PayTo

INSTANT, LOW COST PAYMENTS HAVE LANDED

Paying too much on credit card fees? Initiate secure, one-off or recurring bank payments with PayTo.

Join the payment innovators who are already leading the way

Bank payments have entered the fast lane

Get paid faster, smarter and safer with PayTo and GoCardless.

Easily take pre-authorised payments directly from your customer’s bank accounts after a single approval.

With seamless integration into your existing checkout process, it’s a snap to set up one-off and recurring payments. For both you and your customers.

Harness the power of PayTo through GoCardless to effortlessly migrate your customers to PayTo mandates and offer your customer both Direct Debit and PayTo payments.

No fuss. No friction. Just faster, 24/7 payments.

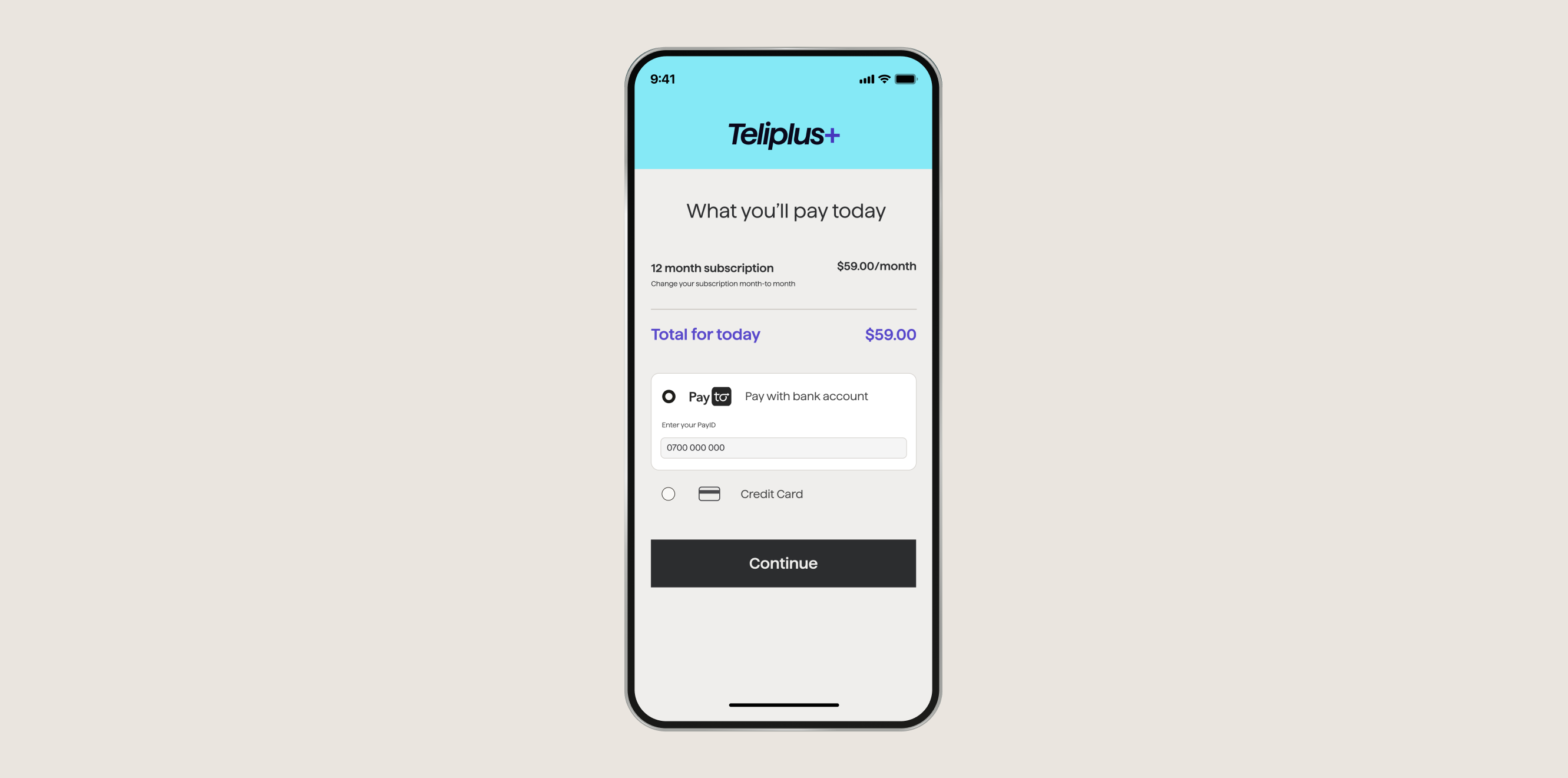

Your customers can now make subscription payments in seconds

Watch how PayTo + GoCardless help you get paid faster.

Streamline your growth with PayTo + GoCardless

PayTo is perfect for:

Subscription goods and services

Create flexible recurring payment plans to suit your business. PayTo’s real-time account validation and notifications remove uncertainty before providing products or services, and allow you to offer a secure, low-fee alternative to credit cards.

Instant one-off and recurring payments

PayTo is transforming subscription payments with its single setup requirements. Not only can you instantly collect first payments, set up fees or hardware costs upfront. You can also set up and approve recurring payments in one go.

![]()

Subscription goods and services

Create flexible recurring payment plans to suit your business. PayTo’s real-time account validation and notifications remove uncertainty before providing products or services, and allow you to offer a secure, low-fee alternative to credit cards.

