Last editedJan 20255 min read

What is a bank transfer?

A bank transfer is simply the direct transfer of funds from one bank account into another. This transfer of funds can be between two different UK banks or between two accounts held with the same UK bank. International bank transfers can also be completed between two banks from different countries or territories.

How does payment via bank transfer work?

In general, the process is quite simple. However, it’s worth noting that the process may differ from country to country, and particularly so when the two bank accounts involved in a transfer are located in different countries.

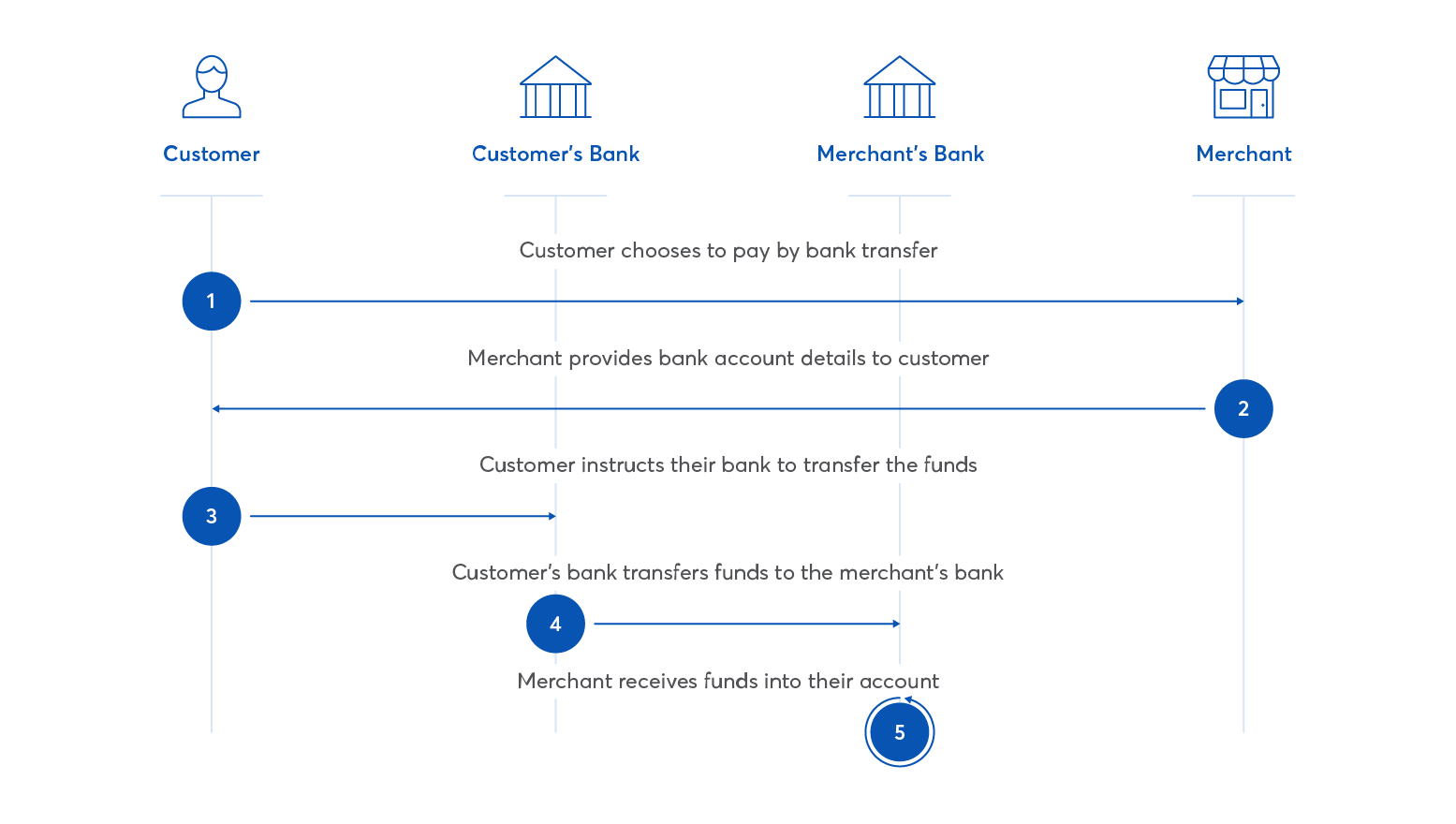

The customer completes the merchant’s checkout process and elects to pay via bank transfer.

The business provides its bank account details to the customer, typically along with a unique transaction reference code.

The customer instructs their bank to transfer the relevant amount to the business’ bank account, including the unique reference code to indicate the purpose of the transfer.

The customer’s bank transfers the funds to the business’ bank.

The business receives the funds into their account, noting the reference code.

In situations where the customer’s bank is different from the merchant’s bank, financial institutions called ‘clearing houses’ are involved to facilitate the transfer of funds between the banks. If you’re interested in learning more about this process, find our overview of clearing houses here.

Continue reading: How long does a bank transfer take?

Are bank transfers safe?

A bank transfer itself is safe. Bank transfers are almost always manually initiated, and as direct transfers between two banks, there are no intermediaries involved other than the clearing house, making them less susceptible to fraud.

Manual bank transfers, however, suffer from two key vulnerabilities.

Bank transfers are vulnerable to human error

Errors made when entering the payee's details are often difficult to reverse. Banks generally check any details entered to ensure that they are in the correct format. If the formatting is correct, but the money goes to the wrong recipient, it can be difficult to retrieve it. In some cases, it may be impossible to recover it.

Bank transfers lack consumer protection

The reason traditional bank transfer methods are targeted by fraudsters is that they lack consumer protection. Banks cannot just reverse a bank transfer in the same way as they can reverse other types of transactions, such as Direct Debits.

