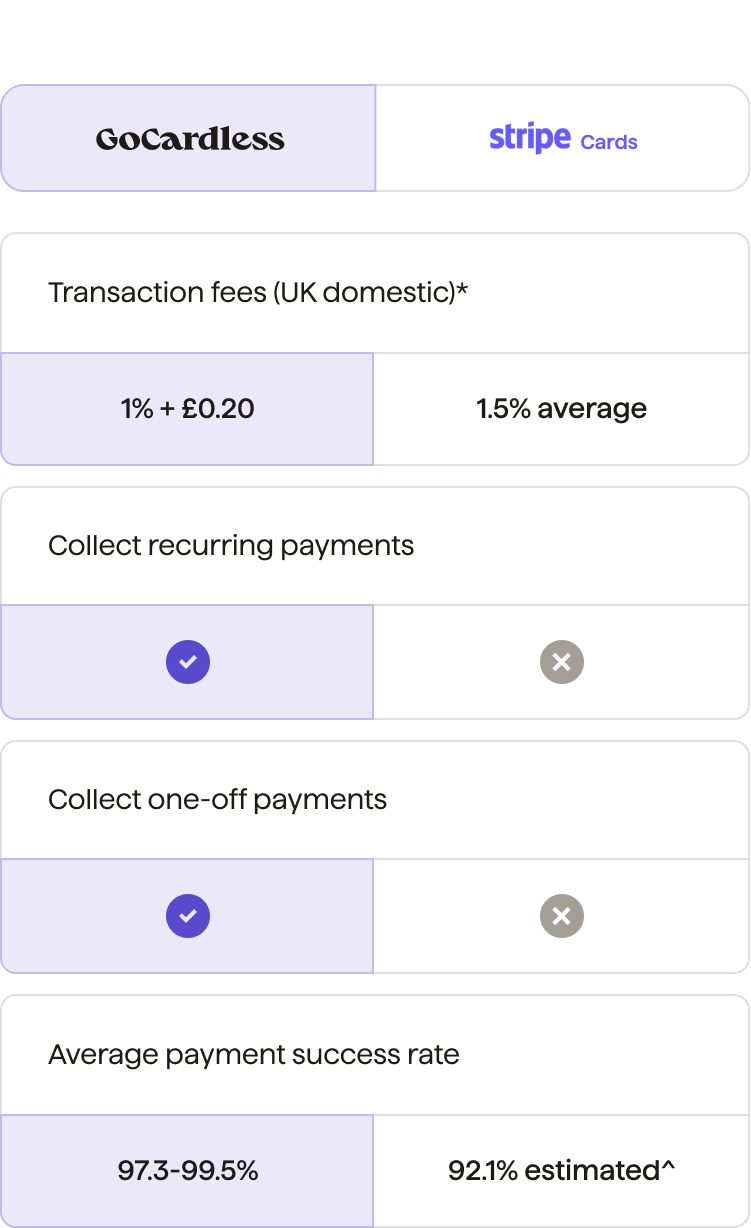

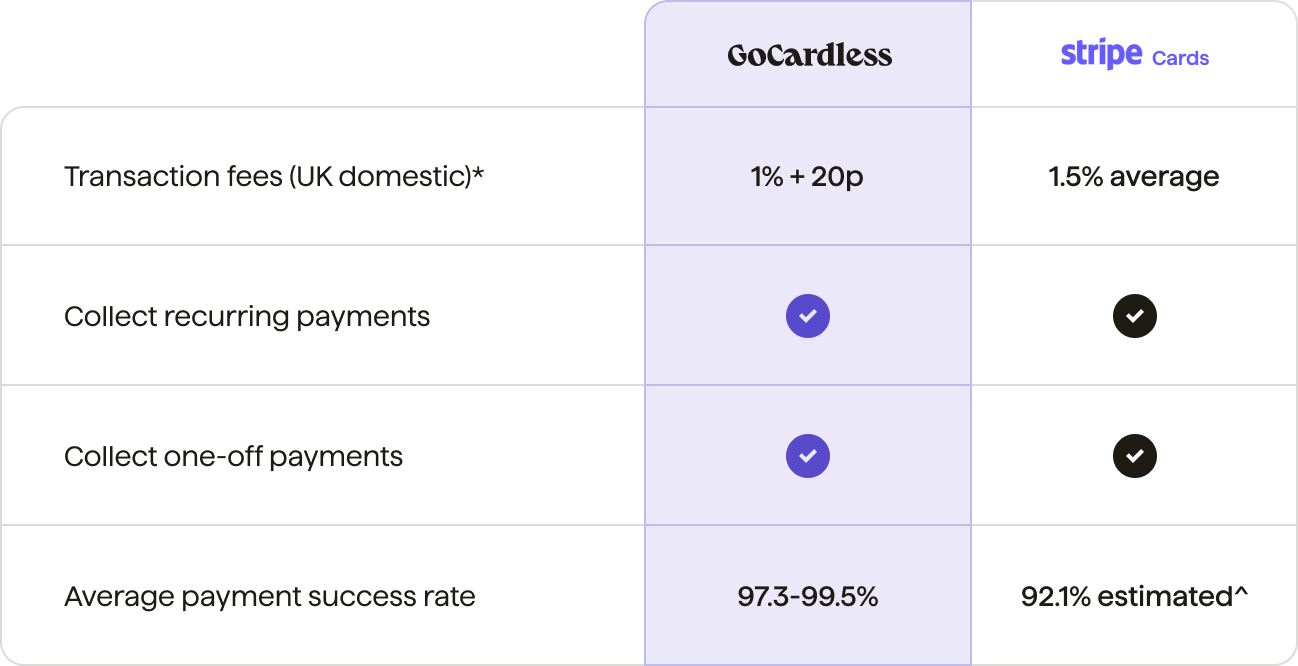

GoCardless vs. Stripe

Lower transaction fees

Lower payment failure rate

Lower level of manual admin

A £500 transaction saves you 48% compared to Stripe

Accepting a £500 payment with Stripe from a standard UK card will cost you £7.70. However, with GoCardless, that transaction costs just £4.00 on our Standard Plan (excluding VAT).

* Pricing as of Jul 2024. Plans vary. Excludes VAT

^ Based on market research for cards - not specific to Stripe’s offering

Why bank payments, not cards?

Lower transaction fees

Card payments are routed through a network of intermediaries, with each adding their fee.

Bank payments, by contrast, are direct account-to-account transfers with no intermediaries.

Lower payment failure rate

Cards expire or get lost and cancelled, resulting in failed payments.

Bank accounts do not expire and cannot be lost, meaning more successful payment collections.

Less manual admin

Card payment failures create a significant level of manual admin.

Bank payment admin with GoCardless can be automated, including reconciliation.

Ready for payments with lower fees and fewer failures?

We've processed around 17,000 direct bank payments in two years and not had a single payment failure, which is absolutely fantastic. That compares with card payments, where we get a lot of failures.

Rod Bull, Project Manager, NHS

Why choose GoCardless over Stripe?

Award-winning customer support

GoCardless’ Customer Support Team have won big awards, including European Contact Centre & Customer Service Awards (2022) and Best Small Customer Service Team (2021).

“I have been working with GoCardless for the past 6 years. Every step of our journey, GC have supported me throughout. I cannot think of a single person that has not tried to help or go above and beyond.”

Payers trust bank payments

Bank payment methods such as Direct Debit are well known and trusted in the UK. Indeed, 80% of Brits have at least one Direct Debit and the average consumer has six Direct Debits set up.

“When asked which payment method they trusted most, 89% of payers chose bank payments over card payments.”

