Improvements to our CSV exports

Last editedJun 20242 min read

At GoCardless we make recurring payments invisible for tens of thousands of organisations. We know that small details can make all the difference and we’re committed to continuously improving our service. We’re also very aware that although the changes we make improve our service for countless customers, some users need time to adapt to them.

This is particularly true of the exports available from our dashboard. These help make it easy for GoCardless customers to reconcile their accounts and keep track of how much they have collected. Many of our merchants use exports regularly and build processes around them, so we often receive feedback on how to make them more valuable.

We’ve reviewed this feedback and we’re making a few tweaks. These are designed to:

Add extra information to make exports more useful for common tasks

Make sure the format for exports is as stable as possible

Add the ability to improve exports while minimising customer impact

What’s changing?

In most cases – nothing! We’ve made some improvements behind-the-scenes to make the format of these exports more stable and reduce the time to export larger files.

We’ve also added new information to provide more useful reporting to our users:

We’ve added the customer data to payment and mandate exports from the events page, so it’s easy to reconcile which payments have failed

We’ve added details such as the payment reference and customer metadata to our payout summary export, so you can get all the information you need in one place

We’ve also fixed the date format in the exports so that it’s now fully readable by popular spreadsheet software packages, meaning you can filter and sort our exports by date

The column order in some exports is changing slightly to accommodate the new information and to provide a fixed order by moving optional elements like metadata to the end.

