Last editedSep 20255 min read

The bulk change process is a simple way to transfer your existing Direct Debit mandates over to another provider

This article will explain the Direct Debit bulk change process. The Direct Debit transfer process allows you to switch from one Direct Debit provider to another while still collecting payments and causing customers no disruption.

In this article, you will learn:

Direct Debit is a great way for businesses to collect customer payments. It is cheap, reliable, and allows firms to control payment collection, but what happens when you want to change direct Debit service providers?

The bulk change process is a simple way to transfer your existing Direct Debit mandates to another provider.

What is the bulk change process?

Bulk change is the process that updates Direct Debit mandates. It allows the merchant name, reference and SUN on a mandate to be changed, as long as:

Customers are notified of the change (although they don't need to take any action)

The new SUN owner agrees (if relevant) and so does their sponsor bank

The old SUN owner agrees (if relevant) and can assist in the transfer

How to change Direct Debit to a different bank account

If you are currently a Direct Debit customer of an organisation and want to change bank accounts from which you pay Direct Debit, please read about transferring Direct Debits here.

If you are a business looking to change your Direct Debit provider, please read on.

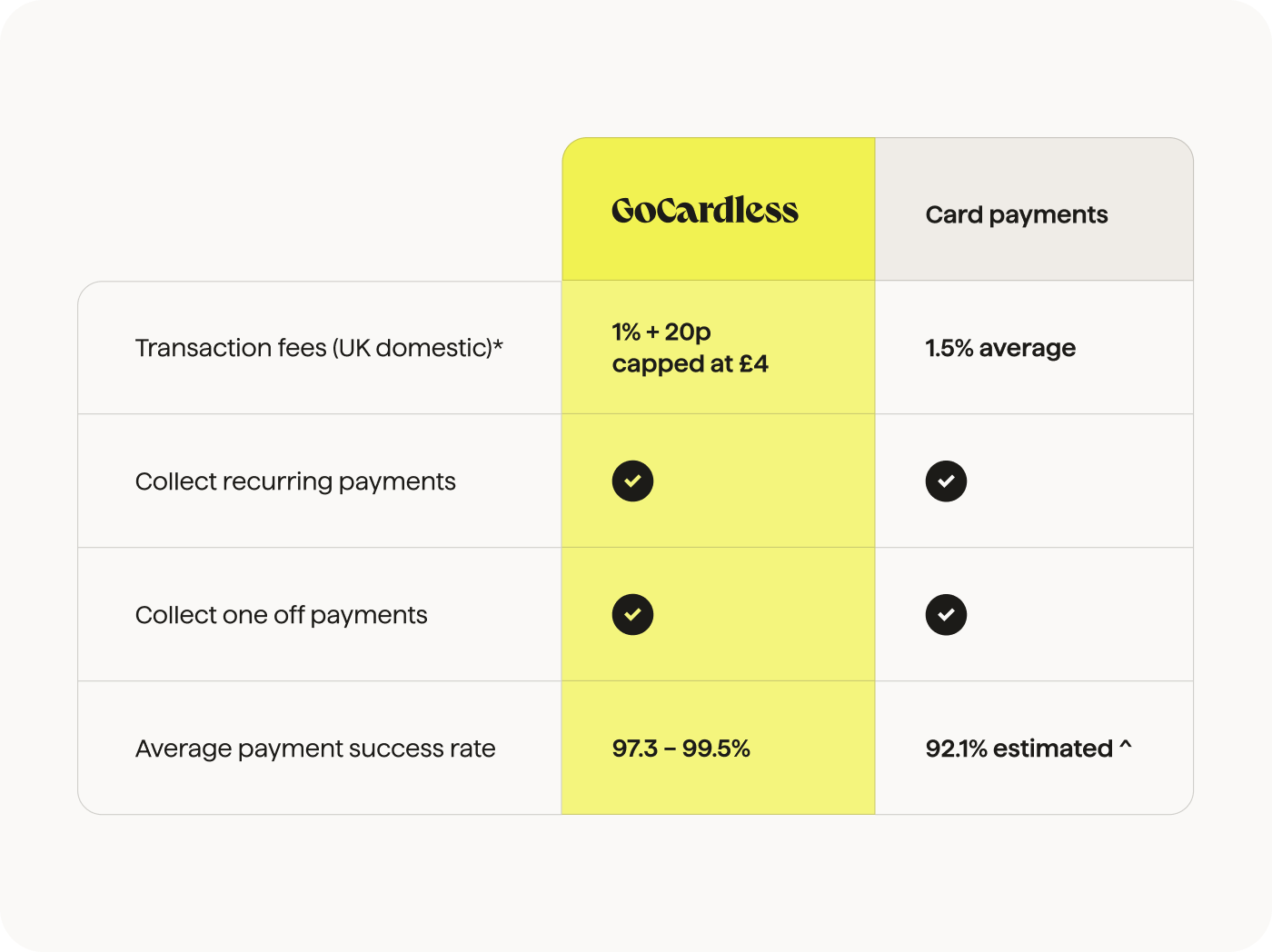

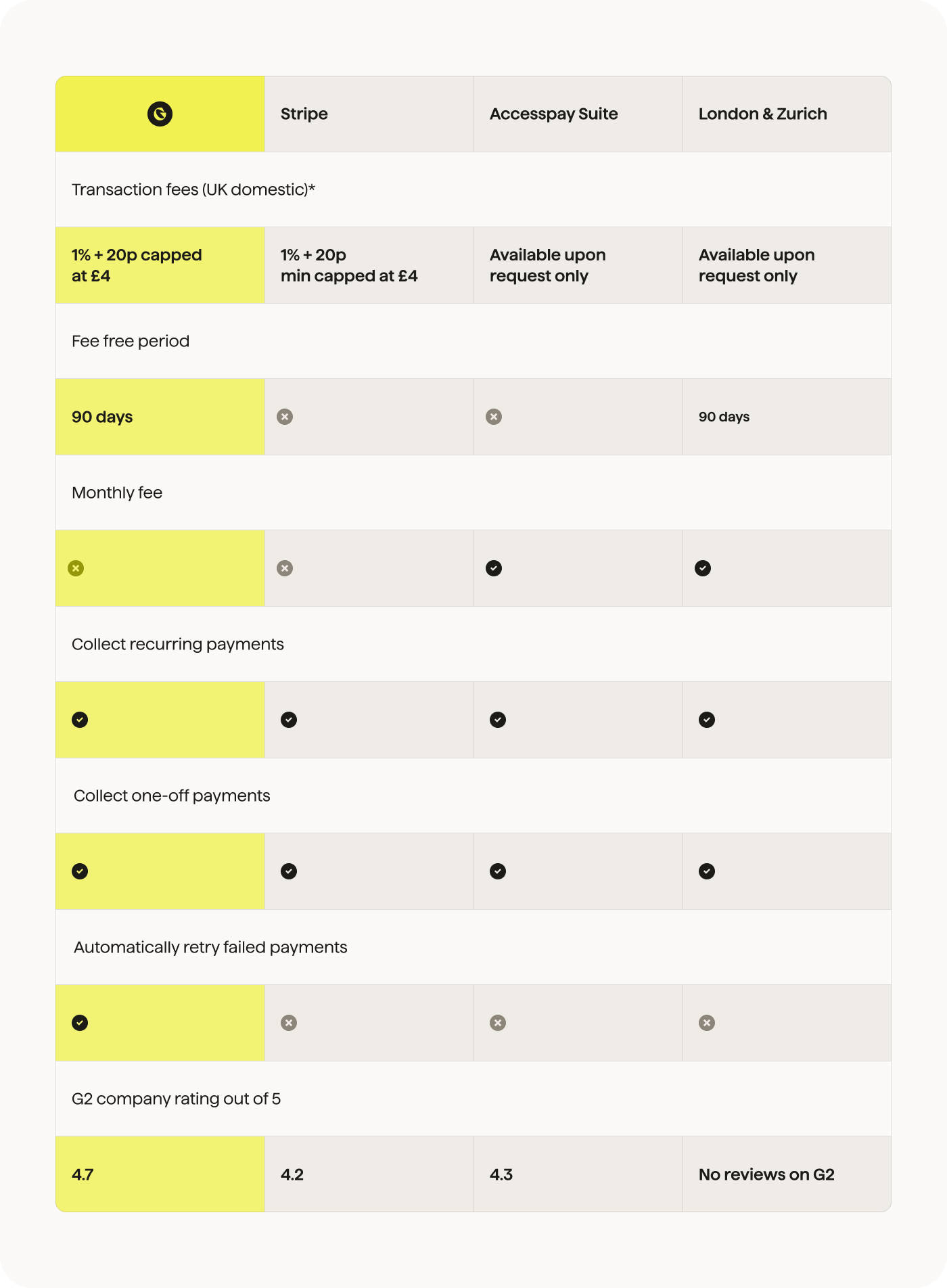

* Pricing as of Aug 2025. Fees differ by provider. ^ Based on market research. Payment success rates vary.

How to collect Direct Debit payments with GoCardless

1.

Create your free GoCardless account, access your user-friendly payments dashboard & connect your accounting software (if you use one).

2.

Easily set up & schedule Direct Debit payments via payment pages on your website checkout or secure payment links.

3.

From now on you'll get paid on time, every time, as GoCardless automatically collects payment on the scheduled Direct Debit collection date. Simple.

Who might need to transfer Direct Debit providers?

If you are a business that currently collects Direct Debit payments from customers, you are using one of the following three arrangements:

1. Direct Submitter

You are a direct submitter to Bacs. As a direct submitter, your company has its own Service User Number (SUN) and is required to upload payment files directly to Bacs.

Direct submission is an option very large businesses often choose as they have the resources needed to be compliant with the scheme's requirements.