![]()

Instant one-off and recurring payments

PayTo is transforming subscription payments with its single setup requirements. Not only can you instantly collect first payments, set up fees or hardware costs upfront. You can also set up and approve recurring payments in one go.

Card-on-file payments, but better

PayTo can be set up to work just like card-on-file. But, unlike credit cards, bank accounts don’t get lost, stolen or expire. PayTo pulls payments directly from your customer's bank account so you can reduce credit card fees and stop worrying about failed payments.

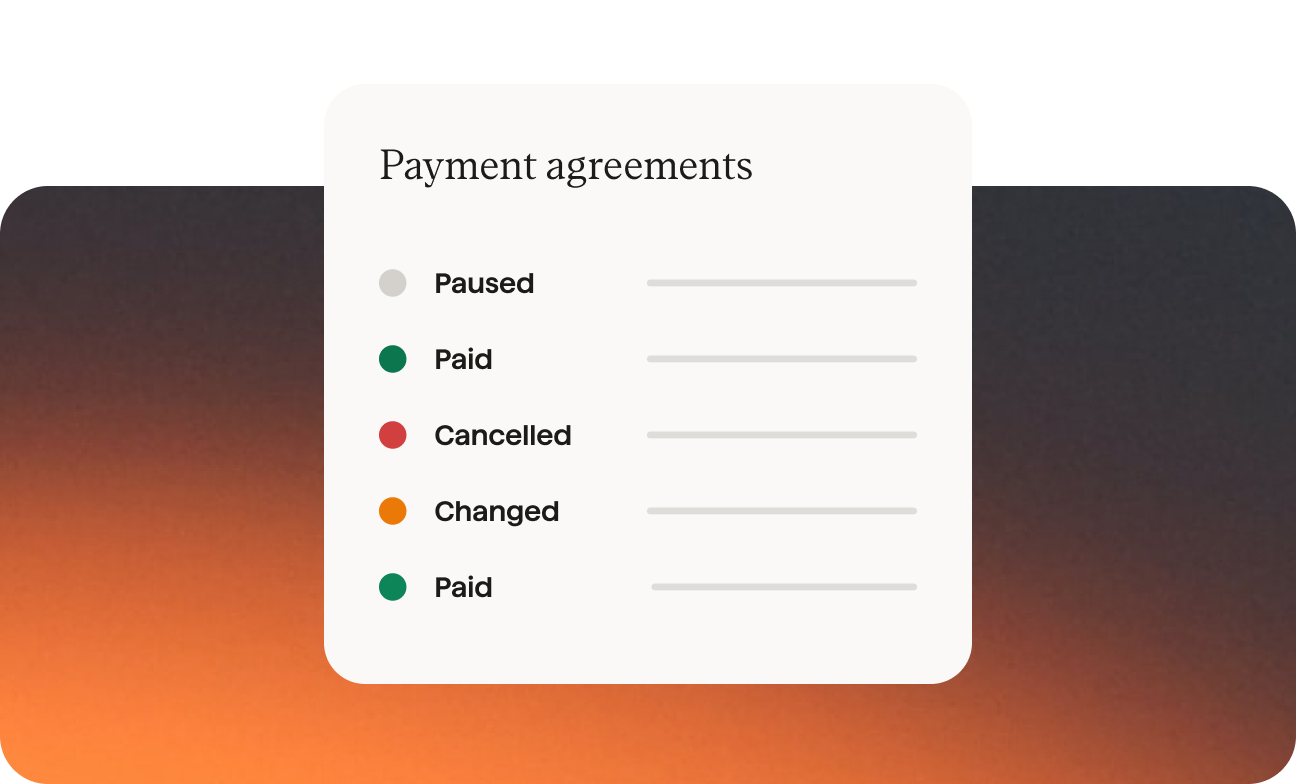

Invoicing

Easily keep track of instalments or buy now pay later (BNPL) plans and get money in your account faster. When you set up PayTo’s instant notifications, you’ll be notified every time a payment is successfully collected or an agreement is cancelled.

![]()

Card-on-file payments, but better

PayTo can be set up to work just like card-on-file. But, unlike credit cards, bank accounts don’t get lost, stolen or expire. PayTo pulls payments directly from your customer's bank account so you can reduce credit card fees and stop worrying about failed payments.

![]()

Invoicing

Easily keep track of instalments or buy now pay later (BNPL) plans and get money in your account faster. When you set up PayTo’s instant notifications, you’ll be notified every time a payment is successfully collected or an agreement is cancelled.

Our investment in PayTo is part of our continuing commitment to provide customers with the best experience, from policy discovery to payments.

Brad Miller, General Manager, BizCover

Get the knowledge to empower your business

Join PayTo University and discover how to grow your business with this new, digital payment solution. PayTo University is a free, self-paced course that demystifies the incredible capacity of PayTo and shows you how to smoothly implement it into your current payment process. Join PayTo University and lead the direct debit revolution today.

Seamless integration with your current software

PayTo will quickly and easily integrate with your existing workflow.

We’re partnering with leading billing and CRM platforms to integrate PayTo into your payments process.

Want a custom integration? Our simple API offers hassle-free integration. And we’ll help you migrate legacy direct debit agreements with ease.

Move at the speed of innovation

Many of the major banks are still building PayTo and won’t be offering it until early 2023. But you can get ahead of your competition today. Start driving faster, safer and better payments. Talk to us about how PayTo + GoCardless can optimise your current payments system and seize the power of this cutting-edge technology.