We surveyed over 500 Australian small business owners and decision-makers to understand how they really feel about chasing late payments. From awkward conversations to generation gaps, SMBs are struggling – but solutions are in sight.

42% of Aussie SMB leaders feel uncomfortable chasing customers for late payments

Those who had avoided a chat about money with their customers in the last 12 months were impacted in many different ways.

Breakdown of the impacts

43%

experienced increased stress on them personally

37%

experienced increased stress at work

36%

said their business was paid late

31%

said it resulted in financial losses for their business

29%

said they suffered from lack of clarity (e.g unable to predict cash flow)

Avoiding awkward money conversations costs more than you think

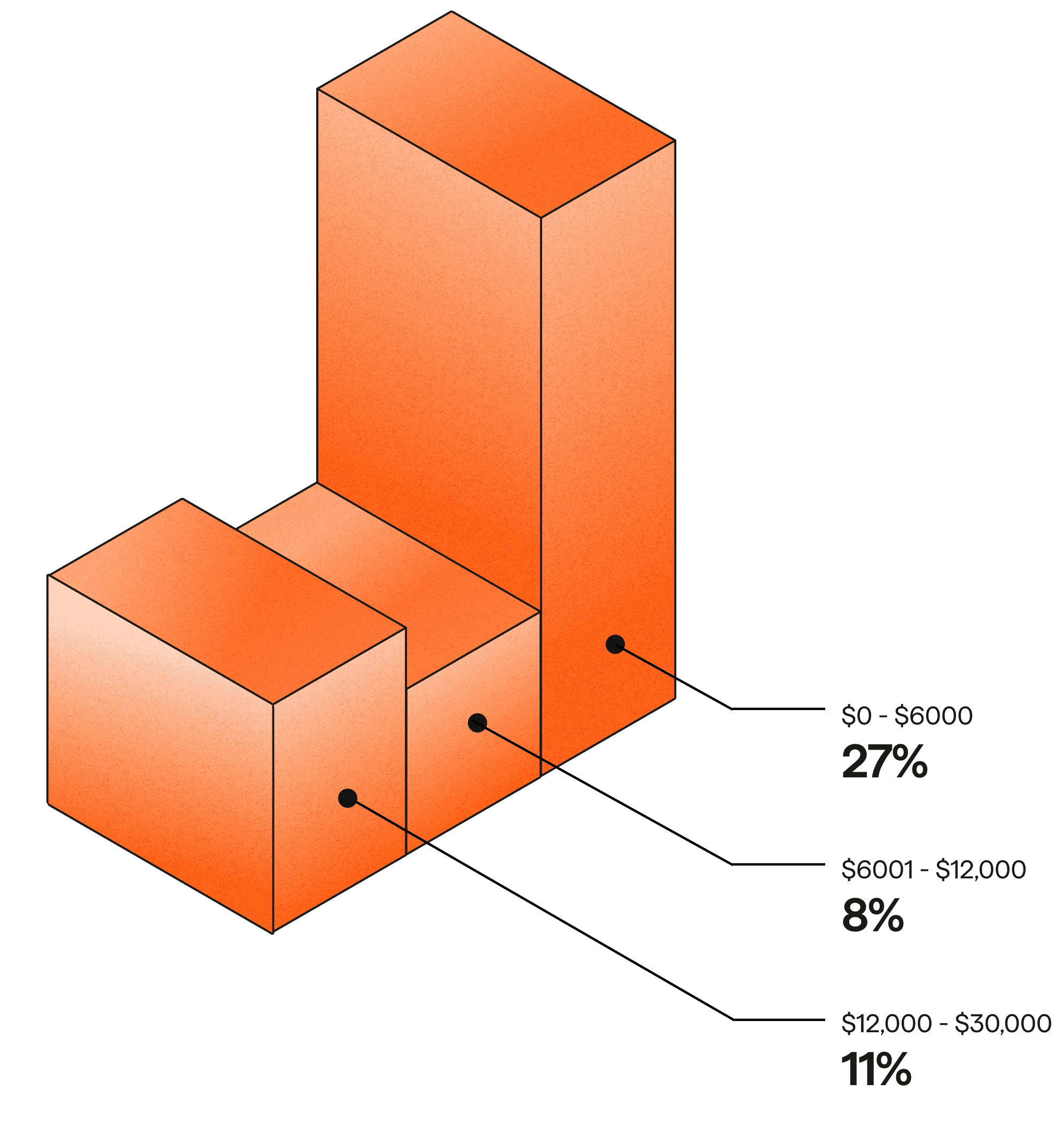

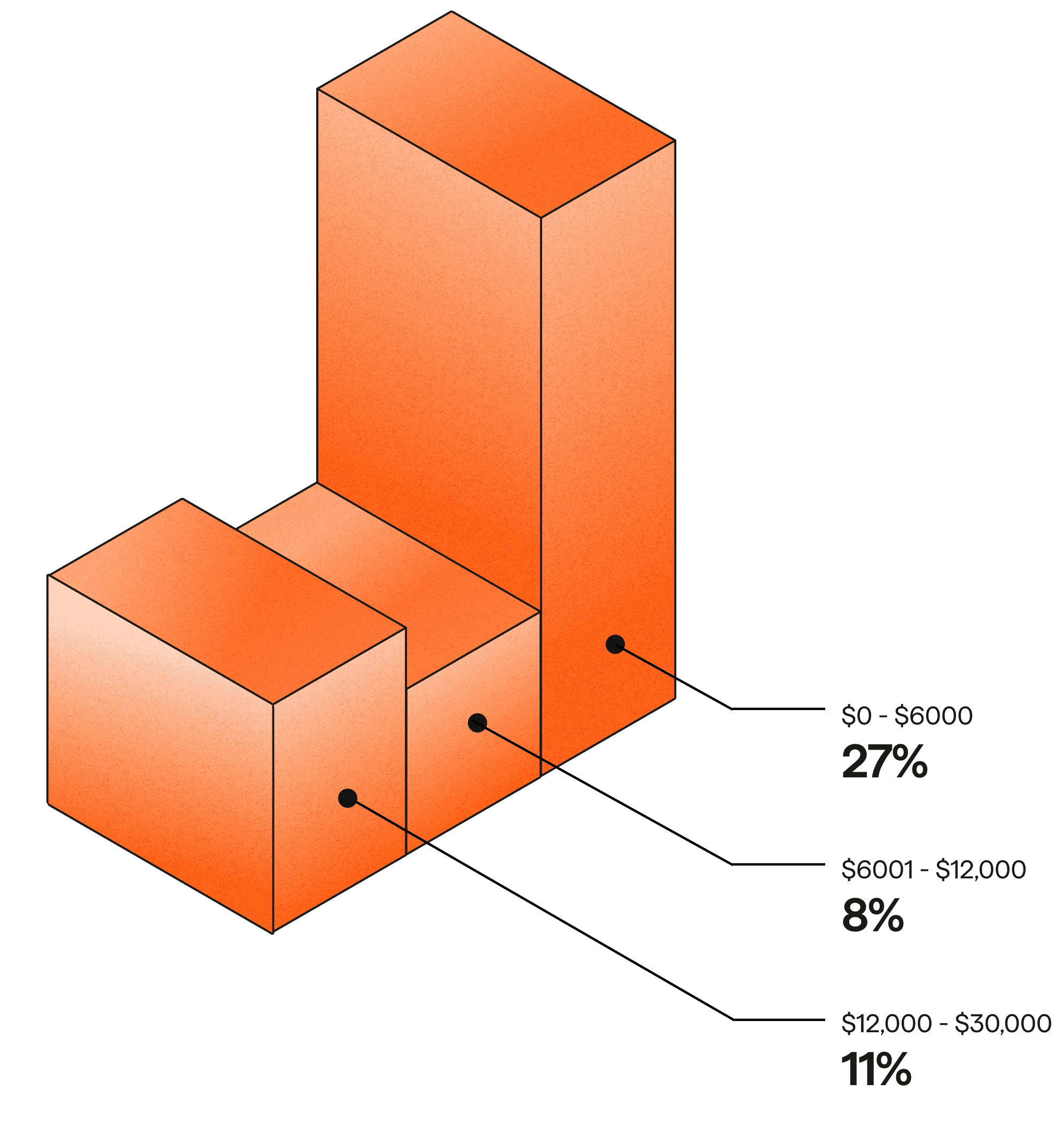

27% of SMBs estimate they lose up to $6,000 from late payments annually. One in 10 say they lose between $12,000-$30,000.

