GoCardless for Xero

End late payments

GoCardless puts you in control of collecting payments directly from your customers’ bank accounts.

Collect invoice payments. Automatically.

1

Predictable cash flow

Take control of unpaid bills. When your invoice is due, GoCardless automatically collects payment from your customer’s bank account.

2

Lower-cost alternative to cards

Bank-to-bank payments cut out the costs of card networks. The automation also greatly reduces the costs involved in chasing and managing payments.

3

Save time

Automatically debit your customer’s bank account whenever your invoices are due.

4

Popular with your payers

When it comes to paying invoices, bank debit is the preferred alternative to manual bank transfers and more popular than card payment.

How it works

All the features you need to streamline your payments

Flexible payments

Made for recurring payments - whether invoicing regular customers or subscription fees.

Seamless integration

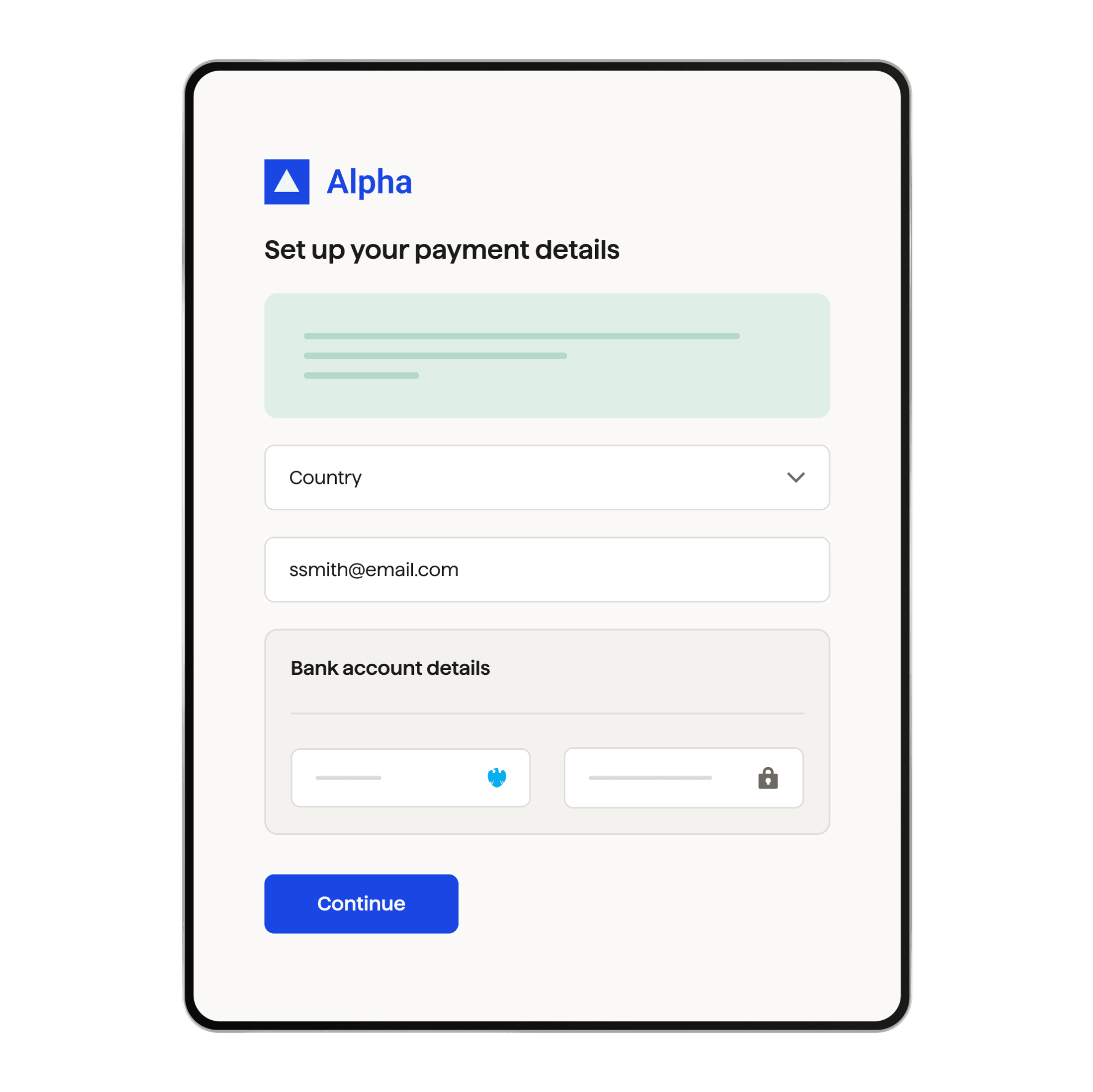

Add GoCardless as a payment service in Xero, then apply it to an invoice or branding theme so customers can pay their invoices online using direct debit. Learn more

Stop chasing payments

Control when you get paid and cut out the stress of debtors. GoCardless allows you to choose when your customers pay you.

Watch a demo

Get a tour of how GoCardless works with Xero

Before GoCardless, our payment process was slow and expensive. It’s now incredibly simple and cost-effective. I want to systemize everything; I don’t want to be chasing payments every month.

Sam Caulton, Finance Director, Re-Leased

Trusted by 85,000 businesses worldwide

Ready to get started?

Stop chasing late payments and save precious time by connecting GoCardless to your Xero account now.