Last editedJul 20234 min read

A guide to the three different options for setting up SEPA compliant Direct Debit Mandates

Before you can collect payment by SEPA Direct Debit, your customer must complete a mandate authorising you to take payments.

Strict rules apply to this process and to the content of mandates. These must be complied with to set up a valid mandate. If a mandate is not valid you will not have authorisation to collect payments under it, so it’s important to make sure you get these right.

This guide will walk you through setting up SEPA compliant Direct Debit Mandates yourself and with GoCardless. You may also want to read our guides to mandate management as well as setting up SEPA Direct Debit and taking payments by SEPA Direct Debit.

What is a SEPA Direct Debit mandate?

A SEPA Direct Debit Mandate is the authorisation given by your customer allowing you to collect future payments from them at any time on their Euro-denominated bank account (subject to advance notice).

Each mandate must include certain mandatory legal wording and mandatory information (as specified here).

This wording sets out the refund provisions under the relevant SEPA Direct Debit scheme. See our guide to SEPA Customer Protections for further details.

Customers will often require a particular schedule of payments such as a fixed subscription. The advance notice requirements of a SEPA Direct Debit Mandate provide protection against payments taken mistakenly or fraudulently.

How to collect SEPA Direct Debit payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily set up & schedule SEPA Direct Debit payments via payment pages on your website checkout or secure payment links.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled date. Simple.

Looking for an easy & affordable way to collect SEPA payments?

GoCardless saves merchants time, money & stress collecting SEPA payments.

Mandatory SEPA mandate contents

SEPA Direct Debit mandates must include certain mandatory wording. Firstly, the standard heading: ‘SEPA Direct Debit mandate’. The heading of the mandate must then contain the following mandatory legal text:

Core scheme “By signing this mandate form, you authorise (A) {NAME OF MERCHANT} to send instructions to your bank to debit your account and (B) your bank to debit your account in accordance with the instructions from {NAME OF MERCHANT}. As part of your rights, you are entitled to a refund from your bank under the terms and conditions of your agreement with your bank. A refund must be claimed within eight weeks starting from the date on which your account was debited. Please complete all the fields marked.”

B2B scheme “By signing this mandate form, you authorise (A) {NAME OF MERCHANT} to send instructions to your bank to debit your account and (B) your bank to debit your account in accordance with the instructions from {NAME OF MERCHANT}. This mandate is only intended for business-to-business transactions. You are not entitled to a refund from your bank after your account has been debited, but you are entitled to request your bank not to debit your account up until the day on which the payment is due. Please complete all the fields marked. *”

The mandate must also contain the following legal wording: “Your rights are explained in a statement that you can obtain from your bank.”

Additional mandatory information

Whether it is core/B2B

Unique mandate reference

Name of the payer

IBAN of the payer

BIC code of the payer’s bank

Merchant company name

Merchant’s Creditor Identifier

Merchant’s full address (including postal code and country)

Type of payment

Signature place and time

Signature(s)*

*The SEPA e-mandate scheme does so through the payer's online banking, but this is currently unsupported by the banks. GoCardless maintains comprehensive logs of the 'electronic signature' the customer creates.

GoCardless can help design a compliant SEPA mandate. We also have created an easy to complete form which populates a SEPA compliant mandate (here) via our API. This mandate includes all of the above information.

GoCardless makes collecting SEPA payments quick, easy, and cost-effective for business owners - find more about how merchants collecting SEPA via GoCardless save time, money, and stress.

Creating a Mandate

To set up a Mandate, your customer will need to complete a SEPA Direct Debit Mandate form. This can be done in three ways:

Paper - A paper Mandate form can be completed by your customer and returned to you.

Paperless – An electronic Mandate form can be completed by your customer through an electronic channel.

E-Mandate – An e-Mandate form can be completed by your customer through an electronic channel within their internet banking. The e-Mandate function is an optional service that has only been implemented by a couple of banks so far.

Paper Direct Debits

The content (but not the layout) of paper SEPA Direct Debit Mandates is strictly controlled. Compulsory information and wording are set out in our guide to Mandatory Mandate Contents.

All Payer mandatory fields must be completed by the customer even if they have already provided the information on other documentation.

Once a paper form has been completed the customer will need to return it to you. You will then be required to convert the written information on the signed mandate into electronic data. This mandate related data should then be submitted to the banks as part of each collection (see submitting messages to the banks below). The paper mandate form should then be retained as evidence of the SEPA Direct Debit authorisation. The mandate can either be stored as the original document or in digitalised format in accordance with national legal requirements.

