Millennials and Gen Z Will Lead the Switch From Traditional Banks to Peer-to-Peer and Social Media App Payments

Last editedMar 20222 min read

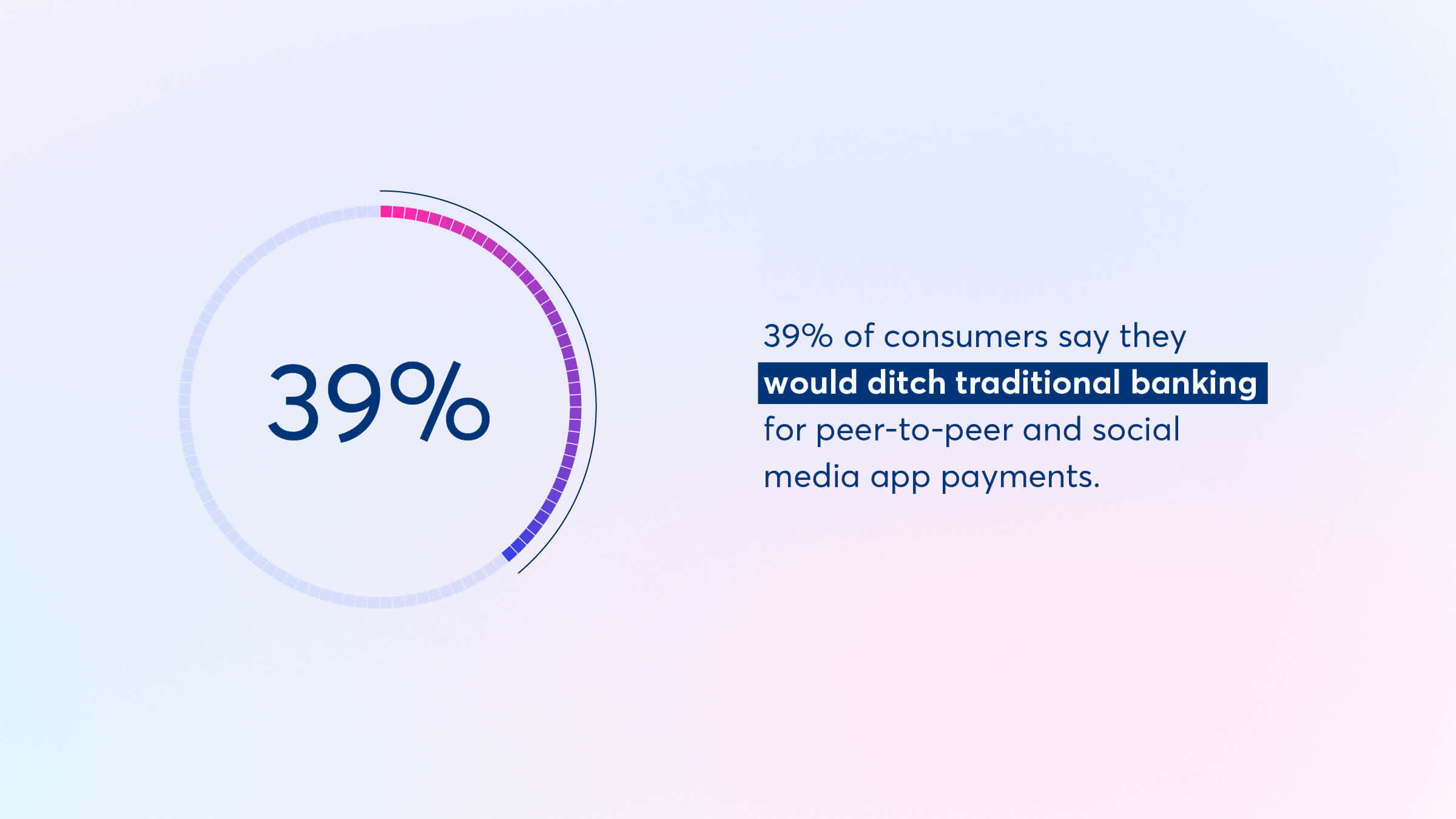

39% of consumers say they would ditch traditional banking for peer-to-peer and social media app payments

More than half of Americans (51%) are now more likely to use peer-to-peer apps such as PayPal and Venmo than before the pandemic

