Payments

Don't let running your business be harder than it needs to be.

How a well-targeted customer campaign can help customers switch to bank debit.

Enable your team to communicate the value of bank debit to your customers.

Incentivise your customers to pay using bank debit

7 steps to improving conversion rates and overall customer experience.

Series F funding round was led by Bain Capital Ventures.

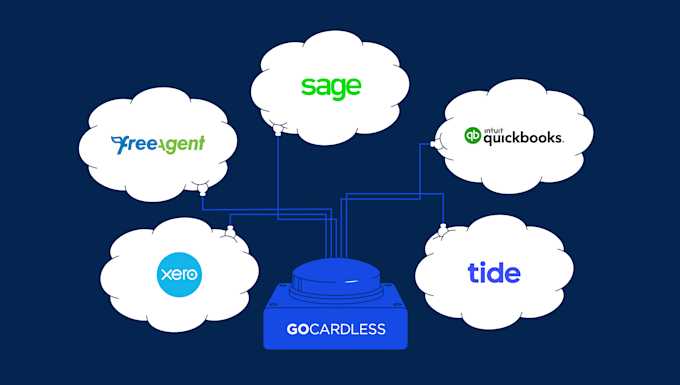

Open Banking can help you in multiple ways. Here are 40+ apps to start.

It's estimated that 2FA keeps you safe from 99.9% of account compromise attacks.

In conversation with The Guardian and Quandoo.

![[Video] The 8 dimensions of recurring payments: A framework for a better payment strategy](https://images.ctfassets.net/40w0m41bmydz/ii0VUs8bdgBtffvGgEEq2/0ca1defea874aabdfff55809793d87b6/Forrester_whiteboard_video_blogpost_EN.jpg?w=680&h=385&fl=progressive&q=50&fm=jpg)

Learn how to optimise your recurring payment operations

The biggest takeaways from our global survey of payment leaders.

Discover more about the state of recurring payments across the globe in this exclusive report.

How much does it cost to collect $5,000 from a US customer? We compare options.

UK customers can now benefit from easy to set-up and manage monthly payments.

Content platform Converge discovered 70% of their customers wanted to switch.

Private label credit cards let retailers offer more lenient terms to customers.

Get to grips with payment facilitators vs. payment processors, right here.

Defending your online security is crucial. Check out our secure payment tips.

Late payment reminder emails are a valuable tool for chasing up unpaid invoices.

Learn more about the rise of challenger banks in the UK.

Xero's Ben Johnson suggests considerations for choosing who to partner with.

Principal payments are payments towards the original sum of a loan.

How do UK & Ireland payment failure rates compare to the global benchmark?