2018 highlights from GoCardless

Last editedJan 20203 min read

2018 has been the year of the global payments network for GoCardless. We’re delivering on our mission to build the world’s first network for bank to bank payments, to take the pain out of getting paid for businesses everywhere.

So far this year, we’ve integrated with Direct Debit schemes in Australia, New Zealand, Canada and Denmark, taking the number of countries in our payments network to 30.

2018 has seen us move into a new London HQ, and open up new offices in Paris and Melbourne (with more coming soon).

We’re also proud to have reached some transactional milestones this year, including processing 1 million payments in one day earlier this month, and more than six hundred million pounds worth of payments a month.

We continue to focus on making sure our customers get the best experience of GoCardless, by integrating with the tools you use every day. This year we joined forces with 50 new partners and strengthened our partnership with Xero, becoming its global best-in-class solution for Direct Debit.

We’re humbled to have won Xero’s ‘App Partner of the Year Award’ for the second year running, and for our growth to be recognised by the Deloitte Fast 50 and in Forbes.

As the end of the year approaches and with so much to reflect on, we asked people from across the business for their highlights – read on to see what else made 2018 so memorable.

International Expansion

This year we launched in four new countries Australia, New Zealand, Canada and Denmark,

2018 has definitely been the year of international expansion. We’ve launched GoCardless in four new markets. This takes the total number of countries where our merchants can collect payments to 30 – with more to come next year!

Juliet, Product Management

In March, GoCardless’ France team settled in to a new local office in Paris. Boris, from the Sales team in France, shares his highlights:

This year, we doubled the number of businesses in France using GoCardless, and have grown from a team of two, to a team of five (soon to be seven), with lots more to come in 2019.

Boris, Sales

Taking the pain out of getting paid

We’re thrilled and humbled to have worked with over 35,000 businesses this year and have loved hearing from our new and existing customers about their experiences using GoCardless.

We welcomed OVO Energy, who have gone on to take over 50,000 payments a month with GoCardless.

This year, we have also heard from more customers who are benefitting from using GoCardless to take payments in multiple geographies. Mork Chocolate, for example, were one of the first customers of GoCardless for Xero, in Australia – and Receipt Bank, who are looking forward to expanding the use of GoCardless to their Australian customers soon. Commercial Finance Manager, Ju-Vern, says, “We’re looking forward to expanding our usage of GoCardless to Australia. GoCardless is the best for Direct Debit so it’s great to be able to use it across different geographies.”

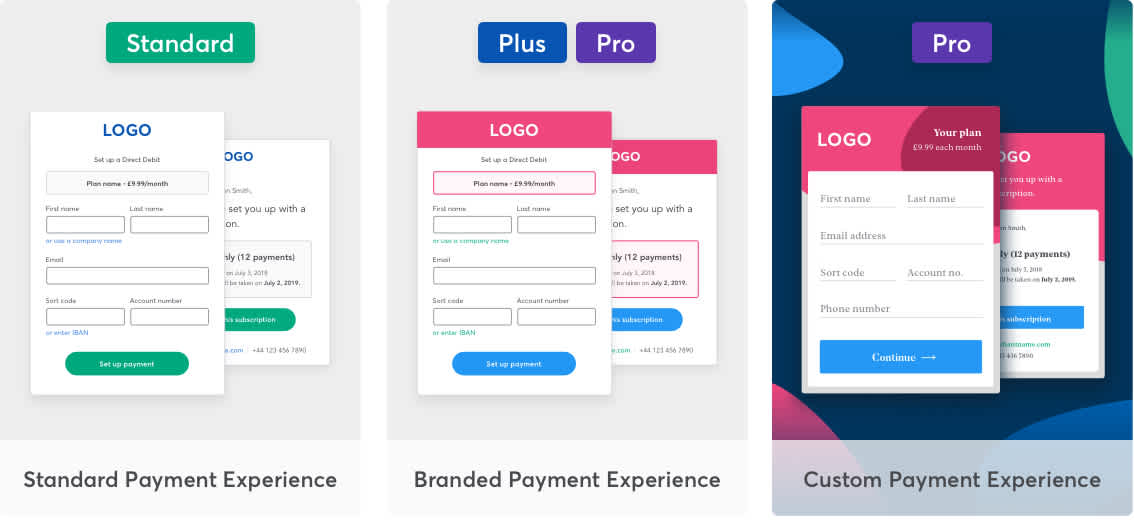

Increasing levels of customisation

In August, we released Branded Payments, allowing businesses who use GoCardless payment pages and emails to fully customise them using their brand assets.

We’ve been able to help businesses who choose to use GoCardless payment pages to benefit from improved conversion rates by increasing their brand recognition throughout their customer’s payment experience, with no technical or design background needed!

Paul, Product Marketing

Delivering on our privacy commitments

Earlier this year, we welcomed Kasey, our new Data Protection Officer, who has focused on getting GoCardless GDPR ready, as well as embedding data privacy at the heart of our business.

GDPR isn’t a ‘fix it and forget it’ kind of deal, it requires us to put a lot of thought into making sure compliance efforts are documented, repeatable, tested and optimised. So once we reached the mark on GDPR compliance, we shifted our focus to measuring and improving the maturity of our global privacy programme.

Things like measuring the effectiveness of our supplier onboarding programme to optimise privacy due diligence, or taking steps to formally embed data ethics and impact assessments into our product development and data science programmes, show a real commitment to data protection across the company.

Kasey, Data Protection

Developing our partnerships

It’s been a very busy year for our Partnerships team. We’ve welcomed 50 new partners, from cloud banking platform, Mambu, to membership platforms, Virtuagym and PerfectGym, and CRM platform Jotform, while expanding our existing partnerships around the world.

We've been on the road meeting customers and partners all over the world, attending events including: Xerocon (Brisbane and London), Subscribed Munich, Accountex North, Elevate London, and more. Rachel from our Partnerships team shares her highlights:

In 2018, we launched our global partnership with Xero as we expanded to Australia and New Zealand, and we’re excited to keep working together to bring Direct Debit to more businesses worldwide.

Rachel, Partnerships

Expanding the team

Finally, we continue to build a talented and diverse team to deliver on our global mission, and this year we welcomed over 100 new joiners to the GoCardless.

In the last 12 months, we have gone from a team of 160 to over 270 – and we’re still growing! So this year, a team of us from across the company worked on a project to revamp our careers page. We wanted to give a true picture of what it’s really like to work at GoCardless, as well as talk openly about the work we are doing to make GoCardless a diverse and inclusive place to work.

Gaby, People