Enterprise

Reduce conversion risk

Globally, bank debit is the preferred payment method for common recurring payment needs, being most preferred 42% of the time. With GoCardless, easily add bank debit to your payment mix and win more customers.

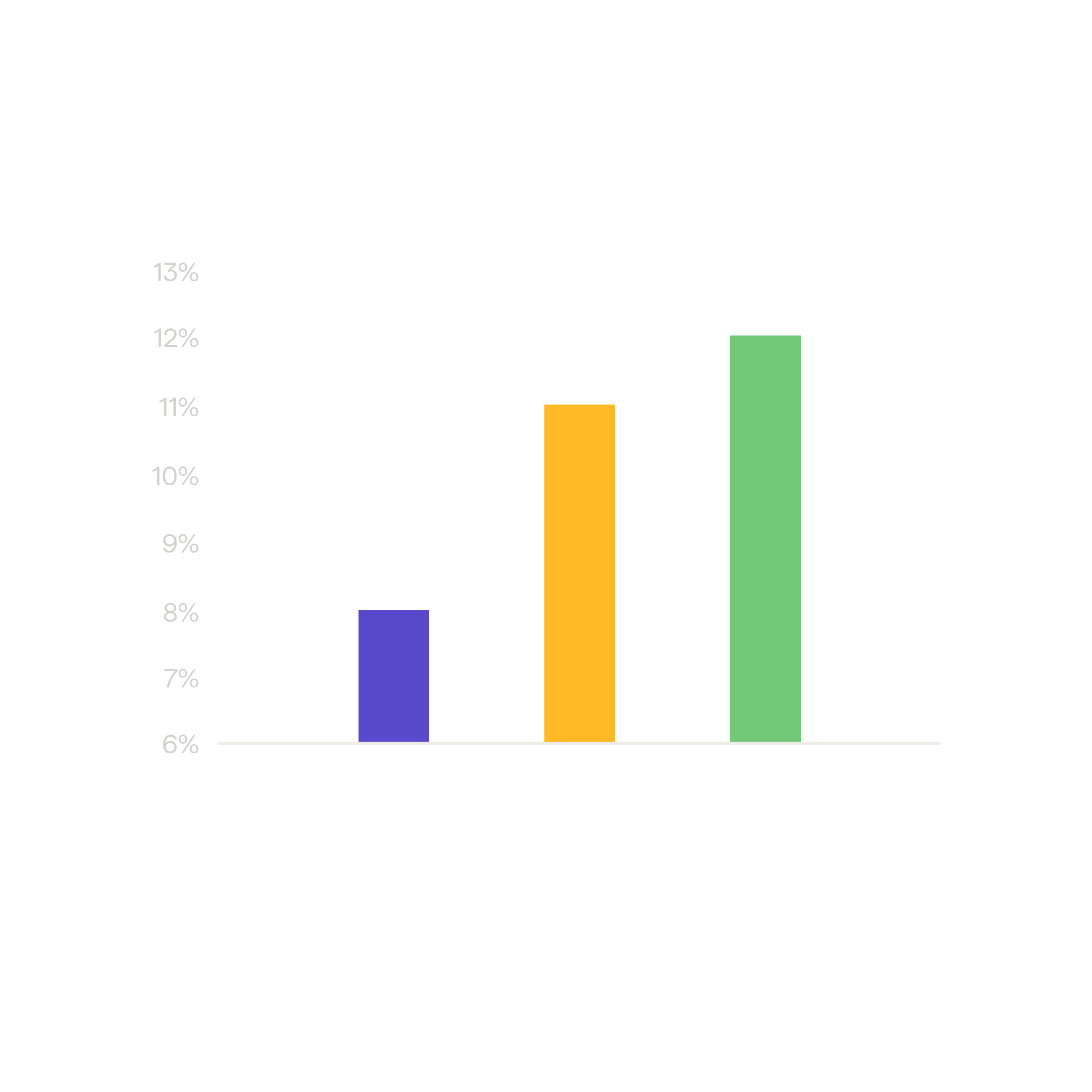

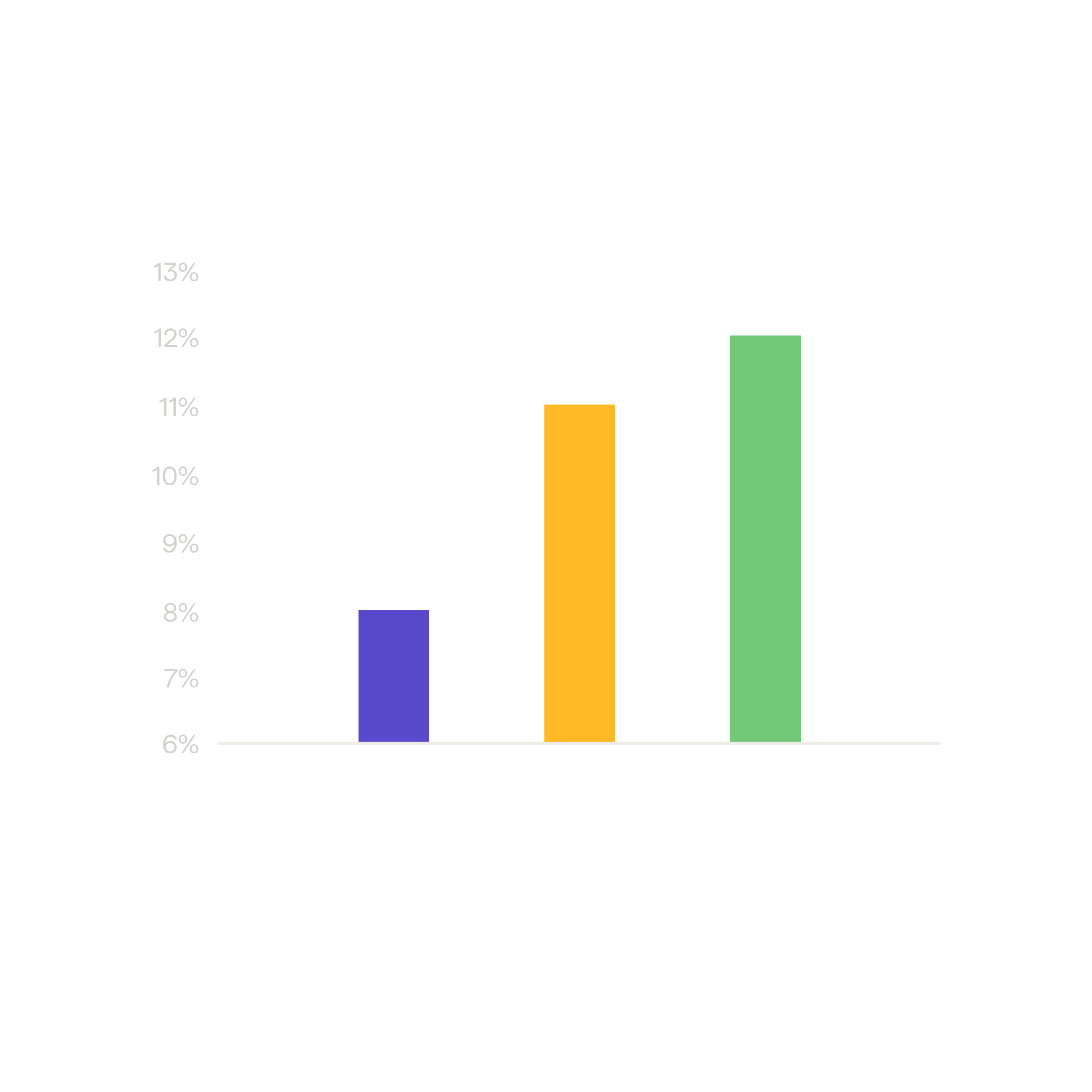

How would your customers prefer to pay you?

Payment preferences change from country to country – while cards are popular in the US, bank debit is a more preferred method in the UK and Australia. If you only offer one payment method, you’ll limit the customers who choose your brand.

The reason we added direct debit with GoCardless as a payment option was to hit our very aggressive international growth numbers. Direct debit is a preferred payment method, especially in Europe, and we were lacking parity.

Study participant, IDC White Paper

Read what 700 decision-makers say about conversion

Did you know half of all businesses see more than 7% of payments fail? And that leads to bad debt, higher churn and loss of revenue.

This startling statistic was uncovered in a Forrester Consulting survey of 700 payment decision-makers.