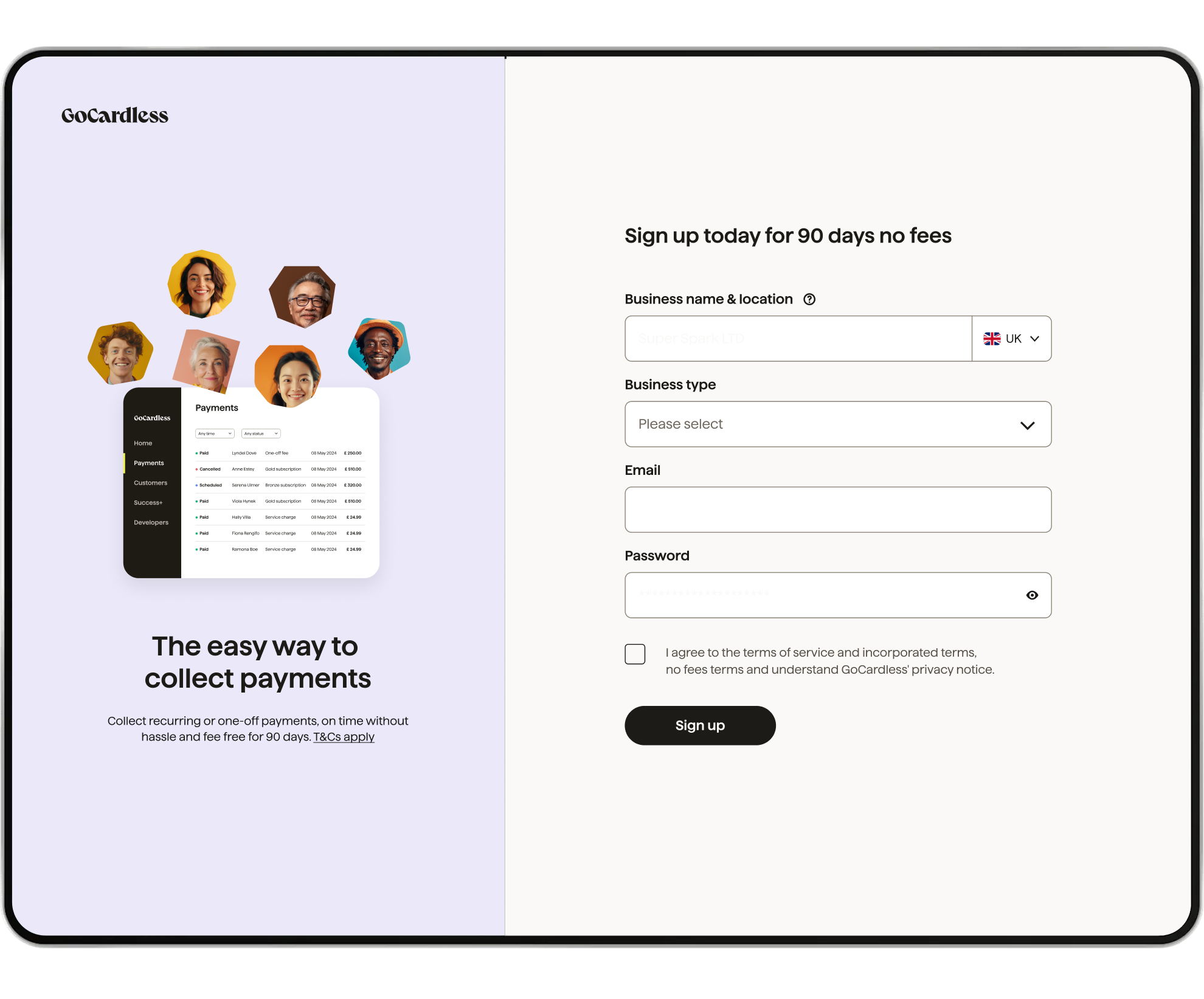

Ease of setup and use

GoCardless is easy to set up and integrates with 350 popular business software platforms. Create payment plans in a few clicks inside the user-friendly merchant dashboard, or by API integration.

“We were ready to go within 24-48 hours, it was very, very easy. Everything from the day I registered has worked seamlessly.”

- Lee Drayton, Managing Director, LD Fitness

Get started with GoCardless

Ready for payments with lower fees and fewer failures?

Give GoCardless a go, and see why businesses on G2 prefer it to Stripe. Pay-as-you-go pricing. No commitments. Easy.