Guide to automated payments and cash collection

Getting paid on time is an ongoing challenge for small and medium-sized enterprises (SMEs). In this guide, we walk you through three automated payment options, and explain the key advantages (and disadvantages) of each as a cash collection method.

In this guide

Getting paid on time is an ongoing challenge for small and medium-sized enterprises (SMEs):

20% of SMEs wait more than 60 days to get paid

SME employees spend 4.1 hours per week dealing with financial administration

With many businesses still using outmoded and inflexible ways to collect their payments, making the payment process more effective and less time consuming would provide a significant positive boost for busy finance teams.

But what are the options available?

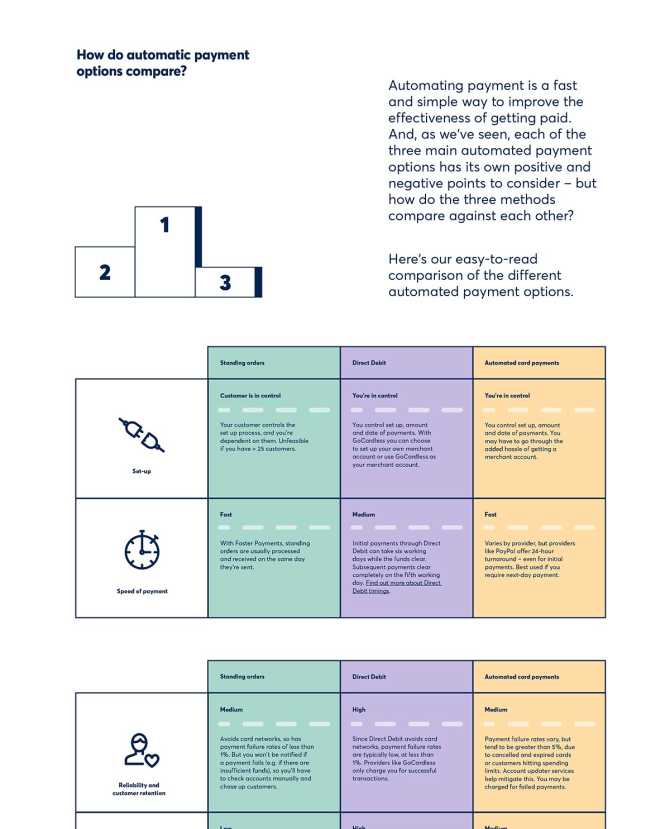

In this guide, we walk you through three automated payment options, discussing the advantages (and disadvantages) of standing orders, Direct Debit and card payments.