Read the full report to get all the insights, as well as recommendations for how to overcome your payment challenges.

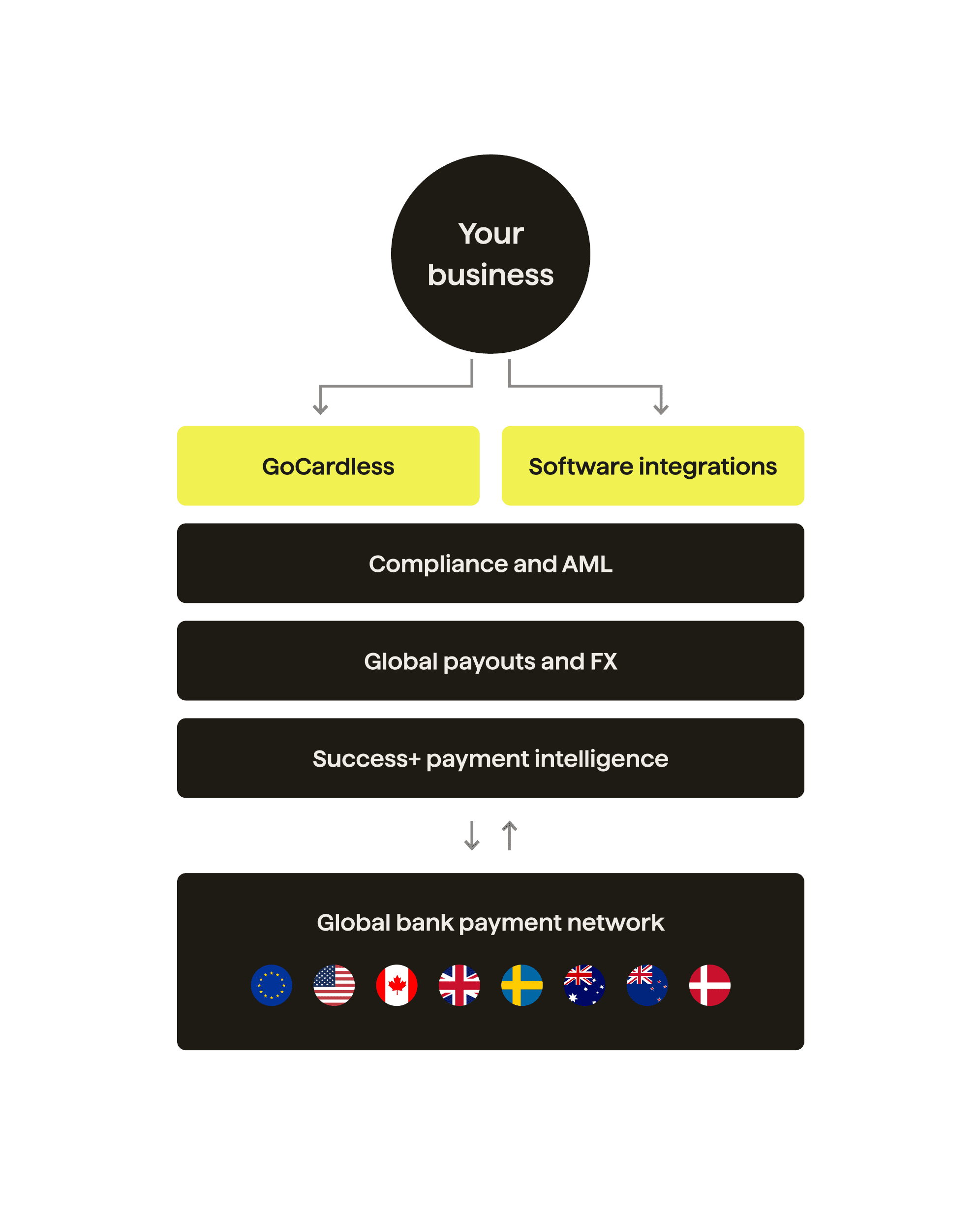

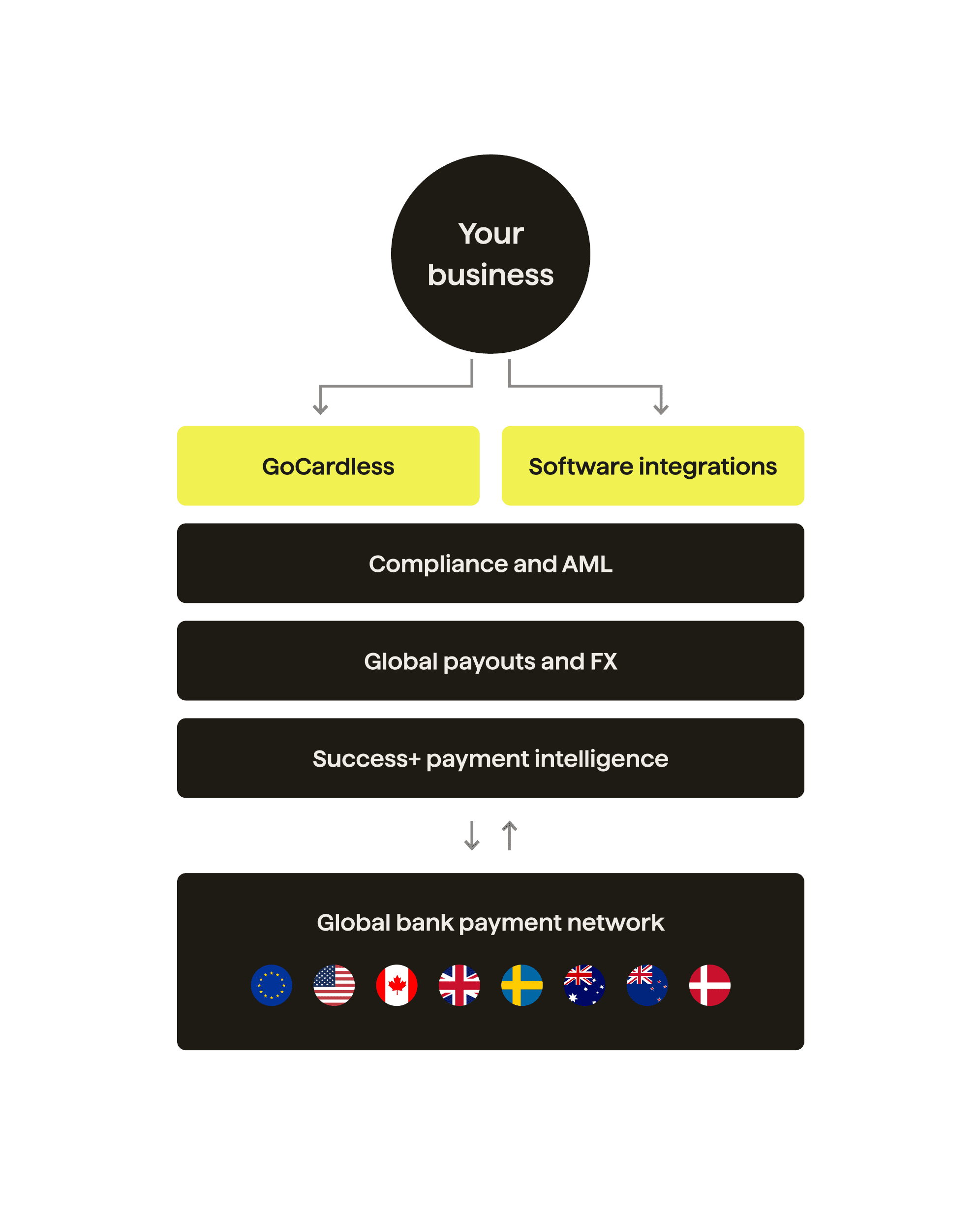

Diversify your payment options with GoCardless

GoCardless can coexist alongside other payment methods to give customers in over 30 countries the option of bank debit – opening up their payment options and your brand’s potential.

Local payments with a global reach

The first global network designed for recurring payments, GoCardless allows you to offer the option of local bank debit payment in more than 30 countries. That includes the UK and Europe, US, Canada, Australia and New Zealand.

Low payment failure rates

With GoCardless, around 97.3% of payments will be collected successfully first time around. With real-time reporting, you’ll know instantly when a payment does fail so you can act fast.

