Going global? Put payments on the agenda

Last editedMar 20217 min read

Growing a business internationally is tough. It’s like repeating all of a venture’s startup experiences many times over again, with a different language and culture each time. And if you’re a SaaS business, it’s sometimes necessary to face those challenges simultaneously in several countries at once.

There are many themes which businesses must assess on the road to international expansion, but they generally come down to two fundamentals:

When?

There’s a right time to move into a new territory. Is there clear demand for your service in-market? Is it a greenfield market, or has it already been disrupted? If so, is there a dominant category king? Are there institutional barriers to entry? For example, China may have a vast population, but the current Chinese Five Year Plan explicitly prioritizes local companies, leading Congress to warn that “the process of ‘indigenous innovation’ involves the introduction, absorption, and adaptation of foreign technology that is rebranded as indigenous Chinese capabilities.” Not so tempting, perhaps…

How?

How will you deliver a quality service? Will you operate entirely from home, or with in-country employees? How can the end-to-end customer experience be localized? That’s more than just skinning the website; consider pricing, for example. Patrick Campbell, CEO of SaaS growth platform, Profitwell, writes: “Just from our past work I know that for products geared towards developer buyer personas, individuals in the UK, Northern Europe, and Western Europe are willing to pay 20-30% more than their US counterparts. Similarly, I know that because of piracy in Southeast Asia, for some on-premise solutions personas in this region are typically willing to pay 60-70% less.”

The Payments Fallacy: one size doesn’t fit all

Campbell’s point puts pricing high on the list of every growing SaaS business. It’s in the very DNA of SaaS finance and growth professionals not to “leave money on the table”.

Whereas payment methods are likely somewhere near the bottom of your list of concerns. There are several reasons for this. First, payments often go under the radar. As a functional aspect of onboarding, it’s not seen as part of the customer excellence mantra.

Plus, you might also think that payments are the same everywhere, anyway.

Both of these assumptions are wrong. In the words of Neil Proctor, Global Head of Customer Systems, at Centrica Hive (one of the UK’s largest connected home providers): “Initially we took a broad brush approach to going global and thought credit cards would work everywhere, but that wasn’t the case. You have to give customers options if you’re going to crack the recurring payments problem.”

Paul Lynch, CEO of billing and revenue specialists, Chargify agrees: “Choice is important in terms of growing any kind of business. Consumer power is getting more relevant as we move into a more connected world. If you don’t deliver the payment methods they require, they’ll find it elsewhere. A Google search will allow them to see multiple competitors in your space, and they’ll go there.”

And when you expand your business, that choice matters; because payment preferences differ dramatically across the globe. GoCardless’ own research found that, for B2B transactions, whilst corporate credit cards remain the payment method of choice in the US and Canada, bank debit is preferred in Australia, Denmark, France, Spain and the UK. Germany and Sweden expressed a preference for bank transfers. Evan Miller, Director of Billing and Collections at SaaS hospitality reservations service, Siteminder, says "Bank debit is extremely prevalent in Europe. Our customers there demanded it and now 70% of them have chosen to pay [by bank debit].” There is a similar variability in preferences for consumer transactions.

