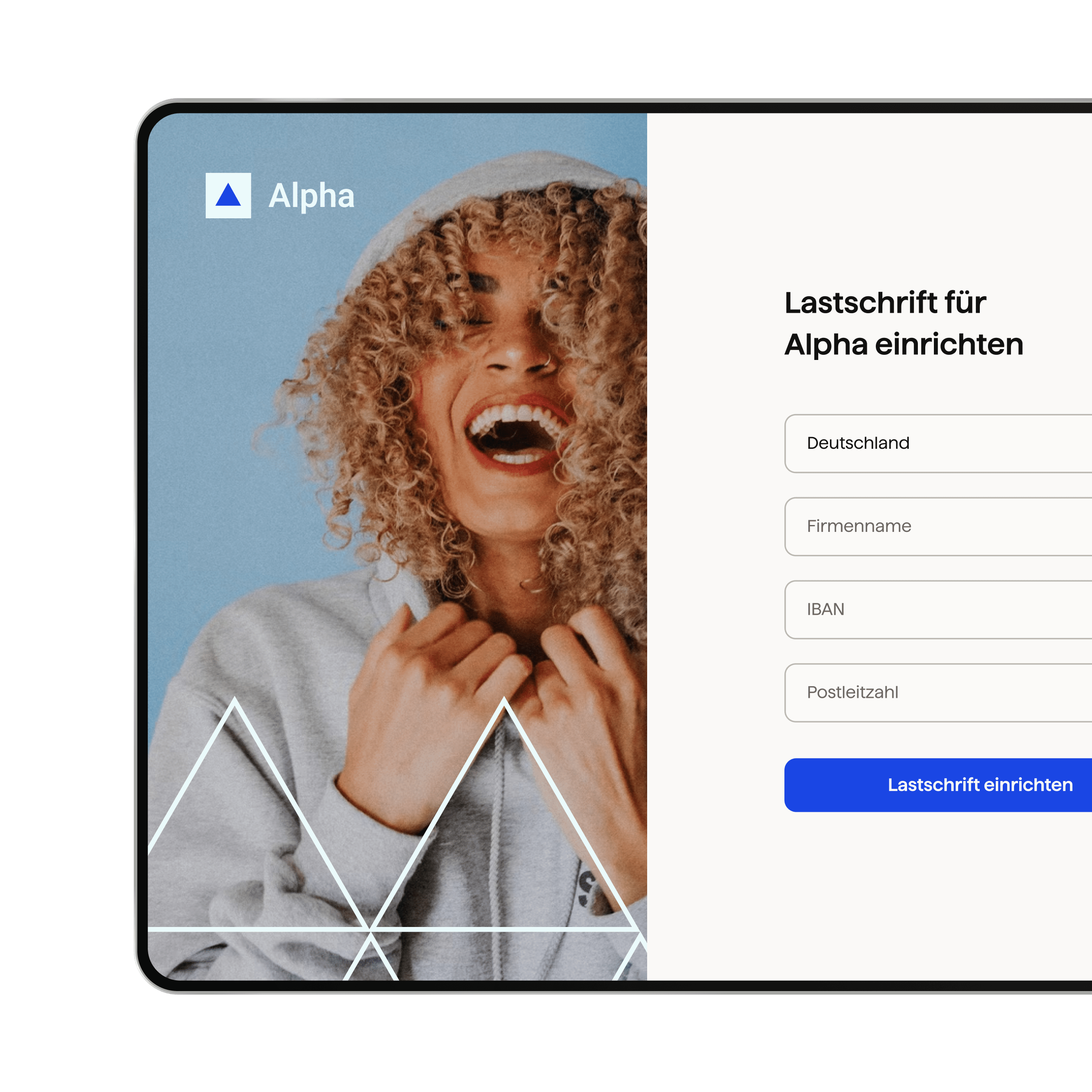

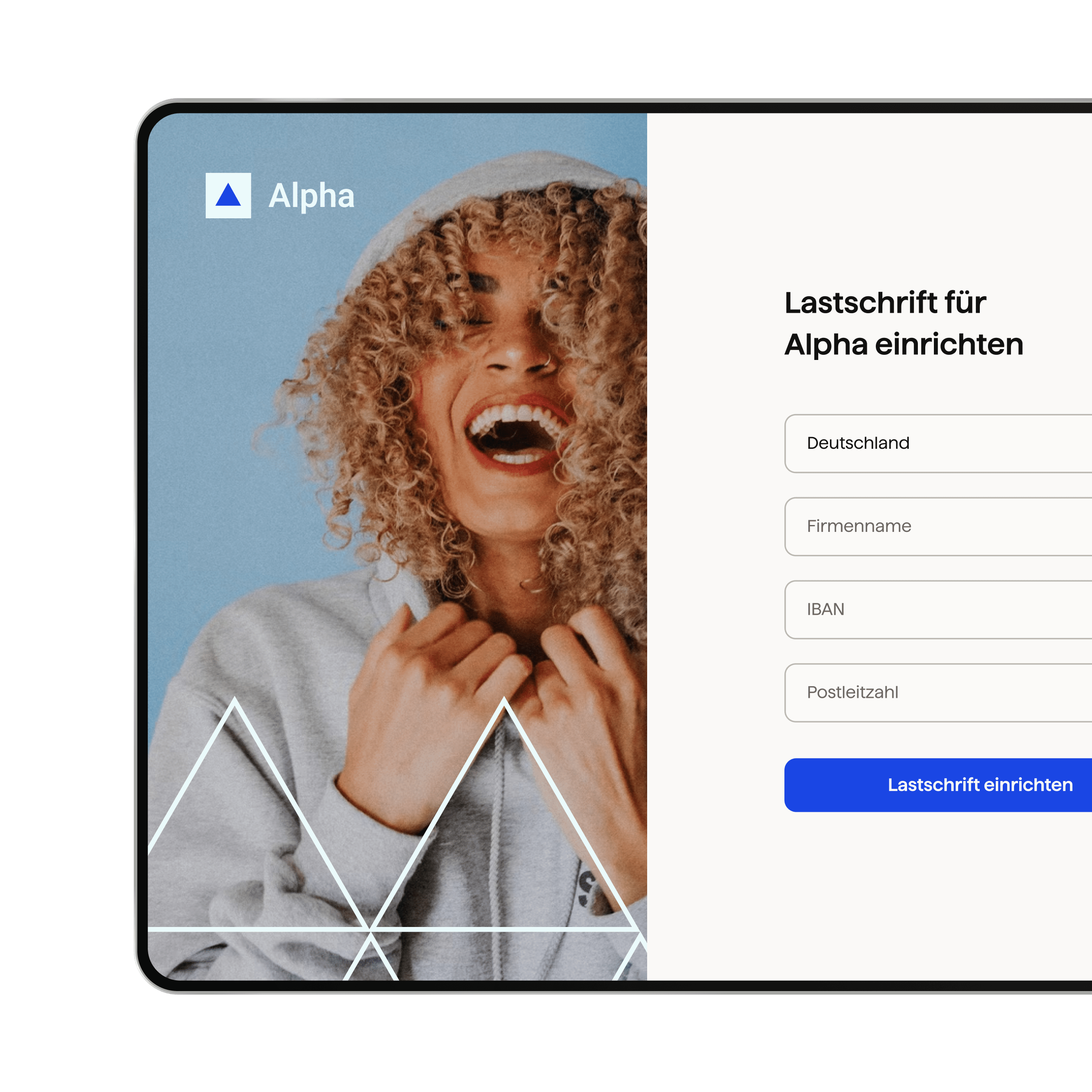

Completely customisable

Customise out-of-the-box payment pages, or build your own bespoke integration using our API.

Secure and reliable

We’re FCA authorised, ISO27001 certified, and GDPR compliant. The safety of your money and data is our top priority.

Let yourself dream bigger

What could you do without all that time and stress wasted on financial admin? GoCardless lets you find out.

Trusted by 85,000+ businesses. Of all sizes. Worldwide.

![]()

Seamless integrations

"Xero has chosen GoCardless as its best-in-class solution for Direct Debit and it shows."

Ready for payment collection to be easy?

Give GoCardless a go – no obligations – with low, pay-as-you-go pricing. And get started in minutes.