Integrate with your existing systems

Connect GoCardless to your global tech stack with our extensive list of partner integrations, including Salesforce, Zuora and Chargebee. Or use our API.

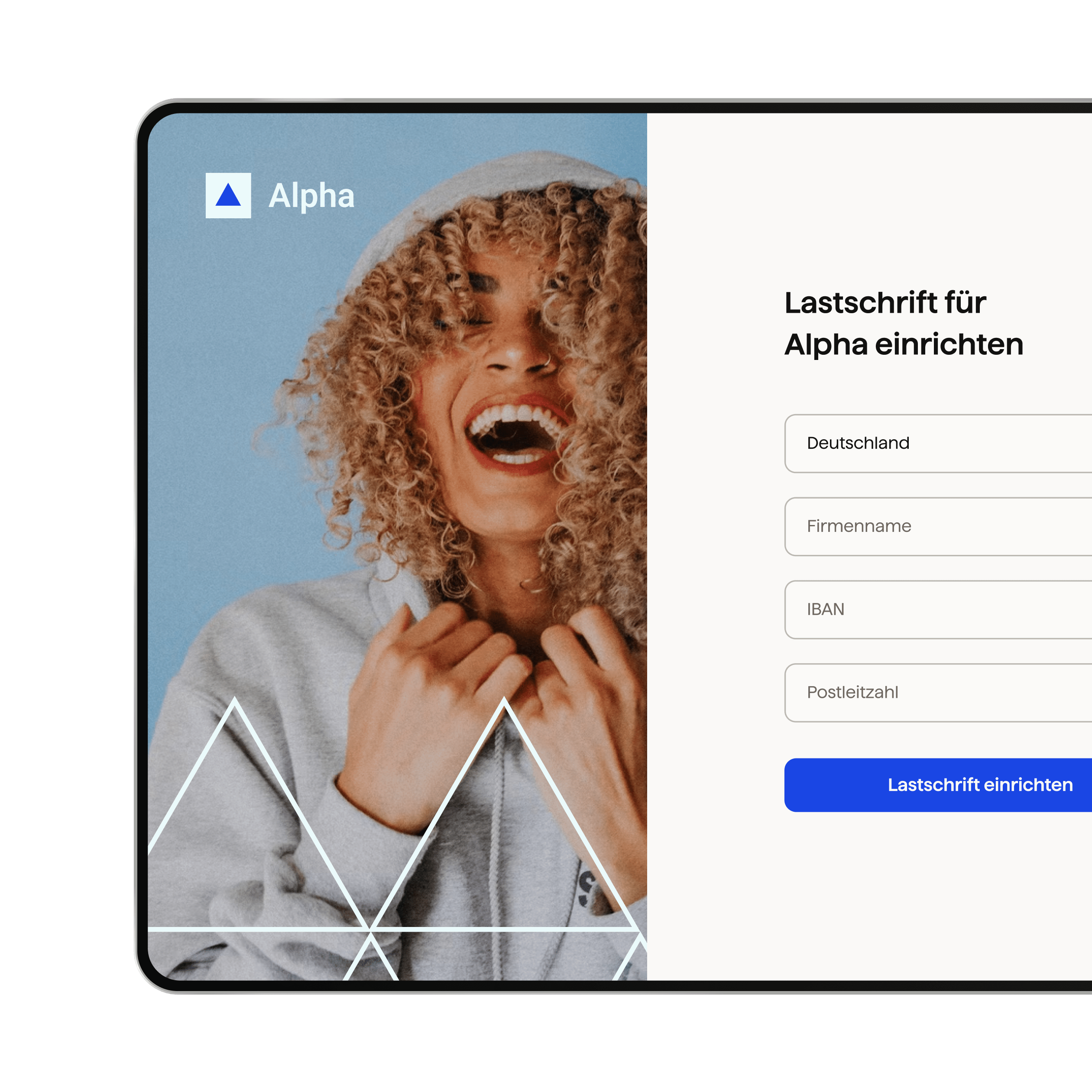

Optimised payment pages

With GoCardless, fully customise our out-of-the-box payment pages, or build a bespoke integration using our API. Plus, localise your payment pages to meet the needs of your global customers.

To date, wherever we offer GoCardless it’s the preferred payment option, with 50%-85% adoption. For us, it means we get paid reliably and on time with better visibility into our payments data.