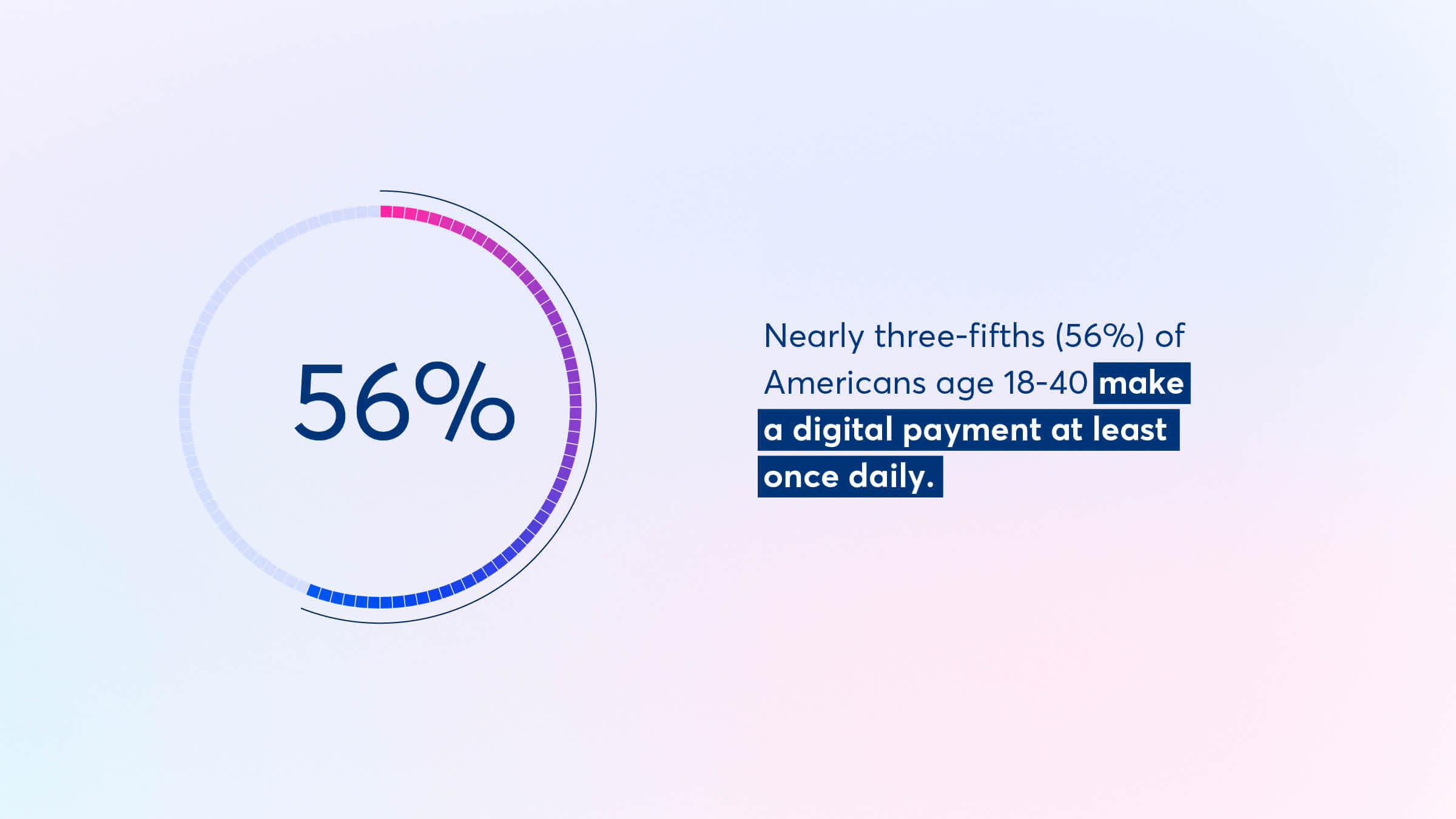

56% of Americans aged 18-40 make a digital payment at least once daily

New research explains why banks are struggling to stay relevant among Millennials and Gen Z.

