Simple and secure direct bank payments

THE EASY WAY TO GET PAID

Collect instant, one-off payments. Or automated recurring payments. Without the chasing, stress or expensive fees.

Used by 85,000+ businesses. Small to enterprise. Globally.

Payments. But without the hassle.

End late payments

Easy for your customers to make instant, one-off payments. Or set them up for automated payments, so neither of you has to lift a finger.

No more chasing

With GoCardless, you don’t have to rely on your customers remembering to pay on time. Saving you all those costly hours chasing up late payments.

Automate admin

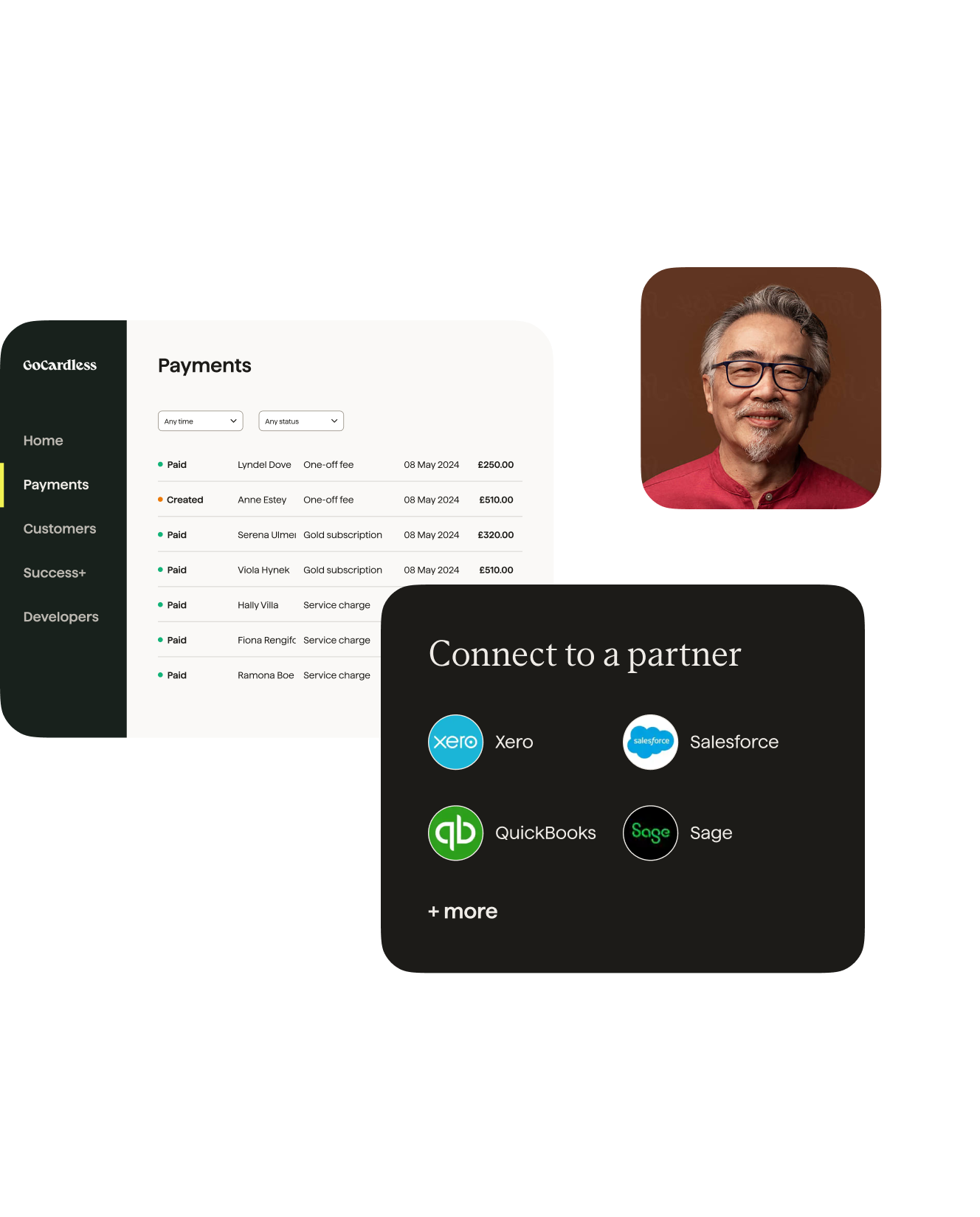

Easily see the status of any payment from any customer, any time. And if you connect GoCardless to your accounting system, reconciliation is automatic.