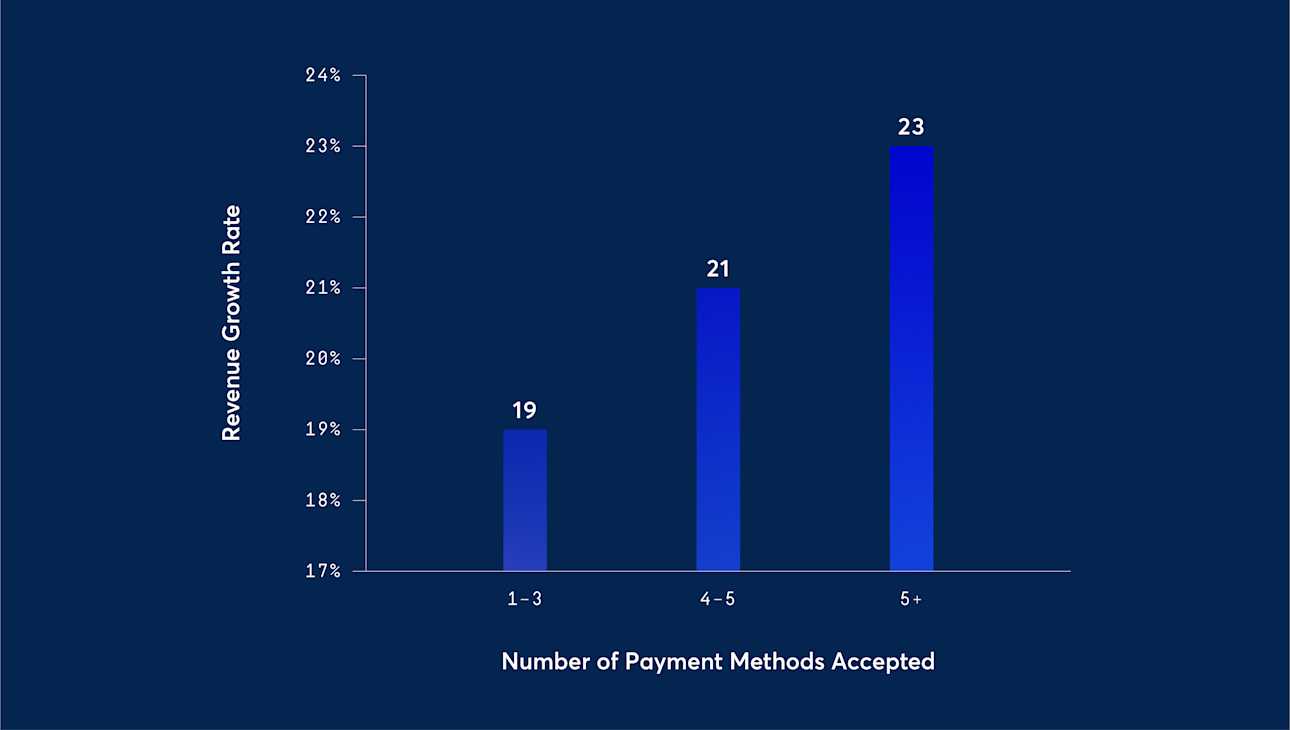

The good news is, this is a huge opportunity. If payments have not been on your globalization agenda, it deserves to be. Businesses that offer multiple payments methods grow faster.

Especially in our more remote, post-pandemic world, where the sales experience is increasingly becoming all-digital, it is crucial to offer customers their payment method of choice as part of a commitment to customer-centricity. In the words of Chargify’s Paul Lynch, “We need to look at billing methods as a business enabler rather than an overhead in terms of IT infrastructure. The worst you can do is go into a market and sterilize it for yourself by winning customers and then giving them a poor experience.”

Payer Preference in action: DocuSign uses payments to acquire more customers

By automating and connecting the entire agreement lifecycle, DocuSign has turned a previously cumbersome process into something more streamlined. Not surprisingly, the company wanted the process of subscribing to be trouble-free, too.

DocuSign realized the value of offering an expanded selection of payment methods—and after being integrated into its subscription management platform, GoCardless was activated in April 2019. It’s available in the UK, across the Eurozone and in Australia.

Today, 11% of new customers choose bank debit where it’s available—but more importantly:

Customers choosing to pay by GoCardless typically spend more, with an average selling price (ASP) 14% higher than other common payment methods.

Retention rates after 12 months are higher for bank debit customers than those using credit cards or PayPal.

And the conversion rate across all payments has increased by 10% compared to when only credit cards and PayPal were available – highlighting the importance of payment method as a factor in the customer journey.

Solving the global payments puzzle

But deciding on payment methods is only one of the choices a globalizing growth manager must make. The considerations broadly fall into five areas across the payments lifecycle:

We’ve already looked at localization – if you’re expecting people to part with their money, you’ll need sensitive language localization, local pricing and, of course, currencies. Profitwell’s Patrick Campbell again: “Making sure that your prices are converted to the local currency using the latest exchange rates is the bare minimum you should be doing.”

Compliance means meeting the tax, regulatory and reporting standards of each territory in which you want to operate. Just as federal and state laws create disparities in the US, so even the broadly consistent Europe has variable tax and statutory reporting regimes.

Take sales taxes, for example. As SaaS revenue specialists, Paddle, report: “The introduction of VAT MOSS in 2015 means that the rate of tax charged in the EU is the rate of the country in which the customer is based, rather than the company making the sale. As a result, software companies [have] to know what rates of VAT to charge in each country within Europe.”

There is a similar patchwork of approaches to data privacy. You’ll already know about the EU’s benchmark regulation, GDPR. Hot on its heels come Canada’s Digital Charter Implementation Act, China’s Personal Data Protection Law, India's Personal Data Protection Bill (coming soon) and many more. Most of these regimes include significant fines for non-compliance, and all include provisions for the transfer of data across borders – including payments. Assume that compliance regimes will be materially different, and ensure that you have flexibility in your systems and appropriate resources to support these differences.