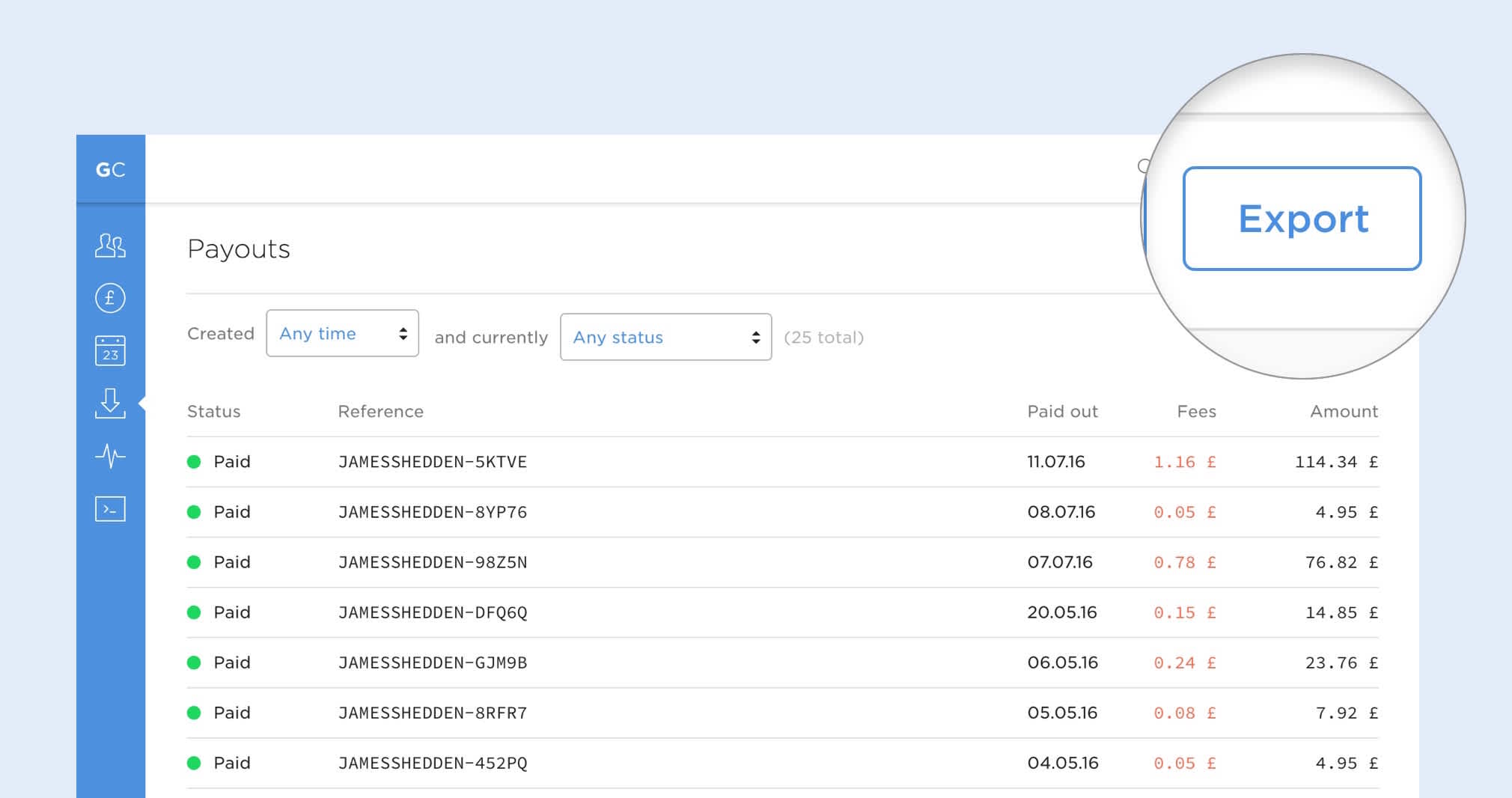

One of our most popular types of export is the payouts export. This comes in three types, so we’ve added a menu system to make navigation easier. From the payouts page you can export a list of payouts:

Exporting a list of payouts

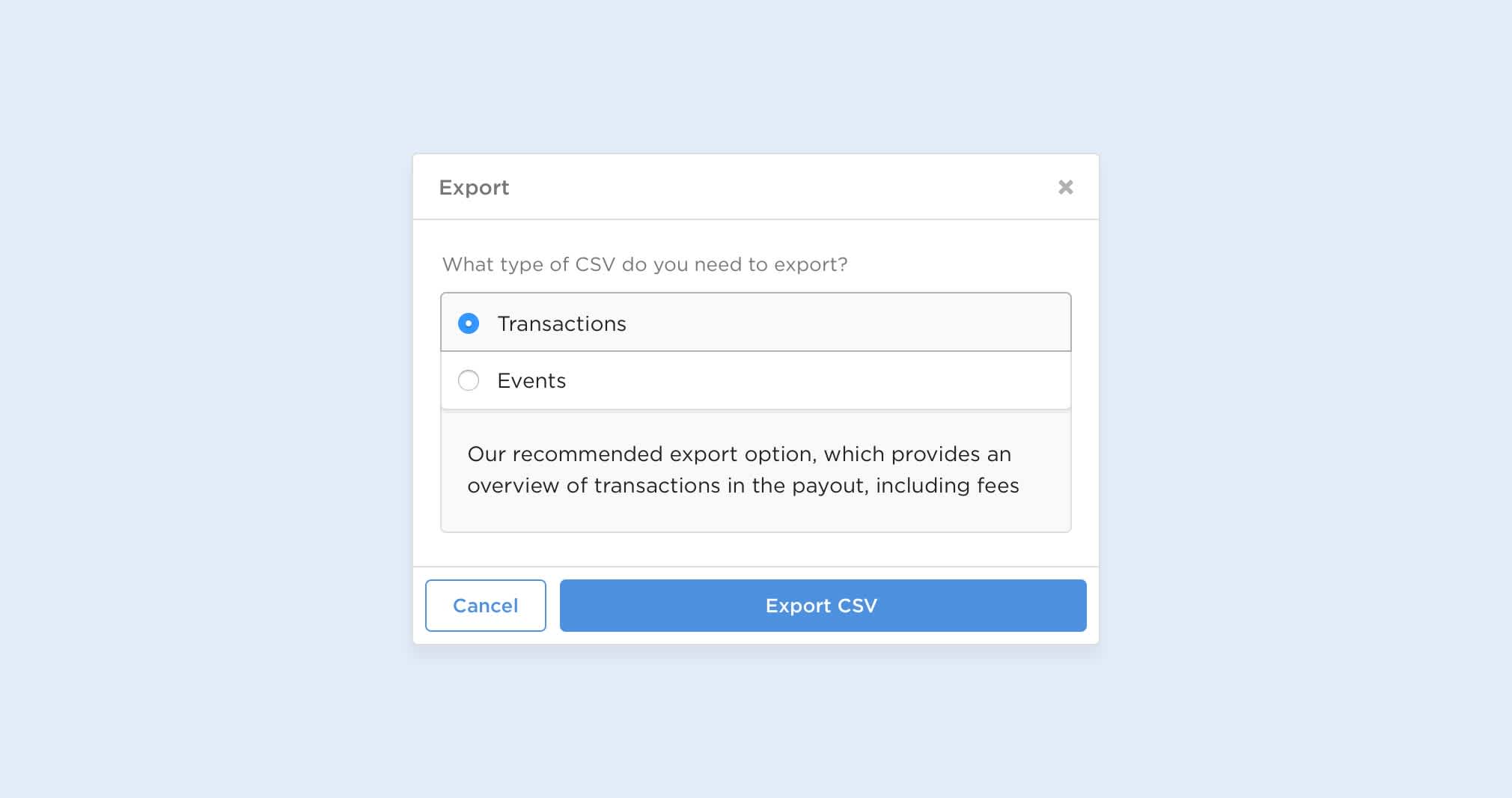

After clicking on an individual payout, you can then export our recommended summary with fees, or click to access a list of the related events:

Exporting payout details

As part of this change we’re also increasing the security of our exports by making all exports downloadable to your computer via your browser using a secure connection.