Forget expensive fees

GoCardless collects direct bank payments. Meaning no card fees. And with all that wasted admin time cut away, the savings really stack up.

Everything your business needs

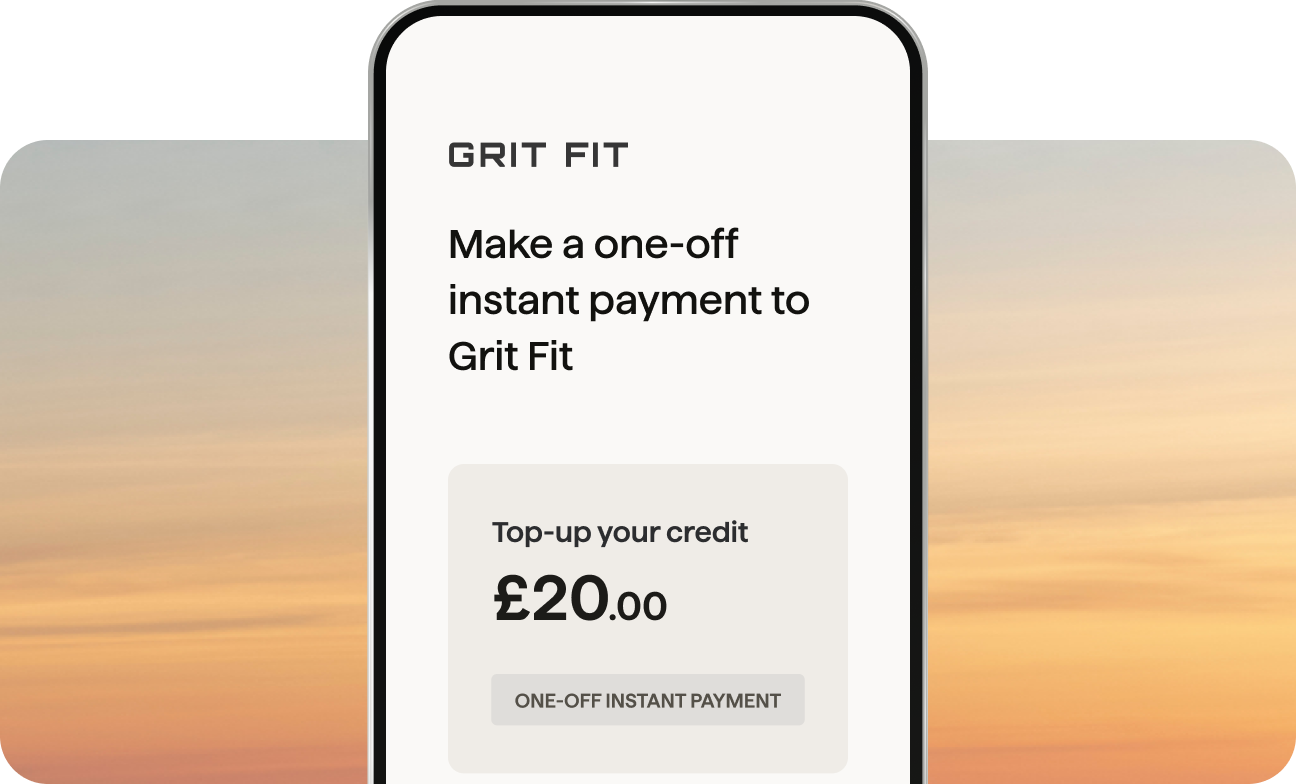

Instant, one-off payments

Let your customers pay directly from their bank account. It's quicker and easier than a manual bank transfer, and skips the high fees of card payments. That means better for you and better for them.

