How do online payments via credit or debit card work?

Last editedApr 20235 min read

Online credit and debit card transactions can be very complex, involving many different entities and several steps.

Credit and debit card payment processing is a multi-step process involving several intermediaries. Making a card purchase in-store or online results in electronic communication between the customer’s card issuer and bank, with the merchant’s payment processor and merchant account.

Over a period of 24 or more hours, the funds are debited from the purchaser's bank or credit card account and credited to the merchant’s account. Clearing can take longer than 24 hours, depending on the merchant’s agreement with their payment processing provider and bank.

How do online payments via credit or debit card work?

The process for businesses to accept credit or debit card payments online from customers involves several entities and many steps. Before we explore these in further detail, let’s briefly define some key terms:

Merchant account - A specific type of bank account required for a business to accept credit or debit card payments from customers. (Learn more about merchant accounts later in this guide.)

Issuer (A.K.A. issuing bank) - A financial institution that provides credit or debit cards to its customers. In the context of this guide, think of it as the customer’s bank.

Card association (A.K.A. card network) - A collection of member financial institutions that process card payments based on an agreed set of rules. Major examples are Visa and Mastercard.

Acquirer (A.K.A. acquiring bank or merchant bank) - A financial institution that processes a transaction based on information from the issuer and card association. They provide businesses with merchant accounts and are licensed members of card associations.

Payment processor - A term often attributed with varying definitions. In the context of this guide, a payment processor is the facility of an acquirer which transfers transaction details to the relevant card association. (Learn more about payment processors later in this guide.)

Payment gateway - Software that facilitates the transfer of a customer’s card details from a merchant’s website to a payment processor. (Learn more about payment gateways.)

From the customer completing the merchant’s checkout process through to the merchant receiving the funds in their bank account, the overall process for online credit and debit card transactions takes place in two broad stages - authorisation and clearing and settlement.

