UK home-buying: challenges and opportunities

In these tough economic times, we surveyed 2,000+ UK consumers to understand their attitudes towards the home-buying process, the challenges they face and potential solutions. The results reveal a stressful experience -- and a possible lifeline for Generation Rent.

72% of consumers say getting on the property ladder is “unattainable"

With successive interest rate hikes and the rising cost of everything, it's no surprise that the mood is downbeat. When asked why home ownership feels out of reach, consumers cited a number of reasons.

Breakdown of reasons

![I feel that houses are too expensive]()

I feel that houses are too expensive

![The rise in the cost of living]()

The rise in the cost of living

![Monthly mortgage repayments are too high]()

Monthly mortgage repayments are too high

![The amount needed for a mortgage deposit is more than I am able to save]()

The amount needed for a mortgage deposit is more than I am able to save

![I am worried about increases to the interest rates making home ownership too expensive in the future]()

I am worried about increases to the interest rates making home ownership too expensive in the future

![The mortgage application process is too complicated]()

The mortgage application process is too complicated

![Home ownership schemes don't offer me the support I need]()

Home ownership schemes don't offer me the support I need

Home-buying and mental health

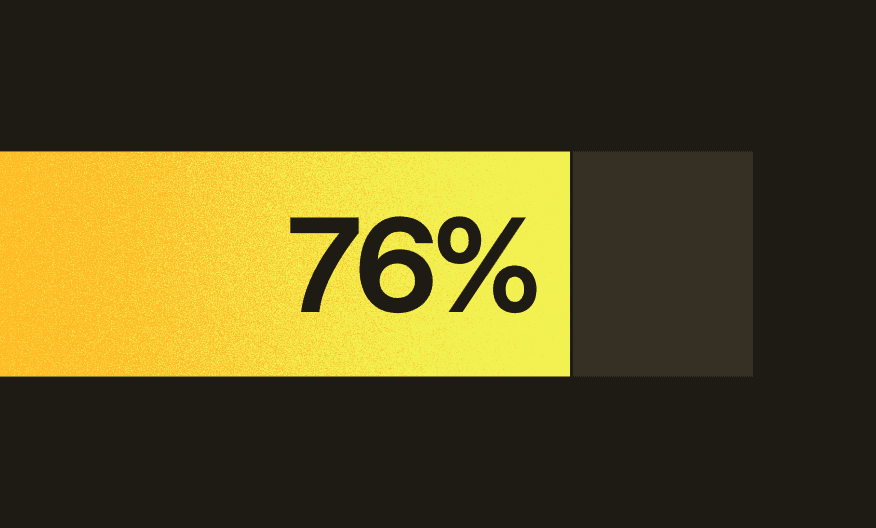

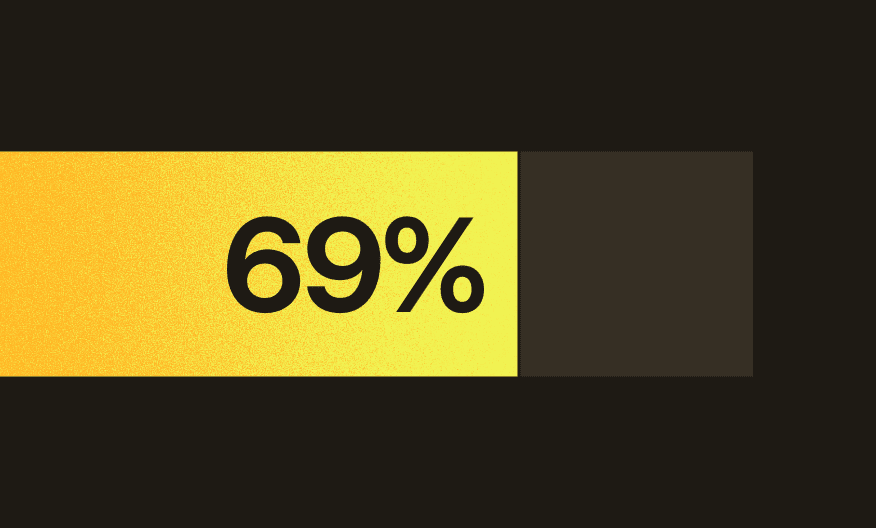

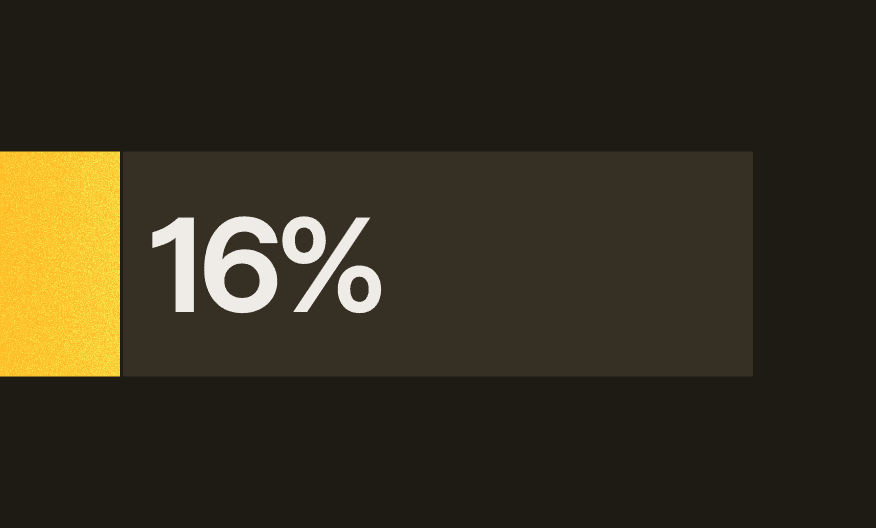

