GoCardless makes it easy to accept Direct Debit payments

Free to set up, no contract required

Collect recurring & one-off payments

No more chasing late payments

Save time and money

90 days no transaction fees (T&Cs apply)

We help over 100,000 organisations get paid on time

78% of businesses using GoCardless say it reduced stress

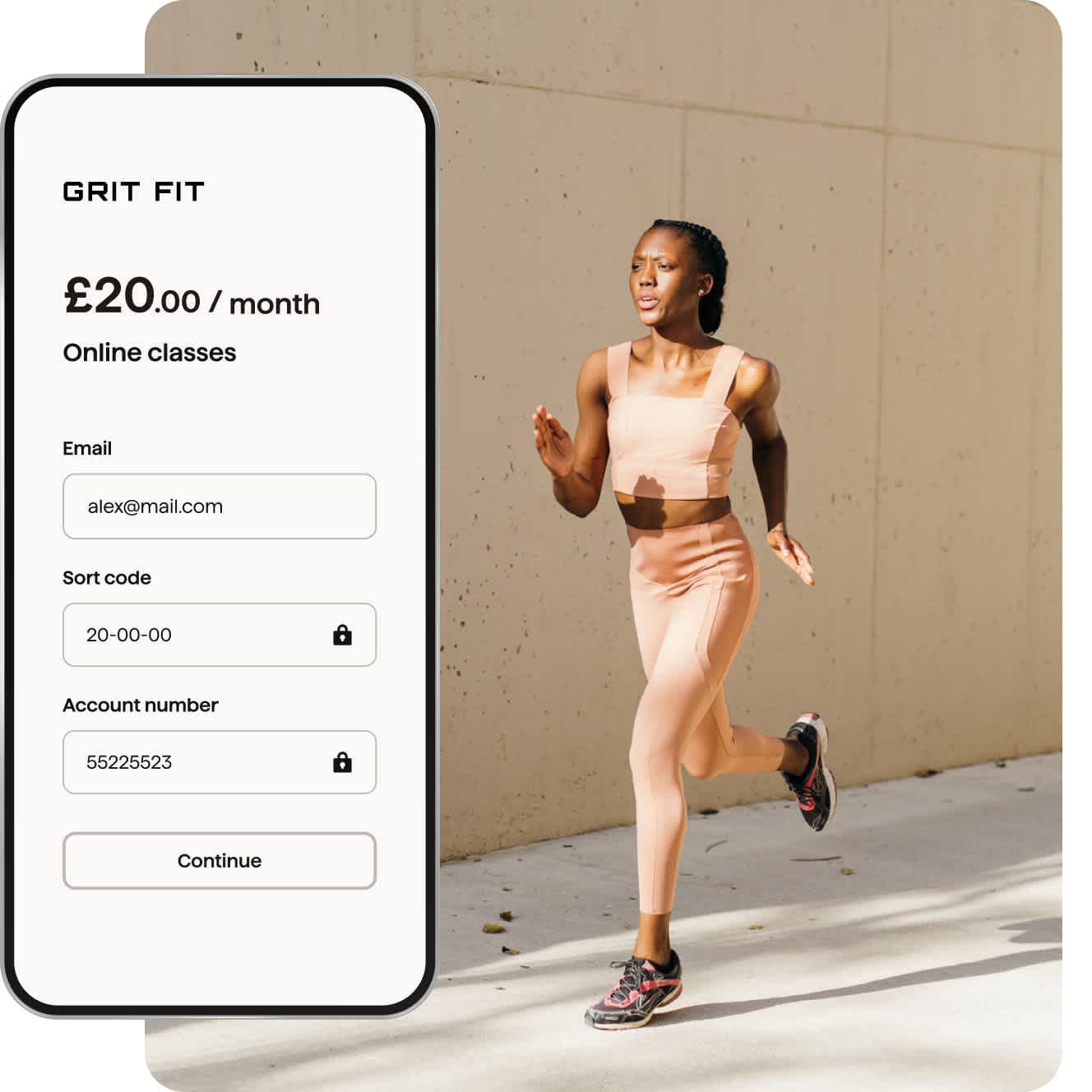

Quick and easy to set up payments

Direct Debit is simple to set up and easy to manage, with GoCardless doing all the heavy-lifting.

