Made for payment success

Success+ uses payment intelligence to manage and reduce payment failures. Recover, on average, 70% of failed payments.

Join the 8,000 businesses already using Success+

Failed payments are optional, not inevitable

Failed payments are a concern for every business. Customers can unintentionally churn when their payments fail and 11-15% of uncollected funds turn into bad debt. Although not all customers are unwilling to pay, complex and manual collections processes give every customer the same payment recovery experience. Success+ intelligently manages your late payments. Automatically collecting 70% of failed payments on the day best suited to your customers. Creating a smoother experience for them and better cash flow for you.

70%

Average recovery rate of failed payments

Why use Success+?

Put your customers first

Save your customers from awkward conversations, by collecting failed payments on the best day for them. 70% of businesses said Success+ improves their relationships with customers.

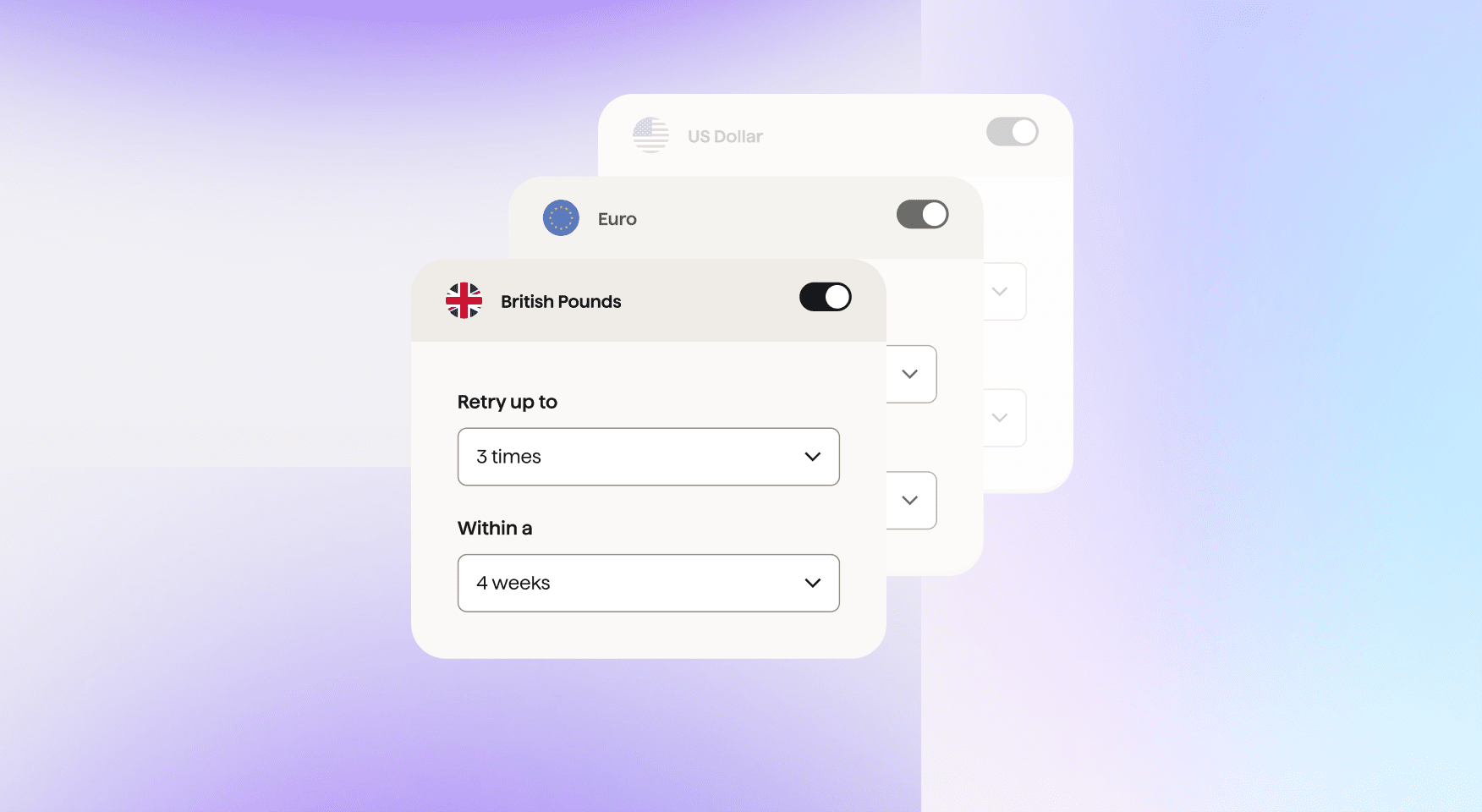

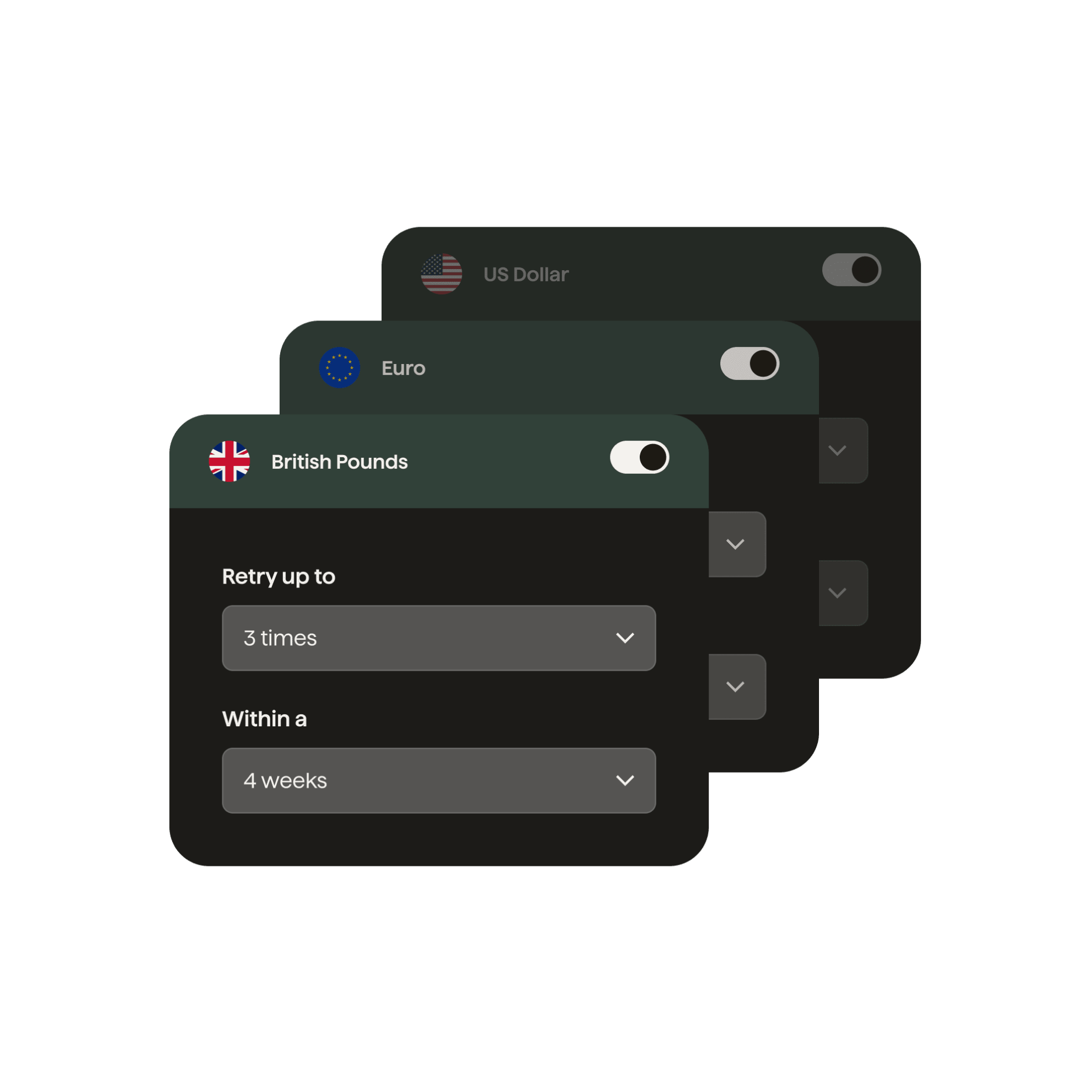

Reduce your admin burden

Success+ does all the heavy lifting, automatically retrying payments up to three times and with visibility of which payments have been successfully collected. 89% of businesses said Success+ saves them time.

Increase your revenue

With Success+, efficiently recover more revenue, so fewer payments are written- off as bad debt or churn involuntarily. Increase your payment success rate to 99.1%.

“The impact was immediate — we’ve seen payment failures drop from 3.6% to 0.48% in three months. This 7.5x improvement in failed payments collected is huge for a fast-growing company like Plum — and helps ensure a seamless experience for our customers.”

Elise Nunn, Head of Operations, Plum

How it works...

"Every failed payment could become a customer service issue, but Success+ from GoCardless has transformed that experience."

Chris McQuillan, Commercial Manager, Lifestyle Fitness

Useful resources

![Calculate how much revenue you could recover with Success+]()

Calculate how much revenue you could recover with Success+

![Say farewell to failed payments with the intelligent payment recovery engine]()

![Discover the impact of payment failure on businesses]()

Discover the impact of payment failure on businesses

Getting started

For developers

Have a look through our API documentation here and see how to enable Success+.

Do you have more questions?

We've put all the frequently asked questions about Success+ on a dedicated FAQs page.

Are you a GoCardless partner?

Give your customers the gift of collecting more payments successfully with Success+. Here’s everything you need to know.