Last editedApr 20233 min read

Do your customers really care about their loan repayment experience?

Or, to be more precise, will their loan repayment experience actually affect their choice of lender? Can the prospect of a bad payment experience put them off your lending product?

The simplest way to find out is to ask. And that’s what we did.

We asked 400 borrowers who have taken out at least one personal loan within the last two years about a number of key aspects of their repayment experience.

We also asked them if they had ever missed a repayment or made a repayment after the due date - 50% of all those we asked had done so.

The troubles with late and missed payments

There is a dangerous assumption that borrowers only ever miss a repayment due date because they don’t have the funds available to pay. While it’s clearly a prominent issue - 53% of all borrowers who had missed a repayment had done so because they did not have the funds required - there are a number of other reasons that a customer might have trouble paying.

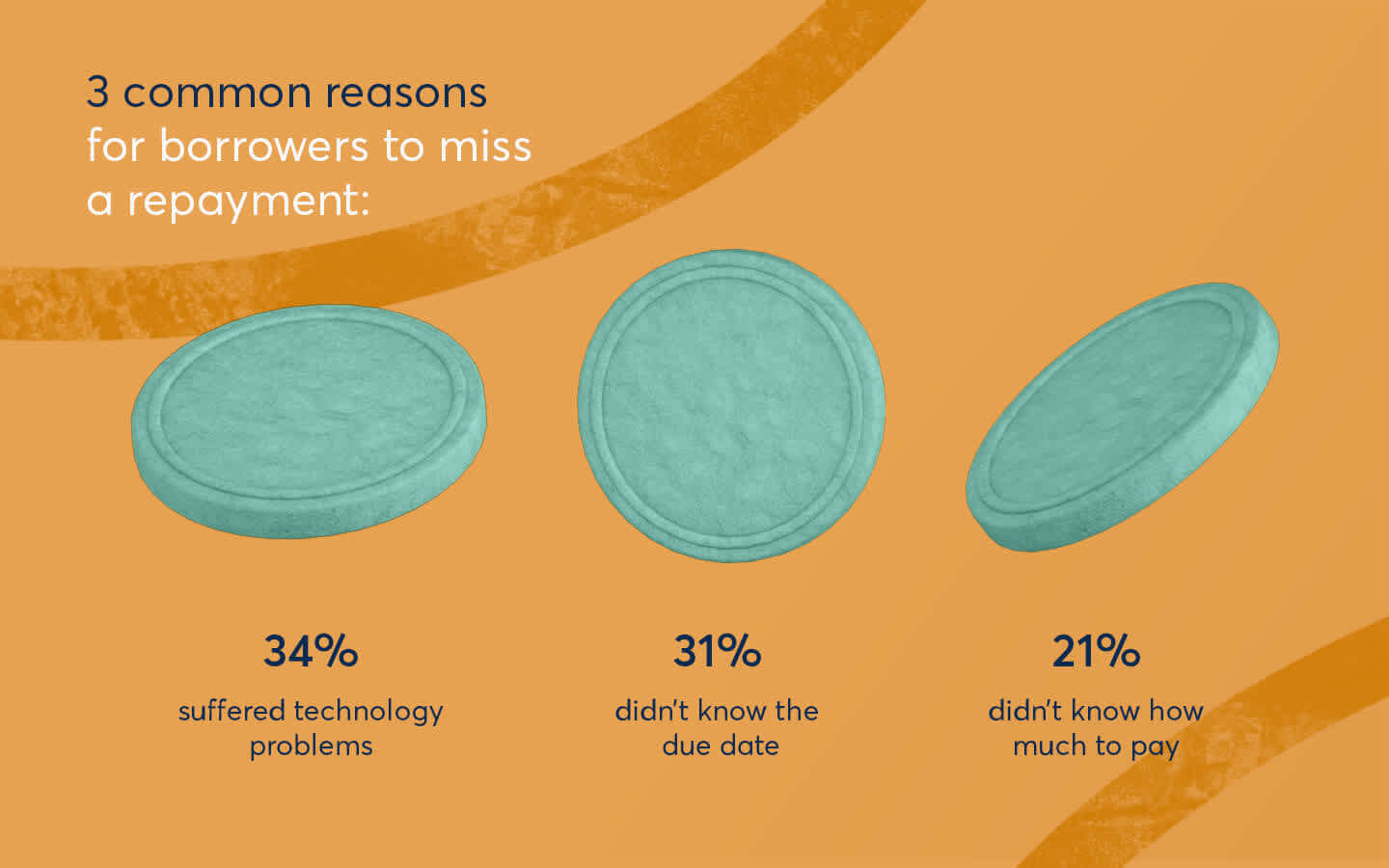

Three of the most likely causes of a late or missed payment are:

34% have missed a repayment because of technology troubles

31% of respondents didn’t know what date their repayment was due

21% of respondents did not know how much to pay

This shows how common it is for borrowers to fully intend on repaying their loans on time, but also experiencing some sort of problem or lack of information that is enough of an issue for them to miss their repayment.

