How much do international payments really cost?

Last editedJun 20232 min read

A year ago this month, we announced the launch of international payments.

The launch brought together our global network of bank debit systems with exchange rates powered by Wise to provide the most holistic, affordable, and transparent way to collect recurring payments from around the globe.

While there are many ways to move money between borders, it’s not always easy to tell how much it costs you.

International payments with GoCardless work just like domestic payments, with no hidden pricing or commission in the exchange rate.

That’s it. No small print, no hidden fees.

But we also had a look at some alternatives to see how they compare. Turns out, not only are fees often buried in lots of legal language, sometimes fees are hidden directly inside the exchange rate.

Hidden fees and exchange rate markups

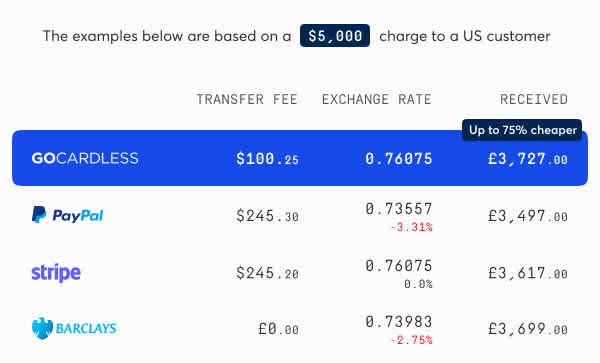

We wanted to know: how much would it cost us to collect a $5,000 payment from a customer based in the US?

To do this we compared GoCardless international payments to PayPal, Stripe, and Barclays — and here’s what we learned.

In our analysis, GoCardless came out 75% cheaper than PayPal.

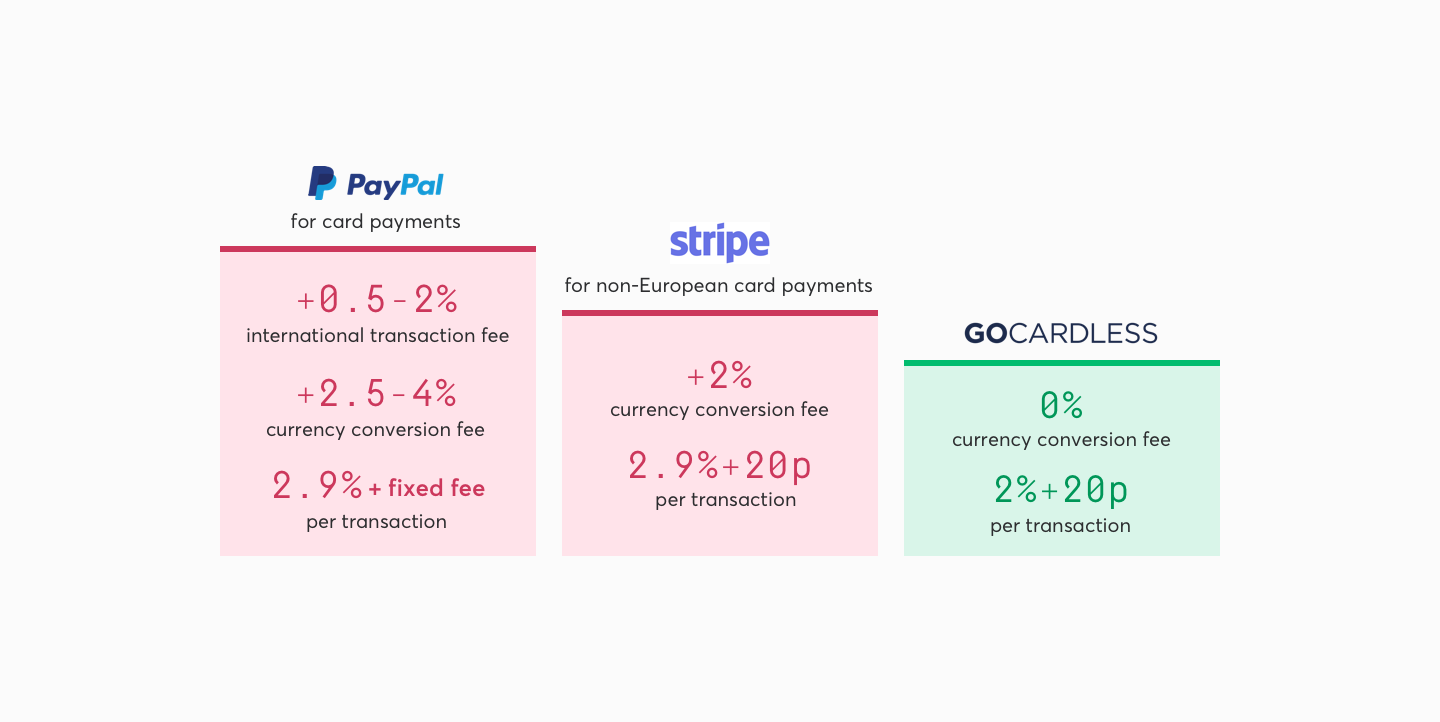

This is because PayPal charges up to a 2% surcharge on top of their standard 2.9% transaction fee. Every transaction also includes a fixed fee. For our transfer coming from USD, it would be $0.30. We also checked the exchange rate and found PayPal took 3.31% margin off every US dollar exchanged, what they refer to as a “Currency conversion fee.” In the end, it could cost over $245 in fees alone to complete the transfer.

While Barclays might not have a standard “wire fee”, it adds a fee into the exchange rate. We thought they were less sneaky than most high street banks, though, as they state that “a margin will be applied to your reference rate.”

Stripe also charges a currency conversion fee, which is added on top of the mid-market exchange rate. Which means if you’re a UK or EU merchant, every non-European card transaction you do with Stripe could have you paying up to 4.9% in fees.

Stop losing thousands on fees

For international payments, GoCardless will charge you 2% of the source currency and a small fixed fee — for a UK merchant, that’s 20p.

That means, if you're in the UK and want to collect a $5,000 payment from a US customer, our fee is $100.25. In other words, it doesn't cost you much to get the full value out of collecting GoCardless payments globally.

The same $5,000 payment would cost you over $300 using PayPal. And those fees add up over time, especially when it comes to recurring payments.

Imagine collecting $5,000 from a customer every month. By the end of the year you’ve lost $3,600 on fees with PayPal. With GoCardless you’d only be spending $1,203 on fees.

That’s over $2,300 still making its way into your bank account when you use GoCardless.

Not bad.

International payments are easy with GoCardless

With GoCardless, collecting from all over the world is easy, and the funds go straight into your domestic bank account.

If you’re already using GoCardless for domestic payments, international payments work exactly the same way. Add a customer, or create a new payment - however you normally do it.

Get started today, and stop paying unnecessary fees.

Get started with international payments in GoCardless

International payments work just the same as domestic payments. So just login and do what you'd normally do.

Still unsure? Read more on getting started here.

GoCardless exchange rates as at 23/10/2020. The information contained here is not intended as individual financial advice. The information supplied is intended to help people make their own decisions based on publicly available data. Pricing information for competitors was taken on 27 October 2020 as follows: Stripe pricing | PayPal pricing | Barclays pricing.