What's new - Summer 2024

PRODUCT UPDATES

Don’t miss a beat with all the latest product news and releases from GoCardless.

From easy-to-use reporting tools to help you understand business performance, to faster, more secure and more reliable payments, discover what’s just launched.

What’s new in the dashboard?

New: Easy-to-use reporting tools

With reporting tools now available in your dashboard, it’s easier than ever to keep track of revenue – so you can focus your effort where it’s needed most.

See collected payments, total earnings and failed payment attempts

Identify growth and risk areas with data refreshed daily

Get cash flow insights right inside your dashboard

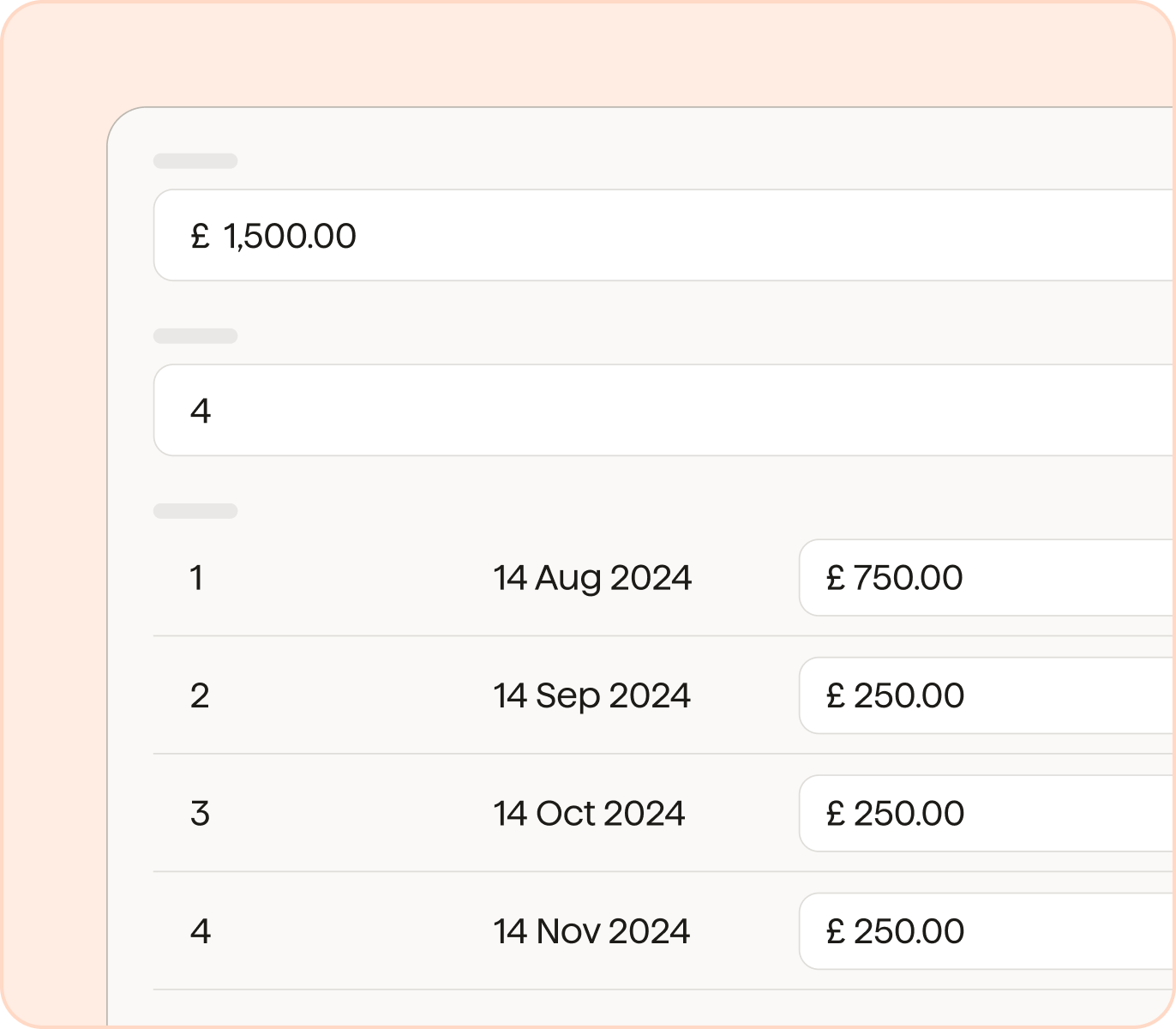

New: Bitesize Instalment payments

Give customers more payment flexibility with the option to split the cost of a high-value product or service into smaller chunks.

