Last editedMar 20251 min read

In general, the process is quite simple. However, it may differ from country to country.

What are Bank Transfers?

Bank transfers - also referred to as wire transfers - are simply the direct transfer of funds from one bank account into another. In the context of this guide, that means a transfer from your customer’s bank account into your business’ bank account.

Unlike other payment methods covered in this guide, bank transfers do not have any specific setup requirements on your business’ behalf, to begin accepting payments from your customers.

How to collect payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily create payment links to collect one-off or recurring online payments, and share them with your customers.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

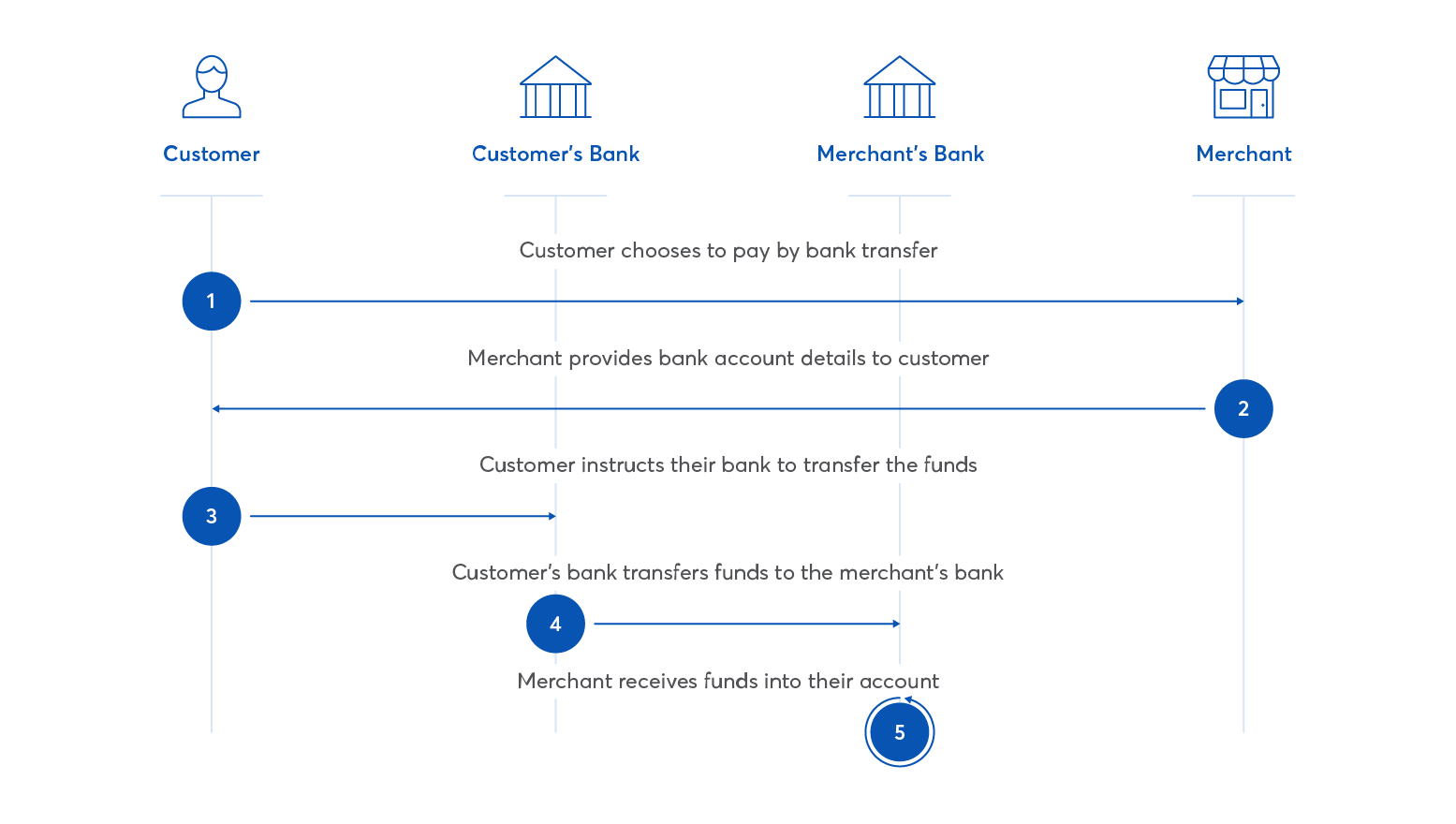

How do online payments via bank transfer work?

In general, the process is quite simple. However, it’s worth noting that the process may differ from country to country, and particularly so when the business’ bank and customer’s bank are located in different countries.

The customer completes the merchant’s checkout process and elects to pay via bank transfer.

The business provides its bank account details to the customer, typically along with a unique transaction reference code.

The customer instructs their bank to transfer the relevant amount to the business’ bank account, including the unique reference code to indicate the purpose of the transfer.

The customer’s bank transfers the funds to the business’ bank.

The business receives the funds into their account, noting the reference code.

(In situations where the customer’s bank is different from the merchant’s bank, financial institutions called ‘clearing houses’ are involved to facilitate the transfer of funds between the banks.)

Do you collect payments from customers internationally? Find out more about how GoCardless can help