How can lenders improve the loan repayment experience?

The above findings show an urgent need for lenders to improve the loan repayment experience to remove as many barriers to repaying. Doing so successfully would reduce loan delinquency and help borrowers protect their lending history - it’s a win-win.

But what would actually improve a borrower’s repayment experience?

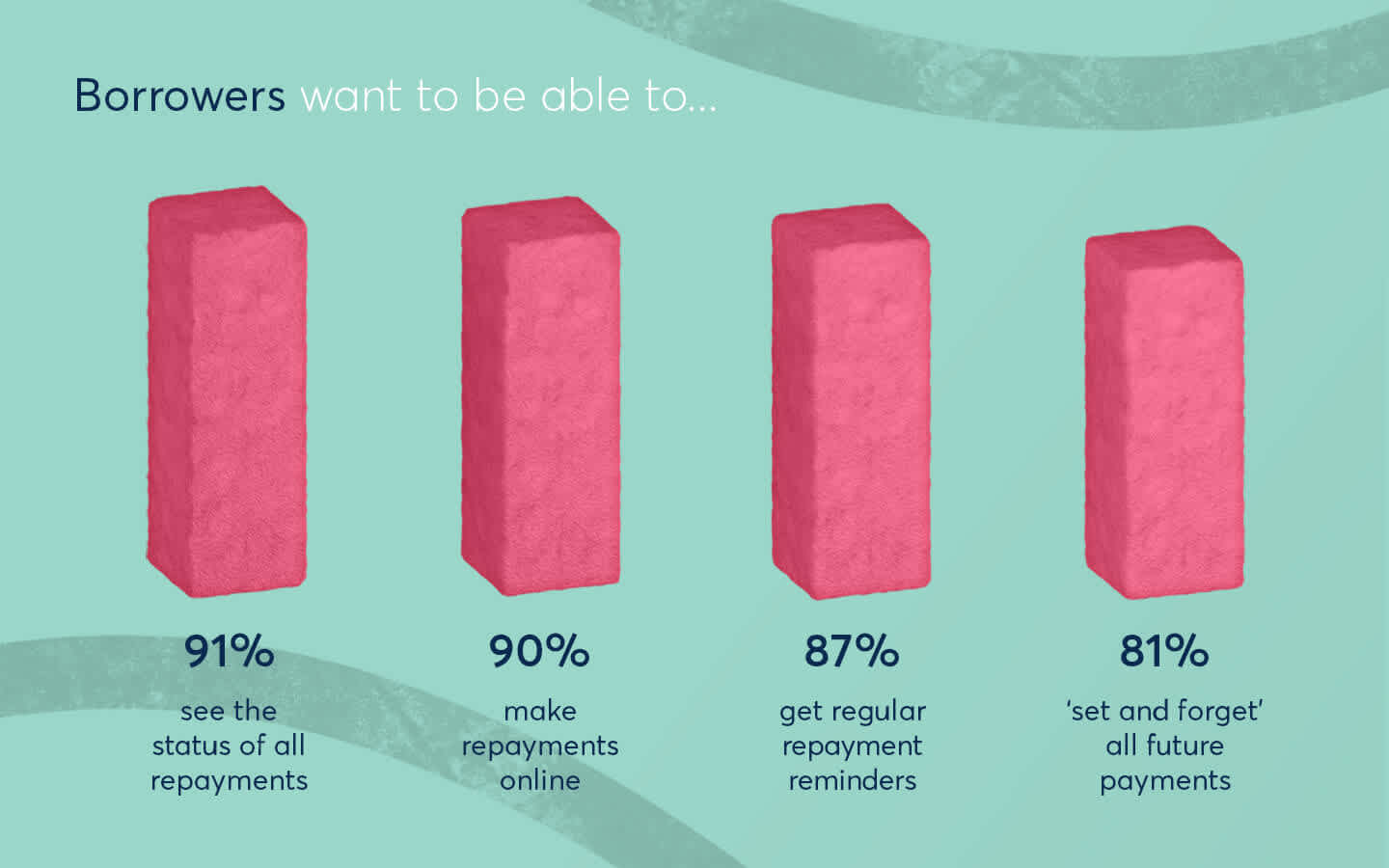

One of the most important aspects for the customers we asked is having better visibility of their repayments. In fact, 91% agreed that it is important to be able to see easily see the status of all their repayments.

Other key findings include:

90% think they should be able to make repayments online

87% would like regular payment reminders ahead of every upcoming repayment

81% would like to ‘set and forget’ all upcoming repayments in one go

Would payment experience affect a borrower’s choice of lender?