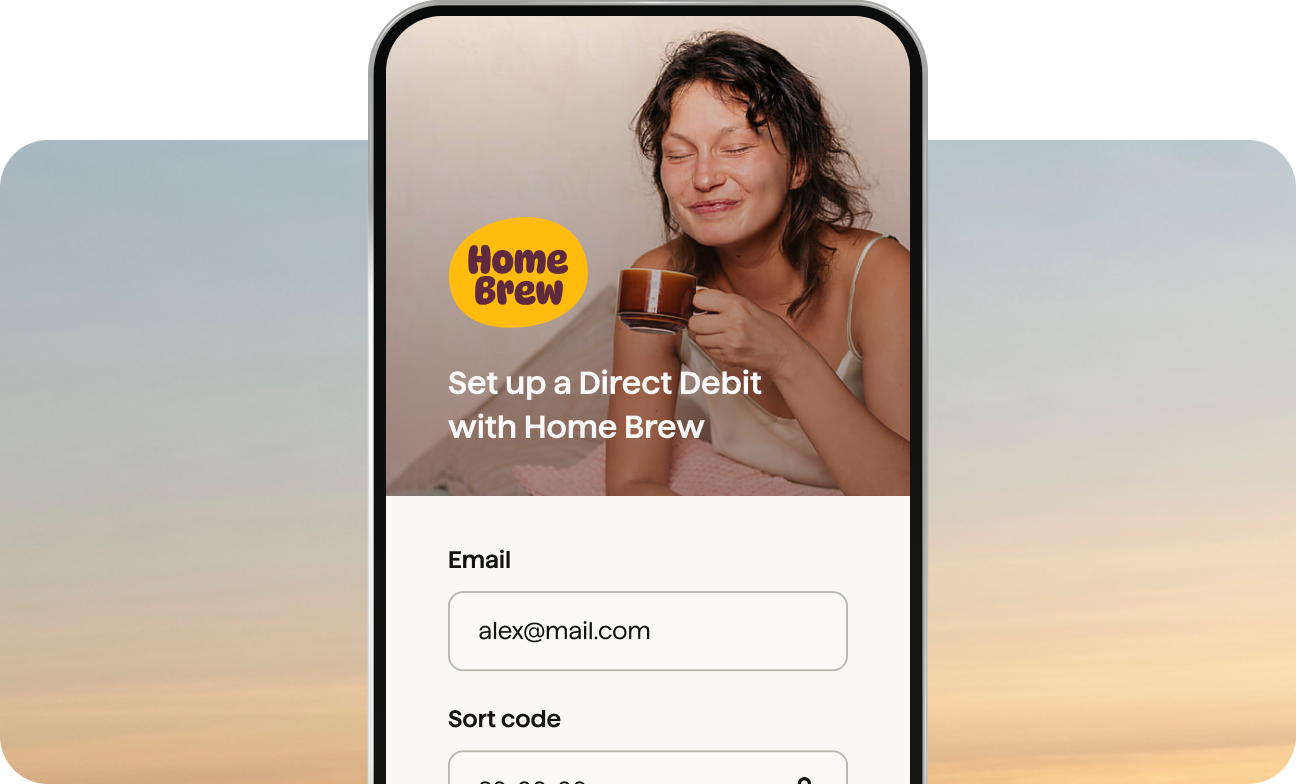

Automated, recurring payments

Automatically collect payments on the due date, via Direct Debit. Even if the dates or amounts change. Perfect for subscriptions, instalments, and invoicing for services.