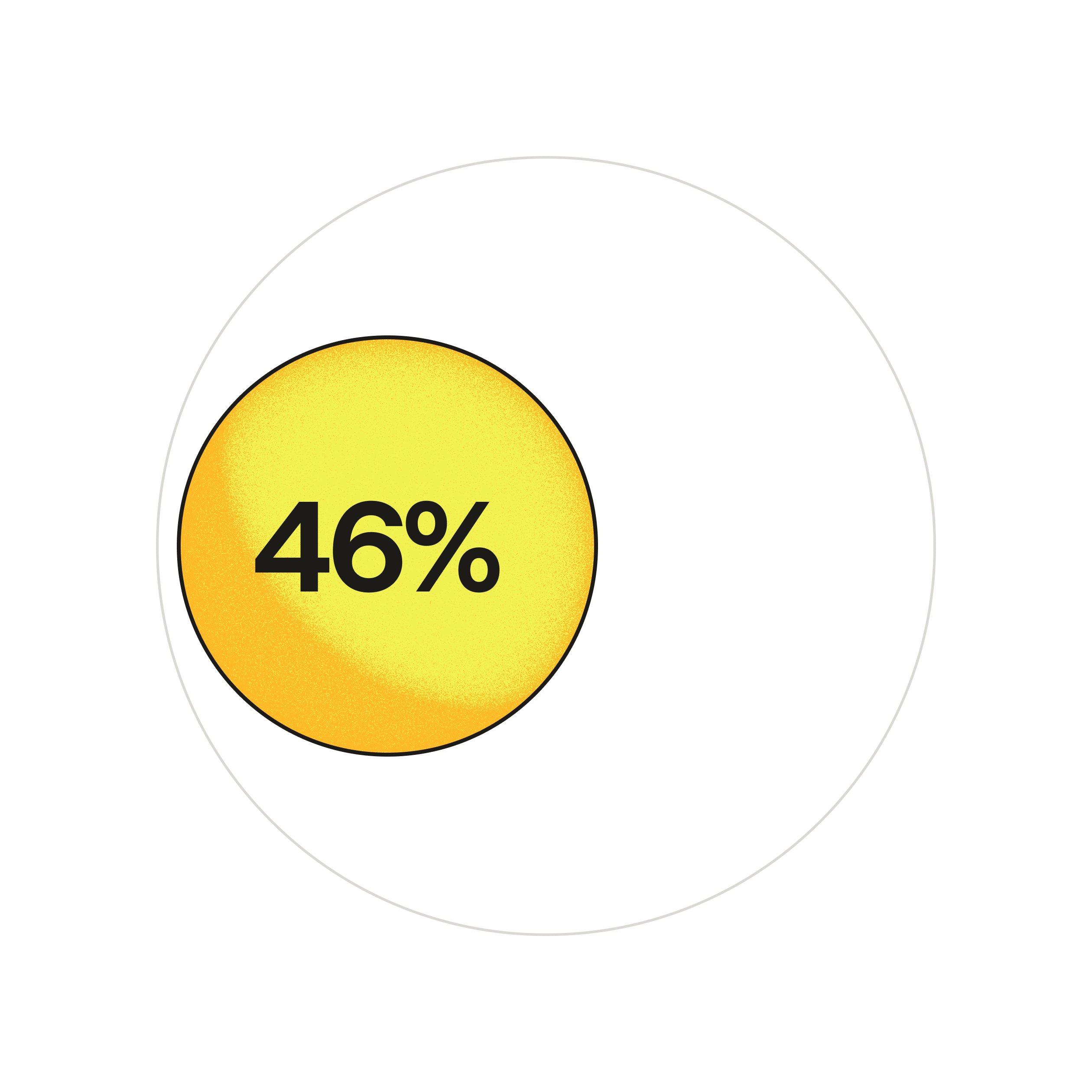

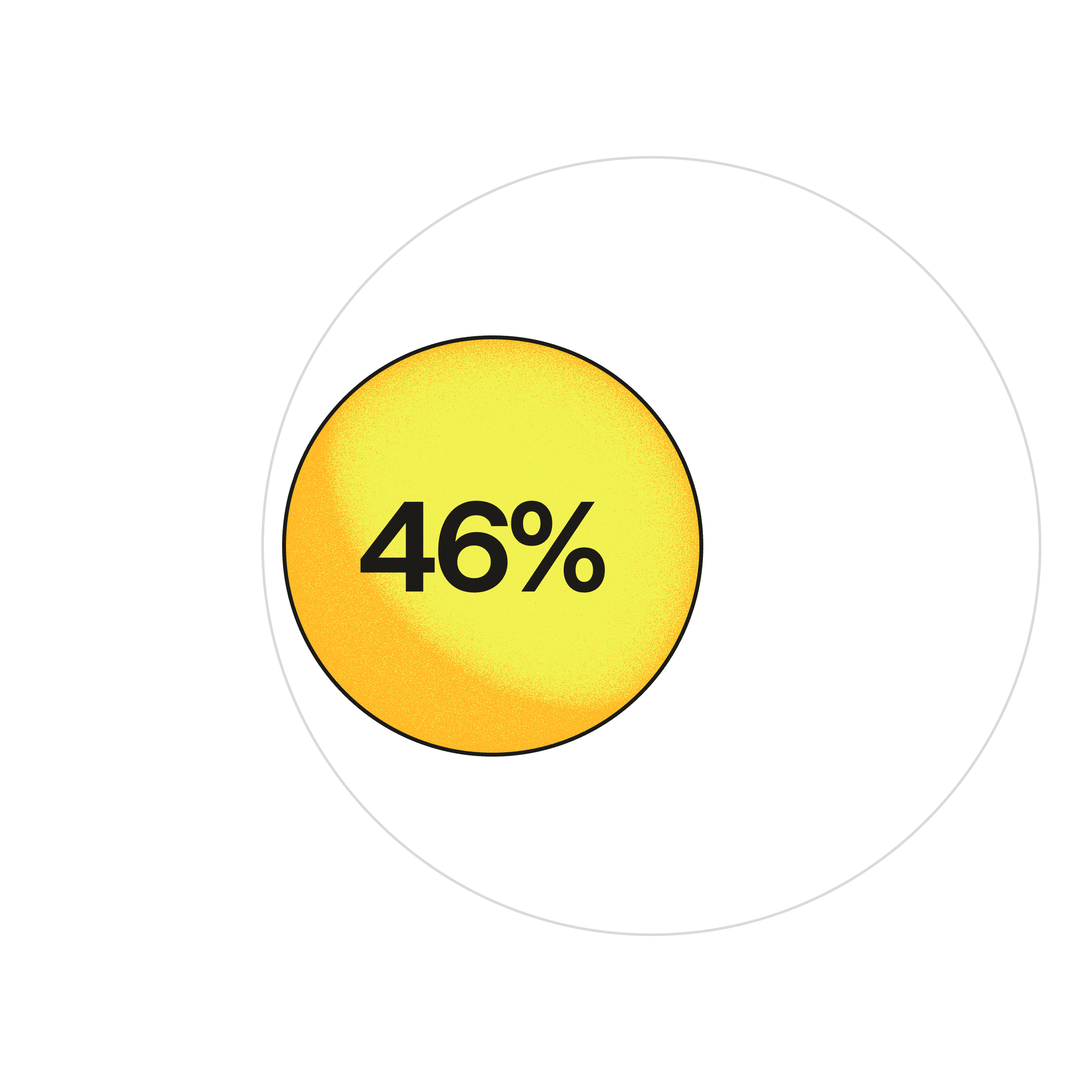

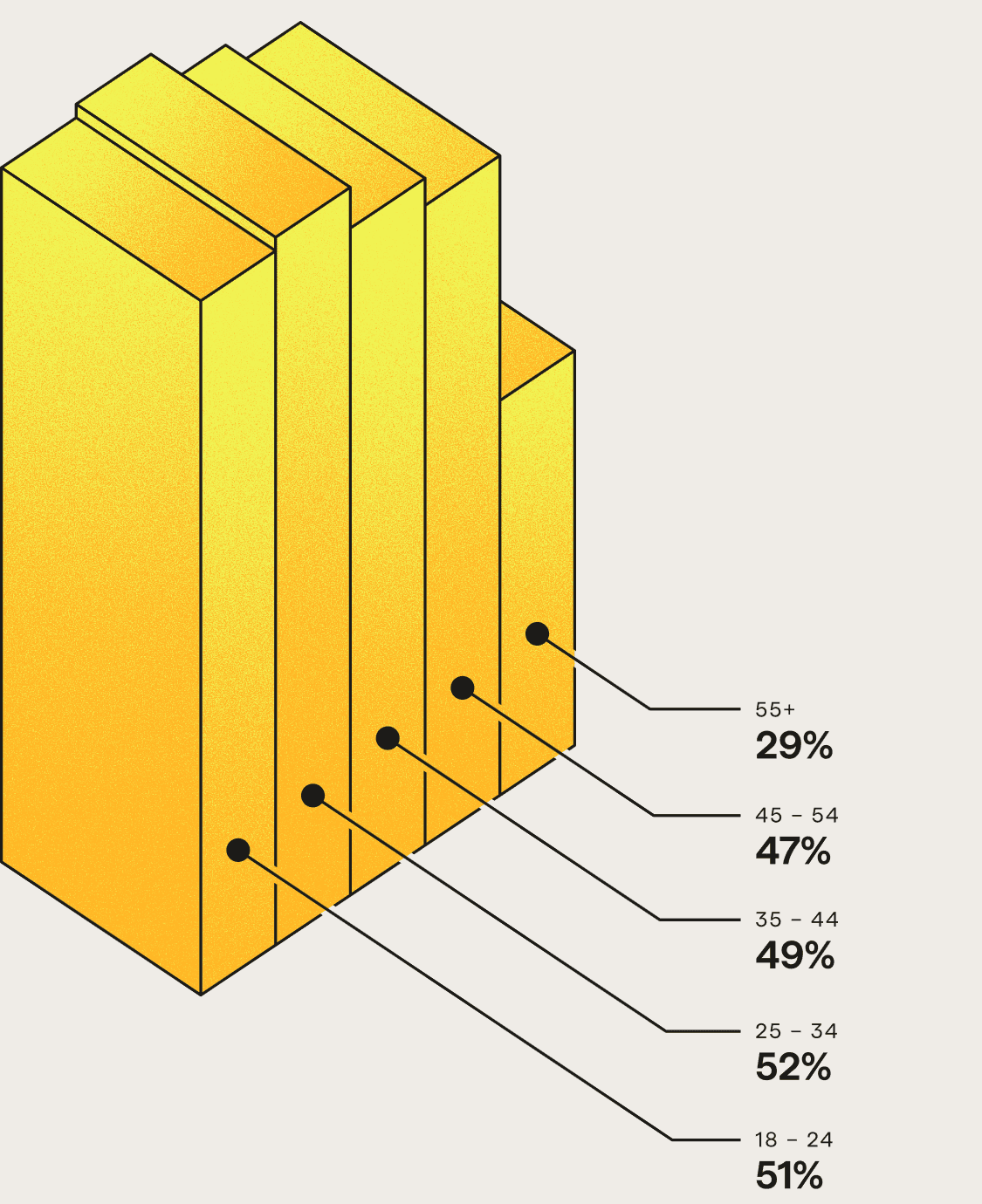

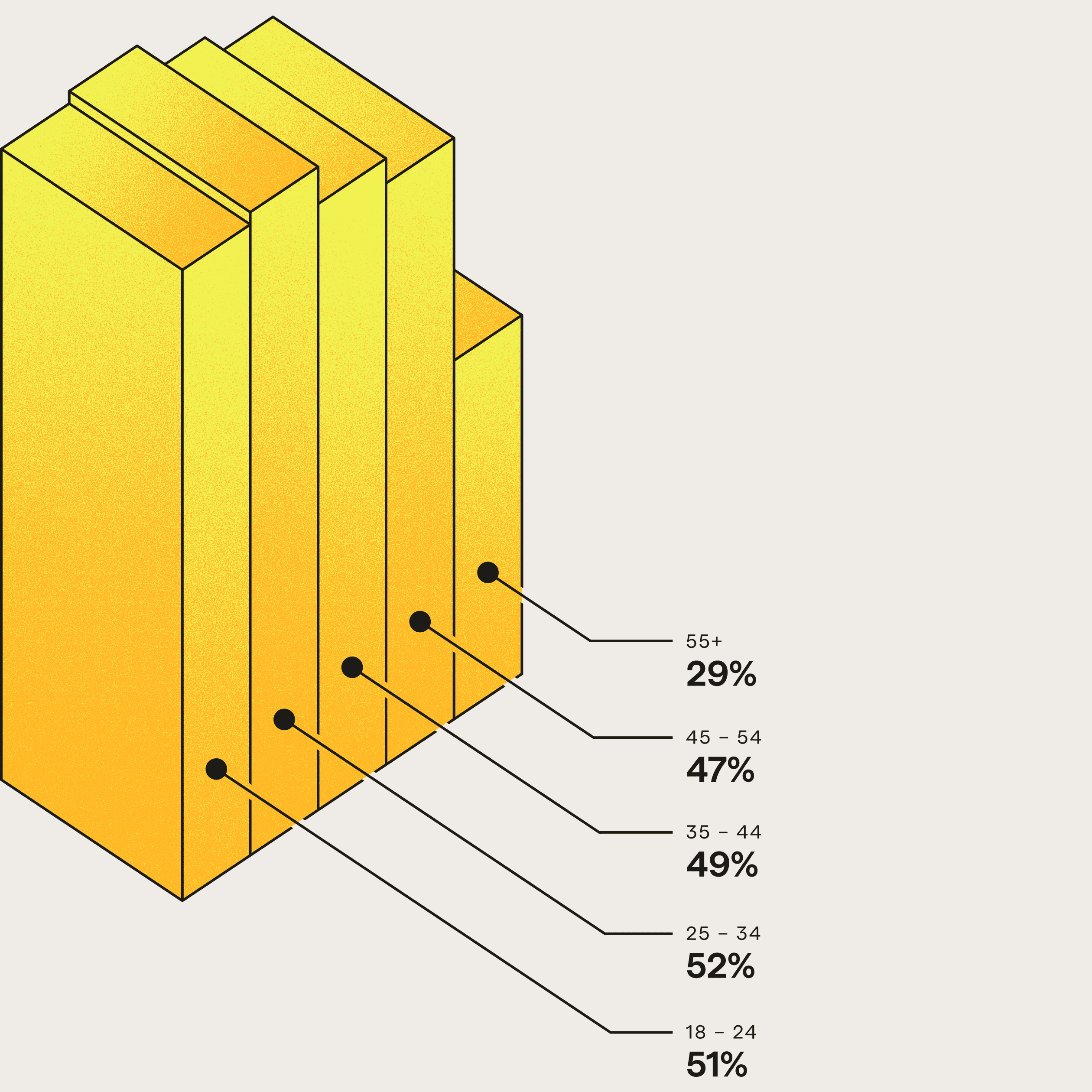

37% of consumers say they found the process of saving for a mortgage "difficult", and of those, 46% revealed it has had a negative impact on their mental well-being. This figure masks a huge variation by age, rising to 69% for those aged 25-34 compared to 29% for those 55 and over.

Open banking: a lifeline for Generation Rent?

The research reveals a strong desire for a fairer, faster and easier mortgage application process.

Save for a mortgage deposit

Open banking can analyse your spending to create personalised savings tips. Some apps also use open banking to allow friends and family to contribute to your "home fund."

Apply for a mortgage in principle

Open banking can aggregate all of your incomings, outgoings and lines of credit to speed up your application.

Apply for a mortgage

Open banking can pull together any additional data that was not submitted for your mortgage in principle.