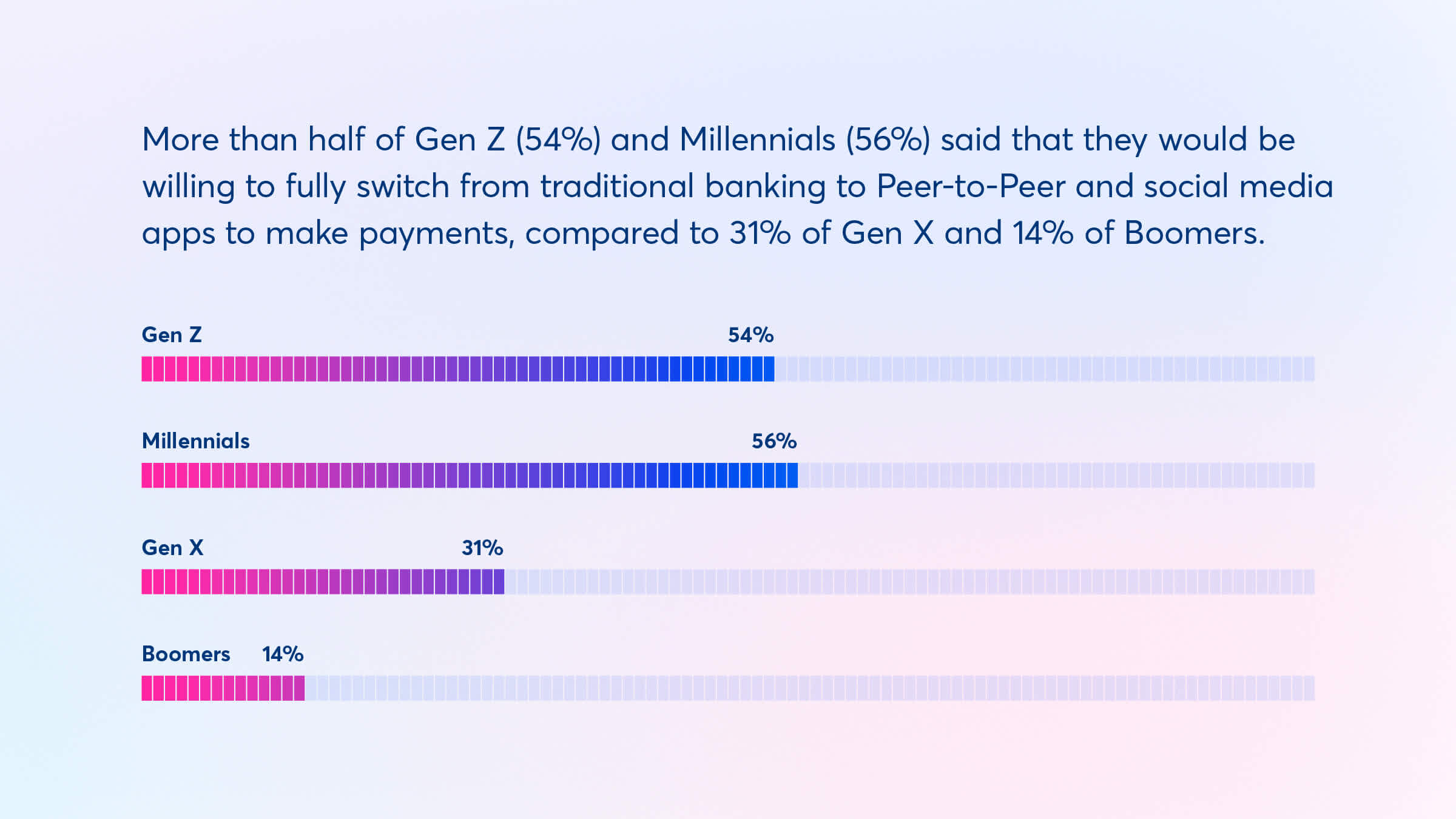

GoCardless recently conducted a survey of 1,000 Americans aged 18 and over to better understand the changing payment preferences of consumers. They found that more than half of Millennials (56%) and Gen Z (54%) said that they would be willing to fully switch from traditional banking to peer-to-peer and social media apps to make payments, compared to just 31% of Gen X and 14% of Boomers.

“The pandemic caused major shifts in the ways we move money and pay for goods and services, with younger generations leading this new wave of alternative payments,” said Hiroki Takeuchi, co-founder and CEO of GoCardless.

Of the 39% of Americans who said they would leave traditional banking, more than half (53%) said they would switch to peer-to-peer and social media app payments because they are faster. Forty-nine percent said these payment apps are easier to use.

“Given the distinct preferences of Millennials and Gen Z, banks should pay close attention and find ways to incorporate new online payment options, ones that provide the speed and ease consumers are looking for,” said Takeuchi. “If not, these cohorts may leave them entirely.”

