Enterprise

Boost conversion, with GoCardless

Bank transfers? Card payments? You’d be surprised what your customers’ preferences really are.

Give your customers what they want

If your customers can pay you using the method they prefer, they’ll be happy. If they can’t, they might choose your competitor instead.

Preference changes from country to country. Industry to industry. But globally, both consumers and businesses tend to prefer bank payments.

Fortunately, that’s our forte.

Read our report on payment preferences

“The reason we added Direct Debit with GoCardless as a payment option was to hit our very aggressive international growth numbers. Direct Debit is a preferred payment method, especially in Europe, and we were lacking parity.

Study participant, IDC White Paper

Read what 700 decision-makers say about conversion

Did you know half of all businesses see more than 7% of payments fail? And that leads to bad debt, higher churn and loss of revenue.

This startling statistic was uncovered in a Forrester Consulting survey of 700 payment decision-makers.

Read the full report to get all the insights, as well as recommendations for how to overcome your payment challenges.

Cater to preference, convert more customers

Already got cards or manual bank transfers covered?

Add GoCardless to your payments mix. And collect both instant, one-off payments as well as automated, recurring payments. Direct from your customer’s bank account to yours.

That way you’ve got everyone covered, for maximum conversion.

Local payments, global reach

No matter where your customers are in the world, make paying you quick and simple. With GoCardless, offer a trusted payment method and localised payment pages for 30+ countries.

Forget about failure rates

Successfully collect 99% of instant one-off payments, and 97.3% of automated recurring payments, on the first try. If one does fail, Success+ automatically retries payments on the best day for each customer.

