Paylinks make getting paid easy

Reduce late and failed payments

Save money on transaction fees

Automate payment collection

Reduce manual financial admin

Fully secure & regulated solution

Integrate your accounting software

![[en-AU] Homepage – Merchant logo – Simply Energy (black)](https://images.ctfassets.net/40w0m41bmydz/7e8sFP6AjmPDFa3MkScjlm/20da743939defaba7e6c49cf13308362/au-01-Simply_Energy.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – Deputy (black)](https://images.ctfassets.net/40w0m41bmydz/13LsfVpwWUhqelIbnJRE40/ce11ab0564c25b4681a15ebd4bdac993/au-02-Deputy.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – SiteMinder (black)](https://images.ctfassets.net/40w0m41bmydz/12B1ARE17oDA2N3WUTsYEL/02c64d47da02981c9f6f578e4a54f5f6/au-03-Siteminder.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – DocuSign (black)](https://images.ctfassets.net/40w0m41bmydz/3fMoyxmgPCZYAaXfR9yq8I/93252f7d23450ccb3f5a07c263978d59/au-04-DocuSign.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – Aon (black)](https://images.ctfassets.net/40w0m41bmydz/1eO8nwj5V73PaM7KFmsInL/4fbaae170631770d3ed11ce5889bd733/au-05-Aon.png?w=200&h=100&q=50&fm=png)

![[en-AU] Homepage – Merchant logo – UNHCR (black)](https://images.ctfassets.net/40w0m41bmydz/1NivxWaXwV5sE6QxQ8stHe/7717ca499e70b5d004fd0d125e8850ac/au-06-UNHCR.png?w=200&h=100&q=50&fm=png)

Collect instant, one-off & recurring payments, with no chasing, stress or high fees.

