Create an Invoice for Retainer Fee

Last editedApr 20222 min read

If you provide goods or services to clients using a retainer agreement, you’ll need to send regular invoices to ensure all fees are received. We’ll cover how to invoice for retainer fees in this guide and provide some examples to help you get started.

How does retainer billing work?

A traditional invoice requests payment for work that’s already been completed and delivered.Retainer billing works in a slightly different way. This covers situations where your business provides work on an ongoing basis. For example, you might be a contractor working on a construction project expected to last for several months, or a lawyer working on a complex case. Retainer billing allows you to collect payment in regular instalments as you complete your work for greater financial security and cash flow. The client benefits by securing the work of the contractor or freelancer over the long-term.

This type of work requires regular invoicing for payment – and this is where the retainer fee invoice comes into play. You might also include a timesheet to track your billable hours to show the client how much work you’ve completed.

What should be included on a retainer invoice?

When you look at any retainer fee invoice template, you’ll see that while the layout might change, the required information stays the same. Here are the basic details that you should see on any invoice for retainer fees:

Vendor contact details

Customer contact details

Invoice date and number

Description of services provided

Quantity of goods or hours worked

Total balance due

Due date for payment

Tax (if applicable)

Payment methods

As far as timing goes, this will depend on the agreement you have in place with your client. For ongoing work, many retainer agreements involve monthly invoicing and billing. You can choose a date – typically the beginning or end of the month – and submit your invoice at the same time each month.

Sample retainer fee invoice template to download

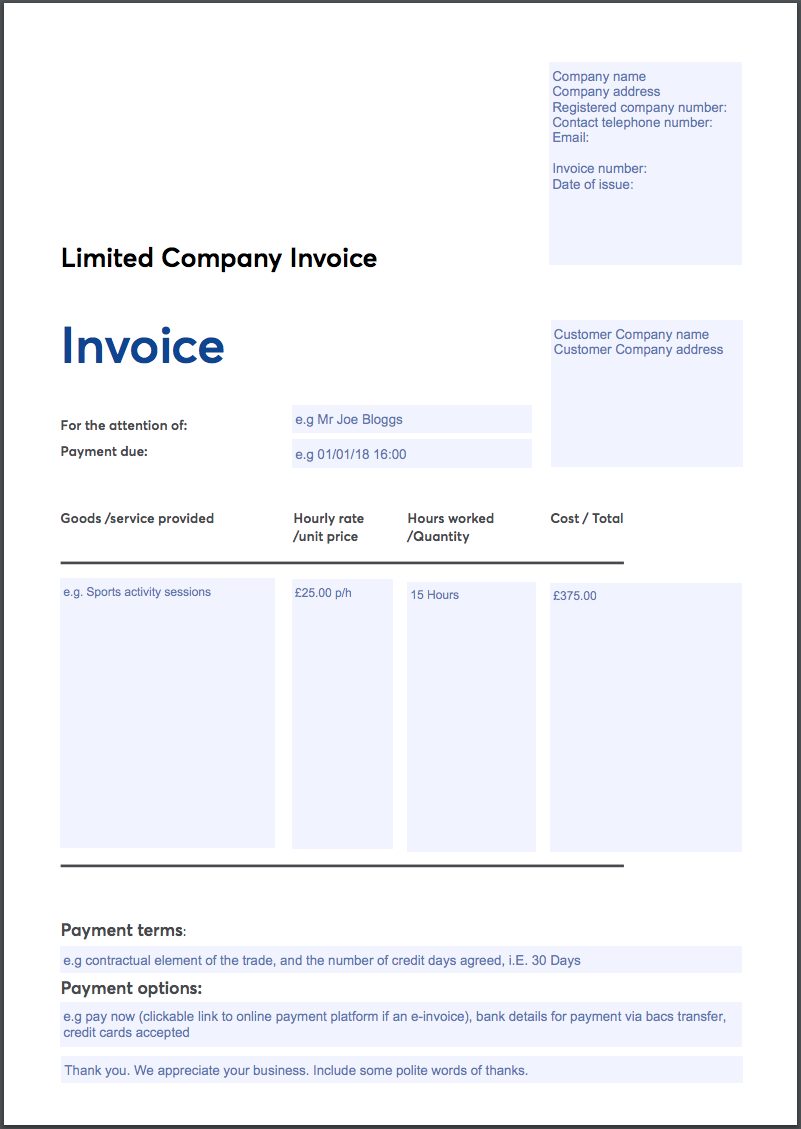

Below is a basic invoice template that you can use to charge for your retainer fee, with customisable fields to add extra information such as payment terms.

Download a basic invoice to use for retainer fees:

Sample monthly retainer invoice

Here’s a sample to show what your invoice might look like:

You may want to add other details like your website, and discount or tax details. Lastly, be sure to specify your payments terms.

|

Description |

Unit Cost |

QTY/HR Rate |

Amount |

|

Item Name |

£0 |

1 |

£0 |

|

Item Name |

£0 |

1 |

£0 |

|

Item Name |

£0 |

1 |

£0 |

|

|

|

Subtotal |

£0 |

|

|

|

Discount |

£0 |

|

|

|

Tax Rate |

0% |

|

|

|

Tax |

£0 |

|

|

|

Invoice Total |

£0 |

You can use this sample monthly retainer invoice as a guide to create your own or use the template of your choice. Most accounting software like Xero and QuickBooks offer a wide selection of retainer fee invoice templates.

Which payment methods should you offer on a retainer invoice?

This will depend on your personal payment preferences as well as those of your clients. However, retainer payments are ideally taken using Direct Debit. This pull-based payment only requires your customer to set it up the first time. After this, you can automatically take bank payments controlling the frequency and amount according to your retainer invoices. This is not only more convenient for customers but also improves your cash flow while reducing failed and late payments.

While it’s difficult for small businesses to access and leverage traditional Direct Debit payment methods, GoCardless is quick and easy to set up. You can get started either on your own or with GoCardless support to start taking payments in less than a day. We also partner with many major invoicing and accounting platforms like Xero to help you set up automatic monthly retainer invoices.

We can help

GoCardless helps you automate payment collection, cutting down on the amount of admin your team needs to deal with when chasing invoices. Find out how GoCardless can help you with ad hoc payments or recurring payments.