Stop chasing payments

Trying to recover late payments is exhausting. It takes time, creates admin, and can drain your resources. No wonder 60%* of small businesses feel held back by late payments.

We believe direct bank payments are the best way to minimise late payments - with our customers successfully collecting 97.3%* of payments on the first try.

Late payments aren’t inevitable

Say goodbye to chasing late payments

53%* of small businesses spend an hour every week chasing late payments. Reduce late payments using automated Direct Debit or Instant Bank Pay to collect fast and secure one-offs.

Payments at your fingertips

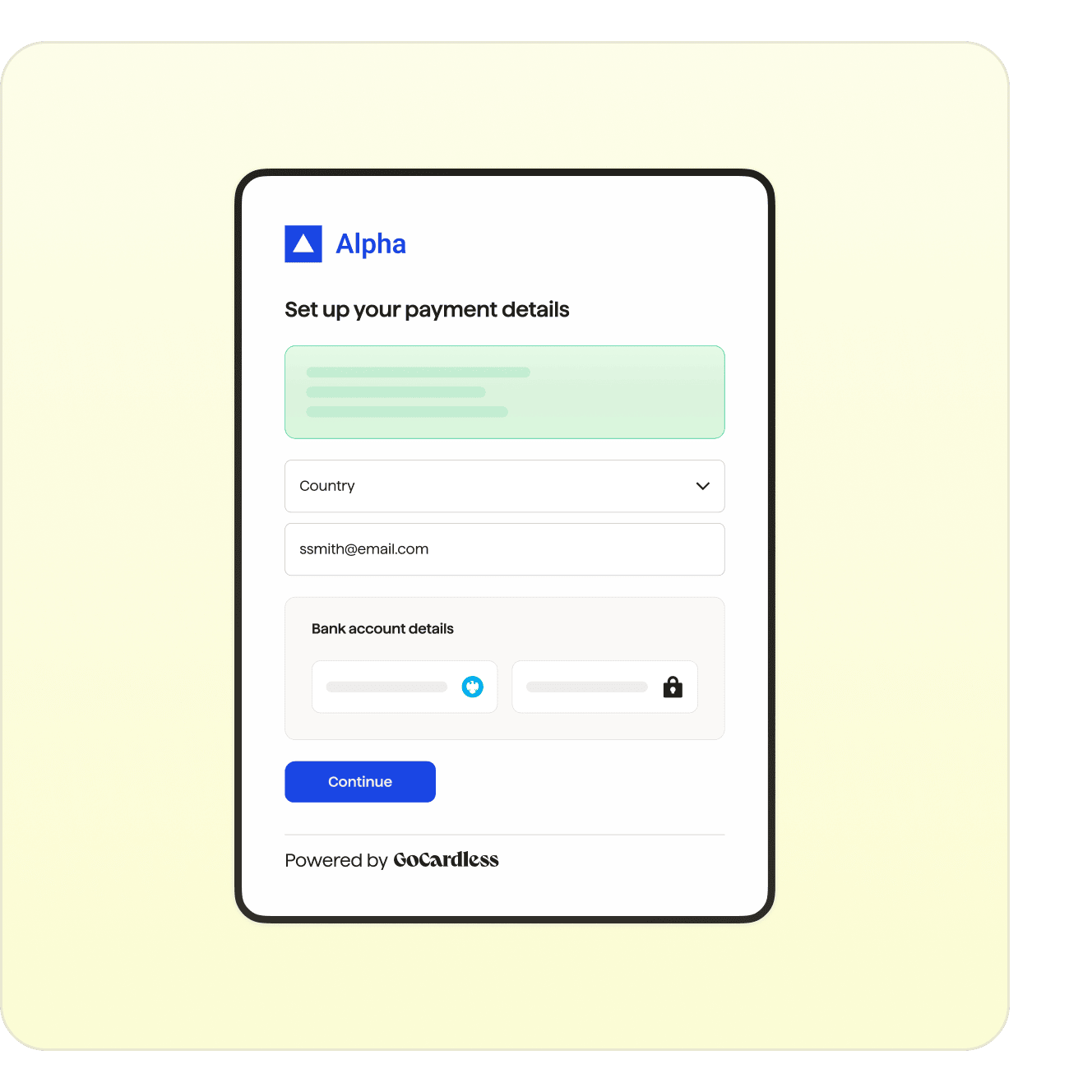

Set up, manage and view your customers’ payments in the online dashboard. This makes it easier to stay in control and request payments no matter where you are or check a payment’s status in a few clicks.