Fully localizing will involve opening a local bank account as a foreign entity. As well as the usual plethora of choices and account options (every continent now has a mature and diverse banking sector), there’s the hassle of lengthy and sometimes slow processes which may require a personal visit and will certainly demand plenty of documentation. Consultants GlobalBanks also warn that “businesses end up rejected for entirely avoidable reasons: misunderstanding the bank’s requirements before applying, not getting the right paperwork, applying with the wrong business structure” and many more. Specialist agents can help you open a bank account, but there will be a cost attached to this service. It’s (hopefully) a one-off challenge, but will eat up valuable time.

Perhaps the most challenging aspect of international payments is bringing the money home – the foreign exchange consideration. GoCardless’ own research finds that 49% of businesses are frustrated by the pain of collecting payments abroad.

The FX challenge includes several components. For starters, offering local currencies adds complexity (FX can be hard to automate) and risk. Analysts at KPMG write: “A global customer base can make SaaS businesses more vulnerable to FOREX risks and currency fluctuations, which can in turn impact revenue and profitability. The impact becomes more pronounced with growth and scale.”

Second, FX embeds cost into the process, and cost is the enemy of SaaS businesses. It cuts margin and therefore profitability, but can also mean costs which must be passed on to the customer; which is also unwelcome. EY reports, “It is easy to forget that SaaS is a powerful tool for lowering costs — many SaaS companies are winning in their market as the lowest cost provider. We asked leaders how important SaaS was in lowering overall costs — over three out of four (76%) responded that it had a high impact or very high impact.”

If customers employ SaaS tools as a cost reduction measure, then operational costs must be a key consideration for SaaS companies themselves. Gaining visibility of FX costs, lowering them, and minimizing exposure to currency risk should all be priorities for payments professionals in businesses expanding into new territories.

Finally, we should mention reconciliation. As with compliance, going global means a comparable increase in data and reporting, with the added complexity of lower (or later) visibility, thanks to those foreign exchange transactions. Cloud consultants, IT Convergence, write, “Financial reports in most local offices are manually reconciled for global consumption. This process is time-consuming and error-prone especially when reports originate from locations with vastly different tax and legal regulations.” Automation which aligns with your current technology stack is essential, and your finance team (local or HQ) must appreciate the extra time and overhead required to reconcile both for accounting purposes and, more importantly, to extract meaningful operational data.

A simplified payments architecture gives 8x8 a better customer experience

8x8, the leading integrated cloud communications platform, has progressively transitioned its bank debit offering to GoCardless, for an automated online solution that manages payments across multiple bank debit schemes and multiple countries. The company initially turned to GoCardless to collect its payments from customers in the BACS and SEPA bank debit schemes and has quickly extended the relationship to include payments from Canada, Australia, New Zealand and, most recently, ACH in the US.

As well as meeting customer needs by offering preferred payment methods to a global customer base, this has resolved many of the challenges discussed above.

First, bank debit has minimized payment failures in multiple key markets – which is great for business.

But the optimized process has also simplified and automated payments, which cuts costs and increases transaction visibility. 8x8 is using the GoCardless API to integrate its global bank debit payments with Salesforce.com and its billing engine, Gotransverse. This provides a seamless ‘quote-to-cash’ process to increase efficiency and provide a 360-degree view of payments across the business. Samuel Wilson, 8x8 CFO, says, “The GoCardless platform not only means that we can provide a great experience to our customers; it has also enabled us to consolidate our paper-based processes and legacy systems into a single payments platform.”

GoCardless unlocks incremental revenues in international markets

SaaS pioneers have lit the way forward on recurring payments, but most businesses are now paying attention. The post-covid world is more digital than ever, with self-service online payments increasingly prevalent in both B2C and B2B contexts. Analysts, Forrester, wrote in a late 2020 research paper, “The already modernizing payment landscape is now on an accelerated track due to COVID-19. US decision-makers understand that having a carefully planned and executed recurring payment strategy improves customer experience, increases customer retention, and can lead to significant revenue uplift.” They found that over 60% of US decision-makers plan to upgrade or implement a pull-based payment solution in the next 12 months. Only 7% had no interest in reviewing their business model for selling their products and services.

When committing to internationalization, the importance of payments strategy increases accordingly. Analysts IDC interviewed GoCardless customers, who agreed that payments make a strategic contribution to geographic expansion, with one company reporting: “GoCardless has allowed us to offer a preferred payment method in markets we consider strategic. In the U.K., for example, we're collecting about 20% now through bank debit with those customers that have purchased with us.” Another said: “The whole reason why we implemented GoCardless was to provide a preferred payment method internationally.” IDC concluded that “Giving customers the ability to make recurring bank debit payments on the GoCardless platform has not only proved advantageous from a cost perspective but has also enabled their businesses. They have improved their ability to make robust bank debit payments a viable option for more of their customers; [on average attributing] almost $750,000 in additional revenue per organization to use of the GoCardless platform.”