Integrate with your accounting software

GoCardless integrates with over 350 different software packages so we've got you covered.

Save hours of admin

Automate your payments and reconciliation. No more wasted time on manual financial admin.

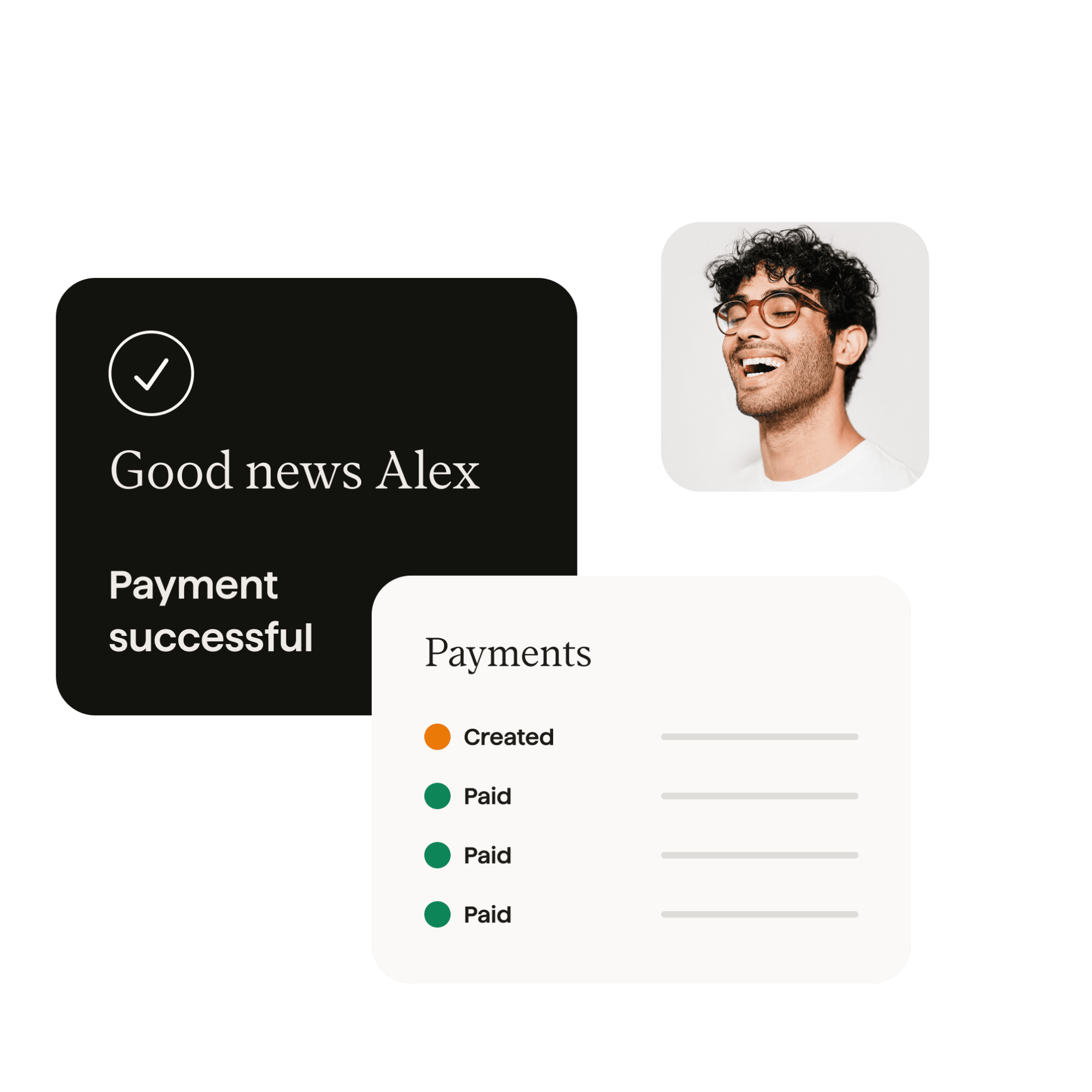

End late payments

With GoCardless, you don’t have to rely on your clients remembering to pay on time. Saving you all those costly hours chasing up late payments.

