Get paid on time. Stress less.

GoCardless makes it easy to collect recurring, one-off and variable payments from customers worldwide.

How much time and money could you save?

Calculate how much time and money GoCardless could save your business, with our interactive tool. It takes less than 3 minutes.

Subscription payments

Create flexible recurring payment plans to suit your business. Accept Direct Debit payments on your website or by sending your customers a secure payment link.

Invoice payments

Say goodbye to overdue invoices. Customers only need to set up their payment details once, securely online. Then collect one-off or recurring payments whenever they are due.

![Subscription payments]()

Subscription payments

Create flexible recurring payment plans to suit your business. Accept Direct Debit payments on your website or by sending your customers a secure payment link.

![Invoice payments]()

Invoice payments

Say goodbye to overdue invoices. Customers only need to set up their payment details once, securely online. Then collect one-off or recurring payments whenever they are due.

Our platform

Recurring payment collection

Perfect for subscriptions, invoicing and instalments, GoCardless is the best way to collect recurring payments, even for variable amounts.

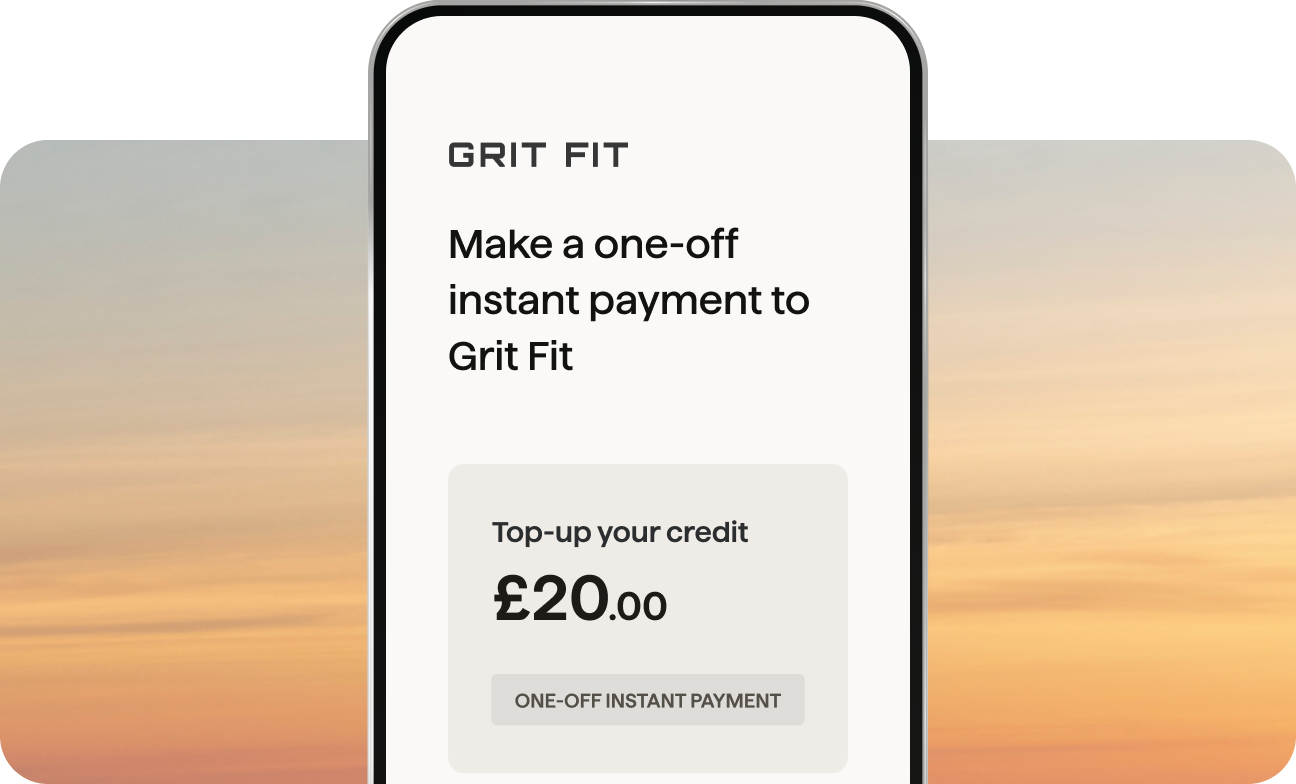

One-off payment collection

Complement your recurring payments with a simple, convenient way to collect one-off payments whenever you need.

International payouts and FX

Collect payments from customers in 30+ countries, including the UK, Eurozone countries, the US, Canada, and Australia.

Success+

Success+ uses payment intelligence to predict and manage payment failures. Recover, on average, 70% of failed payments.