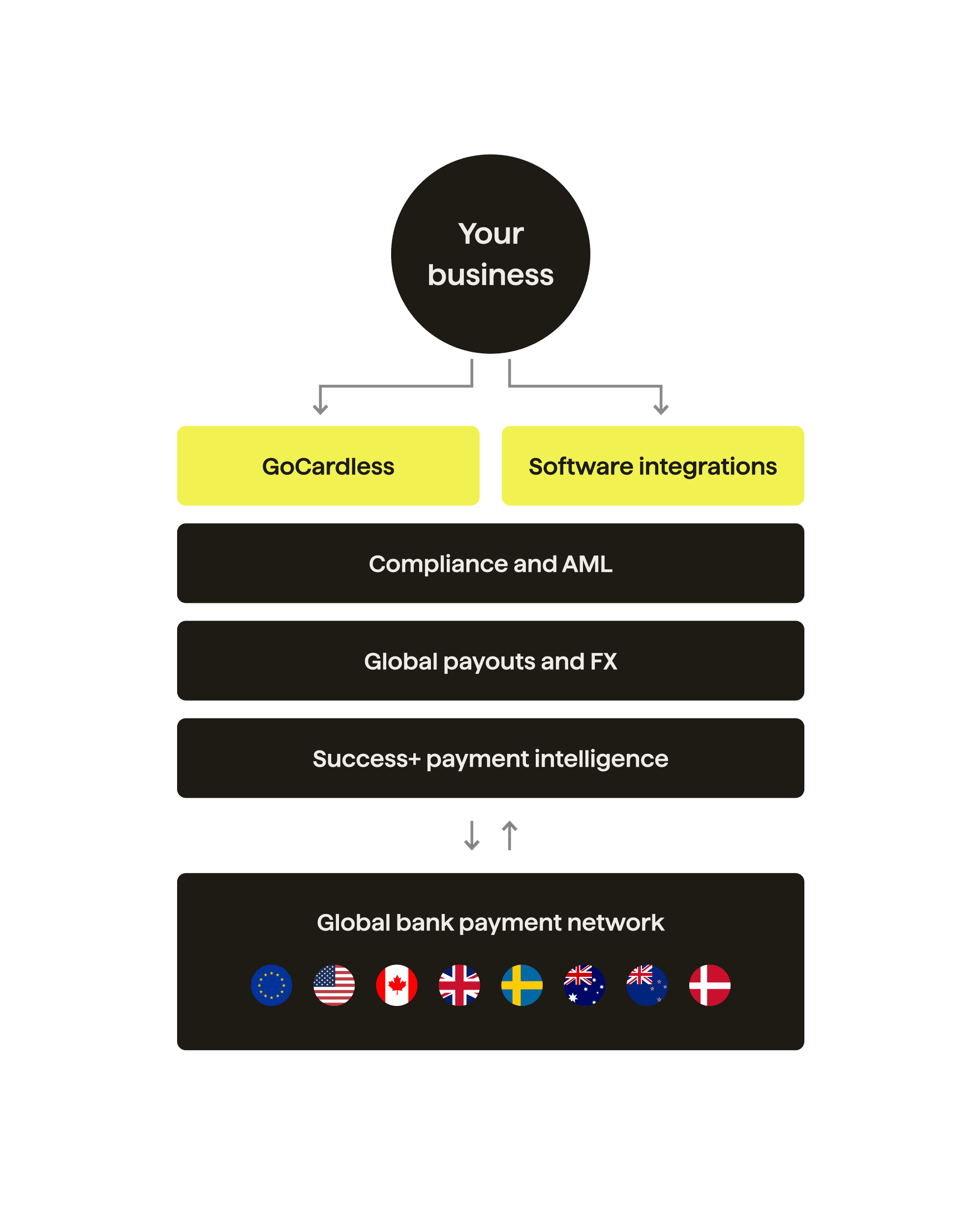

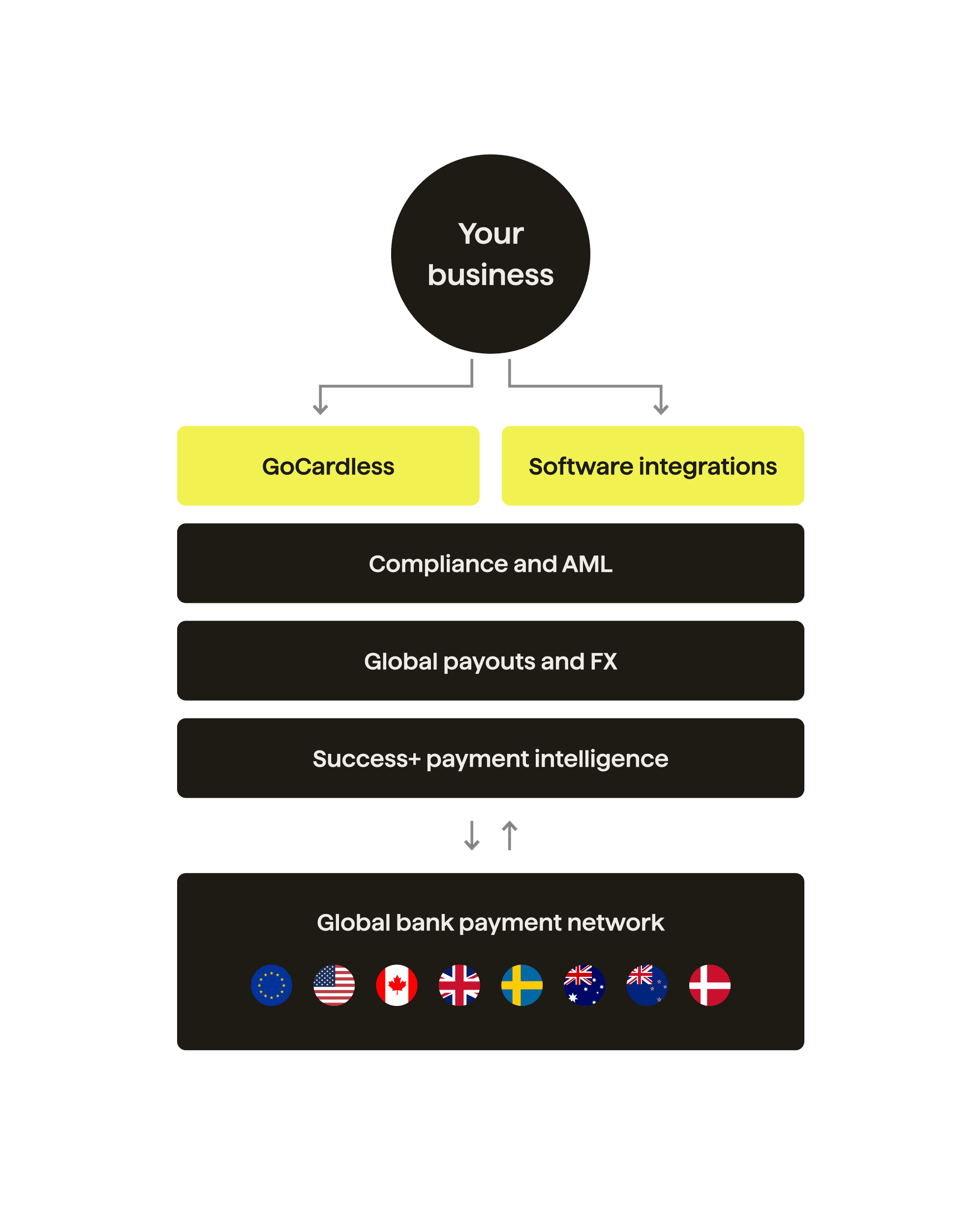

We play nice with others

Connect GoCardless to your existing tech stack with our extensive list of partner integrations, including Salesforce, Zuora and Chargebee. Or use our API.

Payment pages that push prospects through

Our out-of-the-box payment pages are optimised for conversion. But you can customise them to your heart’s content. Or build a bespoke integration using our API.

To date, wherever we offer GoCardless it’s the preferred payment option, with 50%-85% adoption. For us, it means we get paid reliably and on time with better visibility into our payments data.

Diego Passarela, Head of Billing and Payments, Quandoo

A 90% reduction in the cost of collecting payments…

Capital on Tap obsesses over helping small businesses, and works with over 70,000 SMEs.

With GoCardless, Capital on Tap has been able to move over 80% of its global customers to bank debit and reduce the costs of collecting payments by 90%.

Report: Global payment preferences for recurring B2B purchases in 2020

Trusted by 75,000+ businesses. Of all sizes. Worldwide.

All set to supercharge conversion, with GoCardless?

Speak to one of our payment experts about your challenges with conversion. We’ll show you how GoCardless can help.