Connect to your existing software

Keep reporting simple and manage your payments in one place by connecting GoCardless to your existing software. We have 350+ integrations to choose from, including Sellsy, Zoho and WooCommerce.

Put more money back into your business

GoCardless charges lower fees per transaction compared to credit cards, so more of every payment goes directly into your business. Plus, we offer 90 days fee-free for new customers. (T&Cs apply).

When it comes to late payments, businesses are...

![]()

63% spending up to £100 per week managing them

![]()

52% forfeiting payments to avoid the hassle of chasing them

![]()

60% feeling held back from reaching their full potential

![]()

34% spending up to 4 hours every week managing late payments

See how GoCardless compares

How it works

Your business deserves cashflow confidence

10–15% of all credit and debit card payments fail because cards are lost, expired, or rejected by issuing banks. Payments via bank accounts don’t suffer from these issues, so you can set up once, automate for pre-agreed dates, and gain peace of mind.

I've got absolute confidence that when GoCardless says we’re collecting ‘X’ amount on ‘Y’ date, that’s exactly what we’ll get.

Laura Skilton, Baby Squids Founder56% lower average cost per transaction*

Core features

Standard

1% + £/€0.20 per transaction

Get startedMax. price cap £/€4 per transaction

+0.3% added to transactions over £2,000

2% +£0.20 for international

Prices exclude VAT

Benefits

Collect one-off and recurring payments seamlessly

Collect international payments from 30+ countries with the real exchange rate (powered by Wise)

Use GoCardless with an API, our dashboard or integrate with 350+ partner softwares, such as Xero, Sage or QuickBooks

Include your branding on the customer sign-up form

Enhanced payment protection

Advanced

Popular1.25% + £/€0.20 per transaction

Get startedMax. price cap £/€5 per transaction

+0.3% added to transactions over £2,000

2.25% +£0.20 for international

Prices exclude VAT

Benefits

All Standard benefits plus

Reduce failed payments through intelligent retries

Verify new customers' bank account details instantly at checkout

Design a tailored customer experience, from your own payment pages to email notifications (additional fees apply)

End-to-end fraud protection

Pro

1.4% + £/€0.20 per transaction

Get startedMax. price cap £/€5.60 per transaction

+0.3% added to transactions over £2,000

2.4% +£0.20 for international

Prices exclude VAT

Benefits

All Standard and Advanced benefits plus

Prevent fraud by intelligently identifying and verifying risky payers

Resolve fraud by monitoring and challenging chargebacks

Fully customised package

Custom

For businesses with large payment volumes or requiring a bespoke solution with dedicated support

Volume discounts

Contact SalesPremium white labelling

Benefits

All Standard, Advanced and Pro benefits plus:

Dedicated end-to-end customer success

Unlock discounts as you scale transaction volume

Option to commit volume or pay as you go

Collect one-off and recurring payments seamlessly

Collect international payments from 30+ countries with the real exchange rate (powered by Wise)

Use GoCardless with an API, our dashboard or integrate with 350+ partner softwares, such as Xero, Sage or QuickBooks

Include your branding on the customer sign-up form

How much GoCardless will cost you

Calculate your fees

What is the monthly cost?

Calculate your fees

What is the monthly cost?

=

Estimated monthly saving compared to card payment fees

--

Estimated time saving per month not chasing late payments

--

Payments you can count on

Join now to take advantage of paying no fees for 90 days and feel in control of your payments.

*Insights from GoCardless Late Payments and Payment Methods In Small Businesses, commissioned through Federation of Small Businesses, 2024