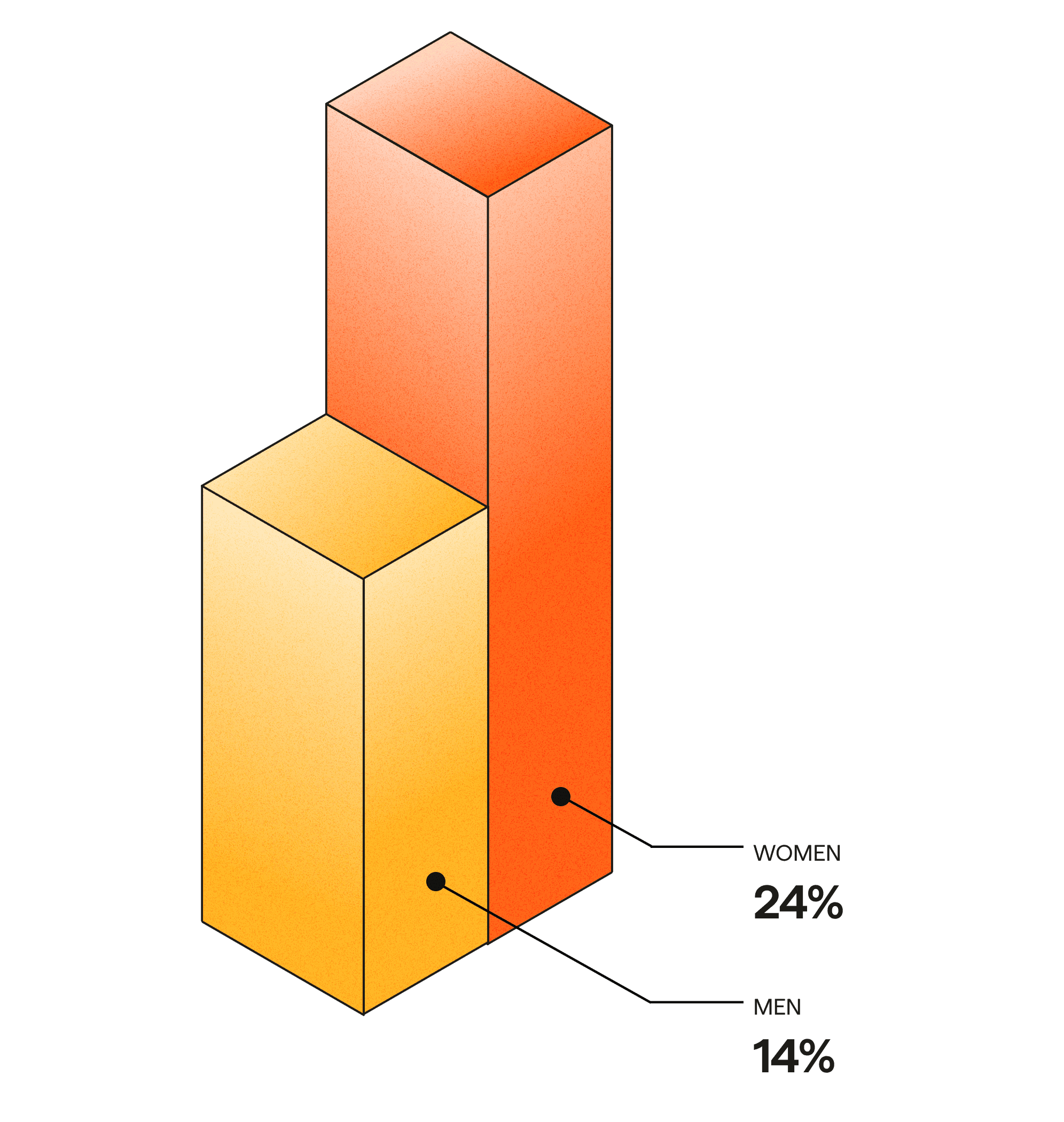

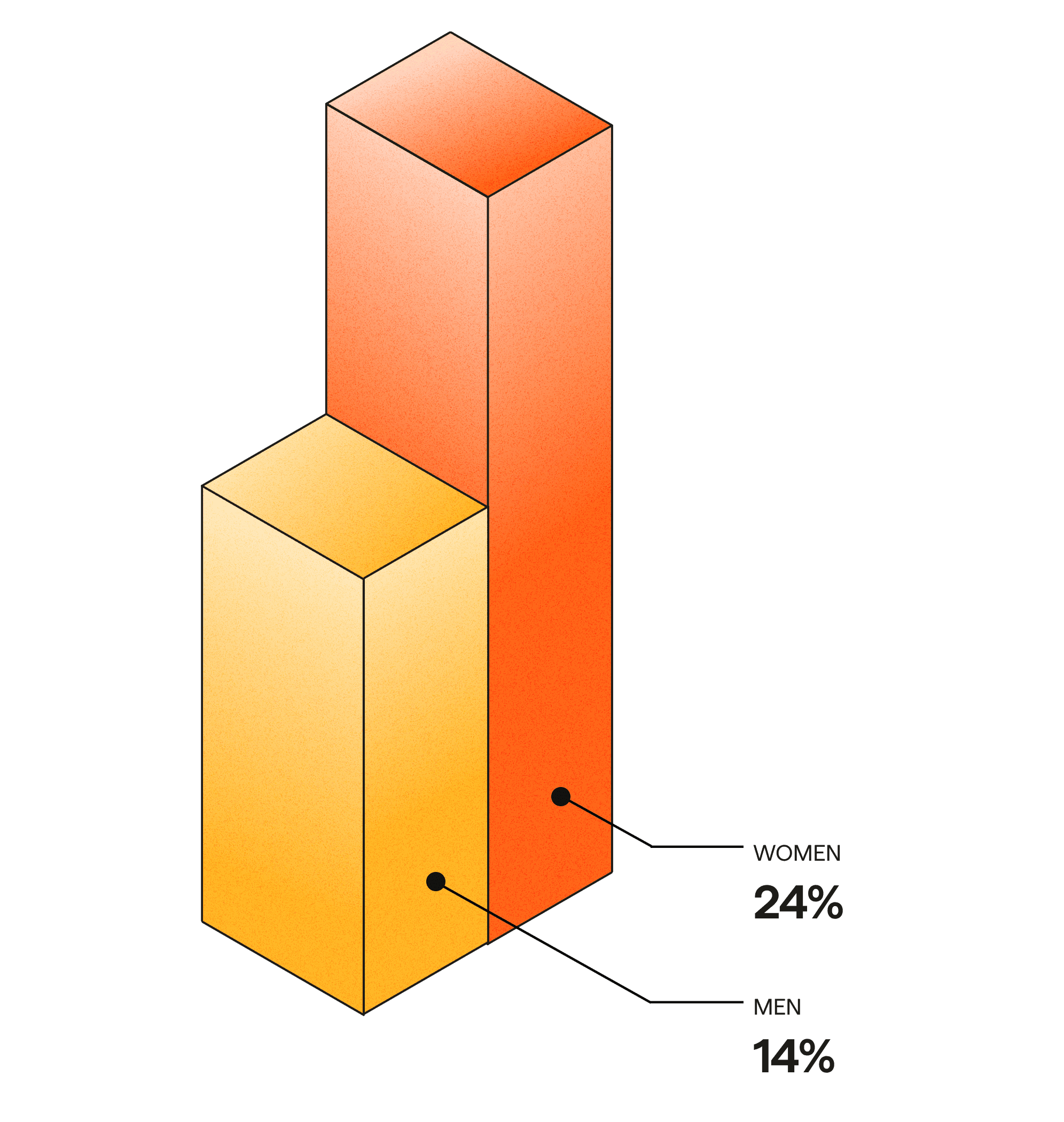

Women feel less confident when it comes to chasing late payments

12% say they wouldn’t know how to broach the topic, compared to 5% of men. And 24% of women find the conversation too uncomfortable vs. 14% of men.

The outlook: will it get worse before it gets better?

The future prognosis: gloomy

55% of Aussie business leaders are concerned that the number of late-paying customers will increase over the next 12 months due to the rising cost of living.

Tough times will force SMBs to break the silence

58% are more likely to speak to customers about late payments now, compared to last year. Of those, 55% say it's because they need to get paid to cover their own rising costs.

But late payments are not an inevitable part of doing business

Every successful, on-time payment comes down to two dimensions: willingness to pay and ability to pay. Once you understand where your payers fall, you can take action.

A Framework: Willingness to Pay vs. Ability to Pay

Quadrant 1

Take the onus of paying off your customer. Try a method like Direct Debit which automatically pulls the payment on the day it's due.

Quadrant 2

Your dream customers. Keep doing what you're doing.

Quadrant 3

Embrace new technology like PayTo, with bank-grade security that makes it much harder for fraudsters to succeed.

Quadrant 4

Automate your payments with pull-based methods such as Direct Debit, so money is collected on the day it's due.

The bottom line

By analysing the source of your late payments, you can take action to stop them. This will reduce the amount of awkward conversations and cash flow woes that you experience.