Last editedMay 20222 min read

B2B sales differ from B2C sales in a few ways. Crucially, B2B transactions tend to have a much higher monetary value. They also tend to be much greater in volume. So, it’s of paramount importance that B2B companies be paid in full and on-time. This starts with the right B2B invoice structure.

When your invoice is clear, unambiguous, and contains the necessary information to ensure prompt payment, it greatly reduces the risk of payments failing or arriving late. This can help SMEs like yours to protect their margins and prevent cash flow problems. If you’ve been constructing your invoices on an as-and-when basis, formalising the process can help to reduce wasted time and ensure prompt payment.

When should I send my B2B invoice?

The turnaround for B2B invoices is usually 30 days. However, it’s not uncommon for B2B companies to set payment terms at 14 or even seven days. Whatever terms are agreed with the client, the sooner an invoice is sent, the better.

Many businesses wait until the next two-week billing cycle before sending their invoices. However, according to Forbes, invoices that are sent on the same day that work is completed are 1.5 times more likely to be paid.

What should I include in my B2B invoice?

Late or failed payments can stymie cash flow and increase your administrative load. As such, you should ensure that whatever B2B invoice format you use, it should include:

your business name, address and contact details

the client’s name and address

an itemised list of products and services

flat fees or hourly rates per line item

invoice date

due date

subtotal

VAT (if applicable)

grand total

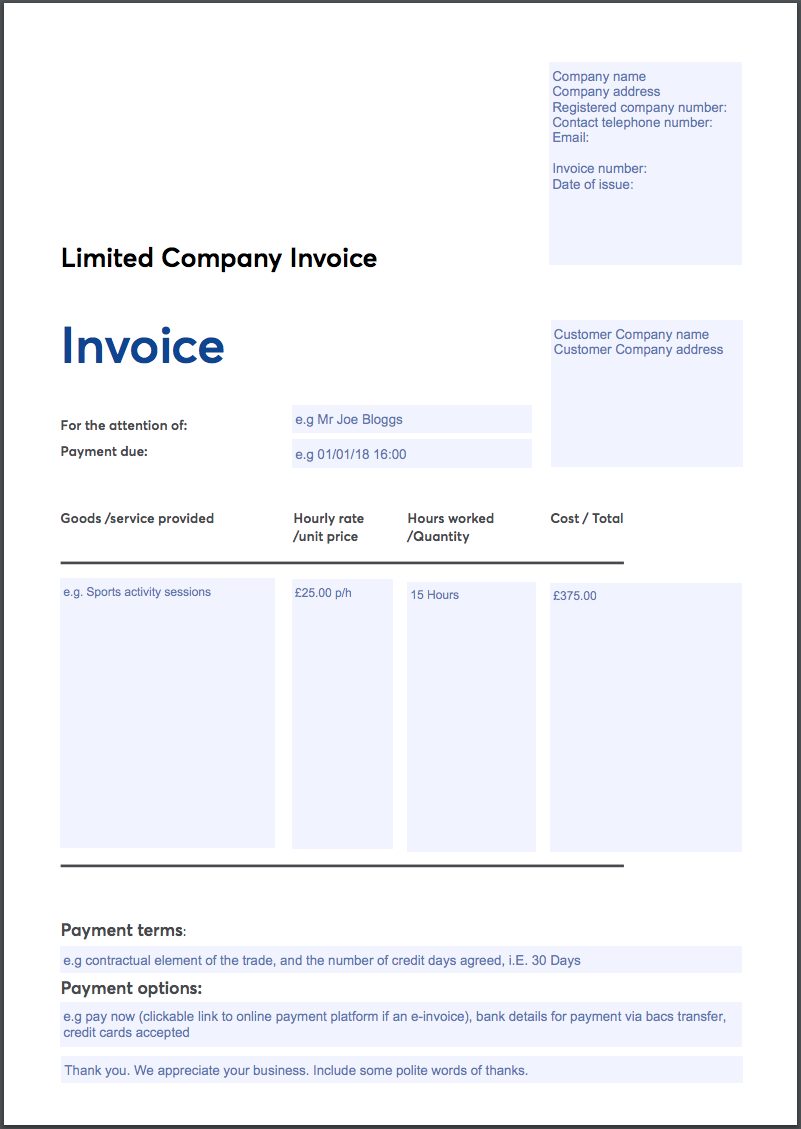

B2B invoice template

There is no single B2B invoice format that all businesses should use. As long as you include all the salient information to get paid on time, you can structure your invoice in any way you like.

However, using a template is especially important for those in the B2B space. Since you’re likely to request and receive far more payments than your B2C counterparts, it’s much quicker, easier and more productive to use a template.

If you’re unsure of where to start, please feel free to use download our B2B invoice template, which you can preview below.

How to avoid chasing payments

The last thing your operation needs is to waste time chasing up late or failed payments. It’s an awkward conversation that most business owners would rather avoid.

Your choice of payment partner can make all the difference when it comes to getting paid in a way that’s both time and cost-efficient.

GoCardless enables businesses to collect recurring and one-off payments directly from their customers' bank accounts. Payments are made by Direct Debit, ensuring a greater degree of control over when you get paid, without the heavy fees that come with accepting credit and debit card payments.

It also integrates seamlessly with more than 300 partners, including major invoicing applications like Xero and QuickBooks, helping you to improve payment visibility. Success+ also automatically recovers up to 70% of failed payments.

In fact, SMEs can get paid up to twice as fast by accepting GoCardless payments on their online invoices

We can help

If you’re interested in finding out more about e-invoicing B2B clients, how to structure your invoice template, and getting paid on time, then get in touch with our financial experts. Discover how GoCardless can help you with ad hoc payments or recurring payments.