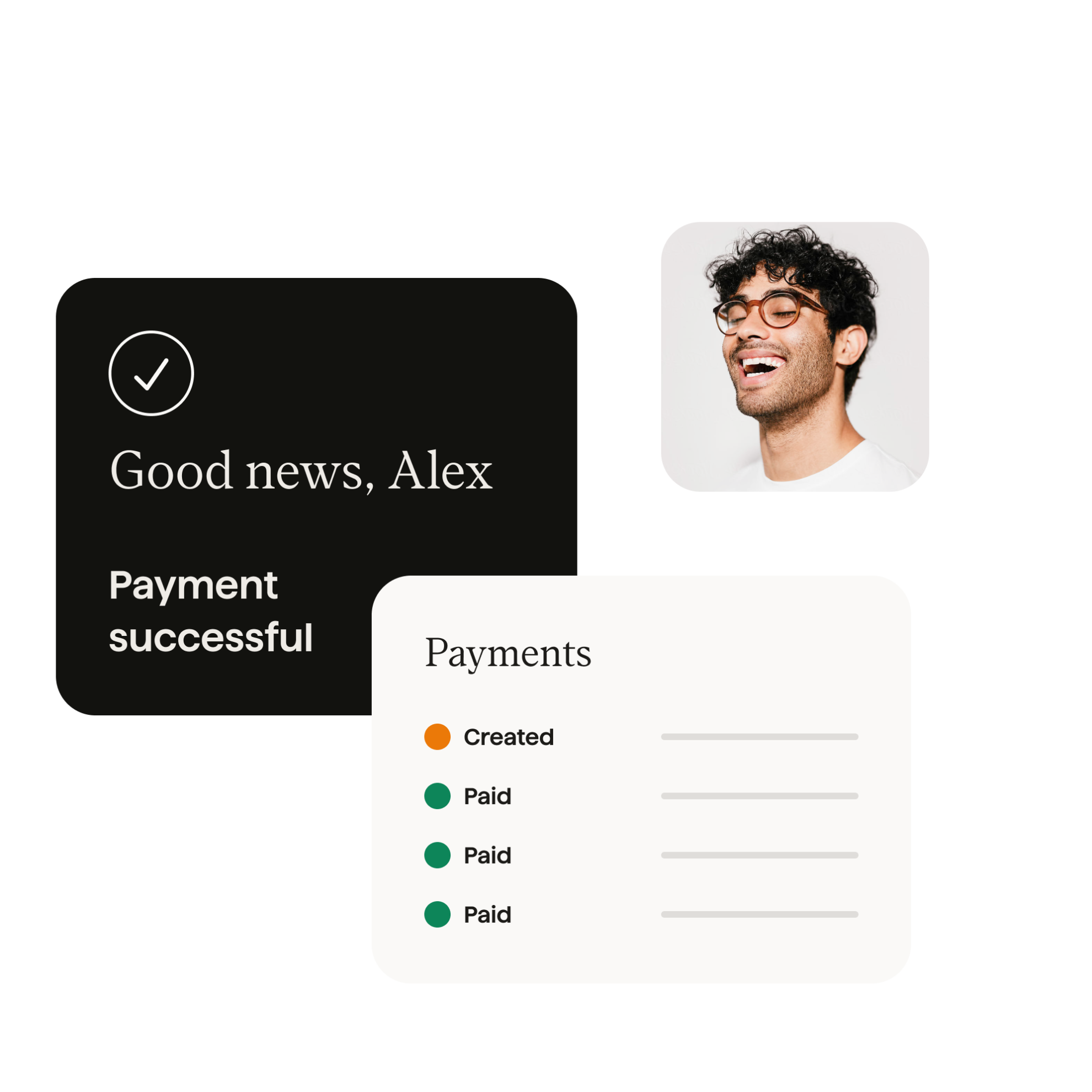

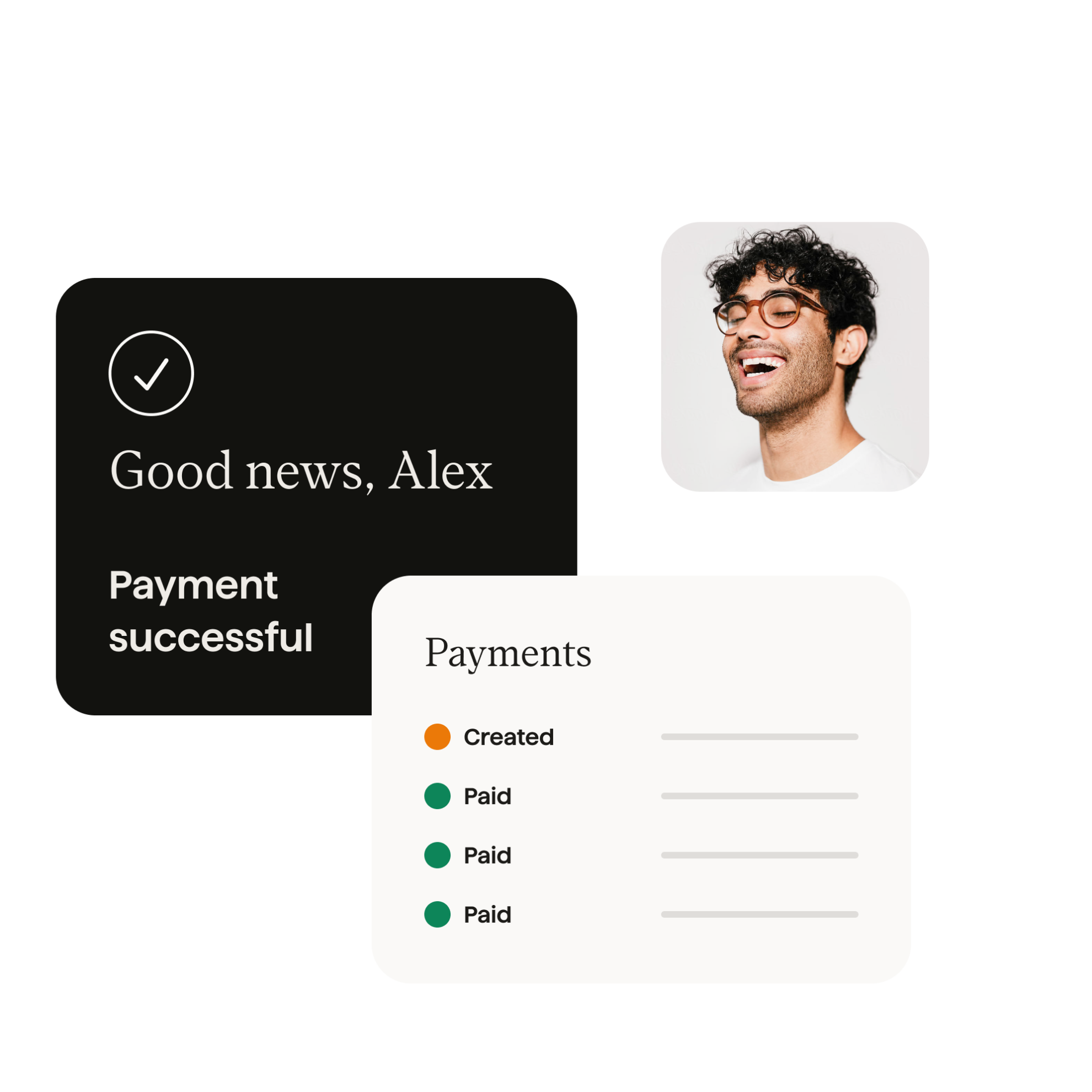

Quick & easy online payment system

Online payments are simple to set up and easy to manage in our user-friendly dashboard in just a few clicks.

Integrate with your accounting software

GoCardless integrates with over 350 different software packages and also offers API access should you require it.

Save hours of admin

Automate your payments and finance admin. No more wasted time manually balancing the books.

Say goodbye to late & failed payments

GoCardless collects via bank payments which means fewer failed payments compared to cards. You can easily schedule payment collection for the dates you require in just a few clicks.

No sign up costs. No contract.

No contracts required

GoCardless offers a pay-as-you-go pricing model with no contract or long-term commitment required.

Merchants can sign up to the GoCardless platform and set up payments for free - you only pay for payments you collect.

Cheaper than cards

Using another payment gateway to accept online payments via cards can be over 3x more expensive than GoCardless!

Exactly how much you'll pay will depend on the card network & your specific fee structure, but on average, fees range between 1.5% - 3%.

Cost-effective & transparent

Not only is GoCardless a cheaper web payment gateway, but we also provide pricing transparency.

Accepting a $500 card payment will cost a merchant between $7.50 and $15. However, with GoCardless, that transaction costs just $4 on our Standard Plan.

Try the GoCardless payment gateway service risk free today.

Pay as you go pricing, with low transaction fees and no monthly contract, plus the ability to automate payment collection.

Get started in minutes. No upfront commitment.

