Sending pre-notifications

Last editedMay 20221 min read

This practical guide will help you to design and send compliant Autogiro (Direct Debit) pre-notifications.

What is an Autogiro pre-notification?

An Autogiro pre-notification informs your customer when they can expect a single payment or regular subscription to leave their account. It is a mandatory requirement of Autogiro, and can be sent by email, text message or as part of a normal or electronic invoice.

To create fully compliant pre-notifications, you will need to:

Inform the customer with the appropriate notice period

Include the amount and due date

Include your contact details

Clearly notify the customer that payment is to be made by Autogiro (Direct Debit).

Throughout this guide, the examples are taken from the GoCardless pre-notification emails.

1. Email the customer with the appropriate notice period

Why? Gives the customer the chance to ensure they have sufficient funds.

How? Send the pre-notification 8 working days before payment is collected.

It is not mandatory to send a notification if the payer has approved an Autogiro payment in conjunction with a purchase or order.

2. Include the amount, due date and reference

Why? Helps ensure the customer recognises the charge on their statement

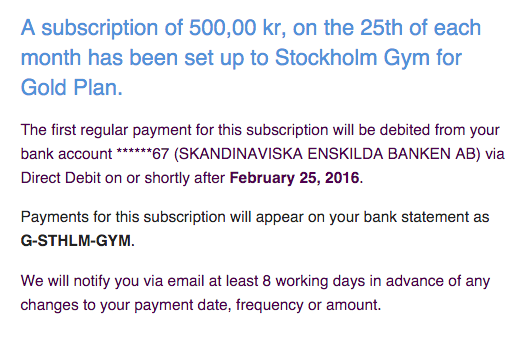

How? Either send an email before each payment, or give details upfront for a fixed subscription.

For recurring direct debits of the same amount, such as subscription plans, you only need to inform the payer before the first Autogiro collection. You must include details of all future charge dates (e.g. "first working day of each month"). A new pre-notification will then only be necessary if the amount, frequency or payment date changes.

Example of a pre-notification for a one-off or recurring variable amount:

Example of a pre-notification for a recurring amount with multiple collection dates:

3. Include your contact details

Why? Makes it easy for the customer to contact you with any queries.

How? Include a snippet in each email with your address.

Autogiro and GoCardless

GoCardless is an end-to-end Autogiro (Direct Debit) provider and can completely handle Autogiro compliance on your behalf.

GoCardless can send compliant emails for Autogiro on your behalf. We cover both Swedish and English and automatically send emails in the language of the payer. We automatically send emails eight working days before an Autogiro collection.

If you wish to send your own emails, you can do this with GoCardless Pro. Your Account Executive will support you during your implementation of compliance guidelines.

To find out more about collecting Autogiro payments or to register your interest with GoCardless, check out our GoCardless Sweden page.