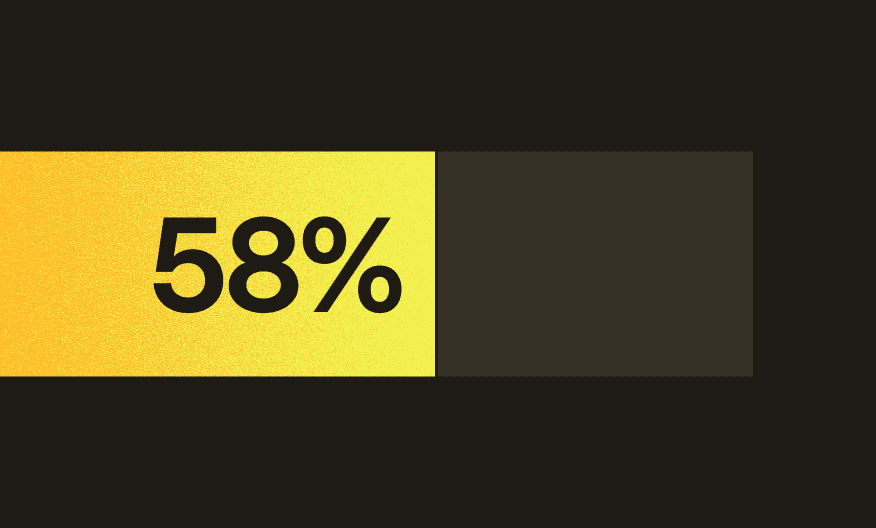

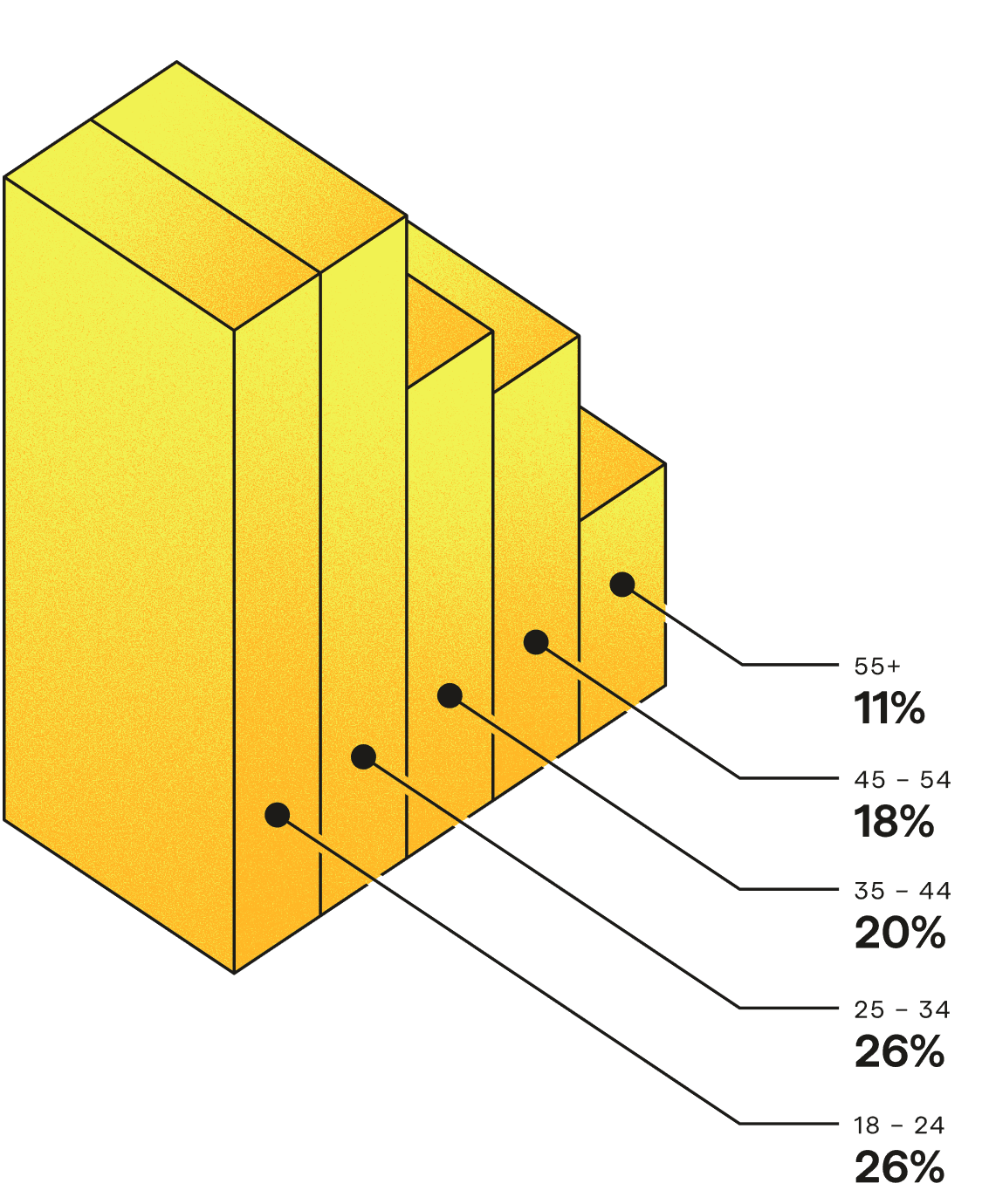

42% of consumers say lenders should embrace new technology like open banking

Those in the 18-34 age bracket, likely to include many first-time buyers, are the most keen. In contrast, consumers aged 55+ were the least enthusiastic.

