How do online payments via Direct Debit work?

Last editedApr 20231 min read

The process for accepting payments via Direct Debit can vary significantly, depending on two key factors.

How do online payments via Direct Debit work?

The process for accepting payments via Direct Debit can vary significantly. It is largely influenced by:

Whether a business accesses the Direct Debit scheme directly, or goes through an intermediary

The country that the business’ and customer’s banks are located in

(As we’ve written extensively about the topic of Direct Debit in the past, this section will give a simple overview of the Direct Debit process. To learn more about Direct Debit in-depth, take a look at our reference guides.)

In simple terms, Direct Debit is a payment method which allows businesses to collect funds owed by their customers, without the customer (the payer) needing to initiate the payment. This kind of mechanism is referred to as a pull-based payment method (see more on push and pull methods later in this guide).

How to collect Direct Debit payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily set up & schedule Direct Debit payments via payment pages on your website checkout or secure payment links.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

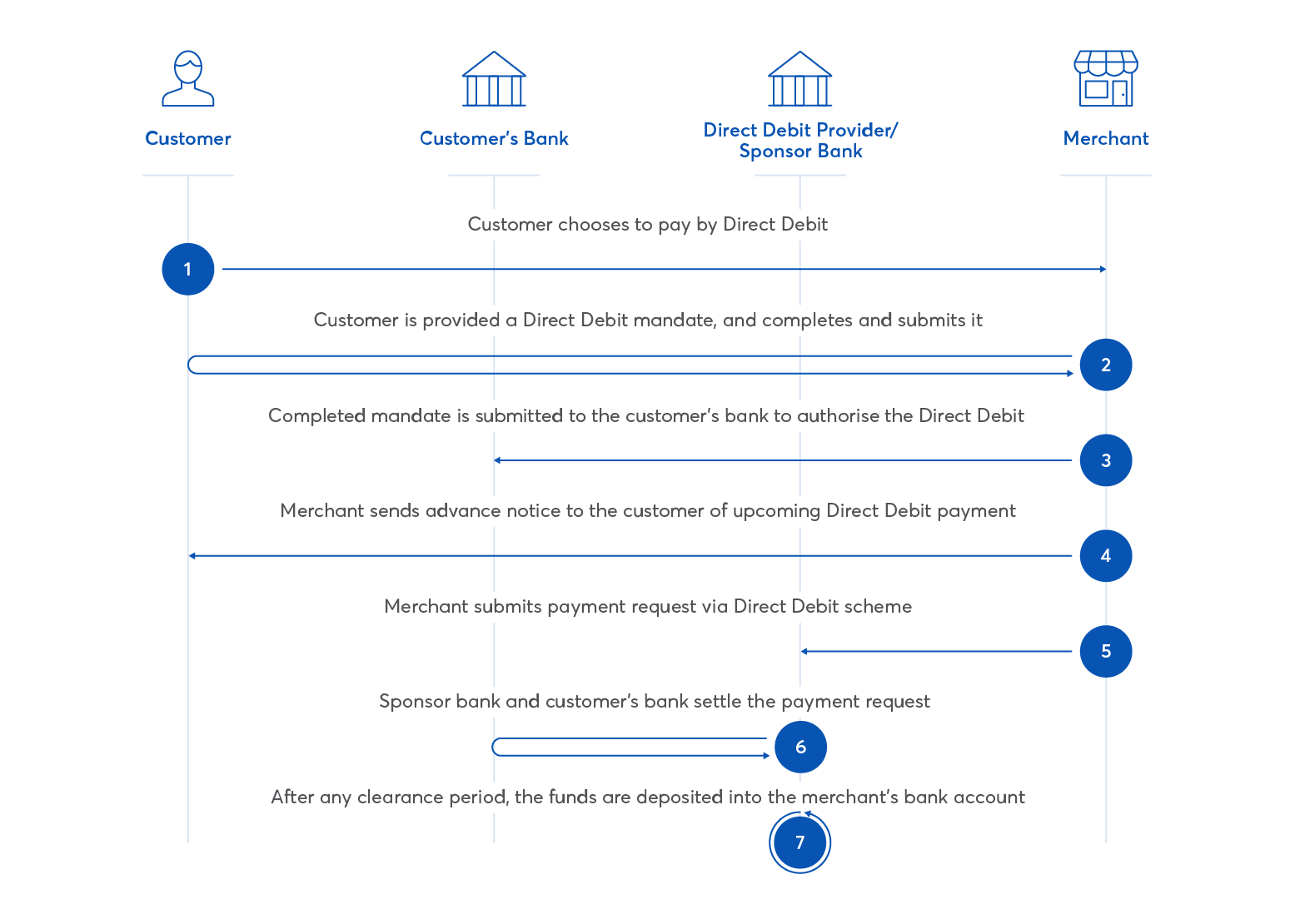

Once a business sets itself up to accept Direct Debit payments from customers (whether directly or through an intermediary), the process to begin collecting those payments looks like the following:

The customer completes the merchant’s checkout process and elects to pay via Direct Debit.

The customer is provided and completes a Direct Debit Mandate form (may be online, paper-based, or via telephone).

The business (or the business’ Direct Debit provider) submits the completed mandate to the bank, authorising them to automatically collect payment when it’s due.

The business notifies the customer of the upcoming payment that will be collected from them, in a specified time in advance (dependent on the Direct Debit scheme, which changes according to country).

The business submits a payment request via the Direct Debit scheme they are a part of (this is dependent on the country they and their customer’s bank are located within).

The business’ (or Direct Debit provider’s) sponsor bank (the bank that enables them to access the Direct Debit scheme) and customer’s bank action the payment request when the payment becomes due, ensuring the correct amount is debited from the customer and credited to the business.

There is typically a clearance period (again, dependent on the Direct Debit scheme) between the payment due date and the date the funds are deposited into the business’ account.

For more detailed, region-specific information about Direct Debit, check out the following resources:

Interested in collecting payments by Direct Debit?

Find out if online Direct Debit is right for your business