The Direct Debit Guarantee provides consumers with strong protections to safeguard against unauthorised debits. Direct Debit has these in-built consumer protections because it is a regulated payment collection scheme. Bank transfers, by contrast, are manual actions often completed on mobile banking apps and therefore have no protections.

How to collect payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily create payment links to collect one-off or recurring online payments, and share them with your customers.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

Secure bank transfers with Instant Bank Pay

GoCardless offers a secure Instant Bank Pay service using Open Banking protocols to solve both of the common issues associated with bank transfers.

With Instant Bank Pay, the recipient can send the payer a paylink. This is essentially a pre-filled bank-transfer order. It identifies who will receive the payment, as well as how much the payer will be charged. This takes away the chance of human error as the transfer details are automatically completed before being sent to the payer.

All the payer has to do is confirm that they are happy to go ahead with the payment. This is a very simple process. It’s literally a matter of a few clicks and can be easily done on a mobile device.

Take online payments quickly and securely, with GoCardless

Different types of bank transfers

There are three main types of bank transfers in the UK. These are Faster Payments, CHAPS and BACS. BACS is also used to process Direct Debits. International bank transfers are normally done through SWIFT. All of these methods can be actioned via online bank transfer.

Faster payments and CHAPS payments tend to be used for time-sensitive payments. For example, the GoCardless Instant Bank Pay service uses Faster Payments in the UK. (In the Eurozone, it uses the SEPA credit transfer scheme).

The key differences between Faster Payments and CHAPS are as follows.

Faster Payments tends to be used for smaller payments. CHAPS is preferred for larger transfers. It is highly unusual to use CHAPS for payments of less than £10K.

Faster Payments typically arrive in, at most, a couple of hours. CHAPS payments typically arrive on the same working day, but it can be the next working day depending on a host of factors.

Faster Payments are always available. CHAPS is only available on UK working days. It has a daily cut-off time of 5:30 PM.

Faster Payments support references of up to 18 characters. CHAPS has no character limit.

Faster Payments can generally be used without charge. CHAPS is more likely to be chargeable.

BACS tends to be used for payments which are not time-sensitive. For example, it is often used for standing orders. These are regular payments. That means the process can be started far enough in advance for the recipient to receive the money on the agreed date.

SWIFT is only used for international payments. It is the global standard for international bank transfers. In fact, the name SWIFT is an acronym for the Society for Worldwide Interbank Financial Telecommunication. SWIFT payments tend to be very expensive.

What bank transfer details are needed?

For Faster Payments, CHAPS and BACS, the only bank transfer details you need are the recipient’s name plus their sort code and account number.

For a SWIFT payment, you need the same bank transfer details plus the recipient bank’s SWIFT code. This is sometimes called a BIC code. You can recognise a SWIFT code by its format.

This is as follows.

4-character bank code

2-character country code

2-character location code

3-character branch code (optional)

You may be required to give the recipient’s bank account details in IBAN format. IBANs are international bank account numbers. All IBANs start with a 2-character country code followed by two check digits. After that, the format of the IBAN will vary by country. IBANs only ever use the 26 letters of the standard English alphabet plus the numbers 0–9.

Accepting bank transfers as a business

Receiving payment by traditional bank transfer tends to be very time-consuming and inefficient for merchants.

Many bank transfers are invoice payments for which invoices need to be raised, sent, tracked, chased and reconciled. This makes it very expensive in terms of staffing time and costs.

Things become even more expensive (and frustrating) if customers do not action a request for payment by bank transfer promptly or accurately, resulting in late payments and all the associated costs and strains.

Completing manual bank transfers can also be frustrating for your customers. Finding the time to action a bank transfer is often an unwelcome interruption to their day.

Alternatives to manual bank transfers

GoCardless offers an alternative to manual bank transfers in the form of automated bank payments. With automated bank payments, such as Direct Debit, a customer provides authorisation to debit their account and after that, you can schedule payments for the amounts and on the due dates you require.

These can be recurring or one-off payments and GoCardless merchants can manage and automate payments via the user-friendly merchant dashboard, through a partner integration (e.g. Xero), or the GoCardless API.

Whatever option you choose, the level of manual payment admin is vastly reduced, as is the possibility for human error. This can significantly reduce your costs as well as your frustration, and enables you to provide a better experience for your customers.

If you’re collecting payments internationally, then you benefit from both transparent fees and the real exchange rate.

Interested in collecting payments by Direct Debit?

Find out if online Direct Debit is right for your business

Case study: automated bank transfers

ManyPets is an online insurance business specialising in niche insurance policies, with a focus on tech and social media. Founders Steve Mendel (CEO) and Guy Farley (CTO) needed a more scalable and less labour-intensive payment process to enable growth.

After adopting GoCardless as their payment platform the business was able to almost totally eliminate the time spent on chasing and reconciling payments, as Guy explains:

"Our legacy system ‘worked’, but could never be used as we grow the business. GoCardless means no extra admin time as we continue the push to grow as quickly as possible."

Customers are benefitting from the change as well, with more visibility in reporting, ManyPets operations team are better equipped to inform customers about their specific payment. Guy confirms:

"Customers are happier because they get better information when they query a payment. They’re used to Direct Debit and are happy as long as it works well and is transparent."

GoCardless makes it easy to collect Direct Debit payments on your Xero invoices. Automate Direct Debit payment collection. Reduce manual admin. Get paid on time, every time

We can help

GoCardless helps you automate payment collection, cutting down on the amount of admin your team needs to deal with when chasing invoices. Find out how GoCardless can help you with ad hoc payments or recurring payments.