Futureproofing payments

GoCardless has acquired Nordigen – a platform that provides free access to open banking data and premium data insights.

Open banking is a once-in-a-generation technological change that we believe will drive bank payments for decades to come.

This acquisition takes us to the next level with state-of-the-art open banking connectivity. Letting us offer best-in-class products for both payments and data, for any business that wants to harness the power of open banking.

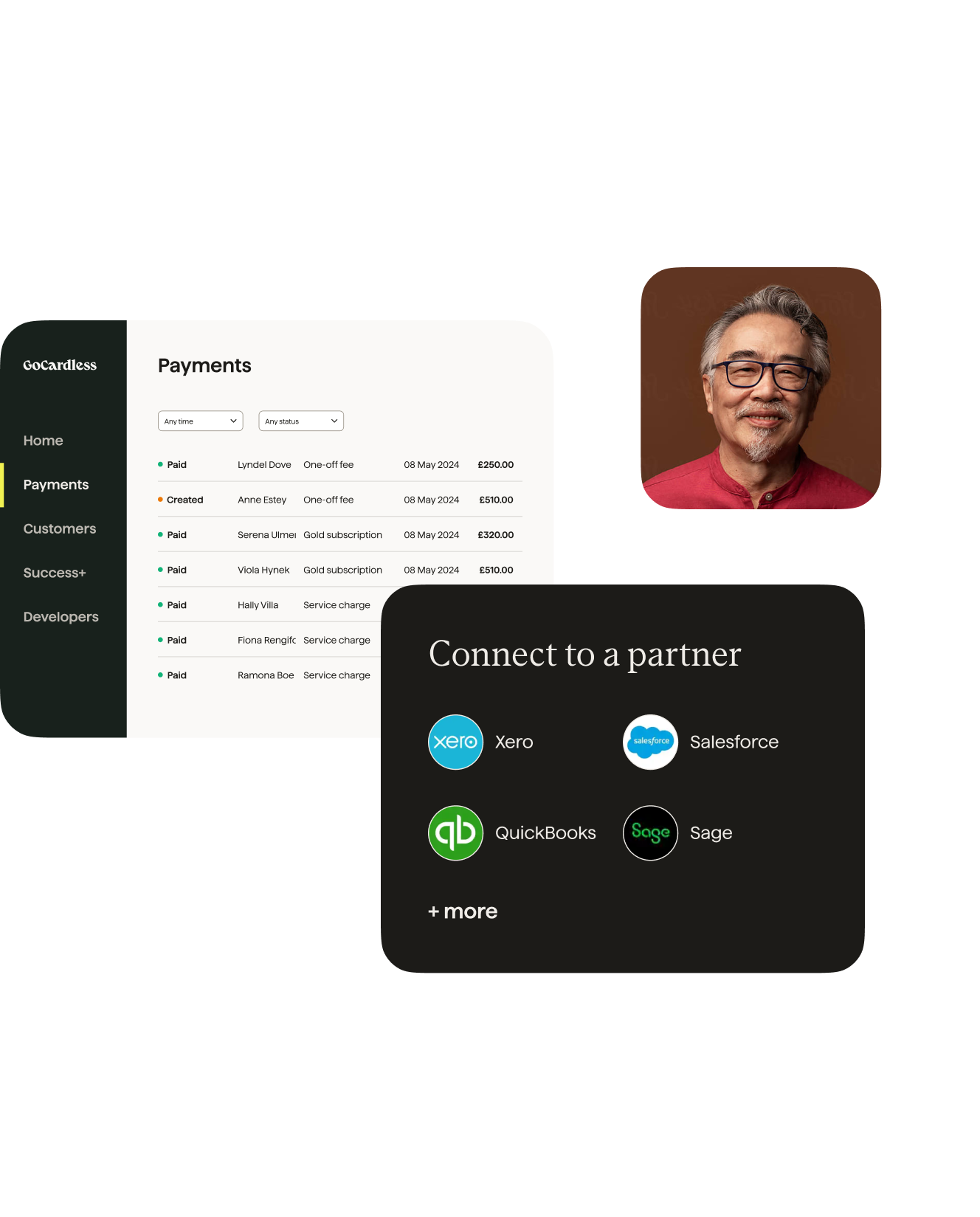

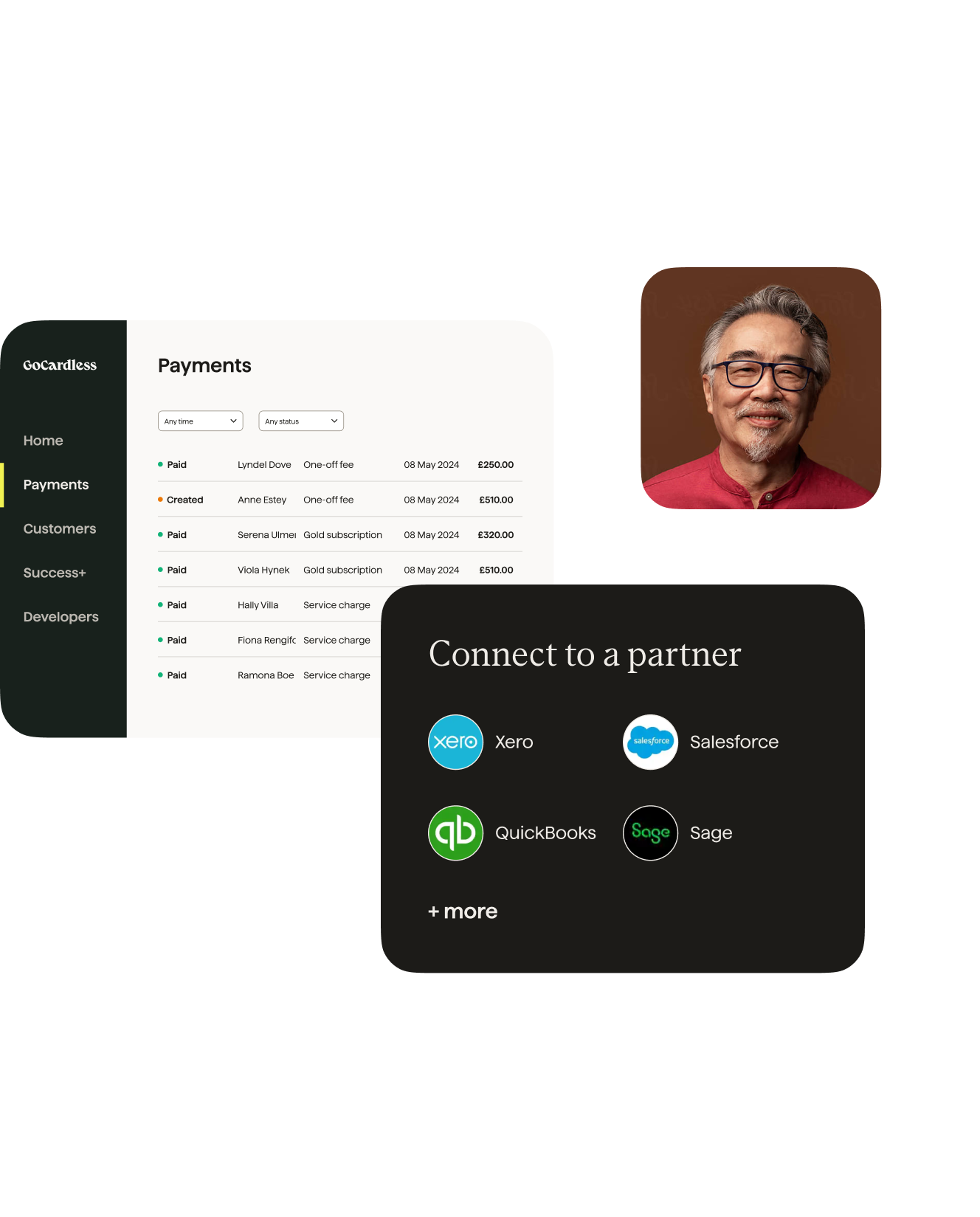

Simple to manage

Collect and manage recurring and one-off payments using our dashboard. Renew, amend and pause payment plans easily and get full visibility on each transaction.

Connect to your software

Connect GoCardless to your business software to automate payment collection and reconciliation.

We can get clients set up in minutes and we know that’s it — our payments come in on time and are automatically reconciled.

Eli Tagi, Director, WE Accounting

Ideal for your customers

Simple

Setting up payment details only takes two minutes for customers to complete online.

Transparent

Customers will always be notified by email when a subscription is starting or one-off payment is being taken.

Efficient

No more customers logging into online banking, updating expired card details or forgetting to pay.

Secure

We’re authorised by the FCA, GDPR compliant, and any payments collected via our Direct Debit feature are protected by the Direct Debit Guarantee.

Trusted by 85,000+ businesses. Of all sizes. Worldwide.

![Seamless integrations]()

Seamless integrations

"Xero has chosen GoCardless as its best-in-class solution for Direct Debit and it shows."

Ready to get started?

Pay as you go pricing, with low transaction fees and no monthly contract. Get started in minutes.