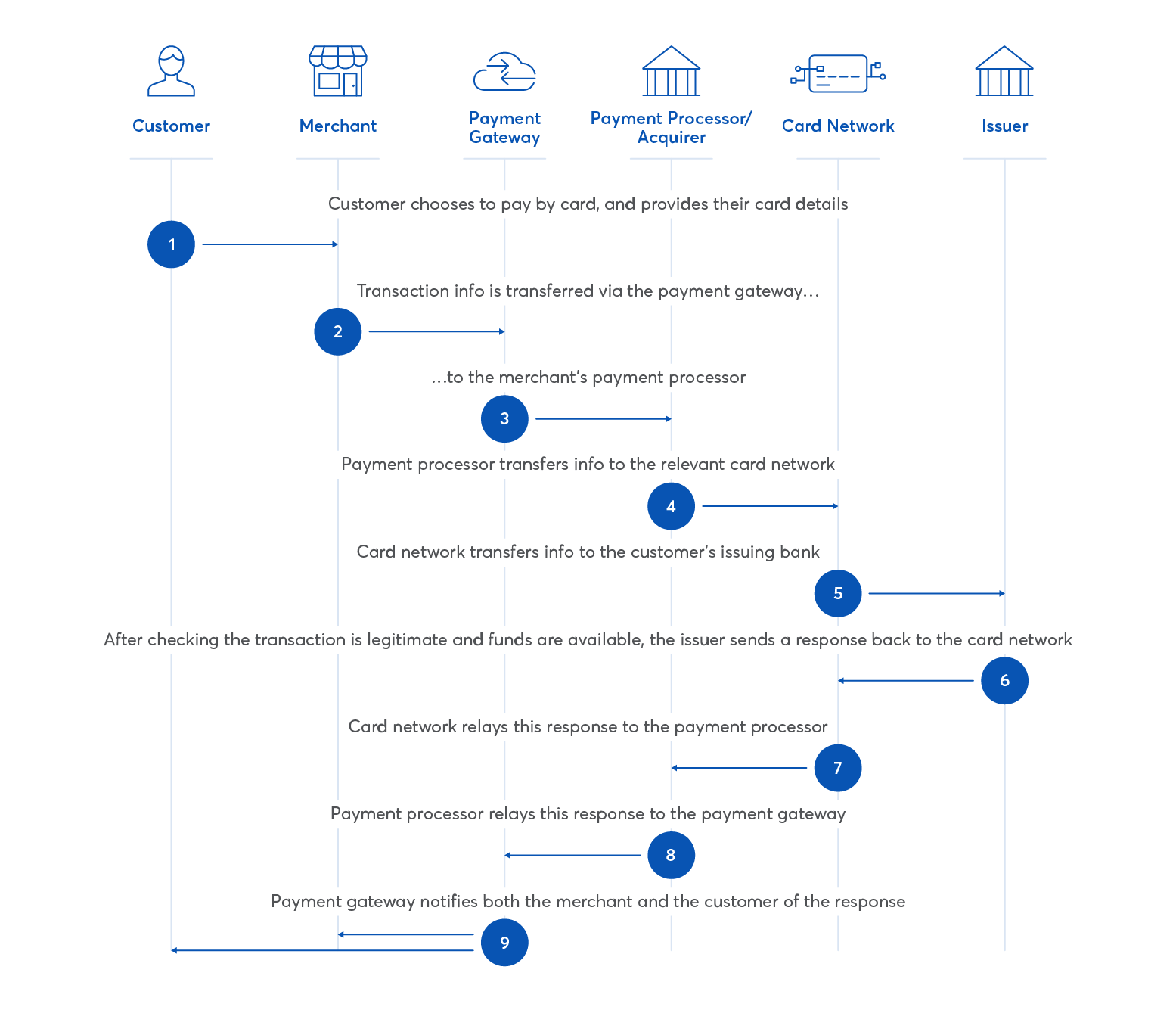

Authorisation step-by-step

The customer completes the merchant’s checkout process and elects to pay via credit or debit card, submitting their card details.

The merchant securely transfers the transaction information (including these card details) to their payment gateway.

The payment gateway securely transfers the transaction information to the payment processor used by the merchant’s acquiring bank.

The payment processor securely transfers the transaction information to the card association.

The card association securely transfers the transaction information to the customer’s issuing bank, which checks there are sufficient funds to complete the transaction, and also runs checks to ensure the transaction is not fraudulent.

The customer’s issuing bank submits a response to the card association, indicating whether the transaction is approved or declined.

The card association relays this response to the merchant’s payment processor.

The payment processor relays this response to the payment gateway.

The payment gateway informs both the customer and the merchant of the response.

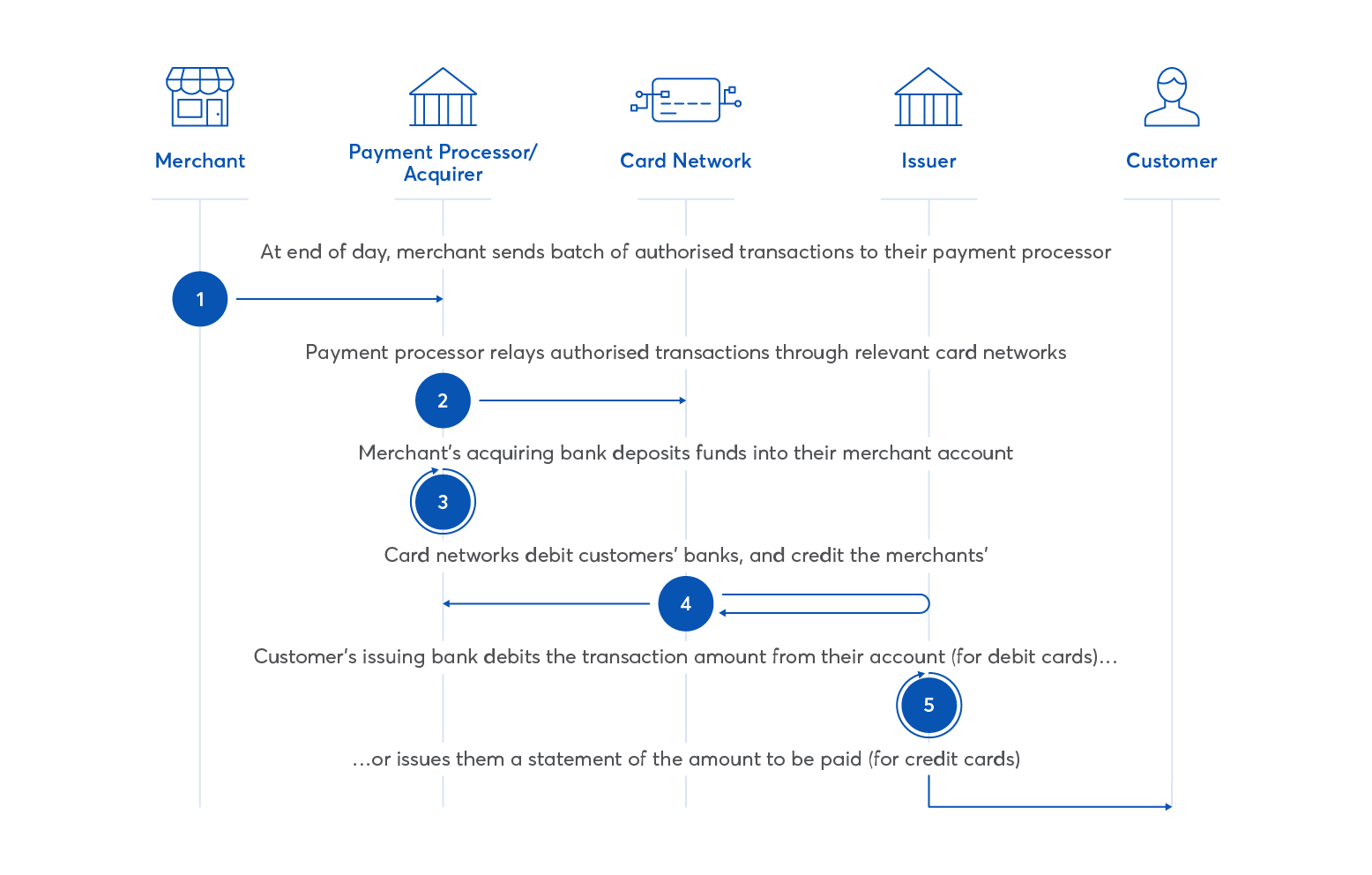

Clearing and settlement step-by-step

At the end of the day, the merchant sends a batch of all authorised transactions from that day to their payment processor.