Paperless Direct Debits

Similarly to paper mandates, the content (but not the layout) is strictly controlled. You can see a SEPA compliant example mandate form here.

Once completed, a mandate needs to be signed using a legally binding method of signature.

Once the mandate has been completed and returned to you, it must be submitted to the banks (see next section). There is no physical version of the mandate to be stored. However, the mandate related data should be extracted from the electronic document and stored electronically. This mandate related data should be sent to your bank with each collection.

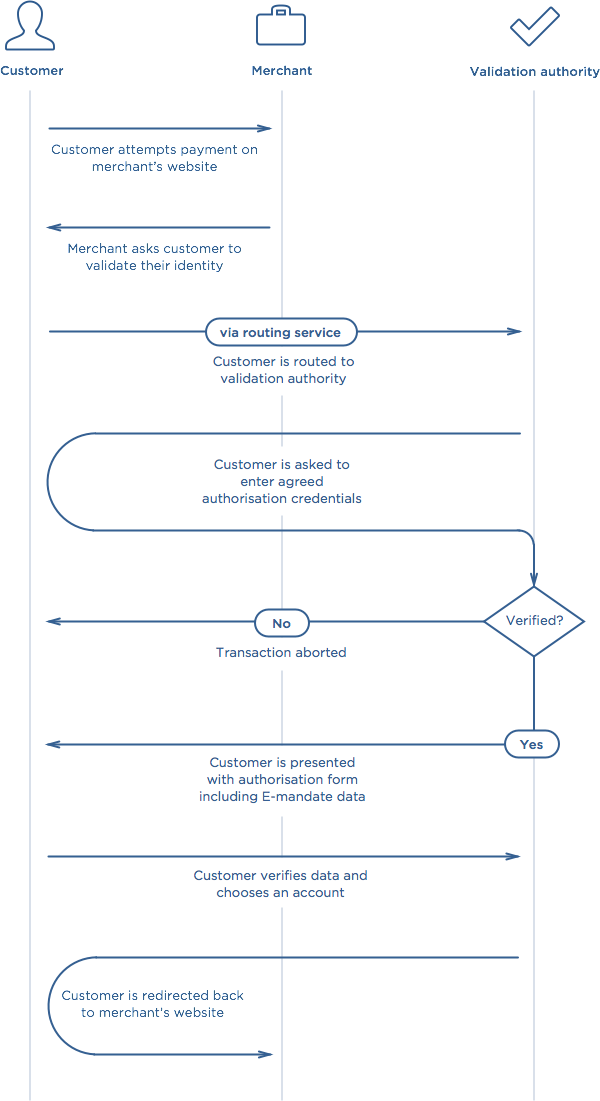

E-Mandates

E-Mandates are an optional service outlined by the SEPA Direct Debit scheme. The e-Mandate process could offer security advantages over paper and paperless mandates, however, there remains a relative dearth of e-Mandate providers on the market. There are currently no banks offering the e-Mandate service in the UK.

E-mandates use your customer's online banking credentials and, as such, are set up in a different way to paper and paperless mandates. The diagram below sets out a brief summary of the e-mandate set up process.

Submitting a SEPA Direct Debit Mandate to the banks

Once your customer has completed a SEPA Direct Debit mandate it is submitted to the bank at the same time as the first collection. When the first payment is successful, your customer's bank activates the SEPA Direct Debit mandate, and allows you to collect payments against it in future.

Submissions to the banking system are made directly to the bank using an XML file containing the mandate-related data. More details on the submission process are available in our guide to submitting messages to the banks.

Once submitted to the banks, the SEPA Direct Debit mandate will be active once the first payment is confirmed (see Timings). Once active you can start taking payments against it. The mandate-related data will also need to be submitted with each subsequent collection.

If anything goes wrong during the setup process, you'll be alerted by a message from the bank (see the Messages from the Banks). If you would like further details on submitting a SEPA Direct Debit mandate to the banks you might find our guide to Submitting messages to the banks helpful.

SEPA Direct Debit mandates through GoCardless

GoCardless provides an optimised flow for your customers to create new SEPA Direct Debit mandates online:

Your own branded payment page. GoCardless provides you with a securely hosted online form which you can brand (see example here). Alternatively, GoCardless also lets you design your own pages.

We manage mandates for you. We keep mandates in electronic format securely on our server, in line with SEPA Direct Debit rules. You can easily retrieve them on our dashboard or via our API.

Submitting mandates is handled on your behalf. Simply request funds through the GoCardless dashboard or API. GoCardless will submit the relevant mandate related data with each collection.