Grow your customer base (and revenue) with more manageable ways to pay

Personalised customer experience with tailored payment plans

Save time with automated collection once an Instalment plan is set up

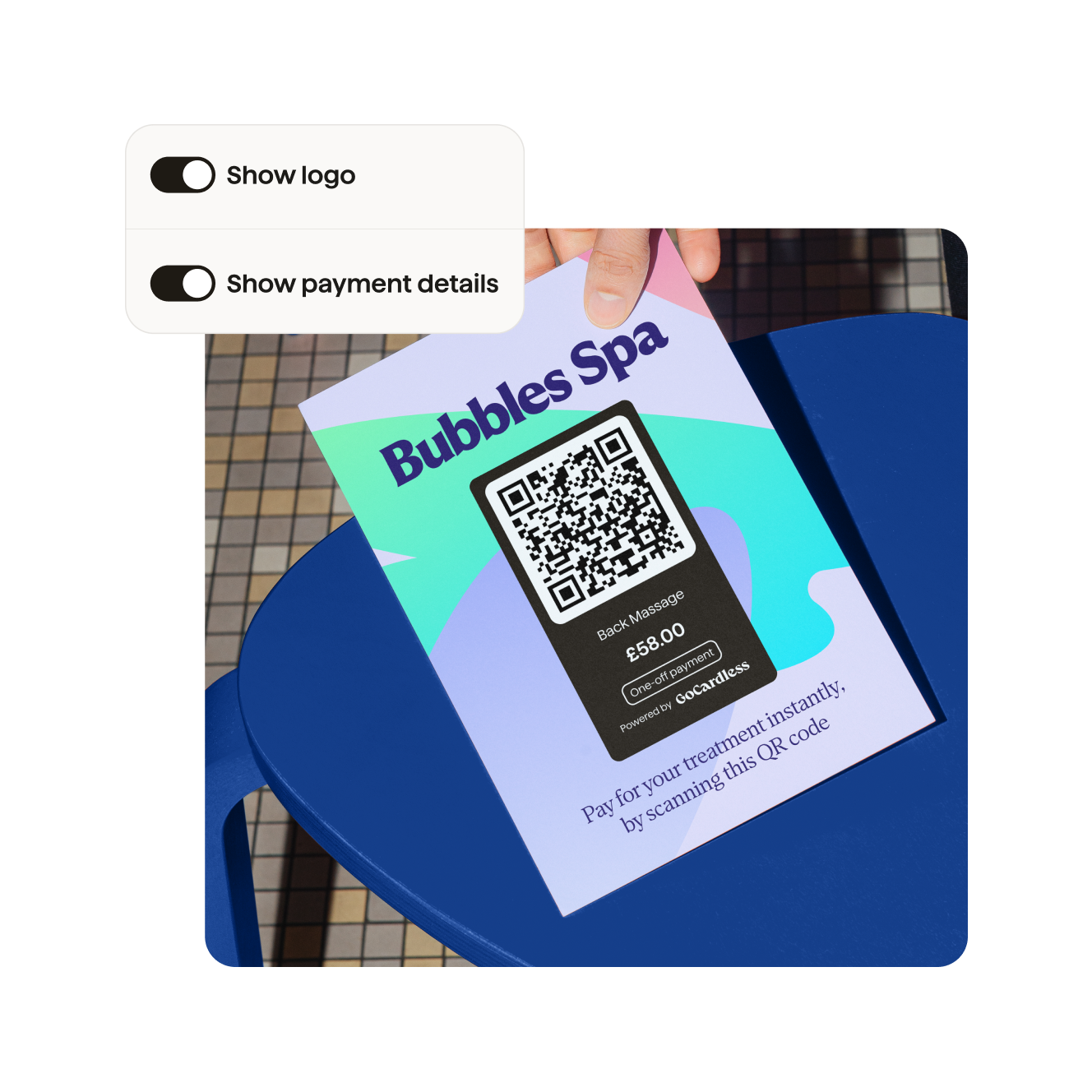

New: Get paid fast with QR codes

Collect payments in person or sign up a new customer on the go, with QR codes now available in your dashboard.

Collect from anywhere, just print out or download your QR code

Take payments instantly, from new and old customers

Sign up customers easily

What else just landed?

More updates to speed up, secure, and simplify payments.

![]()

Coming soon: Same Day Settlement

Get paid two-days faster and improve cash flow. Get money in your bank account the very same day your customer is charged.

![]()

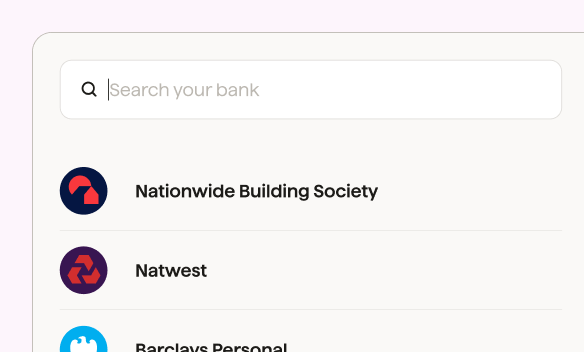

New: Instant Bank Pay upgrades

Speed up payment times for your customers and avoid failures, with a more seamless experience that covers 99% of UK bank accounts.

![]()

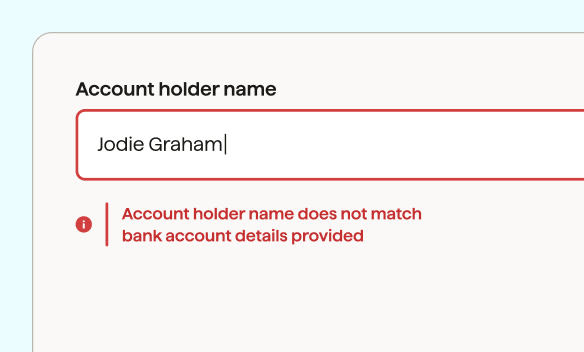

New: Payer Name Verification

Reduce payer fraud and chargebacks with our new security feature that verifies a payer’s account number and name match.

![]()

Two-factor authentication (2FA)

Protect your business and customers from costly cyber attacks and data breaches, with two-factor authentication.

Want to see the new tools in action? Watch our webinar.

See all the latest features in action, including a live Q&A session with our customers and payment experts.