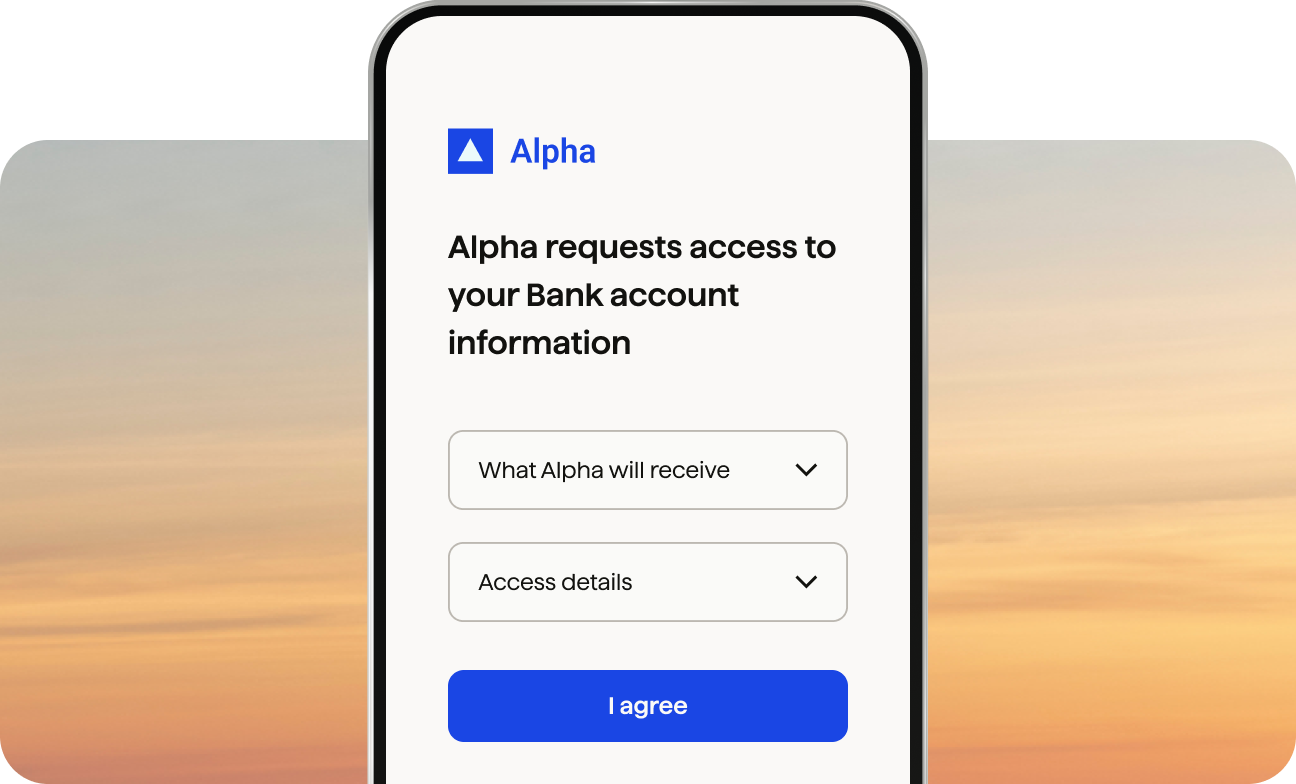

Access bank account data

Let your customers securely share their bank account data with you. From account info, to balances, and transaction data. With connections to 2,300+ banks across the UK and Europe.

![Instant, one-off payments]()

Instant, one-off payments

Let your customers pay directly from their bank account. It's quicker and easier than a manual bank transfer, and skips the high fees of card payments. That means better for you and better for them.

![Automated, recurring payments]()

Automated, recurring payments

Automatically collect payments on the due date, via Direct Debit. Even if the dates or amounts change. Perfect for subscriptions, instalments, and invoicing for services.

![Access bank account data]()

Access bank account data

Let your customers securely share their bank account data with you. From account info, to balances, and transaction data. With connections to 2,300+ banks across the UK and Europe.

International payments made simple

Collect payments from 30+ countries. Either into a local bank account, or your existing UK account thanks to in-built FX at the real market rate. Powered by Wise.

Intelligently retry failed payments

With GoCardless, failed payments are rare. But switch on automatic retries and our payments data determines the best day to try again. Recovering 70% of failed payments, on average.

Better for your customers, too

Businesses and consumers often prefer to make bank payments, instead of using cards and digital wallets. With automation and peace of mind, it’s not hard to see why.

Great on its own. Or connect to one of 350+ other systems.

Use our online dashboard. Or connect GoCardless Payments with the software you already use to run your business, to manage everything in one place.

Customer story

“As a business owner, GoCardless makes me feel secure. I never wake up in the middle of the night worrying about payments.”

James Symes, CEO, Bike Club

Start collecting payments now

Proud official partners

Better payments should be accessible to organisations of all shapes and sizes. That’s why we’re delighted to educate and empower through being the official payments partner of Swim England and the headline sponsor of the GoCardless JustGiving Awards.

Ready for payments to be frustration-free?

Collect instant, one-off payments. Or automated, recurring payments. Without the chasing, stress, or expensive fees.