Most consumers are making at least one digital payment every day

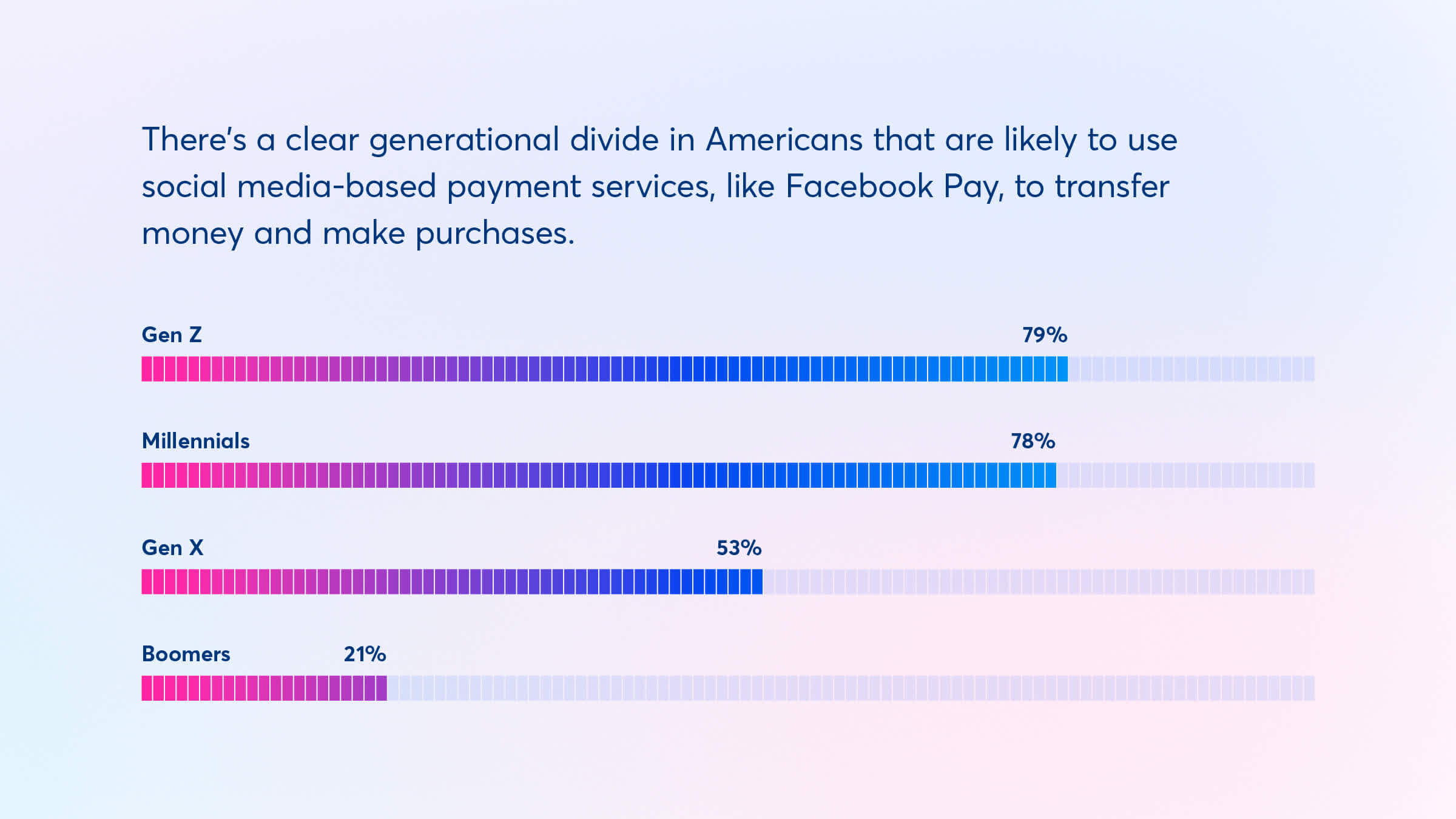

Already, 57% of Americans say they like to use social media-based payment services to transfer money and make purchases, such as Facebook Pay and Google Pay. However, there’s a generational divide. Nearly eight in 10 Millennials (78%) and Gen Z (79%) use these services. Only 53% of Gen X and 21% of Boomers do the same.

Similarly, more than half of Americans (51%) are now more likely to use peer-to-peer apps such as PayPal and Venmo than before the pandemic. Millennials (69%) and Gen Z (65%) are leading the way. Gen X (44%) and Boomers (27%) are lagging significantly. Despite the preferential differences among generations, America is becoming increasingly digital. Already, nearly three-fifths (56%) of individuals aged 18-40 make a digital payment at least once daily (by phone in-person or online, making an online payment, or sending an electronic transfer).

Businesses must adapt their customer experience to meet the expectations of Millennials and Gen Z. After all, 85% of Americans said they would abandon a purchase if the online checkout process took too long.

Fewer older Americans trust P2P and social media payments

Even though most Americans are already more comfortable using online payments than they were before the start of the pandemic, more than a third (35%) are concerned about the lack of regulation. In fact, 41% of Gen Z said the lack of regulation is the reason why they wouldn’t switch fully to P2P and social media app payments, and more than half (53%) of Boomers think app-based payments are not as secure as traditional banking.

Nonetheless, web-based financial management is becoming widespread: 35% of Americans opened an online-only bank account, such as with Ally Bank, Axos, Chime, Sofi, Varo Bank, during the pandemic. There is also a clear age split: only 7% of Boomers have done so compared to 51% of Millennials, 44% of Gen Z and 35% of Gen X.

The bottom line

Digital natives prefer digital-first solutions, and they’re paying with clicks, swipes and taps as opposed to paper checks, debit and credit cards. By embracing online payment methods, banks can provide Americans with the modern experiences customers expect.