According to the results of our survey, 84% of borrowers think payment experience is important to their overall borrowing experience.

But are certain payment features enough to make a borrower consider (or rule out) a specific lender?

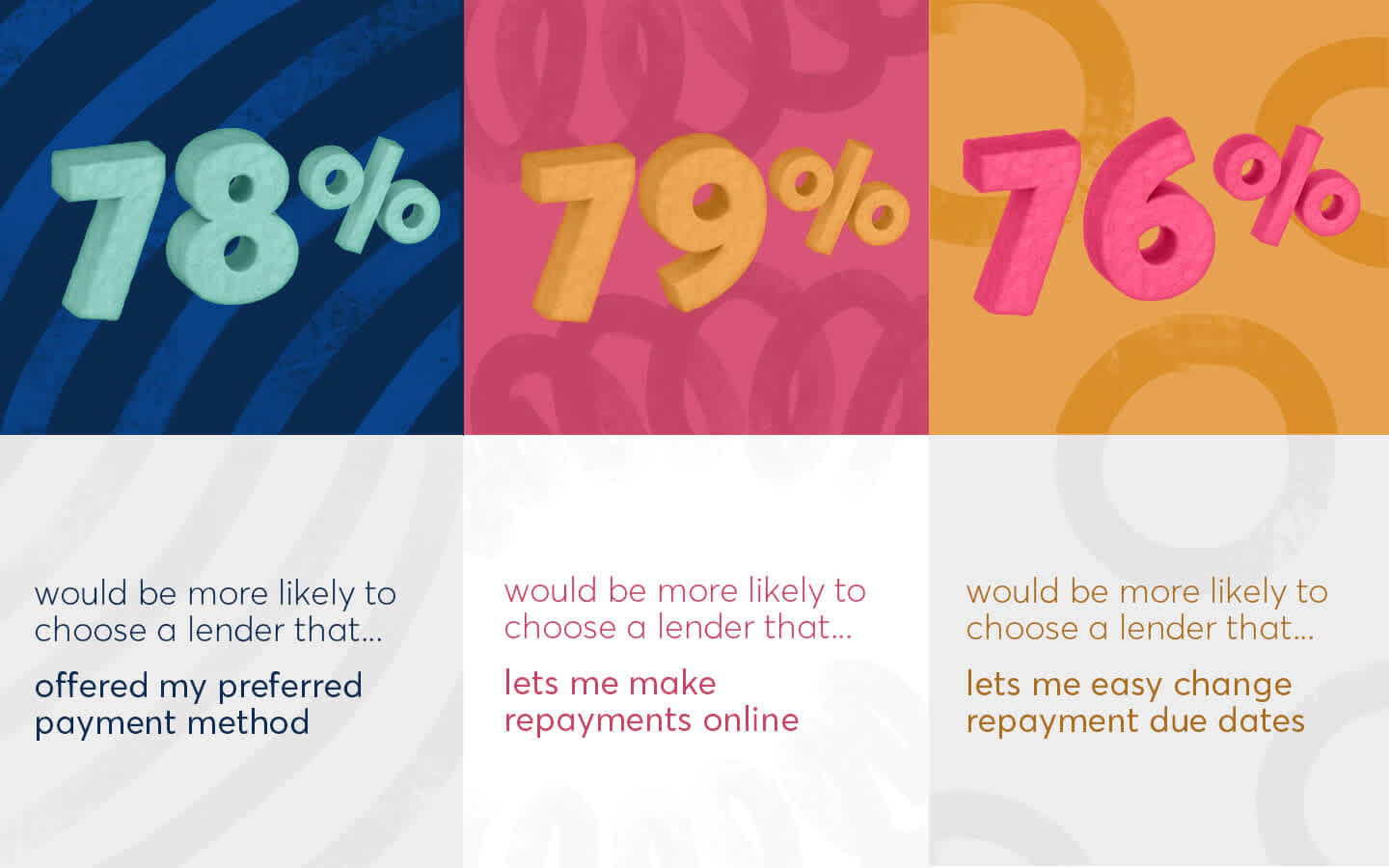

One feature that clearly impacts on a borrower’s decision-making process is the flexibility of payment method...

78% of respondents would be more likely to choose a lender that offered their preferred payment method. This shows that it pays to offer multiple payment methods to cater to different borrowers.

79% would be more likely to use a lender that allowed them to make and manage payments online. This may seem like a no-brainer in today’s market, but any offline blockers (such as paper Direct Debit mandates), could be enough to put off a borrower for good.

Finally, 76% would be more likely to use a lender that allowed the borrower to easily change the due dates of each repayment. Does your business allow that? And if so, how does the borrower go about making that change? If it’s not an automated online process, your online offering begins to seem less appealing to the tech-first consumer.

