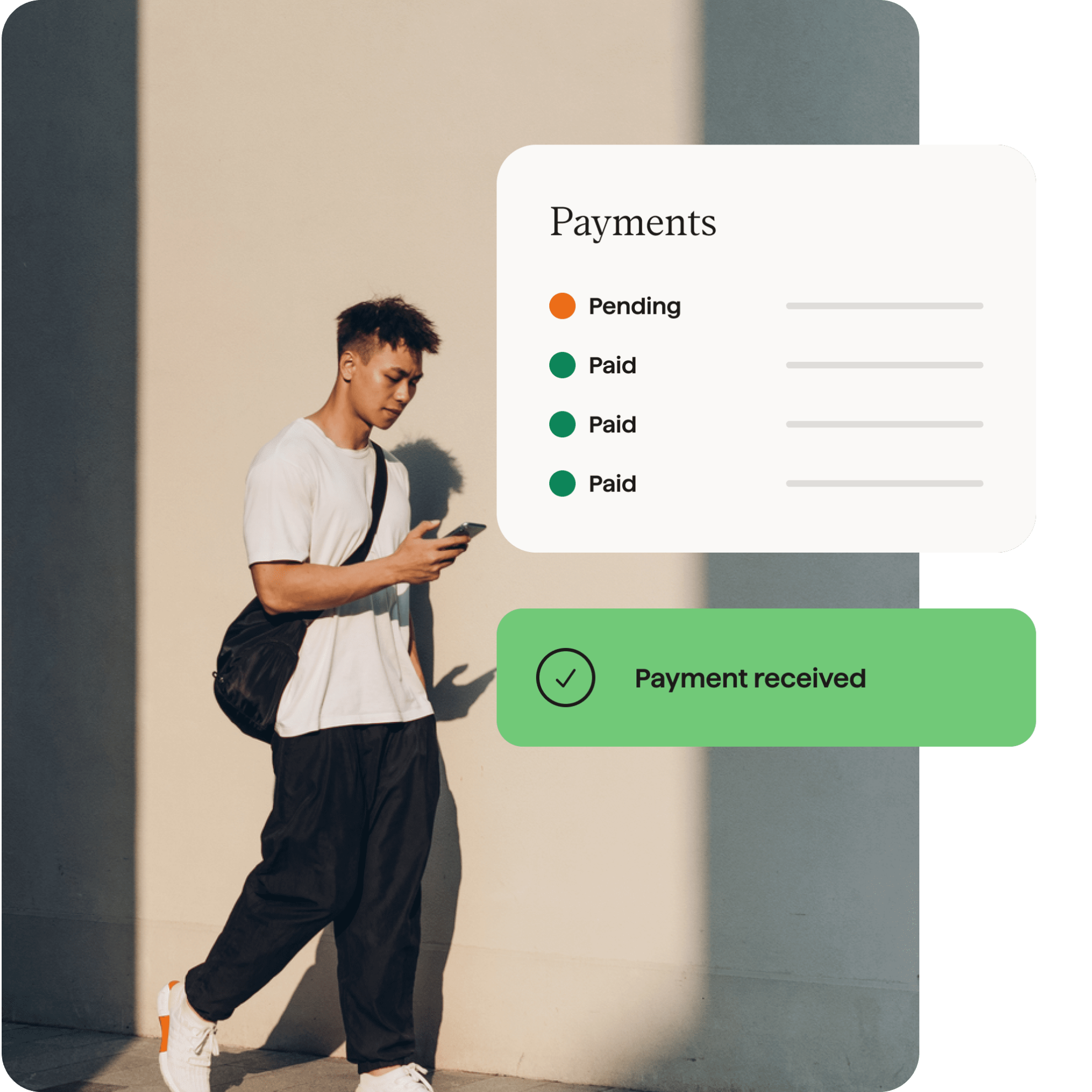

Improve cash flow

Collect payments automatically whenever they’re due, spend less time waiting around to get paid, and plan the future of your business with confidence in your cash flow.

Chasing payments shouldn’t be a full-time job

Cash flow is a common issue for small businesses. Spiralling debtor days and awkward “please pay us” conversations don’t just limit your potential to plan for the future, they can even threaten the security of your business.

We can get clients set up in minutes and we know that’s it – our payments come in on time and are automatically reconciled against invoices.