How GoCardless works

Payment Gateway FAQs

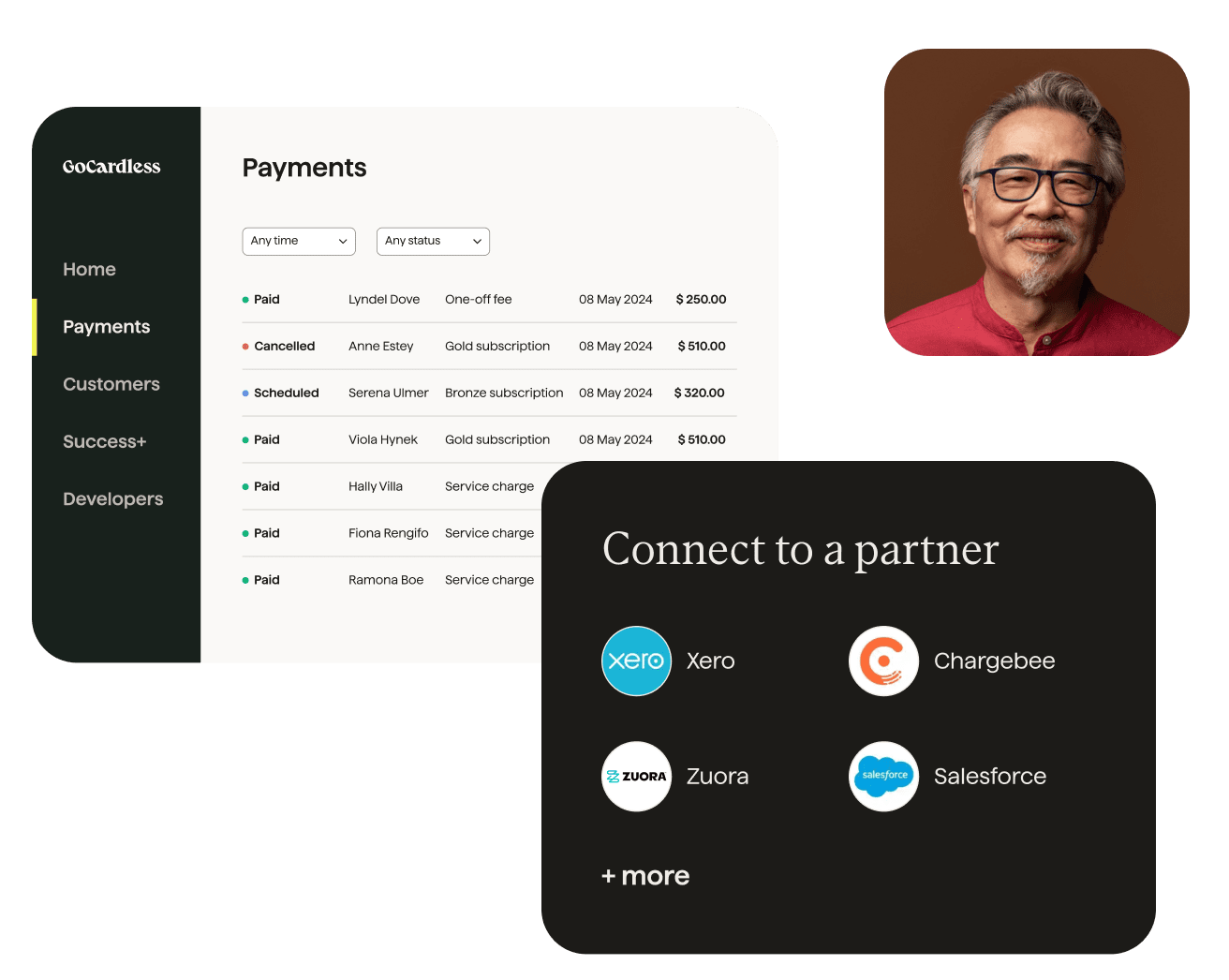

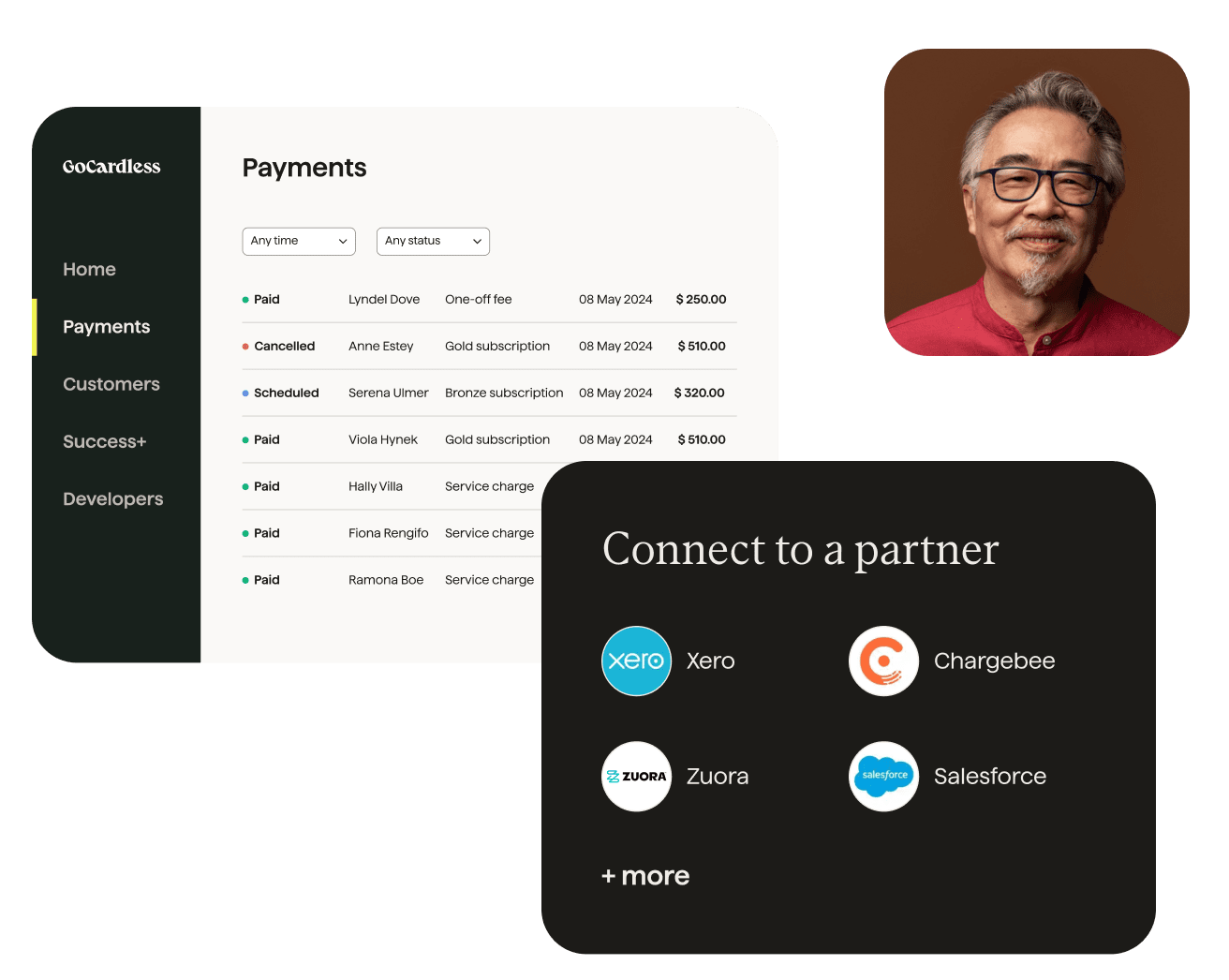

Connect to your software and save hours of financial admin

You can use GoCardless through our dashboard, custom integration or a partner.

If you’re already using billing, accounting and CRM software, connecting GoCardless to your account via our seamless integration is easy to set up.

On average GoCardless merchants spend 59% less time managing payments.

An easier & cheaper way to collect recurring payments

Small businesses can now enjoy the same payments functionality and benefits as larger brands with Direct Debit.

...with GoCardless payments are automatically collected without the hassle of chasing clients for late payments." - Simon Kallu, Managing Partner, GrowFactor

"It takes all the stress away of people not paying..." - Simon Denney, Owner, Pure & Clean

"...it's fantastic as an alternative to collecting payments on cards because you aren't paying the fees associated with cards." - Pete N, G2 Reviewer

Customer case studies

![]()

Seamless integrations

"Xero has chosen GoCardless as its best-in-class solution for Direct Debit and it shows."

Ready to get started?

Pay as you go pricing, with low transaction fees and no monthly contract, plus the ability to automate collection and reconciliation to reduce financial admin. Super simple to set up. Get started in minutes!