Take advantage of Direct Debit payment today.

Pay as you go pricing, with low transaction fees and no monthly contract, plus the ability to automate collection.

Get started in minutes. No upfront commitment.

How GoCardless works

Connect to your software and save hours of financial admin

You can use GoCardless through our dashboard, custom integration or a partner.

If you’re already using billing, accounting and CRM software, connecting GoCardless to your account via our seamless integration is easy to set up.

On average GoCardless merchants spend 59% less time managing payments.

Take advantage of Direct Debit payment today.

Pay as you go pricing, with low transaction fees and no monthly contract, plus the ability to automate collection.

Get started in minutes. No upfront commitment.

No sign up costs. No contract.

No contracts required

GoCardless offers a pay-as-you-go pricing model with no contract or long-term commitment required. Merchants can sign up to the GoCardless platform and set up payments for free - you only pay for payments you collect.

Lower Fees than Cards

Credit card transaction fees can be over 3x more expensive than GoCardless! Exactly how much you'll pay will depend on the card network & your specific fee structure, but on average fees range between 1.5% - 3%.

Cost-effective & Transparent

Not only is GoCardless cheaper, but we also provide pricing transparency. Accepting a £500 card payment will cost a merchant between £7.50 and £15. However, with GoCardless that transaction costs just £4.

Click here for full pricing information

An easier & cheaper way to collect recurring payments

Small businesses can now enjoy the same payments functionality and benefits as larger brands with Direct Debit.

...with GoCardless payments are automatically collected without the hassle of chasing clients for late payments." - Simon Kallu, Managing Partner, GrowFactor

"It takes all the stress away of people not paying..." - Simon Denney, Owner, Pure & Clean

"...it's fantastic as an alternative to collecting payments on cards because you aren't paying the fees associated with cards." - Pete N, G2 Reviewer

Customer case studies

![]()

Seamless integrations

"Xero has chosen GoCardless as its best-in-class solution for Direct Debit and it shows."

Ready to get started?

Pay as you go pricing, with low transaction fees and no monthly contract, plus the ability to automate collection and reconciliation to reduce financial admin. Super simple to set up. Get started in minutes!

*90 Day Fee Free Offer Terms & Conditions

Promotion:

Get 90 days of fee free transactions when you sign up via the GoCardless website for a new GoCardless self-service account.

To welcome you to GoCardless, we are giving you 90 days without transaction fees (the “Promotion”)! You will not be charged any GoCardless transaction fees for transactions successfully collected by GoCardless during the Promotion Period*. *Up to a total transaction volume limit for the region you are located in:

United States: $10,000 USD

United Kingdom: £5,000 GBP

Eurozone: €5,000 EUR

Australia and New Zealand: $10,000 AUD/NZD

Canada: $10,000 CAD

Denmark: 50,000 DKK

Sweden: 70,000 SEK

How to Qualify

To qualify for the Promotion, you must be an Eligible Merchant and click on the “Claim Now” button in your GoCardless account.

Eligible Merchants

Eligible Merchants, as further described in the detailed terms and conditions below, are new, self-serve customers who sign up for a GoCardless account via the GoCardless website or via a partner integration, not including: Xero, Sage, Quickbooks, Salesforce, TeamUp, Recurly, Chargify, Asperato, and Astral.

Start and end dates

3.1. The promotion period commences when an Eligible Merchant claims the offer by clicking on the “Claim Now” button in their GoCardless account (“Start Date”) and automatically ends at 23.59 GMT on the 90th day after the Start Date (“Promotion Period”).

3.2 GoCardless’ normal transaction fees will automatically apply after the Promotion Period. This means that if a transaction is created by an Eligible Merchant during the Promotion Period, but not successfully collected by GoCardless until after the Promotion Period, transaction fees will apply. Visit our pricing page for more information.