Getting paid should be easy. So why are America’s B2B firms having such a hard time?

Last editedMay 20243 min read

US businesses are stuck on outdated and slow payment methods. Find out more about the payment pains caused by manual processes, and how integrated and automated digital solutions are helping.

Are payments working for America’s businesses?

One way of looking at it is to consider what getting paid usually looks like for B2B firms. It tends to go something like this: send an invoice, wait and see. Pick up the phone to chase. And then wait some more. Another way is the fact that more than half (55%) of all B2B invoiced sales are overdue and bad debts affect an average of 9% of all credit-based B2B sales.

But either way you look at it, something clearly isn’t right.

The problem with payments in the US

Even putting aside late payments and bad debts, many business owners or finance pros will have found themselves halfway through the end-of-month grind to reconcile payments and thinking, ‘there must be a better way to do this’. They might have had similar thoughts as they wondered whether a customer had processed a payment yet, and whether they should call to check.

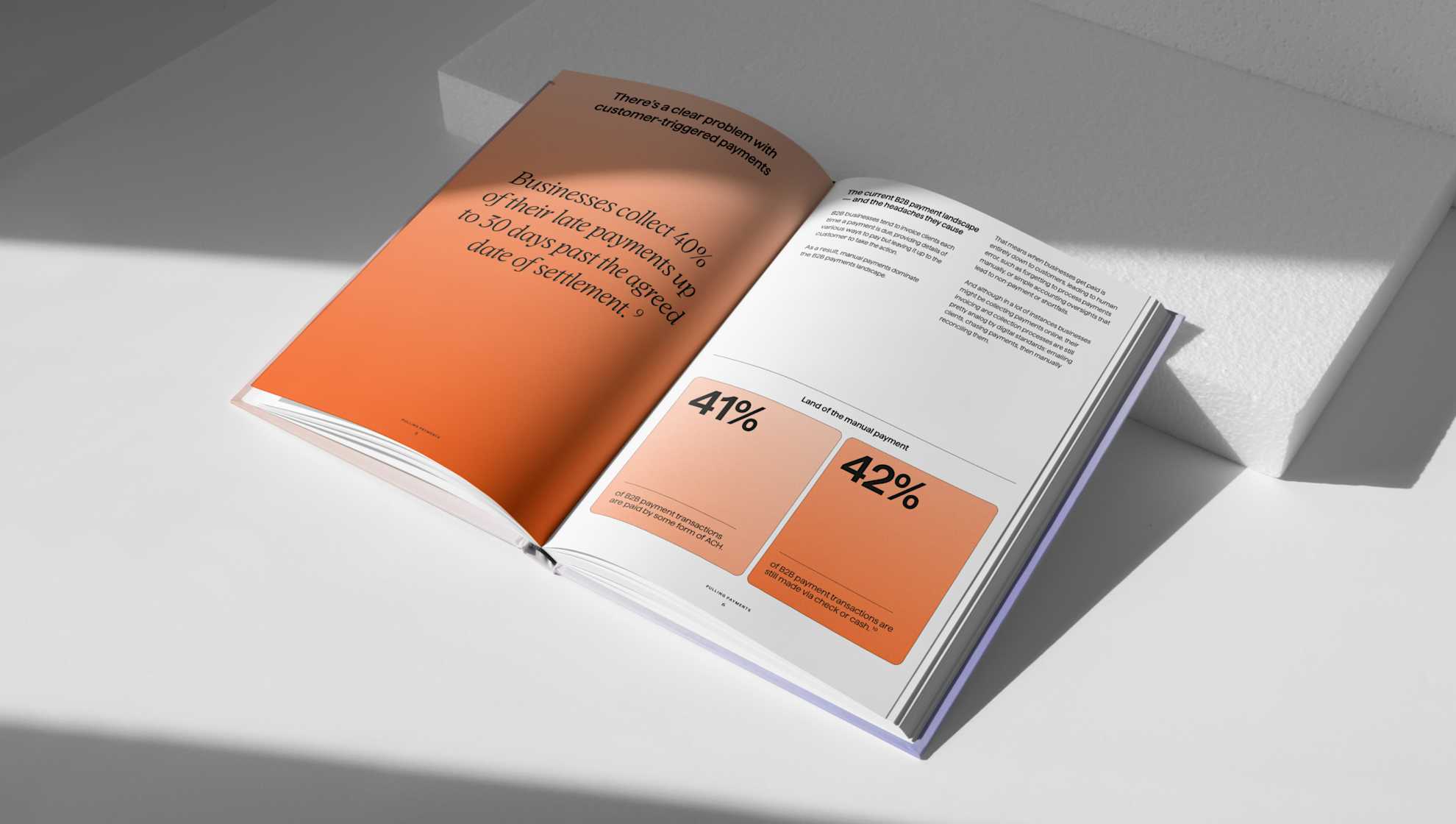

The trouble all stems from the fact that the B2B payments landscape in the US is dominated by checks, cards and wire transfers. While 41% of B2B payment transactions are paid by some form of ACH, 42% are still made via check or cash.

Compounding things is the fact that invoicing and collection processes are, overall, still pretty manual by digital standards: emailing clients, chasing payments, then manually reconciling them.

All this means that when businesses get paid is entirely down to customers. And, as we’ve seen, that ‘when’ is too often late, simply because manual payments leave room for human error, such as forgetfulness or simple accounting oversights.

These issues add up

The way B2B firms handle payments in the US is creating a series of challenges that most — probably every — business will recognise in one form of another. And which they could certainly do without.

How many of these sound familiar to you?

Delays in getting paid: SMBs have reported that 40% of late payments are collected between one and 30 days past the agreed date of settlement.

High costs: Transaction fees on card payments can be as much as 4% - eye watering given many businesses process anywhere from thousands to millions of card payments annually.