The payment processor relays these authorised transactions through the relevant card associations.

The merchant’s acquiring bank deposits funds totalling the transaction amount into their merchant account (deducting any relevant fees).

The card associations (from step 2) debit the customers’ issuing banks for the relevant transaction amounts, then credit the merchants’ acquiring banks (deducting any relevant fees).

The customer’s issuing bank debits the relevant transaction amount from their account (for debit cards) or issues them a statement requesting the amount be paid (for credit cards).

Interested in collecting payments by Direct Debit?

Find out if online Direct Debit is right for your business

How to collect payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily set up & schedule one-off or recurring payments via payment pages on your website checkout or secure payment links.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled date. Simple.

GoCardless and credit and debit card payments

With a name like GoCardless, it is probably evident that we do not offer merchants the facility to accept credit or debit card payments.

GoCardless is a global leader in bank payments - direct account-to-account transfers. However, we continue to write about card payments because they are an important part of the modern payment landscape and are suitable options for certain businesses.

However, bank payment schemes allow merchants to collect payments easily, reliably and securely and have an advantage over cards in several ways.

Transaction cost

Due to the number of parties involved in processing card payments, with each adding a fee for their part in the transaction, accepting card payments can be relatively expensive.

Bank payments, by contrast, involve, at most, two financial institutions that settle the transfer between them, making for a more cost-effective process.

Success rate

Bank payment enjoys a much higher success rate than accepting payments by card. With GoCardless, merchants collect recurring payments successfully on the first try 97.1% of the time. With card payments, merchants can expect a success rate of just 85% - 90%, meaning that card payments are four or five times more likely to fail.

This is explained by the fact that cards are physical objects that often become lost. Even when not lost, they expire after about three years and so will be cancelled and a new card issued. This results in the failure of any payment that is paid via a cancelled card.

Card payment failure results in involuntary loss of customers as many do not renew once their payment has failed, and an increased level of manual payment admin.

Manual admin

Card payments create a lot of manual admin that requires valuable business resources to complete.

By contrast, bank payments can be fully automated, and GoCardless offers over 200 accounting software integrations with partners such as Xero and QuickBooks, meaning you can automate reconciliation as well as collection, saving you and your finance team significant amounts of time.

Case study: saving time with bank payment

Perky Blenders, an east London coffee-roasting business, has been able to save £20,000 on admin costs and two days of operational work per week for the founders by automating payment collection with GoCardless.

Co-founder Adam Cozens explains

“It’s easier for customers to pay, so we get cash into the bank faster. We estimate we’ve saved about £20,000 on admin costs so GoCardless is a real asset to our business.”

Co-founder Victoria loves how GoCardless automation has eliminated late payments, which in turn removes a huge amount of manual payment admin.

“It just cuts down so much time, time on the phone, time chasing emails, time following up. I think I estimate that I save personally two days a week of work just by using GoCardless.”

Adam sees the seamless integration with Xero as a key pillar of the benefit of GoCardless.

“The integration provides the flexibility to invoice each customer within days and the confidence that GoCardless will automatically take the payment on the due date, whether that’s payment on invoice, 60 days, whatever.”

Automating payment collection with Direct Debit via GoCardless is more affordable, more secure and more reliable than accepting credit and debit card payments.

FAQs: Credit and Debit Card Payments

How do credit cards work?

A credit card enables you to make purchases up to a pre-set and agreed limit and repay that money over a period of time via minimum payment amounts. Multiple purchases can be made over time with the costs added to your credit balance. Monthly minimum payments are calculated based on the level of credit taken. Payments include added interest at variable rates depending on your card issuer and the type of card you have.

How to use a debit card for online payment?

As a merchant you can accept debit card payments online using a payment processor and merchant account.

As a consumer, simply follow the instructions in the email or on the web page where you want to make a purchase. You will need to enter some details into a web page, or open a banking app on your phone to complete online purchases with a debit card.

How is a credit card payment processed?

Credit card payments are processed via a number of different entities before funds are eventually debited from the payer and credited to the payee.

When a credit card is submitted as a form of payment, the details are sent electronically to the payment processor and from here the various intermediaries push the payment through a variety of steps from the customer’s bank account associated with the debit card to the merchant’s account.

What is the credit card transaction process?

Credit cards differ from debit cards somewhat as credit cards are associated with a card issuer rather than a customer’s bank account.

This means that the processing journey requires a few extra steps as funds will be debited from the customer's credit card account and sent to the merchant rather than from the customer’s bank account.

Whilst the technical process to complete the process is more complex, the front-end experience for both the merchant and the customer is identical to payment by debit card.