Last editedJun 20251 min read

The Single Euro Payments Area (SEPA) is an EU initiative to harmonise payments across the Eurozone.

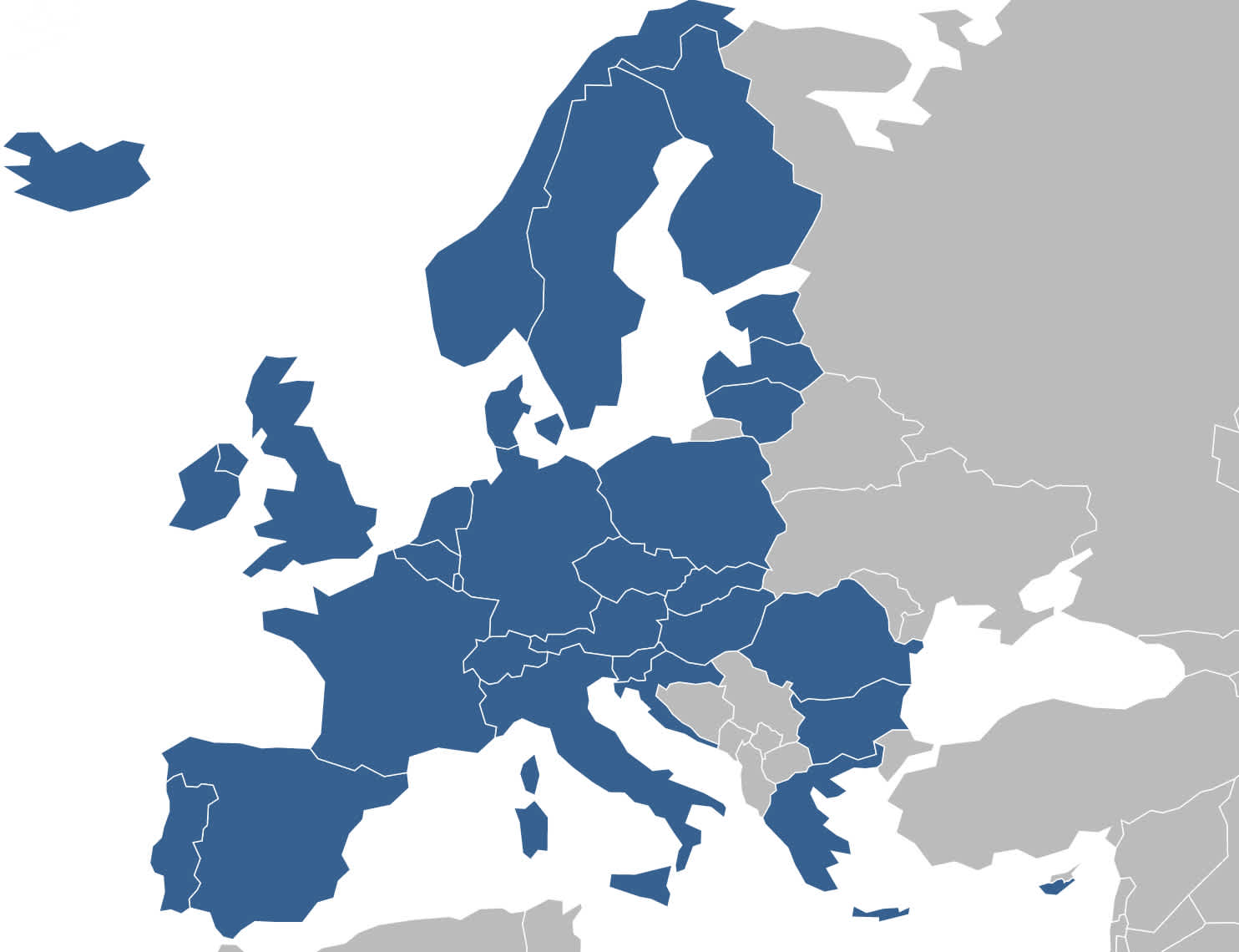

Which countries are part of SEPA?

The SEPA zone consists of the 28 EU member states together with the four members of the European Free Trade Association (Iceland, Liechtenstein, Norway and Switzerland). Monaco Andorra, San Marino, and the Vatican City State are also part of SEPA.

SEPA payments are only used for euro-denominated transactions. For this reason, the percentage of customers reachable by SEPA payments varies on a country-by-country basis.

How to collect SEPA Direct Debit payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily set up & schedule SEPA Direct Debit payments via payment pages on your website checkout or secure payment links.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

Eurozone countries

In Eurozone countries, all bank accounts that were previously reachable through a national scheme are now reachable via the SEPA payment schemes:

Andorra

Austria

Belgium

Croatia

Cyprus

Estonia

Finland (including Aland Islands)

France (including French Guiana, Guadeloupe, Martinique, Mayotte, Saint Barthélemy, Saint Martin (French part), Réunion and Saint Pierre and Miquelon)

Germany

Greece

Ireland

Italy

Latvia

Lithuania

Luxembourg

Malta

Monaco (Monaco and San Marino have bilateral agreements with the EU to use the euro as their official currency)

Netherlands

Portugal (including Azores and Madeira)

San Marino (Monaco and San Marino have bilateral agreements with the EU to use the euro as their official currency)

Slovakia

Slovenia

Spain (including Canary Islands and Ceuta en Melilla)

Vatican City State

Collecting payments from European customers can be complicated and expensive!

That’s why GoCardless makes it simple, affordable and hassle-free for merchants to collect SEPA payments.

Non-Eurozone countries

In non-eurozone countries, the SEPA schemes are only used for euro-denominated payments. Reachability is only required for euro-denominated bank accounts. For payments made in the local currency, national schemes should continue to be used.

Bulgaria

Czech Republic

Denmark

Hungary

Iceland

Liechtenstein

Norway

Poland

Romania

Sweden

Switzerland

United Kingdom (including Gibraltar)

Guernsey, Jersey, and Isle of Man

SEPA and GoCardless

GoCardless is the online Direct Debit specialist. Merchants can collect and manage their SEPA Direct Debit payments from any of the countries in the SEPA zone, using our online dashboard or simple REST API.