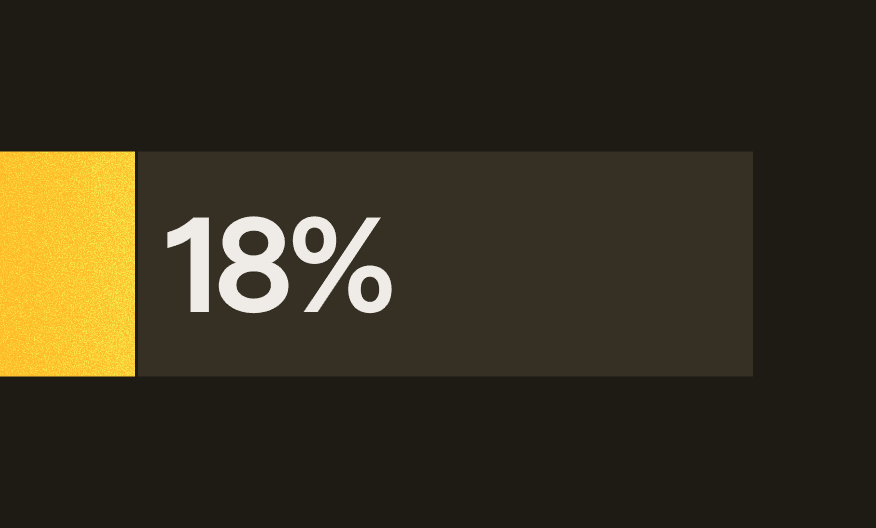

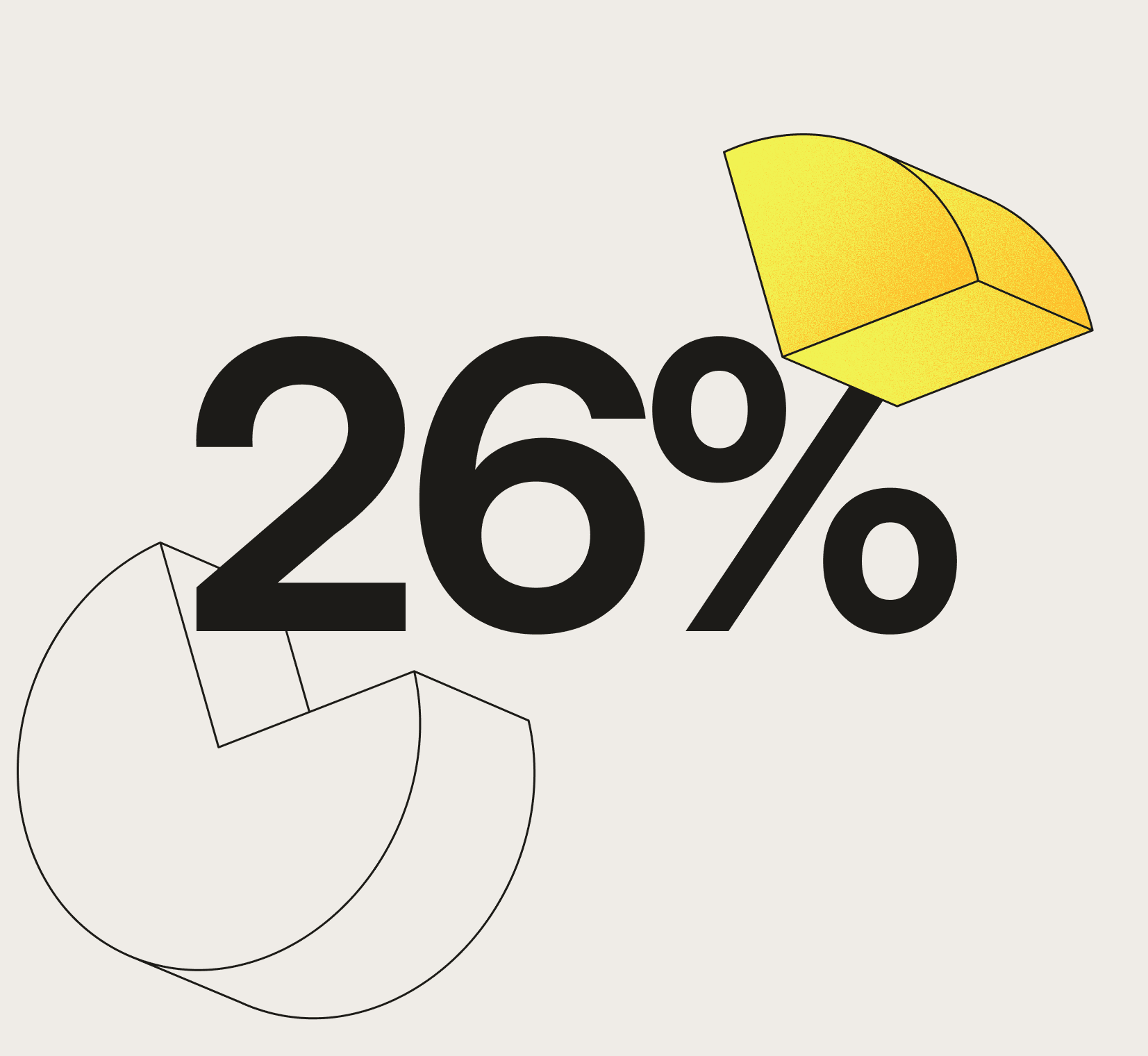

18% believe that open banking would help reduce stress and anxiety in the mortgage application process

This rises to 26% of those aged 18-34. It may also ease the frustrations felt by the self-employed: 31% said they felt "unfairly penalised" by the current system, compared to 18% of the general population.