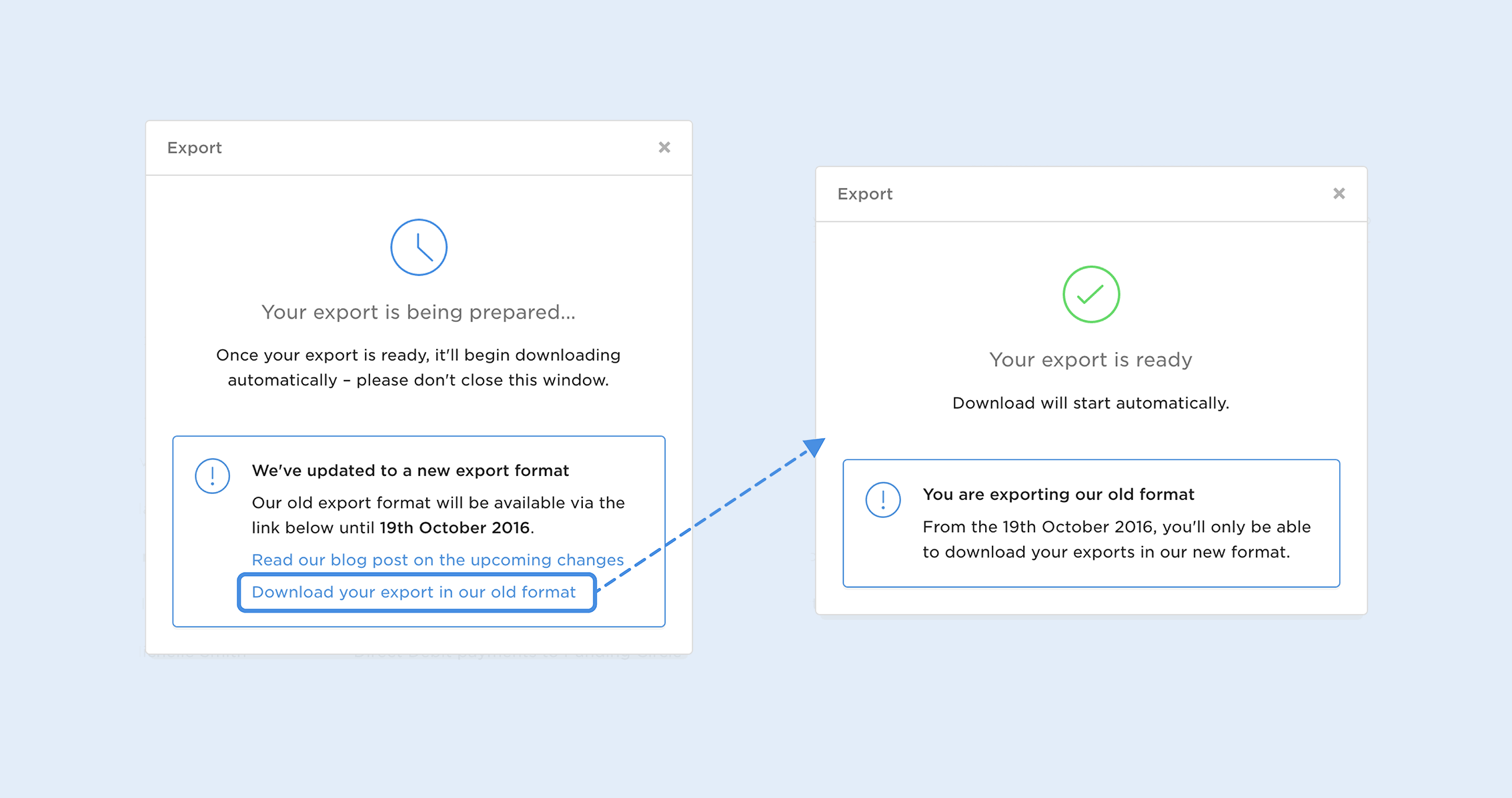

When is it changing?

We’re launching the new exports in early September. We know that many of our customers have built workflows using our exports, and some might be affected by the changes. To reduce the impact of this we’re making the previous version available for a transition period. When you click to export a report you’ll automatically download the new version, but the old versions will still be available at the click of a button until 19th October.

We hope these changes to our exports improve and enhance your GoCardless experience. If you have any questions please don’t hesitate to contact us at help@gocardless.com.