Poor visibility: Being in the dark on whether and when a payment has been processed by a customer leaves businesses wondering if they should chase or not (not a great experience for either party). This extends days sales outstanding (DSO) and denies businesses vital intelligence into payment trends and process effectiveness.

Time-consuming, manual processes: More than 60% of payment decision-makers surveyed by Forrester said the most time-consuming areas are matching payments to invoices and reconciling reporting from different gateways/ processors.

It doesn’t have to be this way, thanks to digital payments

The good news is that every one of these headaches can be cured by digital payment offerings.

These systems leverage connectivity and automation to help businesses claw back the time, talent and money currently tied up with payments, so it can be directed towards strategy and innovation. Towards cutting costs, generating revenue, and improving services. Towards customer acquisition. Towards doing whatever it is they do best.

Of course, adopting digital, automated payments will be a major step for any business. It should be carefully considered against both business requirements and customer expectations. To help, we’ve explored the strong and growing arguments for increasing payment automation in our latest report, Pulling payments: Turn invoicing from ‘wait and see’ to ‘get paid on time, every time’.

The report also dives into the key considerations for firms looking to make the leap into this kind of payments modernization. These include how improved connectivity and visibility into payments allows businesses to release much of the resources previously dedicated to payments — and still get money in faster.

It also covers the elephant in the room when it comes to payments. Customers hate the manual processes associated with wire transfers, cards and checks — 54% of business payers prefer to pay invoices by bank payments — just as much as finance teams, and for the same reasons.

Better can start today

Thanks to digital payment systems, America’s businesses no longer need to accept the pain of getting paid as a cost of doing business.

By swapping out manual and time consuming processes for automated systems that integrate with their billing and accounting platforms, they can become more efficient, reduce costs and improve the customer experience.

And, more importantly, they can spend more time doing whatever it is they got into business for in the first place, and less time on admin and chasing customers.

Learn more: read Pulling payments: Turn invoicing from ‘wait and see’ to ‘get paid on time, every time’.