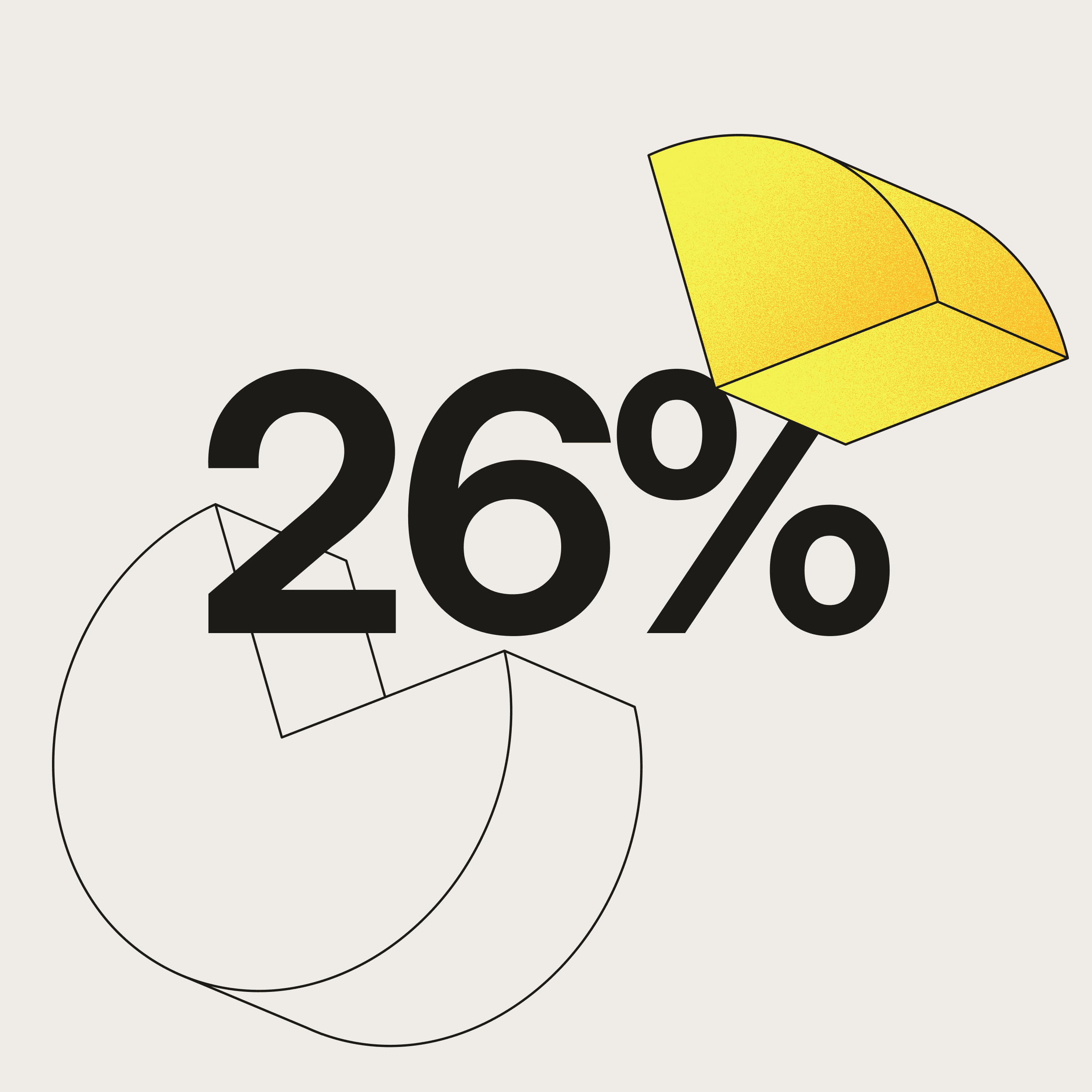

26% of consumers would be open to sharing their bank account data via open banking with a mortgage lender

This proportion jumps to 34% for those surveyed who have purchased a property in the past 12 months -- suggesting their recent experience makes them more aware of the benefits open banking could bring.

Be in the know

Visit the GoCardless blog for our latest news and insights.