Eli Tagi Director, WE Accounting

Keep cash flowing with automated payment collection

The key to better cash flow is automated cash collection that you can count on. Cut down on admin time, and free your customers from having to remember when their bills are due.

How it works

Great for your customers

Simple

Customers can set up their payment details online in just two minutes.

Transparent

Whenever a subscription begins or a one-off payment is taken, your customers will be notified by email.

Efficient

No need for customers to remember regular payments, log into online banking, or write and send cheques.

Safe and protected

If a payment is ever taken by mistake, your customers’ payments are fully protected.

Trusted by 100,000+ businesses. Of all sizes. Worldwide

![]()

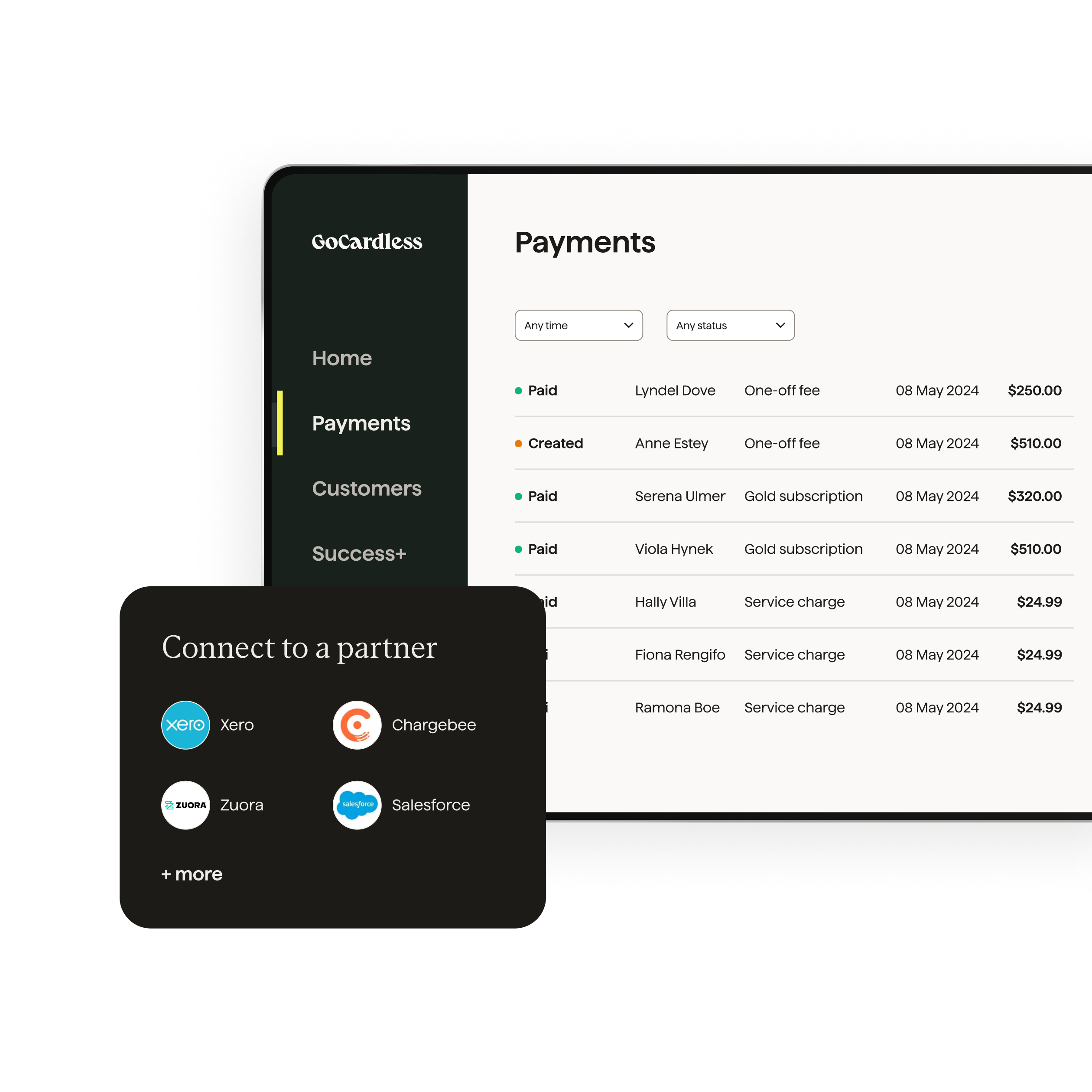

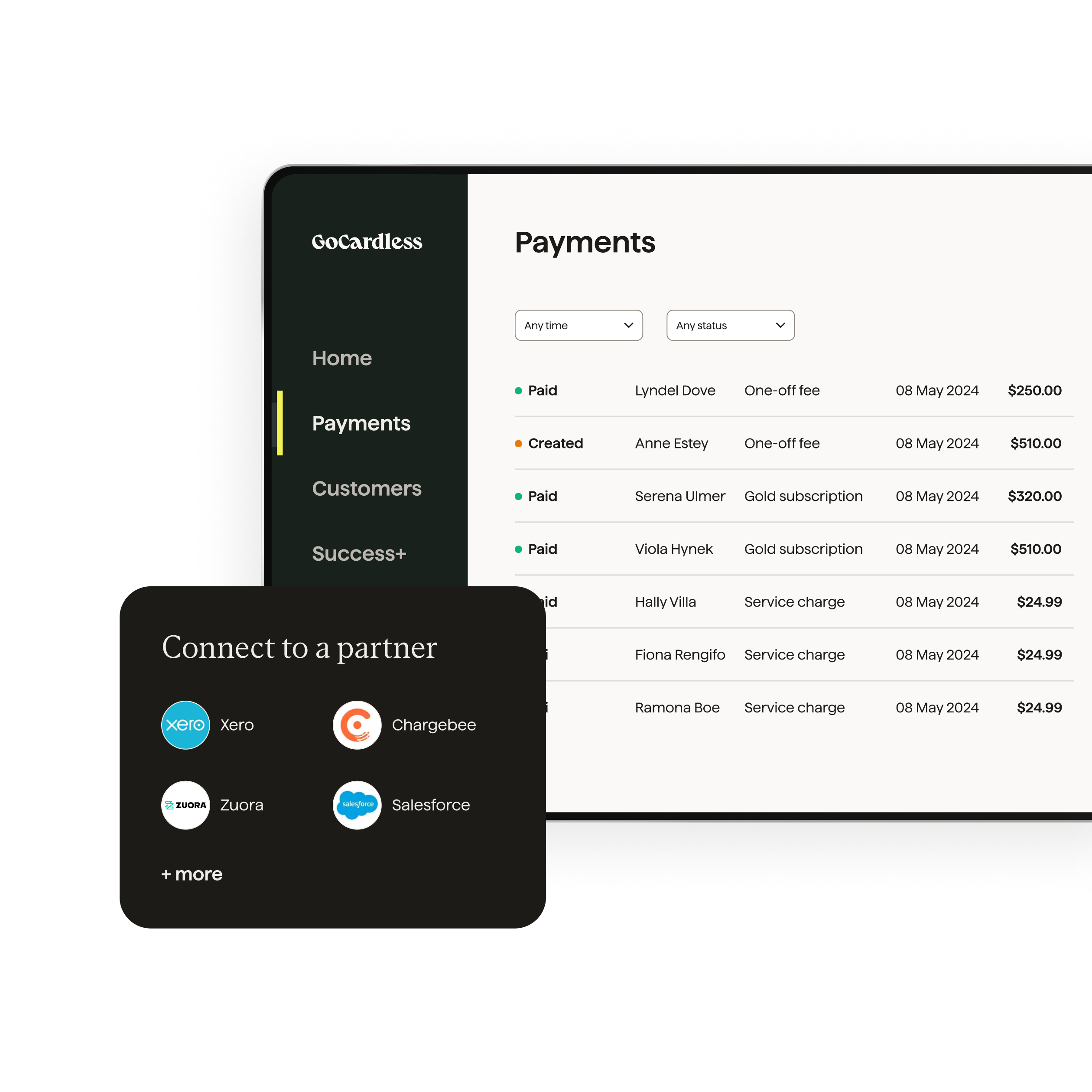

Easy to use

”GoCardless is super user friendly, seamless and allows great visibility at all times. It changed the game for us and has made cashflow issues a thing of the past!”

Ready to get started?

Pay as you go pricing, with low transaction fees and no monthly contract. Get started in minutes.