Simple and secure direct bank payments

No more waiting for the cash you’re owed

Easily collect instant, one-off payments. Or collect payments automatically. Goodbye, cash flow problems.

Chasing payments shouldn’t be a full-time job

And with GoCardless it doesn’t have to be. Save yourself from hours spent on emails and phone calls chasing up payment. Reduce debtor days, and put time and money back in your pocket.

Hello, improved cash flow.

GoCardless stops those awkward conversations with clients, it saves time and it obviously helps cash flow – that’s a huge thing!”

Saija Mahon, Founder & MD, Mahon Digital

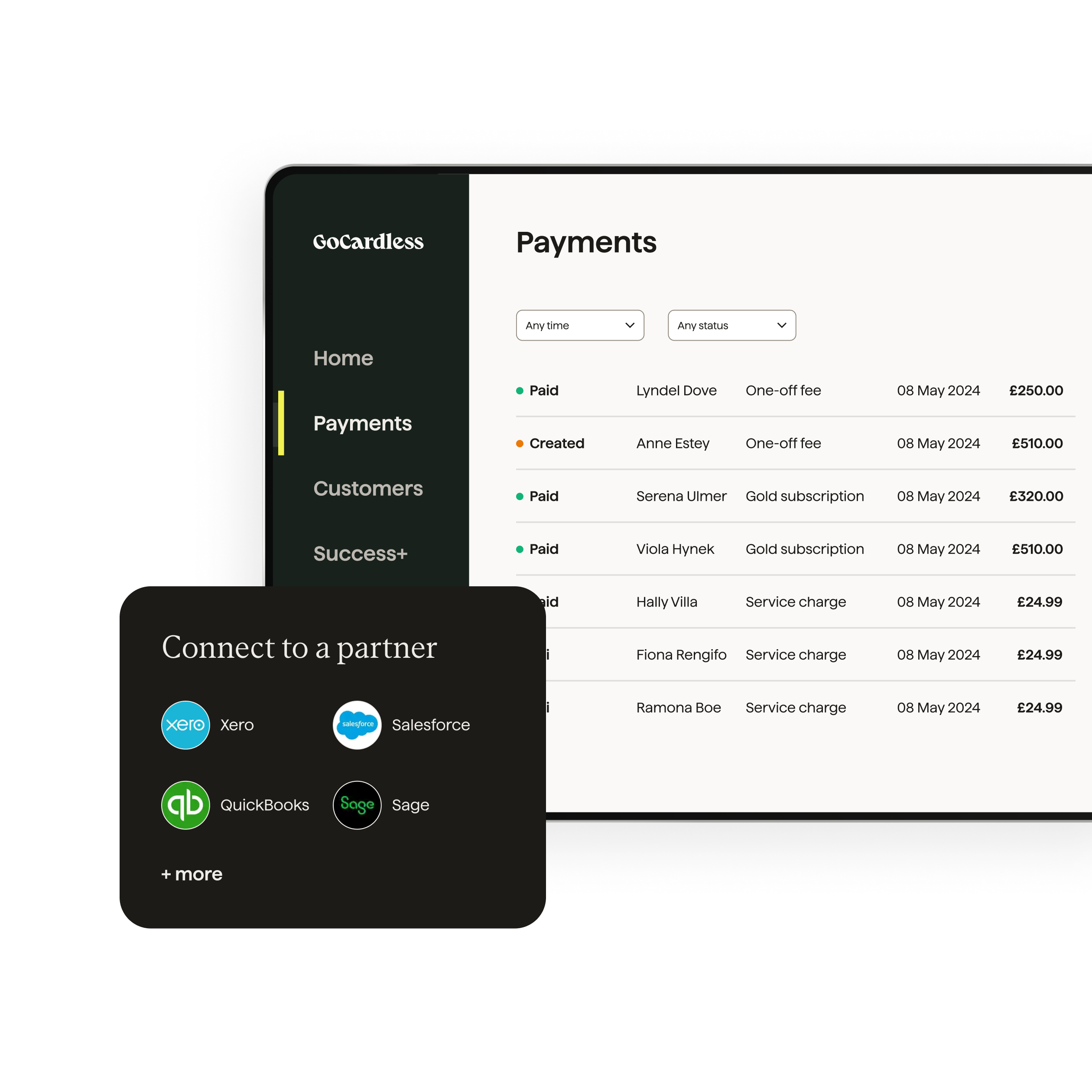

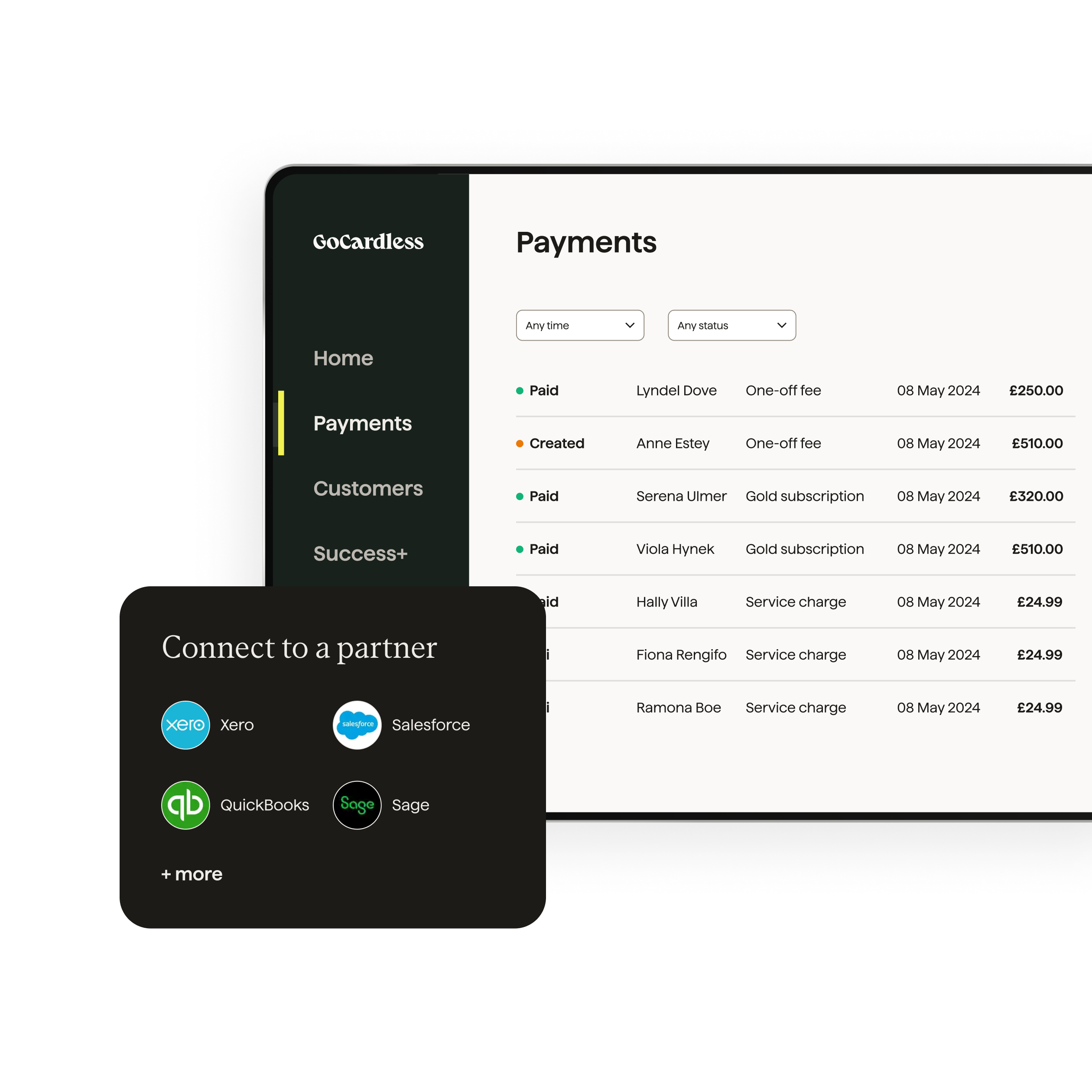

Cash flows in automatically

Instant, one-off payments. Or automated, recurring payments. GoCardless lets you choose how you want to collect.

Automate, and payments are collected as soon as they’re due. A huge time-saver for you and your customers.

How GoCardless keeps the cash flowing in

Your customers will love us too

Quick and easy

They can pay in a few taps or clicks, on any device. Or set up convenient, automated payments.

Transparent

Email notifications give your customers a heads up before payments are taken. No nasty surprises.

Secure

We’re authorised by the FCA, GDPR compliant, and any payments collected via our Direct Debit feature are protected by the Direct Debit Guarantee.

Trusted by 75,000+ businesses. Of all sizes. Worldwide.

![]()

Seamless integrations

"Xero has chosen GoCardless as its best-in-class solution for Direct Debit and it shows."

Ready for payment collection that just works?

Give GoCardless a go – no obligations – with low, pay-as-you-go pricing. And get started in minutes.