2. Direct Debit Bureau

You could use a Direct Debit Bureau, a third-party organisation that uploads the files to Bacs on your behalf. Your business will still need to create the payment files and can choose to use its own SUN.

Therefore using a Bureau is suitable for businesses that need more control over the Direct Debit process. You'll also be able to sign customers up using paper mandate forms and over the phone rather than just using online mandates.

3. Direct Debit provider

A Direct Debit provider is similar to a Bureau - it is a third-party Direct Debit service provider. The main difference between a Bureau and a Direct Debit provider is that providers like GoCardless, offer a more complete, done-for-you service.

This means that your Direct Debit provider will create the files and submit them to Bacs under their own SUN, and you'll sign up your customers online.

A Direct Debit provider is ideal for smaller businesses that need all the advantages of Direct Debit but also a hands-off payment collection process with no contracts or commitment.

Using a third-party service?

As a direct submitter, you will not need to manage a bulk change process as you are your own provider.

However, if you use a Bureau or a Direct Debit provider, then at some point, you may want to switch Direct Debit providers - this article is for you!

This guide will walk you through transferring your Direct Debit mandates to another Direct Debit provider as approved by Bacs. We'll also address some of the most frequently asked questions about the bulk change process.

Why change Direct Debit providers?

The main reasons you may be thinking about changing your Direct Debit provider are likely to be the level of service received, the costs of payment collection, or a combination of both.

Alternatively, you may deal with too much paperwork and want to switch providers for a more automated, streamlined process. Or you may need more visibility on payments.

Why GoCardless?

GoCardless offers a Direct Debit collection service that is quick and easy to set up, is reliable and affordable, with award-winning support that you can rely on.

The merchant dashboard provides visibility on payments and integrates with over 350 accounting software packages, allowing you to save time on tedious manual admin.

GoCardless vs others

* Pricing as of July 2025. Plans vary.

Accept Direct Debit payments for your business with GoCardless

How do you change Direct debit Provider?

To change a Direct Debit mandate, you can use the bulk change process. As part of this process, you'll need to notify:

the customer

the organisation

the bank

For each customer you are moving, you will need their:

Name

Email

Address

Bank details

You'll also need the unique identifiers that connect individual member records with their respective mandate information.

This unique identifier is typically an email address or membership number.

The member record contains the following information:

monthly collection amount

date of the most recent collection

date of future collection

customer's membership type

How do I transfer my Direct Debit mandates to GoCardless?

GoCardless has managed the entire transfer process for hundreds of UK merchants. We've processed over 250 bulk changes and will work with you to handle the whole process without causing any disturbance to your customers.

Your existing customers won't need to take any action whatsoever, and we offer our full Direct Debit transfer service free of charge.

To transfer your Direct Debit mandates to GoCardless simply contact our customer support for further help, or review the Direct Debit transfer FAQs below.

Direct Debit Transfer - Bulk Change FAQs

I want to switch to GoCardless from my current Direct Debit provider. Do I need to get authorisation from them?

Yes, you'll need to get their agreement before proceeding.

Do I need to notify my customers?

Yes, you need to inform them of the change in writing, using bank-approved wording. An example letter is available here. Customers don't need to opt-in or set up new mandates, as their original authorisation to you as the merchant is sufficient.

How long does the process take?

Timelines are the same for each type of mandate. However, the actual timeline may differ based on the various parties involved. For example, one bureau may be slower than another at processing paperwork.

Here's an example of the timeline for changing the SUN:

4+ weeks before

Inform new and old SUN owners of the change. The sponsor banks for each SUN must then agree to the change.

3 weeks before

Complete and submit two forms to the sponsor bank of the new SUN owner:

The Bulk Change Deed transfers liability for indemnity claims to the new SUN owner.

The Notification of Change Form informs the new SUN owner's sponsor bank of the size and date of the change.

0-3 weeks before

Notify payers of the change in writing using bank-approved wording. An example letter to payers is available here.

2 working days before

Submit final payments under old SUN.

Change date

Process the change. Bulk changes are processed by cancelling the original mandates at the same time as creating new ones.

3 working days after

Payments can be submitted using the new SUN from this day onwards.

How do I transfer mandates between Direct Debit providers?

Since the bulk change process allows the SUN field to be updated, it also allows mandates to be transferred between Direct Debit providers.

The SUN field simply needs updating to that of the new provider.

The following transfers are possible:

Your own SUN --> Third party provider

Third party provider --> Third party provider

Third party provider --> Your own SUN

Transfers follow the same timeline as any other bulk change, and no input is required from your customers.

Can I continue to collect payments from my customers during the bulk change process?

Yes, you can. GoCardless will handle the whole process so that your customers remain completely undisturbed.

Will I need to set up my payments again?

Yes, exactly the same way as before, whether using the GoCardless dashboard, via our API or with a partner integration. For further help simply contact our customer support.

Enjoy all the benefits of Direct Debit but without all the hassle & expense of dealing with banks.

GoCardless does all the heavy lifting for you so you can collect payments on time every time with just a few clicks!