Last editedDec 20203 min read

Sending out invoices, collecting payments and reconciling cash are time consuming tasks – with the average UK small business spending up to 120 hours a year on admin.

That’s dead time for the business, and the financial admin associated with payment collection and debtor tracking is a particular drain on productivity.

So, how can you get that valuable time back?

In this guide, we’ve highlighted 5 hacks to help your cash collection process run more efficiently.

1) Switch to online invoicing in the cloud

According to GoCardless research, a quarter of accountants identified increasing their use of technology and automation as a key priority for the year ahead and a separate study found that 42% of SMB owners are looking to use technology to modernise operational processes.

Online invoicing speeds up payment and is included as standard with the major cloud accounting platforms like Xero, Sage and QuickBooks. So as well as managing your finances online, you can also quickly create branded electronic invoices and email them straight to your clients – removing the need to print and post hard-copy invoices. With certain software providers, you can also add a ‘pay-now’ button to your invoices – enabling one-click payment.

2) Move away from manual payment methods and take back control

Relying on clients to make manual payments can be problematic – with the control sitting squarely with the customer, rather than with you.

If you’re using a manual ‘push’ based payment method like bank transfer or one time card payments, switch to an automated payment method like standing order or recurring card payments.

Or better yet, get back control with a ‘pull’ based payment method like Direct Debit. With Direct Debit, you are authorised to automatically take funds from a client’s account – each time a payment is due.

This not only automates the payments but puts you in control of when the payment is taken and how much is charged.

As Direct Debit is a bank to bank payment method, you also avoid spending time dealing with payments that fail due to lost or expired cards and having awkward conversations with customers as you chase payments and ask for updated card details.

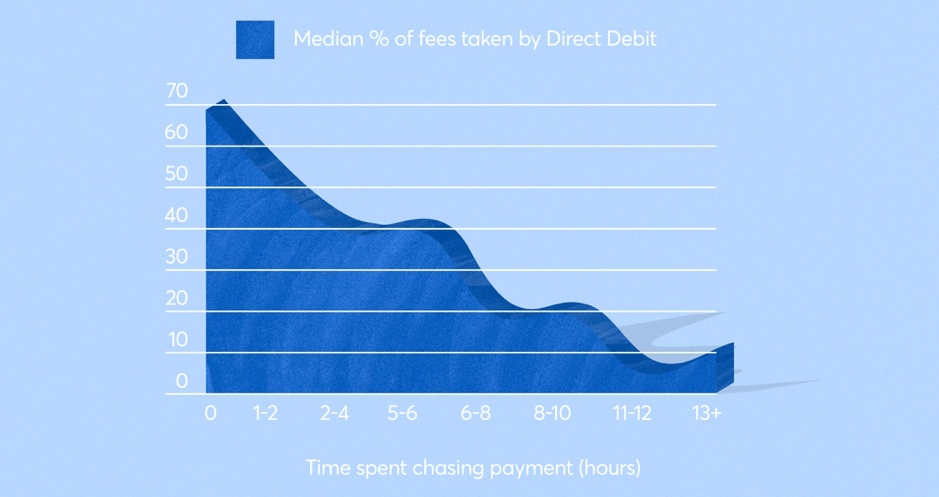

This can give your cash flow position a real boost – GoCardless’ own researchfound that those businesses who use Direct Debit to process payments, spend less time chasing payments.

(Source: Accountants Benchmarking Survey Report 2018)

3) Automate your bank reconciliation

Bank reconciliation is a necessary but time-consuming task. But with the right software in place, you can automate the whole process.

Achieve automated bank reconciliation of your payments by integrating your payment gateway through your billing software.

With GoCardless, for example, you can integrate Direct Debit payments with major billing software (e.g. Xero, QuickBooks and Sage). Once set up, payment is collected by Direct Debit and then automatically reconciled against your invoices.

Moving to GoCardless as a payment solution has a real impact on efficiency – 84% of UK SMEs said they spent less time chasing invoices; and 74% spent less time on reconciliation*.

"We strongly advise our Xero online accounting clients to use GoCardless. It's quick to set up, improves cash flow and admin is reduced to almost nothing due to the automatic reconciliation." Peter Czapp, Accountant and Co-founder, The Wow Company – uses GoCardless for Xero

4) Set up notifications for failed payments

When payments fail, that creates a significant admin and cash flow headache for your business. So the sooner you’re notified about failed payments, the sooner you can act.

With the right payment software in place, you’re quickly notified of any payments that fail. GoCardless sends an email to your inbox if the cash can’t be collected via the usual Direct Debit. This gives you the opportunity to act in real time either by retrying the payments or contacting the client to arrange a new payment date or setup a new mandate.

Read our guide to find out about the two most common reasons for Direct Debit payment failures and what you can do about them.

5) Automatically chase any late-paying clients

Late payment is a big issue for accountancy firms and small businesses alike. So finding ways to speed up late payment, while also reducing that credit control workload, has real value.

The smart features of your cloud platform, combined with an increasing choice of debtor tracking apps, mean you can automate the whole process of chasing your late payments. Apps such as Chaser and Fluidly give you control over your aged debtor numbers, and automatically send out chaser emails to clients.

* Xero/GoCardless survey: 2018 survey of 736 SMEs taking Direct Debit payments through GoCardless.

Cone Accounting save 2 days a month using GoCardless

Find out how GoCardless for Xero has helped Cone Accounting get rid of their debtor list and improve cash flow.