THERE'S A BETTER WAY TO GET PAID

With ACH Pull from GoCardless, automatically pull payments from your customers. Receive more cents on the dollar, get paid faster and safer.

Used by 100,000+ businesses. Small to enterprise. Globally.

ACH Pull. Payments as they should be.

Forget expensive fees

GoCardless collects ACH Pull payments. Meaning no card fees. ACH Pull with GoCardless is also fully automated, reducing all payments costs by 56%.

Get paid faster

Receive your money in as little as 2 days with ACH Pull from GoCardless. Save time and improve your cash flow.

Automate admin

Easily see the status of any payment from any customer, any time. And if you connect GoCardless to your accounting system, reconciliation is automatic.

Stop fraud in its tracks

Without the extra link in the chain, like physical devices such as cards or checks, ACH Pull payments are more secure.

Everything your business needs

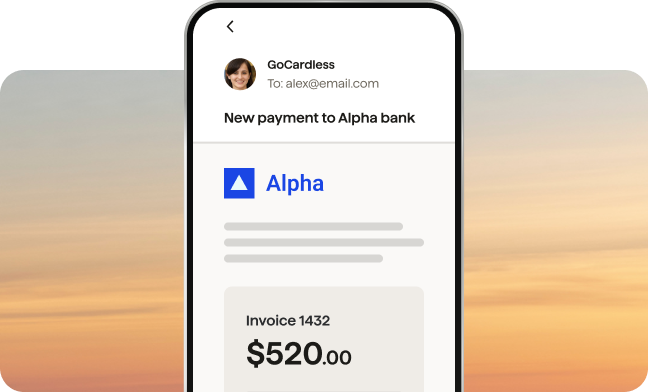

Invoice payments

Automatically collect payments whenever they are due and get paid faster. Reduce admin by reconciling payments with your existing invoicing software, or use our intuitive dashboard.

Automated, recurring payments

Automatically collect payments on the due date via ACH Debit. Even if the dates or amounts change. Perfect for bill payments, subscriptions, installments, invoicing, and more.

![]()

Invoice payments

Automatically collect payments whenever they are due and get paid faster. Reduce admin by reconciling payments with your existing invoicing software, or use our intuitive dashboard.

![]()

Automated, recurring payments

Automatically collect payments on the due date via ACH Debit. Even if the dates or amounts change. Perfect for bill payments, subscriptions, installments, invoicing, and more.

International payments made simple

Collect payments from 30+ countries. Either into a local bank account, or your existing US account, thanks to in-built FX at the real market rate. Powered by Wise.

Intelligently retry failed payments

With ACH Pull, failed payments are rare. But switch on automatic retries and our payments data determines the best day to try again. Recovering ~70% of failed payments, on average.

Better for your customers, too

Businesses and consumers often prefer to make bank payments, instead of using cards and digital wallets. With automation and peace of mind, it’s not hard to see why.

Great on its own. Or connect to the software you already use.

Use our online dashboard. Or connect GoCardless Payments with the software you already use to run your business, to manage everything in one place.

Customer story

“Paying with a low-cost method like ACH debit really makes a big difference for small businesses. It allows us to reduce costs, and, as a result, more money stays in the local economy.”

Carrie Pollak, Owner, Diaper Stork

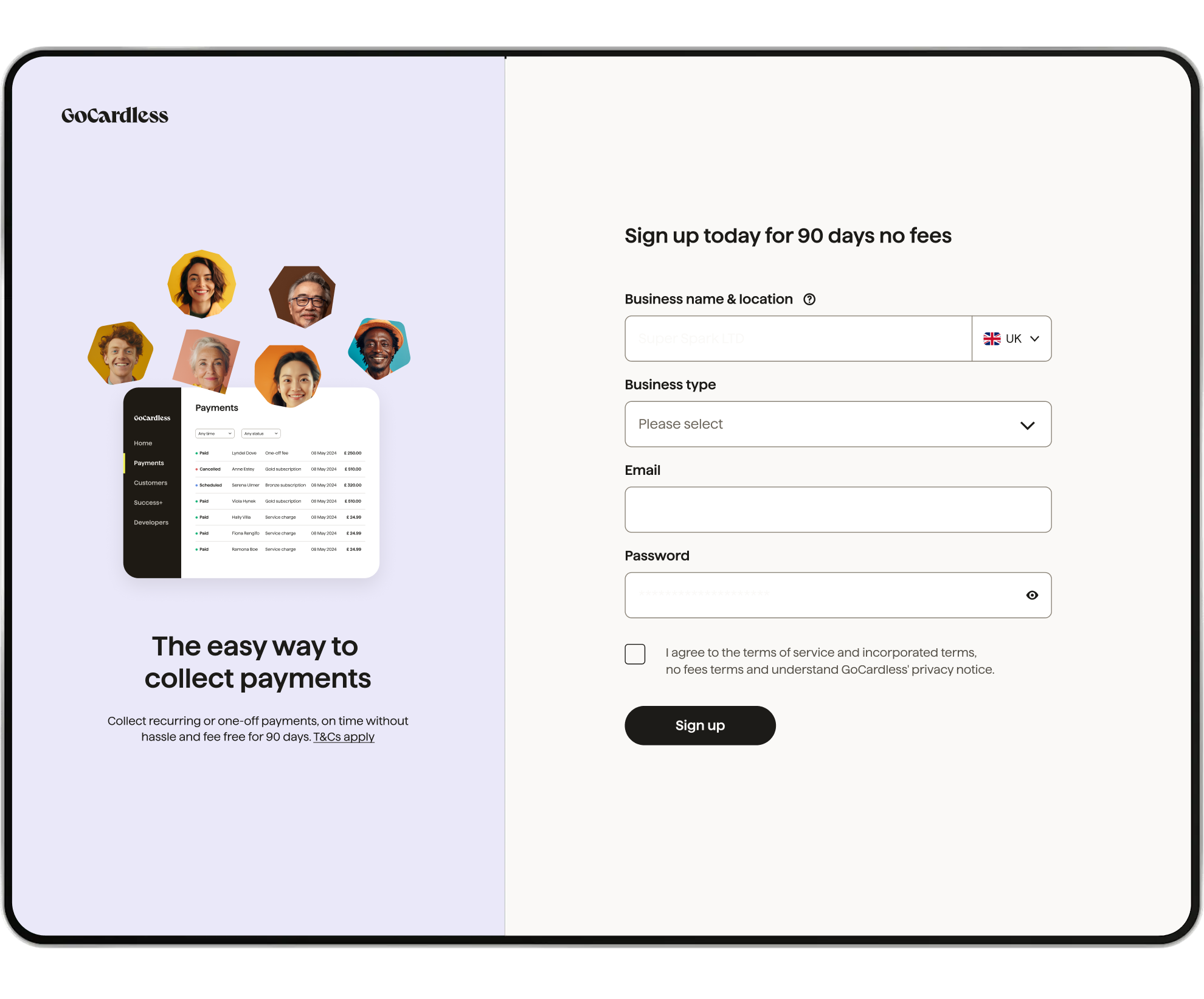

Start collecting payments now

Ready for a better way to get paid?

With ACH Pull from GoCardless, automatically pull payments from your customers. Receive more cents on the dollar, get paid faster and safer.