Diego Passarela, Head of Billing and Payments, Quandoo

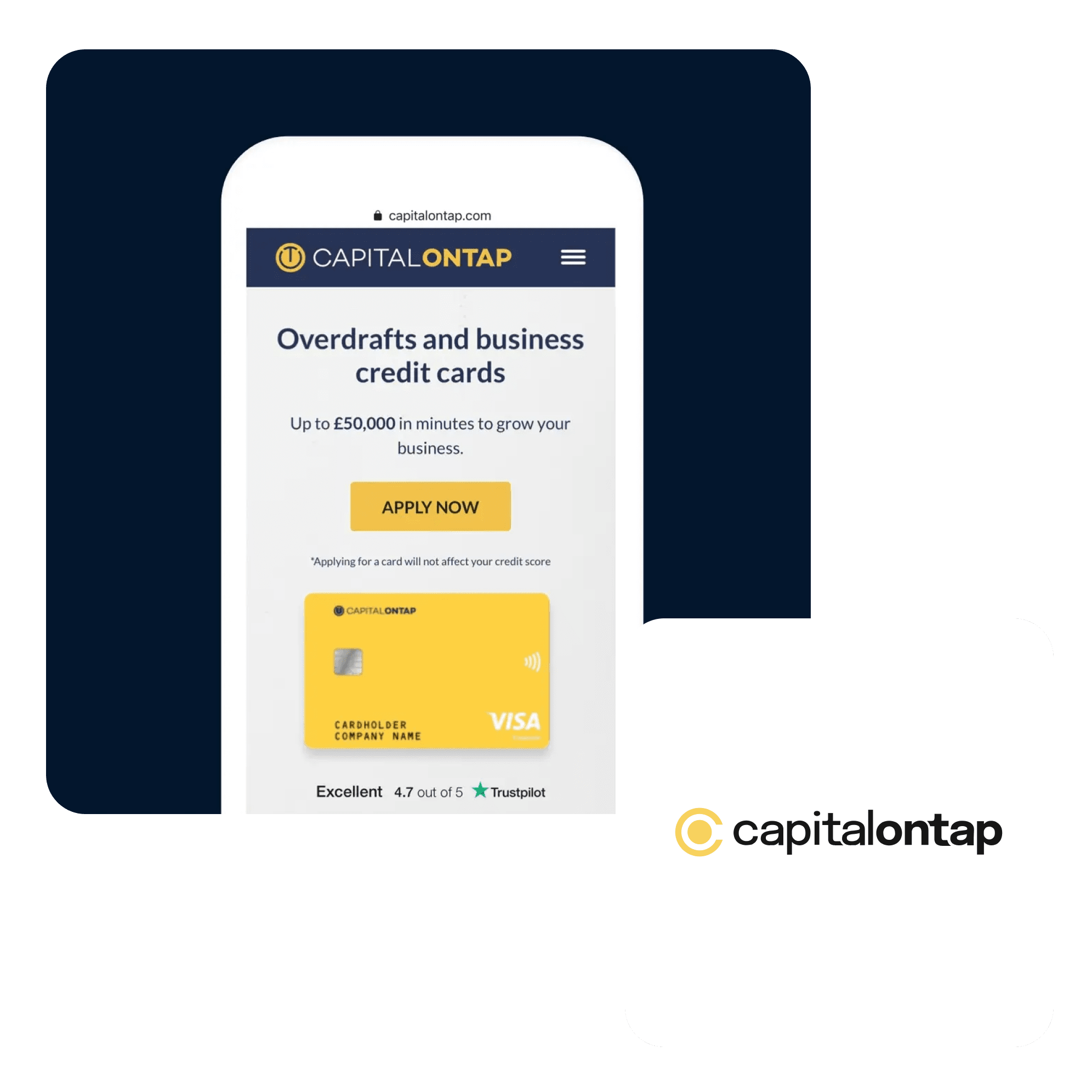

Capital on Tap reduces the cost of collecting payments by 90%

Report: Global payment preferences for recurring B2B purchases in 2020

Trusted by 85,000+ businesses. Of all sizes. Worldwide.

How can we help?

Speak to one of our recurring payment experts about payment preferences around the globe, and we’ll show you how GoCardless can support your goals.