Offering Direct Debit

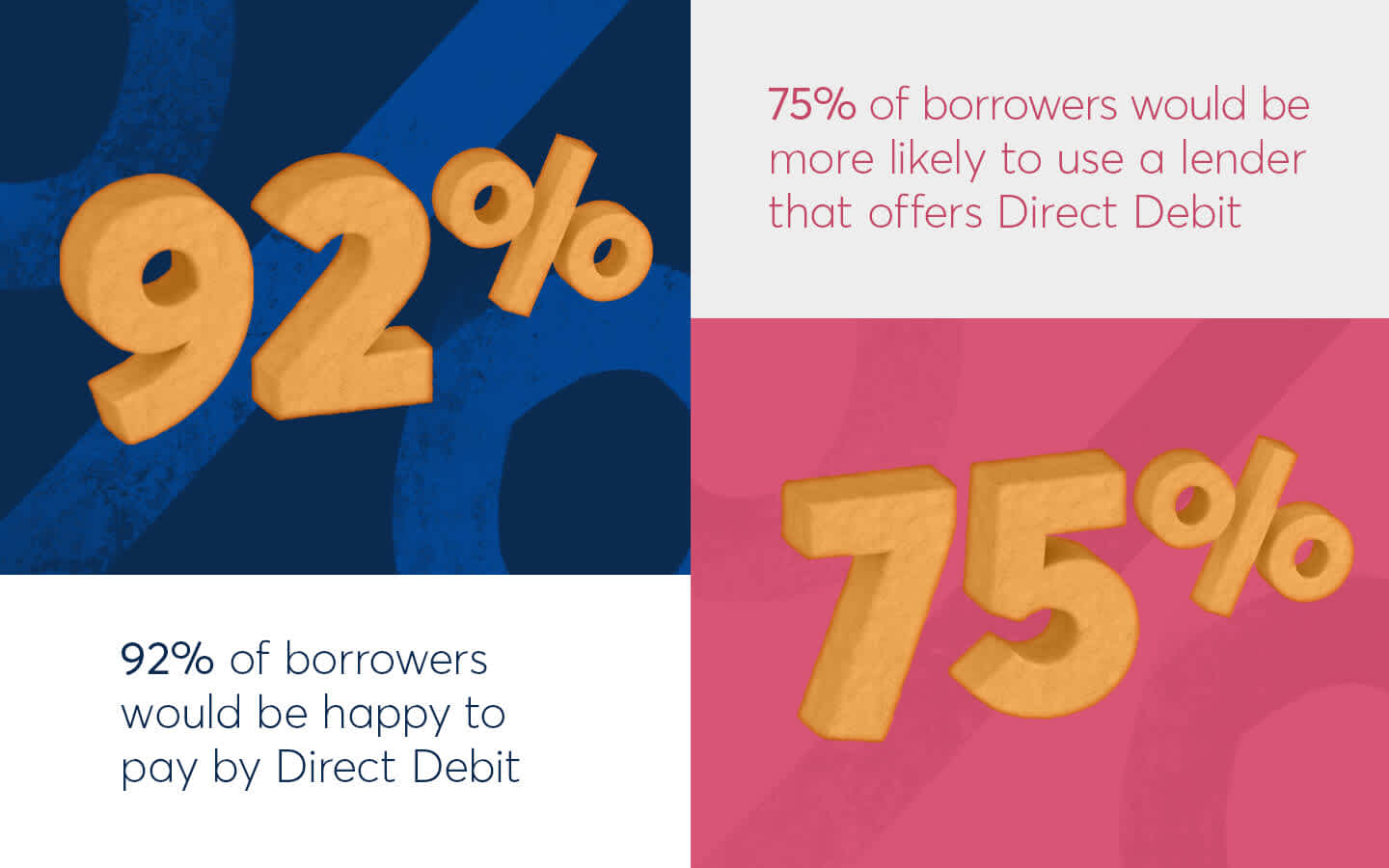

Here at GoCardless, we off smarter automated payments by building our technology on top of the existing Direct Debit network. Direct Debit is an established payment method for paying in instalments.

In fact, of the 400 respondents we surveyed, 92% would be happy to pay by Direct Debitif a lender offered it and 75% would be more likely to use a lender that offered Direct Debit as a payment option.

Time to take repayment experience more seriously?

Hopefully, the insights from our survey will have simply provided the data to back up your current way of thinking - that repayment experience is a core part of every borrower’s customer lifecycle.

As we’ve seen, repayment experience is something the vast majority of borrowers actively care about and elements of that experience can even play a part in deciding whether to use a specific lender or not. That is particularly eye-opening, considering the multitude of other important factors in choosing a lender.

Finally, Direct Debit is clearly a well accepted and even sought after payment method. GoCardless can help you offer Direct Debit that matches the high standards of the rest of your borrowing experience.